Negative Goodwill

Arises whenever the amount of money paid by a company to purchase another company or its assets is less than their fair market values.

What Is Negative Goodwill?

Negative goodwill (NGW), also known as the bargain purchase amount, arises whenever the amount of money paid by a company to purchase another company or its assets is less than their fair market values.

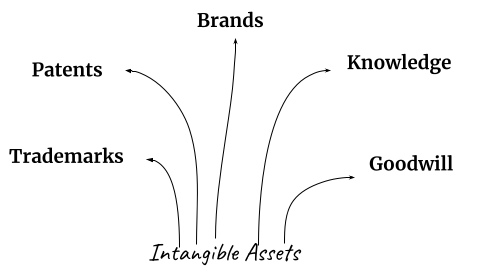

This accounting principle can be thought of as the opposite of goodwill. When a company buys another company, it usually does so at a higher price compared to the company’s tangible assets. That is to account for the intangible values the company has such as

It can be thought of as extra income for the buying company in the period it bought the other firm. That is because the value of the assets it acquired far exceeds the amount paid to get those assets.

Accounting for negative goodwill (as well as goodwill) is formally accepted by the Generally Accepted Accounting Principle (GAAP). The journal entries may differ in different cases, depending on the amount of NGW recorded and the value of the assets obtained.

What Does Negative Goodwill Indicate?

Negative goodwill indicates that the buyer is purchasing an asset at a discount. This transaction favors the buyer.

It generally indicates that the seller was forced to sell assets due to bankruptcy or serious financial distress. When companies go through financial hardships, their only option often remains to sell their assets for a fraction of their market values.

NGW arises whenever a company doesn't have the time or ability to properly assess the value of its assets. Thus, they are compelled to sell those assets - or even the whole company - at a discounted price for the buyer company.

That is why NGW is also referred to as "bargain purchases".

It can also indicate that an unfavorable court ruling has obligated the holding company to sell some or all of its possessions to another party.

When Does NGW occur?

-

A company is in serious financial distress and needs cash immediately,

-

A company has declared bankruptcy,

-

An unfavorable court ruling forces the company to sell its assets.

Negative Goodwill vs. Goodwill (GW)

As mentioned, NGW can be regarded as the opposite of goodwill. During an acquisition, GW will be recorded in the books rather than NGW. Nevertheless, accounting for GW differs from accounting for NGW.

For the selling company, GW is recorded as an asset on its balance sheet. NGW is recorded as a liability since it brings down the value of the selling company. On the other hand, goodwill increases the selling company's valuation.

Just like NGW, there are no other means to increase GW unless the company engages in mergers and acquisitions (when a company purchases another company or if two companies merge, forming a separate firm).

NGW was identified as the difference that arises between the purchase price of a company and its fair market value.

The purchase price would be lower than the market value in the case of NGW. Goodwill, on the other hand, occurs when the purchase price is higher than the market value of the company.

What is Goodwill?

When a company buys another company, it doesn't just acquire the assets; it also acquires other intangible factors & assets, which results in the acquiree company paying a higher than market value for the entire firm.

These assets include

-

reputation,

-

customer loyalty,

-

employee expertise,

-

copyrights and patents, and

-

the value of eliminating a competitor from the market.

All of these assets are noticeable, but none of them are physical assets. That's why they are called intangible assets. Thus, when a company acquires another company, it can sometimes pay more than the book value of the firm's assets and liabilities.

Goodwill sums up all elements besides book value that cause investors to be interested in purchasing a company.

Goodwill is different from other intangible assets in two ways:

-

goodwill has an indefinite life while other intangible assets don't,

-

other intangible assets might be purchased or sold separately (like licenses).

Having positive goodwill is favorable for the selling company. It indicates that the company has highly valued intangible assets stated above. It indicates strong financial health for the company. This means that the company has no obligation to sell itself because of financial distress.

Negative Goodwill and Positive Goodwill Comparison

Negative goodwill typically arises when the money paid to buy an asset or a company falls short of its fair value in the market. On the flip side, positive goodwill - also referred to as goodwill (GW) - occurs when the money paid to buy an asset or a company exceeds its fair value in the market.

In terms of comparing their meanings, they have contrasting interpretations. Through the lens of the buyer company, NGW favors the acquiring firm while GW doesn't.

That is because if it wants to buy a company with positive goodwill, it will have to pay a larger sum of money (although the buying company is also acquiring other valuable intangible assets).

From the selling company's point of view, however, it is favorable for it to build positive goodwill. That way, if it later goes on to be sold to another firm, the purchase price would be much higher than its market value, and it will pay a premium on the original price.

Calculating Negative Goodwill and Goodwill

Calculating goodwill requires a simple formula:

Goodwill = Purchase Price of the Company - Net Fair Asset Value

As discussed, if the purchase price of the company is higher than the net fair asset value, it is recorded as goodwill. If the purchase price of the company is less than the net fair asset value, it is recorded as negative goodwill.

According to the formula, calculating GW and NGW requires finding the net fair asset value of the company being purchased.

Although the formula looks simple, it is not that straightforward to calculate the net fair asset value of the company. To calculate it, we need to find the fair value for net current assets, the fair value for net fixed assets, and estimate the fair value of the firm’s intangible assets.

-

Net current assets are derived by subtracting the current liabilities of a company (like accounts payable, taxes and other payables, and other short-term debt) from the current assets of the company (like cash, inventory, and accounts receivable).

-

Net fixed assets are derived by subtracting accumulated depreciation and long-term liabilities (like notes payable and loans on fixed assets) from the firm’s fixed assets (buildings, equipment, land, machinery).

-

Estimating the fair value of intangible assets is much more difficult than valuing tangible assets. Intangibles assets include

-

Licensing

-

Brand Names

-

R&D

-

Other intellectual properties.

-

We now have measured the values of net current assets, net fixed assets, and intangible assets of a company. Finally, the net fair asset value of the firm would be the sum of those three components.

Goodwill represents the price of the company to be purchased minus the fair value of that company that we found. As long as the purchase price of the company is less than its market value, we will have found the amount of NGW.

Negative Goodwill Example

Suppose Wonka Industries is looking to buy Wayne Enterprises at a price of $100 million. The simplified balance sheet of Wayne Enterprises, as of Dec. 31, 2021, is as follows:

| Assets | Amount $ | Liabilities and Owner’s Equity | Amount $ |

|---|---|---|---|

| Cash | 23,000,000 | Liabilities | |

| Inventory | 5,000,000 | Accounts payable | 9,000,000 |

| Accounts receivable | 12,000,000 | Salaries payable | 4,000,000 |

| Furniture | 18,000,000 | Interest payable | 2,500,000 |

| Equipment | 14,000,000 | Short-term Loans | 3,500,000 |

| Building | 45,000,000 | Notes payable | 15,000,000 |

| Land | 30,000,000 | 34,000,000 | |

| Less accumulated depreciation | (6,000,000) | ||

| Owner’s Equity | |||

| Capital stock | 90,000,000 | ||

| Retained earnings | 23,000,000 | ||

| Total | 147,000,000 | Total | 147,000,000 |

-

Recall that GW/NGW = Purchase Price of the Company - Net Fair Asset Value

-

Purchase price of the company = $100,000,000

-

Net fair asset value = net current assets + net fixed assets + intangible assets

1. Net current assets = current assets - current liabilities

= (cash + inventory + accounts receivable) - (accounts payable + salaries payable + interest payable + short-term loans)

= 40,000,000 - 19,000,000

= $21,000,000

2. Net fixed assets = fixed assets - (accumulated depreciation + fixed liabilities)

= (furniture + equipment + building + land) - (accumulated depreciation + notes payable)

= 107,000,000 - 21,000,000

= $86,000,000

-

Intangible assets: suppose that a professional accountant estimates the total value of the company’s intangible assets to be $13,000,000.

Therefore,

Net Fair Asset Value = 21,000,000 + 86,000,000 + 13,000,000 = $120,000,000.

The amount of money paid to purchase Wayne Industries ($100M) is less than its fair market value ($120M). Hence, Wonka Industries will record NGW with a value of:

NGW = 100,000,000 - 120,000,000 = -$20,000,000.

Negative Goodwill in Accounting

Recording negative goodwill - as well as goodwill - is required by all companies.

It is mandated by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). According to them, every acquiring company must record NGW and GW in their financial statements.

In addition, the Financial Accounting Standards Board (FASB), has clearly stated how to deal with NGW and GW in statement No. 141. It has defined a bargain purchase to occur whenever the total value of the acquired company's assets surpasses its purchase price.

FASB more formally defined NGW as “a business combination where the acquisition date amounts of identifiable net assets acquired, excluding goodwill, exceed the sum of the value of consideration transferred.”

When NGW arises, the company that paid the discounted price must report this “gain” to ensure appropriate financial conduct. This gain is materialized as an addition to the net income in the income statement.

Reporting Negative Goodwill in the Balance Sheet and Income Statement

It is crucial to report NGW in the company’s financial statements. The main financial statements of interest for this reporting are the balance sheet, the income statement, and the statement of cash flows.

Current US GAAP requires the amount of negative goodwill after acquisition to be written off against the allocation assets that the company just acquired.

-

If NGW is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets will be reduced by the total amount of NGW. No NGW will be recorded in the books, and no extraordinary gain will be recognized. This is mostly the case.

-

If NGW is greater than the market value of the assets acquired, the value of the acquired assets is written off to zero. The remaining NGW - also called the residual NGW - is recognized as an extraordinary gain in the income statement.

-

If the value of the acquired assets is zero, then the total amount of NGW is recorded as an extraordinary gain. This is rarely the case.

Accounting Entries for Negative Goodwill Example

1. NGW Is Less Than the Value of the Acquired Assets

Suppose Company ABC is purchasing Company XYZ for $2M. The market value of the company (fair value of net assets) is $6M. Suppose that the value of the acquired assets amounts to $7M.

This means there is NGW of $4M. Since the value of the acquired assets ($7M) is greater than NGW ($4M), NGW should be written off on those acquired assets. There will be no recognized extraordinary gains.

The journal entries for this transaction are:

|

Initial recording of the purchase Fair value of net assets acquired↑ Total consideration paid↓ Initial NGW↑ |

Debit 6,000,000

|

Credit

2,000,000 4,000,000 |

|

Allocating NGW Initial NGW↓ Value of acquired assets↓ |

Debit 4,000,000

|

Credit

4,000,000 |

2. NGW Is More Than the Value of the Acquired Assets

Now suppose Company ABC is purchasing Company XYZ for $2M. The market value of the company (fair value of net assets) is $10M. Suppose that the value of the acquired assets amounts to $7M.

This means there is NGW of $8M. Since the value of the acquired assets ($7M) is less than NGW ($8M), NGW should be written off until those acquired assets have a value of zero. The residual NGW will be recorded as an extraordinary gain.

The journal entries for this transaction are:

|

Initial recording of the purchase Fair value of net assets acquired↑ Total consideration paid↓ Initial NGW↑ |

Debit 10,000,000

|

Credit

2,000,000 8,000,000 |

|

Allocating NGW Initial NGW↓ Fair value of net assets acquired↓ |

Debit 7,000,000

|

Credit

7,000,000 |

The remaining $1M of NGW is recorded as an extraordinary in Company ABC’s income statement.

Negative Goodwill FAQs

Many situations give hints of negative goodwill: a company being in debt, the absence of multiple potential buyers, or the deal being rushed through and completed in a short amount of time.

These types of deals were most frequent during the preceding financial crisis, as there were so many troubled sellers wanting to sell their companies.

NGW is important to track because it provides investors with a more complete picture of a company's value.

Yes, a bargain purchase that creates NGW also tends to increase the assets and the net income of the buying company. This can sometimes significantly decrease some important accounting ratios, such as return on assets (ROA) and return on equity (ROE).

or Want to Sign up with your social account?