Inventory Shrinkage

Occurs when the number of products in stock falls below the number reported on the inventory list

What is Inventory Shrinkage?

When the number of products in stock falls below the number reported on the inventory list, inventory shrinkage occurs. The mismatch could be caused by clerical errors, damaged or stolen products, or theft from the point of purchase to the point of sale.

Loss of inventory causes various problems for the organization, all of which have been discussed in greater detail at a later stage. Amongst various problems, shrinkage leads to lower profits and a mismatch in the accounting books as well.

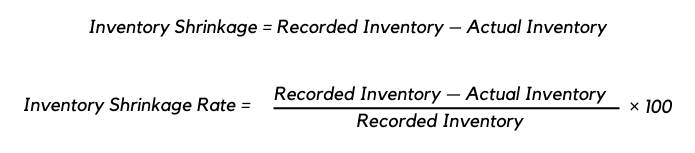

So how do we calculate the value of shrinkage?

Physically counting the stock and determining its value, then subtracting the stock's value from the inventory cost recorded in the accounting records, is how shrinkage value is calculated.

Divide the difference by the amount of stock reported in the accounting books to get the percentage of it.

As a general rule, physical inventory consumes a significant portion of working capital in the retail industry.

To put it another way, inventory is money kept in your warehouse. As a result, any type of theft or shoplifting that occurs in your warehouse must be tracked down and stopped.

While it's understandable to lose a few pieces or units of inventory due to physical damage, theft and shoplifting are more concerning.

As a result, it implies that your workforce lacks credibility and that they may be suffering from issues such as a lack of motivation or workplace grievances.

Furthermore, shrinkage that occurs on a regular basis might cause a slew of problems in inventory control.

Key Takeaways

- Inventory Shrinkage is when the number of products in stock falls below the number reported on the inventory list.

- Inventory is money kept in your warehouse. As a result, every theft or shoplifting that occurs in your warehouse must be investigated and prevented.

- Inventory control is a method used by businesses and organizations to properly manage their inventory/stock in the course of business so that they incur minimal storage and carrying costs and are able to meet their customers' market expectations.

- There are various ways of preventing Inventory Shrinkage, all of which have been discussed in-depth in the article.

Causes of Inventory Shrinkage

The National Retail Security Survey outlines the following five factors as the leading causes.

Shoplifting

According to the 2020 National Retail Security Survey, theft incidents are at an all-time high, costing the sector $61.7 billion and accounting for 1.62 percent of a retailer's bottom line or net profits.

Tag swapping is another common type of retail shrink that has a direct impact on inventory counts and profits.

Tag-swappers put the tag from a lower-priced item onto a higher-priced item and then complete the transaction. This approach initially conceals the theft, but it skews inventory counts for both commodities. Unfortunately, most merchants only notice this during stock counts.

Employee theft

Despite the fact that employees should be at the forefront of minimizing the shrinkage of inventory, some dishonest workers often resort to stealing from their company’s inventory.

Employees may take some company stock to make up for any underpayment, underappreciation, or undervaluation they believe they are receiving. They may be able to rapidly cover up inventory theft because they are corporate insiders.

When one product vanishes from a large stock of over a thousand products, the employer is unlikely to notice. Instead, the employer/accountant will presume the product was lost owing to clerical errors made during packaging or loading products onto a truck.

Administrative errors

Despite the fact that the majority of businesses have transitioned to digital record-keeping, administrative and paperwork errors continue to be one of the leading causes of shrinkage.

Administrative errors include pricing problems, inadvertent reorders, missing or additional zeros, and decimal point omissions. Inventory should be physically counted and re-counted to reduce errors, even if the organization uses automated methods.

Supplier fraud

Inventory may be managed by third party businesses who are not affiliated with the company in the supply chain of the businesses with complex supply networks.

Theft might happen while the products are in transit from the supplier's warehouse to the business premises or while loading and unloading them. Deliveries should be counted and recorded every time they enter or leave the business premises.

Unknown causes

Inventory disappears from the shelves time and again and is unrelated to any of the other causes of inventory loss. Unknown causes account for around 6% of total inventory shrinkage.

Inventory Shrinkage Example

XYZ Limited's accounting records show that it has $1,000,000 in inventory. It does a physical inventory count and determines that the actual amount of merchandise on hand is $950,000.

As a result, inventory shrinkage is $50,000 ($1,000,000 book cost minus $950,000 actual cost). The percentage of it is 5% ($50,000 shrinkage / $1,000,000 book cost).

When a corporation discovers inventory loss, any variations between the records and the physical inventory count should be taken into account. According to the matching principle, inventory shrinkage must be recognized as an expense in the financial period in which it happens in order to be matched against revenues for that year.

A shrinkage expense account will be created for accounting purposes under the Cost of Goods Sold (COGS) account.

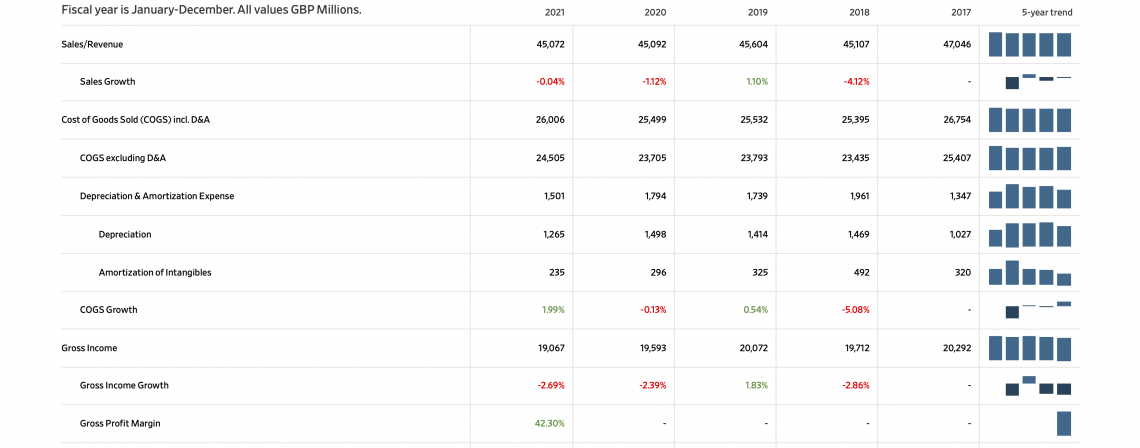

What is the Cost of Goods Account?

The direct costs of producing the commodities sold by a company are referred to as the cost of goods sold (COGS). COGS covers the cost of the materials and labor used to create the product. It does not include secondary charges like distribution and sales force costs.

Formula For COGS

COGS is a straightforward calculation. Use this formula to calculate the cost of goods sold:

COGS = Beginning Inventory + Purchases During the Period – Ending Inventory

Don't know where to get the information listed above to use in the formula? Don't worry, we've put together a list of everything you'll need:

- Beginning Inventory: Inventory that was leftover from the previous period (e.g., month, quarter, etc.)

- Purchases during the period: The price of what you bought during the accounting period.

- Ending Inventory: Inventories that you didn't sell throughout the time frame

You can start estimating your cost of goods sold once you have all of the aforementioned information. COGS can be calculated weekly, monthly, quarterly, or annually, depending on your business and goals.

Example

Let's imagine you want to know your quarterly cost of goods sold. Beginning inventory is recorded on January 1, and ending inventory is recorded on March 31. (end of Quarter 1).

Your company's initial inventory is $15,000 in value. For the quarter, your purchases amount to $5,000. And your total inventory is $4,000 at the end of the quarter. Using the cost of goods sold calculation, you can easily calculate the total COGS for the quarter.

As mentioned earlier:

COGS = Beginning Inventory + Purchases During the Period – Ending Inventory

COGS = $15,000 + $5,000 – $4,000

Your cost of goods sold for the quarter is $16,000.

What is Inventory Control?

Inventory control is a mechanism used by businesses and organizations to properly manage their inventory/stock in the course of business so that they suffer minimal storage and carrying charges and can meet their customer's expectations in the market.

A manufacturing company keeps the inventory count during business to meet the demands of market participants. As a result, maintaining stock levels and controlling inventory inflow and outflow becomes increasingly essential for the management.

For managing inventories, the procedure is established and implemented using scientific techniques and the management's assistance; through implementing controls over transactions and movements linked to stocks. Therefore, they can also be referred to as warehouse maintenance in simpler words.

objectives of Inventory Control

- Inventory counts can easily go to thousands of numbers. Hence it is necessary to keep the storage and transport costs of the inventory as low as possible. The expense of stock upkeep and storage is a key part of the business.

- To provide raw materials, packing materials, intermediate goods, and other items necessary to manufacture completed goods within the specified time frame for fulfilling orders or targets.

- To take advantage of instances where inventory market prices are reduced and properly manage inventories in the event of inflation, where material prices rise, a store's handling can be done better and more effectively.

- Reduce and effectively manage scrap material and non-moving inventory items.

- To properly maintain safety stock and auto-continue minimum order quantity of stocks, among other things.

Inventory Control vs. Inventory Management

Inventory control is a method of keeping track of and managing existing inventories. Inventory management, on the other hand, is used to figure out how much material needs to be stored.

Inventory control manages how inventory is stored in the warehouse to keep storage and management costs minimum. Inventory management, on the other hand, forecasts future demand or production to determine the amount of material that needs to be held.

In order to manage inventory, inventory management requires strategic planning and assessment of the market and business environment. Inventory control, on the other hand, is concerned with management decisions on stock tracking and maintenance.

What if Shrinkage goes Unnoticed?

The company's profitability may suffer a significant hit when the rate of shrinkage rises. Inventory costs may rise, and the revenue may suffer as a result.

Let us have a look at the problems this would create for a company.

Lower Profits

Let us take an example

Paul’s Shoes had $50,000 worth of goods. He makes a 20% profit on each pair of shoes he sells. A total of $1000 worth of merchandise went missing. Thus,

Total Loss incurred = $1200 [1000+20%]

Paul lost nearly $1200 only because of inventory shrinkage. This is how it affects a company’s profits.

Mismatch in Accounting Books

It's an unpleasant situation at the end of the day when you go down to tally your accounting records and discover a few amounts don't tally!

However, you notice that a couple of your belongings are missing at that time. Audit and tax issues arise when accounting books are not aligned. As a result, businesses must be cautious while dealing with inventory shrinkage issues.

How to Prevent Inventory Shrinkage?

There are many techniques available for preventing it from happening:

- Locking and fencing the warehouse

- Allowing no one other than warehouse staff to enter the warehouse.

- Improving the accuracy of the record-keeping of the bills of various materials.

- Installing a continuous cycle counting system.

- Controlling the physical count process's outcomes and how modifications are incorporated into inventory records.

- Counting items when they arrive at the receiving dock and also counting the finished goods as they are sent out of the firm.

Some strategies have been described below in greater detail.

Finding The Right Personnel To Manage The Inventory

Assign one of your employees the role of inventory manager. The person in charge of your inventory needs to know everything there is to know about inventory management.

They should be able to give detailed inventory information, such as stock numbers, incoming stocks, depreciation, and stock valuation, among other things. Inventory audits, purchase orders, and other tasks fall under the purview of the inventory manager.

Give Products Unique Identities

Proper product SKUs (stock-keeping units)and UPCs (universal product codes) are essential for ensuring that your stock levels are correctly documented, thereby reducing inventory shrinkage. Make sure your product codes are as straightforward as feasible and that they are part of a system that can easily be modified to accommodate additional items.

Optimize Your Warehouse & Store Security

One of the most effective techniques for reducing inventory shrinkage is to improve security in your warehouse and store. It's vital to improve security, especially if you have a large store with a lot of merchandise.

Throughout your warehouse and shop corridors, surveillance cameras should be put in place. Use a digital door lock and only allow people in control of inventory to enter the warehouse.

-

Inventory management software can be used to automate the process

- The truth is that human mistakes are to be blamed for many stock-level discrepancies. Businesses can eliminate manual stock handling and processing and inventory shrinkage due to administrative errors by streamlining and organizing the stock with dedicated inventory management software.

Researched and authored by Rhea Rose Kappan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?