Electronic Filing

System that lets you electronically submit legal documents

What is Electronic Filing (E-Filing)?

Electronic Filing (E-File) is a system that lets you electronically submit legal documents using the Internet instead of dealing with paper documents. It's sometimes confused with the Case or Document Management System (CMS or DMS), but there are important differences between them.

Both of them have been proved, from research and experiments conducted, to aid in transforming the paper-based environment into an electronic one.

On the other hand, an electronic filing system is an extension of CMS because it includes all its functions. However, the EFS can easily and electronically submit legal documents, which is known as E-Filing.

This procedure includes electronic communication and transferring legal documents over a safe and reliable source, which is often the internet.

A completely built E-filing system doesn't only have a transmission of documents to the Clerk's office electronically. It also includes the routine of electronic documents and records for case processing, services, and access to use by everyone involved.

In similar words, an Electronic Filing System is a system that the company or business owner uses to organize files that work on hard drive space or network space.

This E-filing system can be either offline software on the computer or online as an Internet-based program; it can also be a simple bunch of files and folders on our desktops.

We will explain more about the Electronic filing system and its benefits in this article.

Key Takeaways

- While E-Filing Systems and Case/Document Management Systems (CMS/DMS) share similarities, they have key differences. EFS includes all functions of CMS but enables the electronic submission of legal documents known as E-Filing.

- E-Filing has transformed how businesses and offices handle information, moving from paper-based systems to electronic ones. It offers secure and immediate data transfer and aids in efficient organization and retrieval of documents.

- EFS offers convenience, time, and cost savings, increased accuracy, reduced manipulation, and improved authenticity and accountability. It simplifies the tax filing process, providing immediate notifications and instructions on the filing status.

Understanding E-Filing

For the past three decades, E-Filing has evolved the way we report, store or analyze important information, whether in a company, business, or governmental offices.

This EFS is a computer-based system for saving, organizing, and retrieving documents.

It shifted the use of hard-copy papers and files to a higher and easier method with electronic files that can be saved on personal computers or in huge databases.

Moreover, the EFS provides a secure and instantaneous transfer of information between two parties.

In other words, an EFS is a system of organizing documents and files that uses a hard drive or network space. This means that this system can take the shape of software, an Internet program, or even a simple folder on your laptop's desktop.

Electronic filing systems are used everywhere and every time, even on our phones when playing video games or applications.

Electronic Filing Functions

A computer itself is a whole enormous E-Filing system giving us different and helpful features. It starts with the drive (HDD or SSD), the large filing system, and disintegrates into smaller EFS within the software and the applications of the computer.

A simple example is the "Documents" folder on your PC; It is an E-filing system that arranges your documents according to your preference, whether the date of creation or alphabetical.

A helpful feature in these EFS is the searching and browsing between the files and documents, allowing you to pick the file you need out of lots of files.

Electronic documents like spreadsheets, presentations, and text documents may all be created, edited, and formatted by users. Furthermore, electronic filing makes it simple to organise, classify, and search for files using keywords or metadata.

Multiple users may share and collaborate, creating effective document processes. Access restrictions and encryption are two security features that are frequently used in electronic file systems to safeguard sensitive data. It encourages productivity, improves data integrity, and simplifies document processing.

Benefits of Electronic Filing

The Electronic Filing System offers various benefits and advantages; here are some:

1. Convenient/flexible

EF has made tax filing a lot easier and more flexible, where it became more convenient because you can file your taxes electronically from your couch at home or on your chair behind your office without the need to submit it physically or the need to submit between 9 to 5 o'clock.

2. Time and money saver

This system can afford you less time and money. Whether you have a business or a company, or you are a professional or even a regular worker, you are e-filing your taxes, meaning that it is immediately transferred online from your server to the tax agency's servers.

When transferring data by hard-copy files and documents, you are ensuring more costs and possible transmission errors. However, by doing it with online input, you save time and money and ensure fewer mistakes.

B using the EFS, not only are you reducing time and effort from your side, but also for the tax agency because it is easier and faster to process electronic documents and files than hard copies. Thereby, you are saving a huge amount of time on both parts.

3. Accuracy

E-filing ensures fewer transmission errors and mistakes, and all its likes will be avoided. This means more accuracy in data records and the process of overall tax filing.

4. Fewer manipulation and window dressing

Electronic filing ensures fewer possibilities of manipulations of data reports and window dressing of information.

With this system, the data's availability and connections are more intense. Linking or tracing these data back is made much simpler and easier with electronic filing.

5. Authenticity and Accountability

E-Filing proved itself to ensure more authenticity in the procedure of filing taxes, as well as increased accountability on both sides, the tax agency and the taxpayer.

Furthermore, paper filing is considered more ambivalent since there exists a high ambiguity on the receipt of those tax papers and those of tax records.

When you successfully E-File, you will receive a notification and instructions on the tax filing process thoroughly. In addition, you will be answered within 24 hours, whether it is accepted or rejected.

This increases the certainty level of the whole process. This all would be more ambiguous if it were done on paper and in hard copies.

Limitations of Electronic Filing

Although the EFS has multiple benefits, it comes with some limitations, such as:

1. Complicated software

If you are a trained professional or a tax agent, this system is a piece of cake for you.

However, the usage of E-filing software isn't being taught everywhere. Hence this process will be considered complicated to use for parties that want to file their taxes without benefitting from a tax agent or a professional.

Besides that, the knowledge of Electronic filing is considered to be a new process; hence it is not widespread.

Unfortunately, only a few individual tax-paying units have the knowledge of the knows-and-hows of this process and the system.

2. Security

When you file a tax, E-filing involves you putting your faith in their equipment's safety, starting from the internet connectivity to the drive, software, and every other tool.

However, electronic systems are not that safe of a system when it comes to security breaches.

This procedure includes storing electronically very sensitive financial data. A crash in your space drive can mean the loss of all your data.

Another risk is hackers, where one hack can mean a massive loss in data and so on. Security and safety are the biggest concerns that are involved in E-Filing. Here is more explanation about the issues

E-Filing Cabinet

Different filing software solutions use something that is called the E-Filling Cabinet. What is it?

Most of us already know how to file and organize our space, documents, and paper. It is the same thing in digital docs. Just like your physical cabinet, you should organize your digital documents into an E-Filing cabinet that has drawers(which are represented by folders).

Same as old offices and companies have a file cabinet put in the corner of the room, and your electronic filing system must have a cabinet to store and safely keep these files. All systems have cabinets to keep files organized and in one place.

In other words, our electronic filing system should be a mirror of our physical filing system. This method (E-filing cabinet) is a great way to organize and browse our files and data due to its simplicity and ease. Also, you can say the human mind is a strong and well-built filing system.

The difference between Database-driven systems and EFC is clear. The first relies on input to find documents; hence, there is no structure to browse when it fails.

While the latter can do both, this means that if you didn't find your file in a few clicks, just a simple keyword could comb the whole cabinet for them.

How to set up an Electronic Filing system

It depends on which filing software package you decide to install in your company to set up this system.

Choosing one that uses a database, or choosing one that stores the data in normal Windows folders, or saves it on a network, each one has its benefits and purposes.

Enhance your company's storage to a higher level and set up an EFS in the correct way possible. It is about time your business gives up on papers and starts managing all the data and files electronically and digitally.

You can do that if you make sure you have the best system for your business, according to its needs and priorities.

Always consider these points when you want to set up an EFS:

1. Budget

When you want to buy your set-up, make sure it fits your budget. Fortunately, there are lots of equipment and tools that are affordable.

2. The learning curve

It is essential to know your skills and your office's. Your team should be compatible with the system you are setting up.

3. Several uses

Before purchasing any software, make sure of its minimum capacity and members because some might have a maximum number of users that are less than that of the team.

Steps to set up an Electronic Filing System

After setting your mind and reviewing the considerations and requirements, you have to set up your EFS.

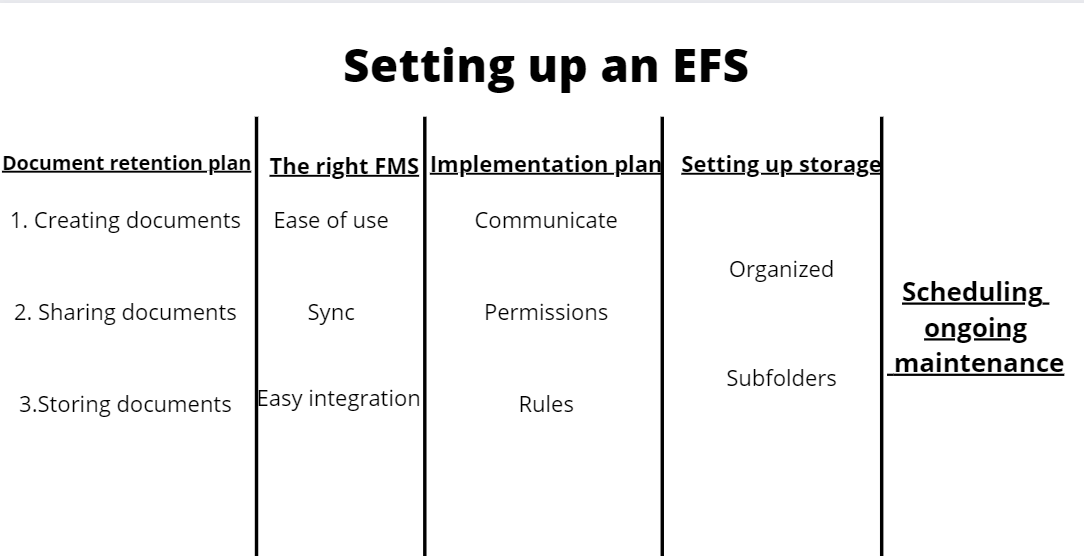

Here are the five steps to do so:

1. Document retention plan

This is considered a pre-workout. You need to set your goals and rules. You need a general plan in different areas, and here are some:

1. Creating documents

You have to set up a few rules for creating and following your business’s files, like contracts, invoices, proposals, etc.

Also, you need to use specific templates for you1r docs, whether already built frameworks or newly created ones. That’s according to your preference.

2. Sharing documents

When sharing documents inside your facility or outside, you need to have certain regulations, like what documents can be sent, where they can be sent, or to whom.

Also, you need to know the safety and security of this sharing and whether it is an editable or only-view mode. This also depends on you.

3. Storing documents

You have to store your data carefully. You will have to choose what data to keep, delete, and archive. Most importantly, you need a backup for all the data your company processes and analyzes.

2. The right file management software

When you succeed in putting your rules and regulations, you have now to choose the right file management software.

You will compare various offerings and choose according to your preferences and needs. Here are some features to look at while searching:

1. Ease of use

The user side will need to be simple and catchy. The front-end experience will have to be smooth and interactive.

2. Sync

Syncing your files is a great feature, and there is multiple software that either is online or offline. Each has its syncing process, so like usual, it depends on you.

3. Easy integration

A good system shouldn’t mess around with your to-do list and must be easily integrated.

3. Implementation plan

Once finished with the plan and the software you are going to use, it is now time to implement. After this step, all our hard work should pay off. You have multiple tasks to do when figuring out an implementation plan.

1. Communicate

Communicating with your staff about the undergoing changes and discussing the guidelines about sharing, rules and regulations, and many other topics. You can help your staff as well when doing common procedures and conventions.

In addition, all the employees you have that can access files and documents should name them accordingly, so they are easy to find and read.

2. Permissions

Permissions should be set according to levels and as well as ownership. Having everyone able to edit files will end up in a mess.

By assigning permissions according to levels, issues can be handled smoothly and fast and will ensure less work and more efficiency.

3. Rules

When using this system, expectations and predictions will be set, and it is good for the software to live up to them. Setting rules and regulations will lessen the confusion, like no unnecessary copies, empty files, sharing, and connecting.

4. Setting up storage

Now we are almost done. We need now to set up the storage to upload, save and share. Here is some advice when doing so:

1. Organized

Categorizing and specifying rules so that files are neither lost nor duplicated is a great help for setting up your storage.

A good filing system should be instinctive and smooth without having any disruptions in the workflow. You can organize however you feel right, whether by name, date, or topic.

2. Subfolders

Creating folders within folders will organize your storage and space. Instead of having everything thrown into one folder, you can have multiple folders, each containing a specific topic or purpose.

5. Scheduling ongoing maintenance

Keeping your system unchecked and unattained will get cluttered and start to sustain damage over time. So it is important to keep checking up on it and keep maintenance working continuously to ensure the best workspace.

Archiving your docs and files and having a backup for all your data is important because you never know what might happen. This will ensure your data is safe and secure from any problem your database might face.

or Want to Sign up with your social account?