Operating Cash Flow Formula

Calculating cash flow that results from day-to-day production and selling activities.

What is the Operating Cash Flow Formula?

Operating Cash Flow (OCF) refers to cash flow that results from day-to-day production and selling activities, excluding costs associated with long-term investment in capital items or securities.

A positive OCF means the company can generate sufficient cash flow to support its operations. Conversely, a negative OCF implies that the company may need external financing.

OCF is the first section in the cash flow statement; the other two are capital spending and change in Net Working Capital. The purpose of using Operating Cash Flow is essential to determine the financial success of the business’s activities.

The operation cash flow formula can be written in many ways. But one of the most common and basic formulae is

OCF = (Revenue - operating expenses) + depreciation - income taxes - change in working capital

Here is an example of why we use Operating Cash Flow to determine the financial success of a business:

Suppose a company would like to book a large inventory to sell to boost the company’s revenue but is currently having a hard time collecting cash. In that case, the Operating Cash Flow is an excellent way to provide a clear picture of the current situation of the company’s operations.

If the company does not have enough money from its business operations, it may consider external financing to support the company.

Understanding The Operating Cash Flow Formula

As previously mentioned, Operating Cash Flow, also known as OCF, equals total revenue minus total costs; however, depreciation expenses and interest expenses are not included because they are not considered cash items despite being considered in different types of accounting statements.

The accounting definition of OCF considers interest expense to be an operating expense. However, in finance, it is financing.

There are several ways to figure out the adjustments in the Operating Section:

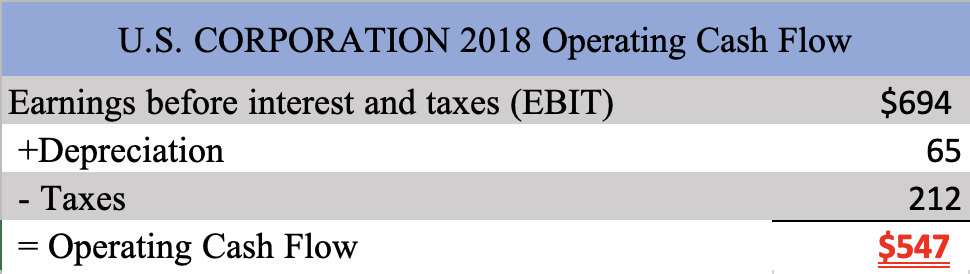

Operating Cash Flow = Earning before interest and taxes (EBIT) + Depreciation - Taxes = EBIT*(1-Taxes) + Depreciation

The formula can be written in many ways:

OCF = (Revenue - operating expenses) + depreciation - income taxes - change in working capital

OCF = net income + Depreciation - change in working capital

OCF = net income - change in working capital + non-cash expenses

OCF = total cash received for sales - cash paid for operating expenses

Cash = Liabilities + Stockholders Equity - Non Cash Assets

This formula can be proved:

Assets = Liabilities + Stockholders Equity

Cash + Noncash Assets = Liabilities + Stockholders Equity

Cash = Liabilities + Stockholders Equity - Non Cash Assets

It follows that any transaction that changes cash must be accompanied by a change in Liabilities, Stockholder's Equity, or Noncash Assets.

Net Cash Flow From Operating Activities

Net Income less

- Depreciation and Amortization Expenses

- Decrease in Assets

- Increase in Liabilities

- Increase in Assets

- Decrease in liabilities

Example Problem 1

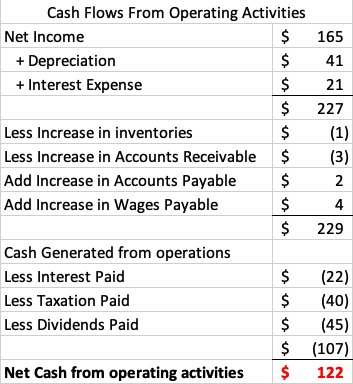

Complete the Operating Activities section of the Statement of Cash Flows using the indirect method using the following information.

- Net income for the year is $165,000

- Credit card receivables increased by $3,000

- Inventory increased by $1,000

- Depreciation expense for the year was $41,000

- Wage Payable increased by $4,000

- Account payable increased by $2,000

- Interest expense $21,000

- Interest paid $22,000

- Taxation paid $40,000

- Dividends paid $45,000

Hence, the net cash from operating activities is $122,000.

Example Problem 2

You have a small business. Your cash came from customers, a total of $200,000. During this period, you spent $2,000 in operating expenses. You also own a vehicle, which depreciated by $1,000.

Come tax time, you ended up paying $25,000. Your net income = $200,000 - $2,000 - $1,000 - $25,000, which is equal to $172,000.

Based on the OCF formula,

OCF = Net Income + Depreciation

OCF = $172,000 + $1,000

OCF = $173,000

Example Problem 3

Which of the following statements does not correctly describe an adjustment to net income when determining cash flows from operating activities when using the indirect method?

- An increase in wages payable will be added to net income

- Depreciation expenses will be added back to the net income

- An increase in income taxes payable will be deducted from net income

- An increase in prepaid expenses will be deducted from net income

Why is Operating Cash Flow important?

It is essential from the following point of view:

- Financial Analysts: OCF indicates the overall financial health and profitability; it is essential to determine if the company has an excellent financial status.

- Investor: Every investor who wants to invest in a company has fast future growth to ensure they will receive enough money; therefore, OCF will give investors more confidence to invest and prove the company itself for better achieving a high ROI on their investment.

- Lenders: Lenders want to ensure that the company that borrows the loan can be paid within the set time. Businesses with a favorable OCF can get a higher chance of loan approval.

Operating Cash Flow is located within the Cash Flow Statement; CFS is a financial statement representing the status of cash and cash equivalents in and out of a company and tells us how much and why cash is increasing or decreasing.

Cash is so essential to every business that it has its report. CFS indicates how well the company's cash position is and how well it can pay its debt obligations and operating expenses.

A Cash Flow Statement is one of the three financial statements (Cash Flow Statement, Balance Sheet, and Income Statement). The main components of the Cash Flow Statement are:

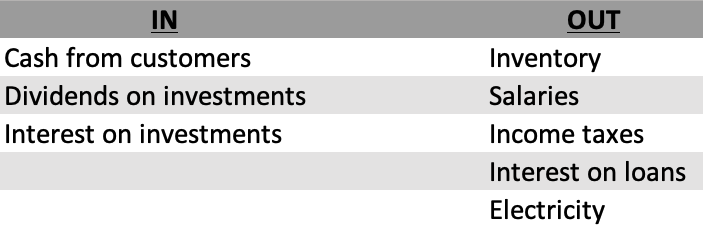

Cash Flow From Operating Activities (OCF)

Cash Flow that relates to revenues and expenses reported on the Income Statement.

Changes in cash, accounts receivable, depreciation, accounts payable, and inventory is reflected in the operations cash.

Example

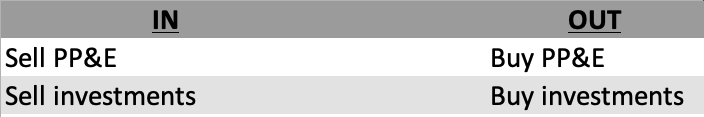

Cash Flow From Investing Activities

Cash flows related to the purchase and disposal of productive assets (CAPEX) and investments in the securities of other companies. Changing cash from investing activities is usually considered cash-out activities because cash is used to purchase PP&E.

Example

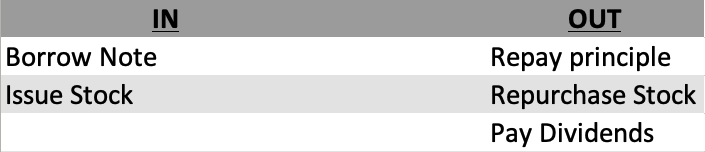

Cash Flow From Financing Activities

Cash flows with creditors and owners. Changing cash from financing activities is usually considered cash in activities because capital is raised. So, for example, when a company issues a bond to the public, it will receive cash.

Example

How To Prepare The Statement Of Cash Flows

- Presented with the facts

- Real-World Way - you are given:

- Income Statement

- A starting point for the Operating Section is Net Income

- Comparative Balance Sheet

- Go down the Balance Sheet and record the change in accounts that affects the Operating Section.

- Go down the Balance Sheet and record the account changes that affect the Investing and Financing Sections.

How to present Operating Cash Flow

There are two methods to prepare the Operating Cash Flow, and this article will cover both of them and describe them specifically.

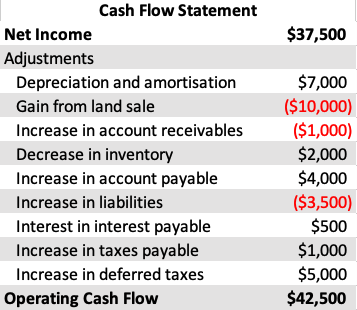

Indirect Method

Start with Net Income, then add or subtract non-cash items that go into computing Net Income.

Using the indirect method shows how much money has been spent or generated during a specific period and for what specific purpose, it takes the Earning before Interest and Taxes (EBIT), which is adjusted by adding or deducting the balance sheet to determine the cash flow. This method is more commonly used, especially within large firms.

Advantages of the indirect method:

- It is easier than the direct method

- All the factors are taken into account

- Provide a valid link to the income statement, a better estimate for net income, and adjustment by differences.

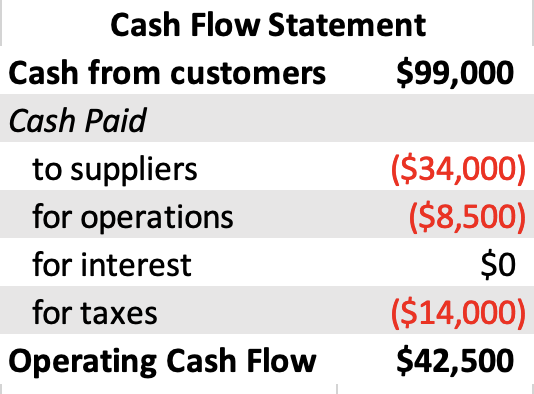

Direct Method

The direct method lists actual inflows and outflows during the reporting period. The direct method is okay if you have a small number of transactions or a small company (Example: Bank Investment). However, it is a bad idea if you have many transactions.

Advantages of the direct method:

- Shows the company’s operating cash receipts and more information about payments, a better estimate for future OCF.

- There is no such preparation required

- Cash Flow by using the direct method is more accurate when there is no need for any adjustments

Here are some examples of using the direct method:

- Cash paid to suppliers and vendors

- Cash from customers

- Income tax paid and interest paid

Operating Cash Flow vs. Net Income, EBIT, and EBITDA

Four of these terms are different and serve different objectives as metrics to the organizations.

Net Income is the last line in the income statement after deducting all the expenses (operating and non-operating). incurred during the period. Where are EBIT and EBITDA are items that appear above the NI.

Where EBITDA is the amount the organization has before deducting the Interests, Taxes, Depreciation, and amortization from the organization's earnings. Then, EBIT is the amount we arrive at by deducting D&A from EBIT.

Formula of EBITDA

Net Income + Interests + Taxes + Depreciation + Amortization

EBIT's formula is as follows

EBIT = Revenue – COGS – Operating Expenses

Below we discuss some of the differences between these metrics.

Operating Cash Flow

OCF is a more accurate measure of how much cash a company has generated than traditional profitability measures. It is the amount of money a business generates from its operations.

Calculating this number will help financial analysts, investors, and lenders understand how much money the company has developed and how much capital the company keeps after accounting for taxes, depreciation, and operating costs.

Net Income

Net Income includes all expenses; some have been paid, and some are not. As a result, the company’s revenue recognition principle and matching costs to the revenues can result in the difference between OCF and Net Income.

Net Income = total income generated from sales, including investments and minus total expenses

EBIT (Earnings Before Interest And Taxes)

EBIT is the net income excluding interest and taxes because these costs are cash expenses. Information will be found in the income statement.

Business owners use EBIT to know the business’s competitiveness to the investors. The investors use EBIT to compare the companies that have different capital structures.

There are two methods of calculating the EBIT:

The first method to calculate the EBIT is to start with the net income and then add back the interest expenses and taxes paid:

EBIT = Net Income + Interest Expenses + Taxes

The second method to calculate the EBIT is always equal to the operating income under GAAP based on the specific information given:

EBIT = Sales Revenue - COGS - Operating Expenses

EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization)

EBITDA, pronounced Ee-by-dah, is the most common metric for beginning to value a company. It measures its cash flow and presents how much money the company produces yearly.

The difference between EBIT and EBITDA is that although they are all measurements of a business's profitability, EBIT is commonly used to measure operating profit, including some non-cash expenses; EBITDA is used within the company's asset-intensive industry, which has only cash expenses.

or Want to Sign up with your social account?