Non-Controlling Interest (NCI)

When a party has more than 50% but less than 100% ownership of the company

What Is A Non-Controlling Interest (NCI)?

Non-controlling interest (NCI), formerly known as a Minority Interest, refers to when a party has more than 50% but less than 100% ownership of the company; as such, they cannot make decisions for the company. The opposite is known as a Controlling Interest (CI) or a Majority Stake.

Said ownership tends to be in the form of equity and is measured at companies' Net Asset Value (NAV) and does not account for voting rights.

If one party has 100% ownership of a company, there is no non-controlling interest if no minority shareholders own a portion of the company's equity.

Most investors in publicly listed companies hold a non-controlling interest and are known as Minority Shareholders. However, that is not to be underestimated, for when publicly listed companies have market capitalizations of up to trillions, a 1% stake represents billions.

Even prominent and successful billionaires may only have a non-controlling interest in their own companies, as many have sold off their stakes as the company grows. Tesla's Elon Musk is a famous example, with him having a 12.95% stake as of 2023.

Key Takeaways

- Non-Controlling Interest (NCI) signifies ownership of a company between 50% and 100%, where the holder lacks decision-making power, contrasting with Controlling Interest (CI) above 50%.

- Investors with NCI enjoy exposure to company growth with reduced risk but lack decision-making abilities. Diversification and lower investment concentration are key advantages.

- NCI is calculated using consolidation, equity, or cost methods based on ownership percentage.

- NCI holders lack authority in significant corporate decisions like board nominations, contracts, mergers, and dividends unless they possess over 50% voting rights.

Understanding Non-Controlling Interest

A non-controlling interest refers to a situation where a shareholder possesses less than 50% of the total outstanding shares and lacks the authority to influence decision-making processes.

With such large companies, usually having >5% of a stake is enough to enable one to have their voice heard, for they may be granted a seat on the board of directors or have channels in which they can lobby for changes.

Such may include:

- Communicating to the board of directors their ideas

- Banding together with other significant NCI stakeholders for a larger ownership percentage

- Propose action items at an Annual General Meeting

That said, it is important to remember that due to their NCI, they do not have the final say in any corporate decision unless they have over 50% of the voting ability or counted votes in their favor.

Some examples of corporate decisions are also shown below:

- Nomination/ Voting of the Board of Directors (and, in turn, the company executives)

- Enter into contracts with suppliers, customers, and other professional services (audit, consulting, etc.)

- Choice of acquisition and disposition of assets

- The issuance of dividends

- Approval/rejection of mergers and acquisitions (M&As)

- The passing of executive compensation packages

- Issuance of new shares

- Raising of new debt

Advantages of Non-Controlling Interest

With the ability to dictate the present and future of a company, wouldn’t it be a no-brainer just to have a majority stake in a company? Short of financial reasons, why would people opt for an NCI stake?

Some of the more likely reasons include:

- Diversification of investment, and thus lower risk

- Unwillingness to actively overreact

Firstly, the key benefit is that it helps lower investment risk. Having an NCI gives you a stake in the business, and not needing to put in more money helps diversify one’s portfolio and reduces concentration risk.

Think of it this way, one of the golden rules in investing is diversification. Even if a firm may be highly profitable or can bring about huge cash flows, the percentage return on investment (ROI) of $10 million or $100 million in the same company remains the same.

As the old proverb goes

"Don’t put all your eggs in one basket!"

However, if a bad event happens to the company, the absolute decrease in investment is considerably more when a larger sum is invested solely in it. If the sum were spread across different companies or sectors, then the negative impact of one event would be mitigated.

Furthermore, not everyone is as keen on being an active shareholder or taking on the roles and responsibilities of a majority stakeholder with decision-making capabilities for a firm. Regarding a company sale, it’s also more convenient and has fewer legal complications.

One can also see that it’s not necessary to have a controlling interest/be a majority stakeholder to be able to achieve superior returns. Trust in a company’s management and existing moat works wonders and is practiced by the great Warren Buffett himself.

Examples of Non-Controlling Interest

Some of the most famous real-world examples of NCI would be Berkshire Hathaway’s stakes in prominent public companies such as American Express (~20%), The Coca-Cola Company (~9%), and Apple (~5%).

There are also cases where individuals may have non-controlling interests in terms of NAV but be able to make all the decisions for the company to their majority holding of the voting rights. This may come about as not every type of share issued by a company has voting rights.

A well-known company would be Alphabet Inc., the parent company of Google. The founders, Larry Page and Sergey Brin may only have ~12% of total shares outstanding, but they have ~51% of all voting shares, resulting in them effectively having full reign of all company decisions.

This mainly arose from the presence of 3 different kinds of Alphabet stock, Class A, B, and C shares, all of which have differing properties.

- Class A shares have 1 vote per share. They are listed and traded under the ticker GOOGL

- Class B shares are “super-voting” shares with 10 votes per share. Not only is it not traded publicly, but it is also concentrated in the hands of the founders

- Class C shares are “non-voting” shares that come with no voting rights. They are listed and traded under the ticker GOOG

Due to the founders’ large holding of Class B “super-voting shares,” they retain a controlling interest in the company concerning voting rights despite not having >50% of the shares on an NAV basis.

Note

To find out more about the various stakes the Oracle of Omaha, Warren Buffett himself, has acquired under Berkshire over the years, click here.

accounting treatment of non-controlling interest

Now, with a better understanding of NCI, let’s look at what it entails in accounting terms. In accounting, NCI is used to understand a company’s ownership structure better and helps to reflect a company’s financial performance better.

By understanding where a not insignificant portion of revenue and cash flow comes from, investors can make more well-informed decisions and better quantify their risk.

Under GAAP, the goal of accounting for NCIs is to present users of the consolidated financial statements with a clear representation of the allocation of a less-than-wholly-owned subsidiary’s net assets and net income that is attributable to equity holders other than the parent.

If one were to have a larger stake in a company and use the consolidation method without having a clear distinction between the other minority shareholders, then revenue and assets would undoubtedly be overstated.

Similarly, for minority shareholders, if their NCIs are not accounted for properly under the equity or cost methods, their revenues and profits may similarly be overstated. When companies invest in each other, the accounting treatment of such investments depends on the size of the ownership stake.

Financial Statements and Non-Controlling Interest

NCIs can be seen clearly in a company’s financial statements, specifically the balance sheet and income statement. The investing activities of the cash flow statement will also show a summary of the cash paid out and received with regard to the investee.

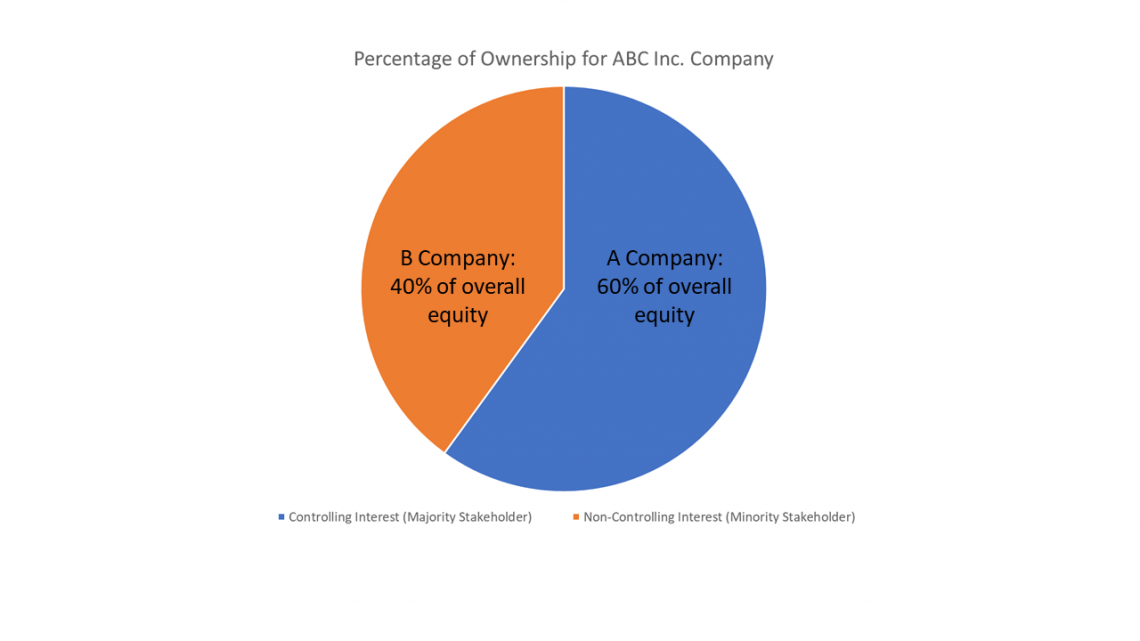

Using an example where Company ABC Inc. above is owned by two stakeholders, one with a controlling interest of 60% (Company A) and another with a non-controlling interest of 40% (Company B).

There are a few methods to account for them, as shown below.

Consolidation Method

It is used when a company has a controlling interest and is a majority stakeholder. In this case, Company A and its subsidiary, Company ABC Inc.

- Company A will combine its financial statements with Company ABC Inc.

- The 40% of the equity in ABC not owned by Company A will be reflected as NCI in its balance sheet

- 40% of the consolidated net income earned will be credited to the non-controlling interest, in this case, Company B

Equity Method

It is used when one company has a significant hold over the investee, with investor ownership ranging from 20%-50%. In this case, Company B and their investee, Company ABC Inc.

- Company B records its share of Company ABC Inc.’s earnings as investment revenue on its income statement

- Company B also records its investment in Company ABC Inc. on its balance sheet as an asset at historical cost

Cost method

It is used when one company does not have significant control over the investee, with a “minimal” ownership stake of <20%. Let’s use another example of XYZ Inc., where company C has a 10% equity stake in it.

- Company C will not reflect XYZ Inc.’s earnings in its income statement but rather the dividends issued by XYZ Inc.

- Instead, Company C will record the historical cost price of the investment in its balance sheet under investments

How to calculate non-controlling interest?

This is more with regard to consolidated financial statements, where there will be a line item for NCI. The calculation is quite straightforward, as the number reflected as NCI on the financial statements is the percentage of the minority ownership.

Continuing the example of Company A’s 60% ownership of ABC Inc, Company B’s NCI of 40%, and M stands for USD in millions.

Income Statement

- Company A will take ABC Inc.’s net income and multiply it by the NCI percentage

- In this case, it would be Company B’s 40% stake. Assume ABC Inc.’s net income is $10M

- The net income belonging to the non-controlling interest would be calculated as $10M x 40% = $4M

- The $4M would be reflected under the non-operating line item on the Income Statement as per GAAP

- The $4M of net income that is credited to Company B through their 40% stake will also not be under Company A’s net income

Balance Sheet

- Company A will take ABC Inc.’s book value and multiply it by the NCI percentage

- In this case, assume ABC Inc.’s book value is $30M

- The NCI listed in Company A’s balance sheet would be calculated as $30M x 40% = $12M

- The $12M will be found in either a “Non-Current Liability” or “Equity” account that is distinct from the parent company’s total equity, depending on the way it is accounted for under GAAP

Types of Non-Controlling Interest

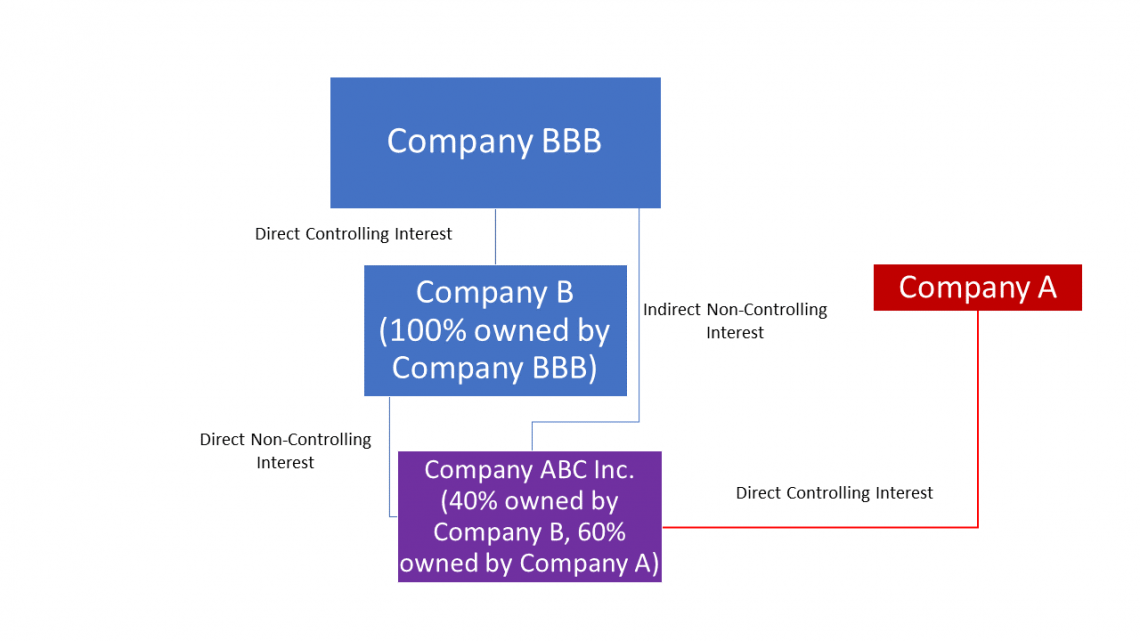

Due to the presence of acquisitions, 2 types of NCI exist.

- Direct NCI: It enables the party to receive a proportionate percentage of all the recorded equity of a subsidiary, both before and after a merger/acquisition

- Indirect NCI: It enables one to receive a proportionate percentage of a subsidiary’s recorded equity only after a merger/acquisition

To be able to visualize better what constitutes a direct/indirect NCI, refer to the graphic below:

Company B, which directly holds a 40% stake in Company ABC Inc, has a direct NCI, whereas the parent company of Company B, Company BBB (of which Company B is a wholly owned subsidiary), will only have an indirect NCI in Company ABC Inc.

If another company, Enterprise 123 Inc., wants to acquire Company ABC Inc. for $100 million US in cash, Company BBB will receive 40% of the sum at $40 million. However, as it does not have a direct NCI, it would not be able to partake in profits before that transaction.

If it were a direct NCI like Company B’s stake in ABC Inc., from the point of owning equity, Company B would be able to partake in ABC’s profits and record them down on the balance sheet and income statement accordingly using the equity method (as ownership is at 40%).

or Want to Sign up with your social account?