NOPLAT

A financial metric used in corporate finance and financial analysis to measure a company's profitability after adjusting for taxes

What Is NOPLAT?

NOPLAT stands for "Net Operating Profit Less Adjusted Taxes." It is a financial metric used in corporate finance and financial analysis to measure a company's profitability after adjusting for taxes. It represents the profit a company generates from its core operating activities after adjusting for taxes.

This measure helps investors and analysts compare two companies' profitability with distinct capital structures and tax regimes. Portfolio managers and analysts consider several variables in determining whether to invest in a company or not.

Analysts often use net operating profit minus adjusted taxes to compare companies because companies with negligible debt would not benefit from the tax-saving capacity of interest on the debt that debt-loaded companies enjoy.

Here are the components of NOPLAT:

- Net Operating Profit (NOP): This is the company's operating profit, which is calculated by subtracting operating expenses (such as the cost of goods sold and operating overhead) from its revenue. NOP reflects the profit generated from a company's primary business operations.

- Less Adjusted Taxes: This part of NOPLAT adjusts the operating profit for taxes. It subtracts the taxes a company is expected to pay based on its taxable income, considering any tax credits, deductions, or other tax-related adjustments that apply to its operations. The goal is to reflect the after-tax profit from core operations.

NOPLAT is a valuable metric for investors and analysts because it provides a more accurate picture of a company's profitability than simply looking at its net income, which various accounting factors and tax considerations can distort.

By focusing on the profit generated from operations after tax adjustments, NOPLAT helps assess a company's operational efficiency and ability to generate profits from its core business activities.

Key Takeaways

- NOPLAT, or Net Operating Profit Less Adjusted Taxes, is a key financial metric used in corporate finance to assess a company's profitability after adjusting for taxes.

- It aids in comparing companies with different capital structures and tax situations, offering a standardized measure for cross-company assessments.

- Companies with significant debt benefit from interest-related tax savings. NOPLAT helps gauge the influence of these tax advantages on operational profitability.

- NOPLAT is calculated as NOPAT (Net Operating Profit After Tax) plus the change in adjusted taxes. NOPAT, in turn, is determined by multiplying EBIT by (1 - Tax Rate).

- Analysts use NOPLAT in financial models to compute unlevered cash flows for intrinsic security valuation. It enables fair company comparisons despite varying capital structures and is especially useful in merger analysis.

How to Calculate NOPLAT

Let us understand how to calculate this metric. The formula to calculate is as follows:

Net Operating Profits Less Adjusted Taxes (NOPLAT) = Unlevered Net Income + Change in Adjusted Taxes

NOPLAT = NOPAT + Change in Adjusted Taxes

NOPAT = EBIT * (1 - Tax Rate)

An example of how to calculate net operating income after tax is provided below:

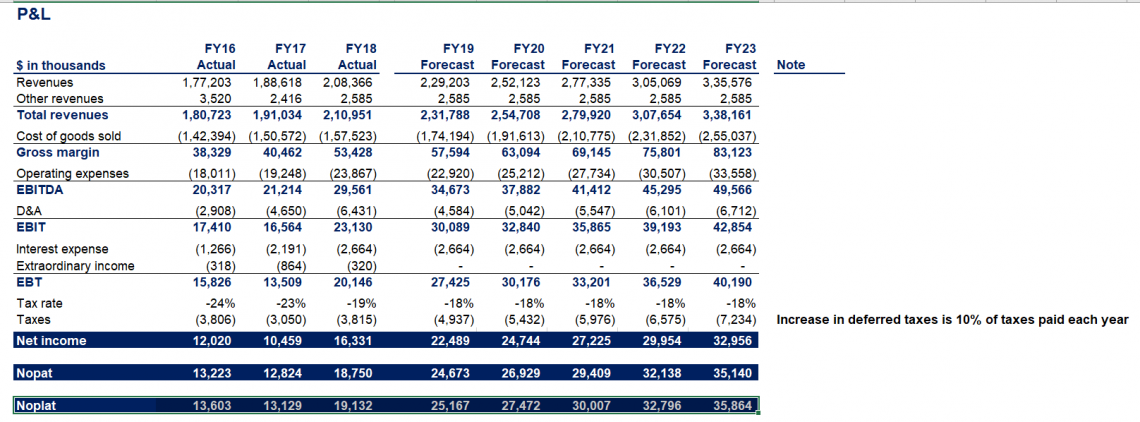

Let's say these are numbers for a company XYZ, whose profit statement is provided above. For the year 2016:

- Net income = $12,020,000

- Net operating income after taxes = $13,223,000

Now, for calculation, it is assumed that 10% of taxes paid each year have been due to deferred taxes; therefore, we add 10% of taxes paid each year to NOPAT.

Therefore:

NOPLAT for year 2016 = NOPAT + 0.1* Taxes paid

NOPLAT = $13,223,000 + 380,600 = 13,603,600

Operating income is the company's operating income, assuming it has no debt (interest expense).

After that, we can calculate a hypothetical tax payment by multiplying the EBIT by the tax rate of 24%, i.e., $17,410,000.

Subtracting the hypothetical tax payment from EBIT, we obtain the Net Operating Income After Tax.

While making financial models, analysts use NOPLAT to obtain the unlevered cash flows to be discounted back to get the security's intrinsic value.

Often, financial modeling uses enterprise value instead of equity value to compare companies with different capital structures. The reason for this is to value a firm based on its assets.

Uses of NOPLAT

NOPLAT plays an important role in corporate finance, serving as an adjustment to net income to reflect the after-tax cash flows available to all capital providers of a company.

Unlike net income, NOPLAT is favored in discounted cash flow (DCF) and leveraged buyout (LBO) models because it normalizes the impact of capital structure.

In merger analysis and DCF valuations, NOPLAT is pivotal, especially when assessing target companies.

It stands out as a before-interest and after-tax metric, excluding the influence of debt financing while incorporating the costs of debt and tax-shield benefits. This characteristic makes NOPLAT a superior indicator of operating efficiency compared to net income.

Essentially, it unveils how well a company's core operations performed, considering adjusted taxes.

NOPLAT allows the measurement of earnings without the distortion of debt-related factors, enabling fair comparisons of companies with different capital structures.

This aspect proves invaluable in determining the unlevered free cash flows and evaluating target companies, eliminating the impact of capital structure.

Moreover, in merger analysis, where the target company's capital structure is often irrelevant, NOPLAT proves advantageous, particularly in whole-company acquisitions.

NOPAT vs. NOPLAT

Let's understand the difference by taking a look at the table below:

| Aspect | NOPAT | NOPLAT |

|---|---|---|

| Definition | Net Operating Profit After Tax | Net Operating Profit Less Adjusted Taxes |

| Calculation | Operating Income * (1 - Tax Rate) | Operating Income * (1 - Effective Tax Rate) |

| Tax Adjustment | Uses statutory tax rate | Adjusts for any tax inefficiencies or incentives |

| Purpose | Basic measure of operating profit | Adjusted measure to account for tax variations |

| Usefulness | Simple and widely used | More refined when there are tax inefficiencies |

NOPLAT FAQs

We can calculate NOPLAT by:

Net Operating Profits Less Adjusted Taxes (NOPLAT) = Unlevered Net Income + Change in Adjusted Taxes

NOPLAT = NOPAT + Change in Adjusted Taxes

It can be calculated by multiplying EBIT by (1- tax rate). It indicates the operating profitability of a company. Also, it does not include sudden or unexpected one-time losses.

NOPLAT Formula = EBIT * (1 – Tax rate)

Free cash flow to the firm (FCFF) is the amount of cash left over for all the investors, i.e., bondholders, equity owners, preferred equity holders, etc.

On the other hand, free cash flow to equity (FCFE) is the amount of cash available to equity owners after payment coupons and preferred dividends.

It is a financial tool that provides a measure of a company's profits after adjusting for taxes. It is a better measure to estimate a company's operational efficiency than EBIT or NOPAT.

or Want to Sign up with your social account?