5 Cs of Credit

Forces determining a borrower's creditworthiness, providing creditors with a framework for assessing a loan applicant's eligibility for a new loan and checking their creditworthiness.

What Are the 5 Cs of Credit?

The five significant forces determining a borrower's creditworthiness are the 5 C's of credit. The five credit C's provide creditors with a framework for assessing a loan applicant's eligibility for a new loan and checking their creditworthiness.

By considering the borrower's character, ability to make payments, economic conditions, income, and securities, lenders can better understand the potential risks to the borrower.

You must apply for a loan if you seek financing for personal or professional purposes. However, getting a loan approved by financial institutions is not easy. Nevertheless, there are ways to simplify the process to make acquiring money much more manageable.

You can do this by examining your financial situation from a lender's perspective and determining whether you are in debt. Lenders usually assess your loan application based on the 5 C's credit.

If you are applying for a loan, mortgage, or credit card, the lender will want to know if you can repay the loan as agreed upon. Therefore, lenders will look at your creditworthiness, debt management ability, and whether you can take out another loan.

Key Takeaways

- The 5 Cs of credit are crucial factors that lenders use to assess a borrower's eligibility for loans, providing a comprehensive framework for understanding creditworthiness.

- To improve the chances of loan approval, applicants must evaluate their financial situation from a lender's perspective.

- Capacity measures a borrower's ability to repay a loan based on their income and recurring debt. A lower DTI increases eligibility, with lenders often preferring ratios around 35% or less.

- Conditions encompass external elements affecting loan repayments, such as economic health and interest rates. Being aware of these conditions and how they impact credit applications is essential for borrowers.

Understanding the 5 Cs Of Credit

When you apply for a loan, mortgage, or credit card, the lender will want to know if you can repay the money on time. Lenders will assess your creditworthiness, or how well you've managed debt, to determine whether you can take on more.

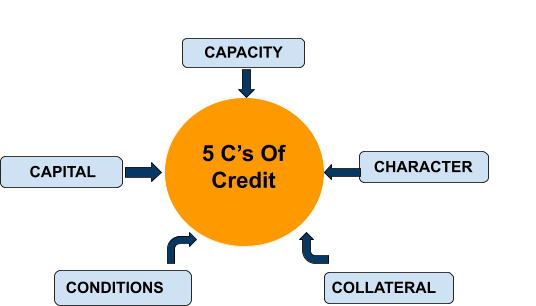

One method to examine a potential lender's creditworthiness is through the five C's of credit:

- Character

- Capacity

- Capital

- Collateral, and

- Conditions.

In any game, all players must think about and evaluate what the opponents are trying to do to win.

Similarly, in the field of credit, it is essential to look at things from a lender's perspective and understand their needs to increase the chances of getting a loan for the desired value.

The 5Cs of the credit method of consumer credit include both quality and quantity measures. Lenders may view a consumer credit report, credit score, income statements, and other documents that deal with a consumer's financial situation. They also consider information about the loan itself.

Each lender has its way of assessing consumer suitability. Still, using the five C's (character, capacity, money, collateral, and conditions) is typical in individual and business credit applications.

Character

Character refers to your credit history or how you previously managed your debt. You start developing this credit history when you withdraw your credit card and loan. Lenders may report your account history to credit bureaus.

Credit bureaus record them in documents called credit bureaus. Companies such as FICO and VantageScore then use this information to calculate their credit score.

The lender uses the credit score and credit report to determine if a loan or credit is eligible. However, all lenders have different criteria for assessing your creditworthiness.

When searching your credit report, they look at your payment history and details of your loan amount. They also check for late payments, foreclosures, bankruptcies, and more.

Lenders can also set a minimum credit requirement. Generally, the higher the credit rating, the lower the risk to the lender. Therefore, maintaining a good credit score or improving your credit score will help you qualify for a loan in the future.

The first C is "character," which refers to the individual's credit history. It represents the borrower's reputation or performance of debt repayment. This information will appear in the borrower's credit report.

Credit bureaus are created by three major credit bureaus

Provided detailed information above about how much the applicant has borrowed in the past and whether the loan has been repaid on time. The information from these reports helps lenders assess the credit risk of borrowers.

For example, FICO uses information from consumer credit reports to create credit scores. This is the tool that lenders use to take a credit rating snapshot before reviewing their credit report.

The FICO score, which ranges from 300 to 850, is intended to help lenders predict whether or not an applicant will repay a loan on time.

Many lenders have a minimum credit requirement before the applicant is approved for a new loan.

Capacity

Capacity measures a borrower's ability to repay a loan by comparing income to recurring debt and assessing the borrower's debt-to-income ratio (DTI).

The lender calculates the DTI by summing up the borrower's total monthly debt repayments and dividing it by the borrower's total monthly income.

The lower the applicant's DTI, the more likely they will be eligible for a new loan. Each lender is different, but many lenders prefer an applicant's DTI to be around 35% or less before approving a new funding application.

It is worth noting that lenders are sometimes prohibited from lending to consumers with higher DTIs.

For example, according to the Consumer Finance Protection Agency (CFPB), borrowers typically need a DTI of 43% or less to qualify for a new mortgage, making it comfortable for borrowers to pay monthly for new loans.

The ability to pay refers to the ability to repay a loan. Lenders can check your ability by looking at your debt amount and comparing it to your income. This is known as the debt-to-revenue ratio (DTI).

You can calculate your DTI ratio by summing up all your monthly debt repayments and dividing it by your monthly pre-tax income. Then multiply that number by 100.

In general, a low DTI ratio means less risk to the lender as it indicates that it may be able to undertake additional monthly debt repayments.

The Consumer Finance Protection Agency recommends keeping the DTI ratio for all debt below 36% for homeowners and between 15% and 20% for lessors.

Collateral

Collateral is putting your property on the line to protect the lender's interest. It is usually used for a secured loan or secured credit card. If you can't make the payment, your lender or credit card company may be able to take your collateral.

Providing collateral can help you get a loan or credit card if you don't qualify based on your creditworthiness.

A collateral asset that a borrower pledges to a lender (or creditor) as security for a loan.

Borrowers typically seek credit to purchase items such as a home or a car for an individual, manufacturing equipment, commercial real estate, or even something intangible (such as intellectual property) for a business.

If the loan exposure is supported by collateral, it is referred to as secured credit; if the direction is not backed by collateral, it is referred to as unsecured credit.

While collateral can make a sound borrowing request more secure, it is not a substitute for other risk management and loan underwriting best practices.

The properties you offer as collateral may depend on the type of credit you are applying for. For example, the car you buy for auto loans often acts as collateral. To open an account, you'll make a cash deposit on a secured credit card.

Secured loans and secured credit cards are less risky for lenders and can benefit those establishing, building, or rebuilding their credit.

Capital

Capital denotes the total pool of assets held in the borrower's name. It represents an individual's investments, savings, and assets, such as land.

Loans are repaid primarily with household income; capital provides additional security if unforeseen circumstances or setbacks, such as unemployment.

Capital includes assets you can use for savings, investments, and loans. An example is a down payment for buying a home.

As a general rule, the higher the down payment, the better the interest rate and loan terms. That's because down payments can show lenders your seriousness and ability to repay your loan.

To get a line of credit, you need to show that you have the capital (your own money or money from your partner) to use for the initial cost or the acquisition cost. Think of it as a down payment to show that you are serious and competent.

The amount of the down payment can also affect the rate and terms of the borrower's loan. In general, higher down costs result in better rates and conditions.

Conditions

In addition to assessing the borrower's finances, the lender also looks at other financial conditions, such as the overall health of the economy and loan details. This typically includes the loan income's interest rate, principal, and purpose.

However, the lender also considers external factors such as

- General economic conditions

- Industry trends (for business loans), and

- Other conditions that may affect loan repayment

The terms include additional information to help determine if you are eligible for credit and the times you will receive it. For example, a lender may consider these factors before lending you money.

- How you spend your money: A lender has a specific purpose other than a personal loan that can be used for anything you may be willing to lend.

- External Factors: Lenders may consider situations beyond your control, such as economic conditions, federal interest rates, and industry trends, before lending to you. You can't control these, but the lender can assess the risk.

How do lenders evaluate creditworthiness?

The five C's of credit are a framework that banks and lenders use to assess a borrower's creditworthiness. By analyzing the five criteria, lenders can fully understand the borrower's financial status and the level of risk in providing the money.

Financial institutions use credit ratings to quantify and decide whether an applicant is creditworthy and set interest rates and credit limits for existing borrowers.

Banks and other financial organizations assess these qualities differently: some develop and implement point systems that encompass each feature, while others take a more flexible approach to the five traits.

The five C's of credit are also important to understand before applying for credit. In addition, you can use them as a checklist to help you manage your own money:

- Character: To build a strong credit history, always make on-time payments and keep your credit utilization (the amount of credit you're using) low.

- Capacity: Only apply for the credit that you require. A low DTI ratio can demonstrate to lenders that you have the financial means to make a new loan payment.

- Capital: Having cash on hand may help you qualify for a loan because it shows lenders your level of commitment.

- Collateral: Some loans and credit cards may require you to provide collateral. You can keep your collateral if you constantly make on-time payments and follow the loan terms.

- Conditions: Some of the conditions that affect your credit application may be beyond your control. However, being aware of them will give you an idea of whether you may be eligible for credit.

As a result, knowing the five C's of credit is essential when applying for a loan. Prequalification for a personal loan can help determine whether you're likely to qualify, but understanding the five C's can help decide whether or not you're likely to be approved.

Researched and authored by Falak Anjum | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?