Credit Bureau

Refers to a private company that collects, gathers, and organizes individual credit information to generate credit reports

What Is a Credit Bureau?

A credit bureau, also known as a consumer credit reporting agency, is a private company that collects, gathers and organizes individual credit information to generate credit reports. They also sell data to potential lenders, such as credit card issuers and mortgage lenders.

Potential lenders use such information to determine customers’ creditworthiness and decide whether offering their products is the best choice. Essentially, bureaus collect basic facts, such as employment history and salary.

They also research the behavior of borrowers and their credit history through collecting data like:

- Outstanding debts

- Records of bankruptcy

- Types of credit accounts

- Records of possessions

- Repayment history

Information collected by each private company may vary occasionally. Each company has a different formula and system for gathering and collecting credit information.

Individuals are entitled to have access to their credit reports. Consequently, they have the right to dispute any information on their credit report because bureaus’ reports may be misleading or incorrect.

Key Takeaways

- Credit Bureaus generate a credit report by collecting and gathering a client’s credit information.

- Reports are sold to creditors and, sometimes, consumers themselves.

- There are approximately 400 credit reporting agencies in the U.S. However, the three main bureaus are Equifax, Experian, and TransUnion.

- Credit histories are used to generate credit scores, which may affect the decision of a lender, employer, landlord, etc.

- The higher your credit score, the more credible and trustworthy you are to lenders.

- Bureaus do not make the final decision on whether a person should get credit or not.

- FICO scoring is the most common system used in financial institutions.

- Credit bureaus play an essential role in the economy and must be supervised.

- The Consumer Financial Bureau (CFPB) and the Fair Credit Reporting Act are supervisory steps taken by the U.S. government to protect consumers.

What Does a Credit Bureau Do?

To assist them in making loan decisions, credit bureaus collaborate with all kinds of lending organizations and credit issuers. Making sure creditors have the data they need to make lending decisions is their main goal.

Banks, mortgage lenders, credit card issuers, and other personal financial lending businesses are typical clients of a credit bureau.

A credit bureau’s tasks include:

- Compiling information from lenders, like collection agencies

- Looking at public records containing information about tax liens and repossessions

- Ensuring that creditors have the information required to make an informed decision

However, they are not responsible for deciding whether an individual should receive a service or product.

Consumers can ask for their credit history from bureaus.

The Information Included In Your Credit Report

The following information is included in the credit report of an individual.

- Full name

- Birth date

- Social security number

- Current address

- Current phone number

- Employment history

- Job history

Who Can See And Use Your Credit Report?

An individual’s credit information should remain confidential. Therefore, bureaus follow strict rules that outline who can see your credit report. Institutions and people that can access your credit report:

- Government

- Employers

- Landlords

- Mobile phone companies

- Car leasing companies

- Banks

- Retailers

Financial Information In Your Credit Report

- Bankruptcy

- Debts in collections

- Identity verification alerts

- Credit cards

- Lines of credit and loans

- Accounts closed (with reason)

Businesses use credit reports to make decisions such as:

- Providing a loan

- Consideration for a job

- Offering a promotion

- Offering a credit increase

- Providing insurance

The data in an individual’s credit report makes a credit score.

Credit Scores

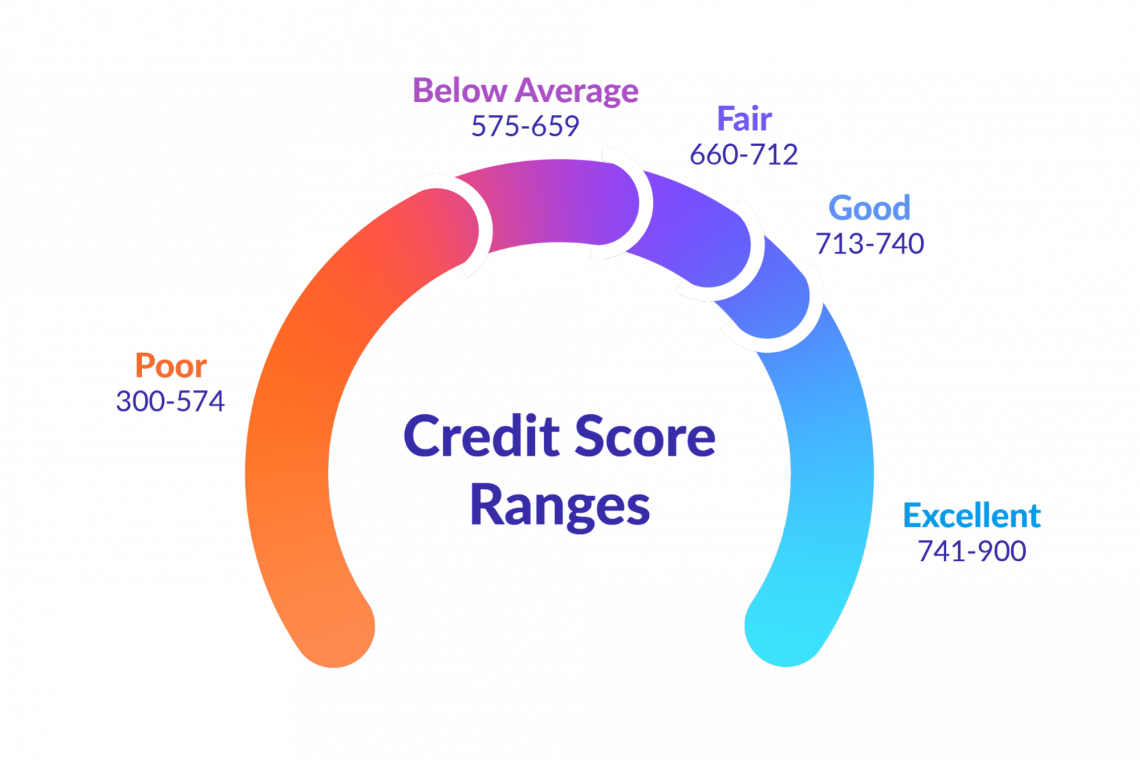

A credit score is a numerical expression between 300 and 900. Essentially, it measures how capable someone is of paying bills on time. Credit scores are calculated using a variety of factors, including payment history and current debt outstanding.

The Fair Isaac Corporation (FICO) established the credit score model. The company focuses on credit score services in the United States. FICO scores are used to assess credit risk.

Credit score ranges:

- 300-579: Bad

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

FICO scores vs. Vantage Scores

While FICO scores dominate the industry, VantageScores have become popular since their creation in 2006. Both companies create credit scores for potential lenders and creditors with similar aims.

VantageScores chooses to categorize credit factors according to their “influence” on consumers’ credit scores:

- Payment History (Extremely influential)

- Credit Usage (Highly Influential)

- Total debts (Moderately Influential)

- New Accounts Opened (Less Influential)

| FICO Scores | VantageScores |

|---|---|

|

Creates bureau-specific scores |

Creates a single tri-bureau scoring model |

|

Good score: 670-739 |

Good score: 661-780 |

|

The credit report must show a tradeline (credit card, loan.) |

The credit report must have at least one account. |

Factors That Make Up Your Credit Score

- Payment history

- Amount you owe

- Length of credit history

- New credit you apply for

When lenders ask to “check your credit,” bureaus add credit scores to their acquired information to produce a usable credit report. Generally, the higher the credit score, the less the interest is on the loan.

Did You Know?

You are entitled to one credit report every year.

Three Main Credit Bureaus

Credit bureaus are companies that gather, examine, and sell consumer credit data to lenders for a profit so the latter can decide whether to offer credit or make loans.

Credit bureaus use the credit histories they compile to provide credit ratings to people.

These are:

Equifax

Equifax is a data and analytics company with approximately 13,000 employees.

It is currently headquartered in Atlanta and operates in about 24 countries: Canada, United States, Australia, Argentina, Brazil, Cambodia, Dominican Republic, Ecuador, El Salvador, Honduras, India, Paraguay, Peru, Portugal, Russia, Saudi Arabia, Chile, Costa Rica, Mexico, Malaysia, New Zealand, Singapore, Spain, Uruguay, and the United Kingdom.

Experian

Experian was originally an American-Irish consumer credit company with a domestic headquarters in Costa Mesa, California.

It currently has approximately 17,000 employees and operates in 34 countries. In addition, they have corporate and operational headquarters in Dublin, Ireland; Nottingham, U.K.; and Brazil.

TransUnion

TransUnion is a credit reporting agency that prides itself as “a global information and insight company that makes trust possible between businesses.”

It currently has its main office in Chicago, IL, with regional offices in countries like Canada, India, Hong Kong, South Africa, the U.K., Brazil, and Colombia.

The trio uses different methods to compile credit reports and analyze consumer information. Information across bureaus is not always consistent.

It is always a great idea to buy credit reports periodically to ensure there are no signs of fraud or theft.

NOTE

Want to buy your report and take financial control? Contact the national bureaus at the information below:

- Equifax: 1-800-685-1111 | Equifax.com/personal/credit-report-services.

- Experian: 1-888-397-3742 | Experian.com/help.

- TransUnion: 1-888-909-8872 | TransUnion.com/credit-help

Laws Regulating Credit Bureau

These bureaus must follow strict rules and laws to protect consumers’ rights. Due diligence is also encouraged when compiling customers’ information because it ensures that no mistakes are made and data is not mismatched.

The following are requirements that must be followed when agencies request crucial financial information:

- Agencies and institutions that request that kind of data should have a permissible purpose. These include debt collection, credit decisions, and employment decisions

- Requestors must inform borrowers if they obtained their credit information to take adverse actions such as denying credit or increasing loan interest fees

- Bureaus must request permission or consent to use an individual’s credit report. For example, when you apply for a loan online, there is always an option to consent to lenders pulling your credit history

- Credit bureaus must keep positive credit information for at least 20 years to benefit consumers when they want to apply for loans or seek mortgages

- If a consumer files a dispute on the credit report they received, the bureau is responsible for investigating the matter and making necessary changes

- Consumers have the right to access a copy of their credit reports. Requesting your credit report does not affect your credit score

Credit Bureau Regulation

Bureaus hold a considerable responsibility. Their task is essential in determining the credibility of a consumer. In the U.S., they are supervised by the Consumer Financial Protection Bureau (CFPB).

Additionally, a federal law passed in 1970, the Fair Credit Reporting Act (FCRA), outlines how consumer credit should be used, collected, and distributed legally.

The Consumer Financial Bureau (CFPB)

- Supervises approximately 400 reporting agencies

- Ensures that consumer reporting agencies are effective

- Makes sure that the system is working efficiently for the economy

- Provides educational material to consumers

- Supervises lenders and banks by enforcing laws

- Protects consumer needs by accepting and investigating complaints

The Fair Credit Reporting Act (FCRA)

- Prevents obtaining a consumer's report without notifying them

- Ensures the privacy of the information on consumer files

- Ensures free credit reports annually

- Ensures that a person's information is deleted if it is over ten years old, as reporting old information can lead to misleading or incorrect reports

- Ensures disputes are investigated

- Ensures that creditors give accurate information about their clients

- Ensures that the client's files are not mixed

NOTE

Violating the FCRA may lead to severe consequences such as fines and jail sentences.

or Want to Sign up with your social account?