Financing Contingency

Proactive strategy designed to mitigate the impact of unforeseen events that could adversely affect one's financial stability

A financial contingency refers to a proactive strategy designed to mitigate the impact of unforeseen events that could adversely affect one's financial stability.

Financial contingencies are designed to act as a buffer against potential risks including:

- Market swings

- Unanticipated costs

- Loss of income or economic downturns

By adopting a contingency plan, individuals and organizations can better safeguard themselves against financial difficulties and maintain financial stability.

The type of financial contingencies may differ according to the specific circumstances and goals of the individual or organization.

A few typical examples include building an emergency fund, getting insurance, diversifying your investments, opening credit lines, and making a budget that allows for unanticipated costs.

It is impossible to overestimate the significance of financial contingency planning. It helps people deal with unforeseen financial obligations without resorting to excessive debt or depleting all their assets.

A backup plan may help firms continue running amid emergencies and ensure long-term viability.

Financial contingencies are essential instruments for managing the financial landscape's uncertainty. Individuals and organizations may better protect their financial well-being and preserve stability despite unexpected disasters by implementing the right safeguards in place.

Key Takeaways

- Financial contingency planning is essential for companies to prepare for unexpected events or crises impacting their financial stability.

- Contingency planning involves identifying potential risks, assessing their impact, and developing strategies to mitigate or respond to them.

- Key components of financial contingency planning include creating an emergency fund, diversifying revenue streams, maintaining strong relationships with stakeholders, and having comprehensive insurance coverage.

- Regularly reviewing and updating the contingency plan ensures its effectiveness in addressing evolving risks.

- Financial contingencies can include economic downturns, natural disasters, supply chain disruptions, regulatory changes, or unexpected expenses.

- Effective communication and transparency with employees, investors, and other stakeholders are vital to maintaining trust and confidence during a financial crisis.

- Seeking professional advice from financial experts or consultants can provide valuable insights and guidance in developing a robust financial contingency plan.

What is a Financing Contingency?

A finance contingency is a condition that may be included in a real estate contract, indicating that the buyer will only purchase the property if financing is available.

This contingency acts as a safety net for the buyer, allowing them to back out of the deal if they cannot secure financing. It protects the buyer against potential financial risks and ensures that the transaction will only proceed if the buyer obtains the necessary financing.

The significance of a finance contingency lies in its ability to safeguard the buyer if they cannot secure financing for the property. Without this clause, the purchaser would be obligated to purchase assets if they could not secure funding, which may have serious consequences.

Moreover, the finance contingency reduces the risk of the transaction falling through due to the buyer's inability to obtain financing. It benefits both the buyer and the seller, as it increases the likelihood of successful and smooth deal completion.

Incorporating a finance contingency in a real estate contract can aid in a more efficient and effective transaction process.

forms of funding contingencies

Financing contingencies in a real estate contract allow the buyers to cancel the transaction if specific financing criteria are not satisfied. The following are the most typical forms of funding contingencies:

1. Mortgage financing contingency

This condition specifies that the buyers will only acquire the property if they can obtain a mortgage loan. A purchaser has the option to terminate the deal if they are unable to secure finance.

Buyers must assess their financial situation and secure pre-approval for a mortgage before entering into a contract.

2. Appraisal contingency

This condition specifies that the buyer will only buy the property if it appraises for the purchase amount or above. If the appraisal comes in lower than the agreed-upon price, the buyer may have the right to negotiate a lower price, request repairs, or withdraw from the contract. This contingency helps protect the buyer from overpaying for a property.

3. Inspection contingency

This condition specifies that the buyer will only buy the property if it passes a home inspection. If major faults are discovered during the inspection, the buyer may be free to withdraw from the deal or negotiate repairs.

4. Sale contingency

This contingency applies when the buyer needs to sell their current home to purchase a new one. The recipient can cancel the contract without being charged if they cannot market their current home. This contingency helps manage the risk of being responsible for two mortgages simultaneously.

5. Title contingency

It ensures that the buyer will only acquire the property if the seller can offer a clear and marketable title. If title problems arise, the purchaser may be able to agree or prefer out of the agreement.

This contingency protects the buyer from potential legal and financial complications related to the property's ownership.

The type of financing contingency included in a real estate contract may vary depending on the individual circumstances of the sale and the buyer's demands. Therefore, it is important to consider the terms of any financing contingency before signing the contract.

Working closely with a real estate agent and a mortgage lender is essential for making an educated choice about financing conditions. They can assist you in understanding the expenses and risks involved with each contingency and can assist you in planning for a successful real estate transaction.

How to Create a Robust Financial Backup Plan for Your Company

Creating a solid financing contingency plan for your company is critical to ensure that you can navigate financial problems and retain stability during unpredictable times. Here are some steps you may take to develop a solid funding contingency plan:

1. Assess your current financial situation

Evaluate your financial situation, considering company working capital, overall debt, or expected income. It will assist you in identifying and preparing for any financial dangers.

2. Identify potential financial risks

Consider external elements that may influence your firm, such as economic developments, industry trends, or competition. Determine possible risks and their implications for your cash flow, revenues, and profitability.

3. Define your financial goals

Establish clear financial goals and objectives, such as keeping a particular amount of cash on hand or meeting certain revenue targets.

Note

Objectives will aid in the development of your financial contingency plan.

4. Identify alternative revenue sources

Explore potential financing options that can be utilized in the event of a financial emergency, such as a credit line, a business loan, or debit cards. Consider the terms and circumstances of different funding mechanisms, such as lending rates, taxes, and return timelines.

5. Construct a cash flow plan

Develop a financial flow strategy that details your anticipated cash flows over the coming months. It will assist you in identifying possible cash deficits and taking appropriate measures to overcome them.

6. Establish financial reporting and monitoring processes

Create processes for tracking and reporting your financial performance, such as periodic financial statements and budget reviews. It will assist you in identifying possible financial hazards and taking measures to reduce them early on.

7. Review and update your plan regularly

Regularly review and update your financial contingency plan to stay current and effective. Make modifications depending on changes in your business or external circumstances that may influence your finances.

Following these steps, you can create a solid financing contingency plan to help your company weather financial crises and retain long-term stability.

Financing's Role in Financing Contingencies

Underwriting plays a crucial role in financial situations as it assesses the risk associated with a loan application and determines whether it should be approved or denied.

Banking businesses establish identical interest amounts and conditions, such as the interest rate, payback period, guarantees, borrower's creditworthiness, financial stability, and capacity to repay debt.

Underwriting is important in the context of financing contingencies because it helps to reduce the risk of lending money to a borrower.

Underwriters can identify possible hazards and assess the chance that the borrower will be able to repay the loan by thoroughly investigating the applicant's financial status and credit history.

This information is used to establish loan terms, such as borrowing cost and return time, that represent a borrower's level of risk.

If a borrower cannot get finance due to a lack of creditworthiness or financial stability, the underwriting procedure may aid in identifying acceptable solutions or alternatives.

For example, the borrower may be forced to provide additional collateral, obtain a cosigner, or seek other financing. In financing circumstances, underwriting is crucial since it evaluates the risk involved with a loan application and decides whether it should be allowed or refused.

Underwriters can assist in reducing the risk of lending money by extensively investigating the borrower's financial situation and creditworthiness. This guarantees that borrowers may obtain the required funds to achieve their objectives.

Why Business Owners and Investors Should Prioritize Financing Contingency

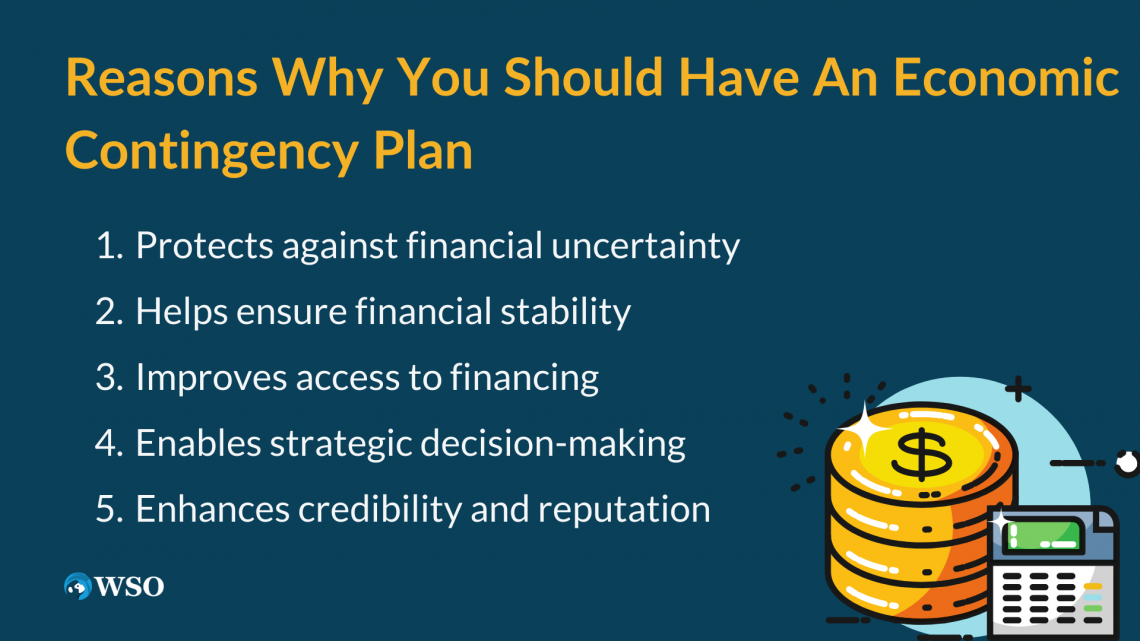

Business owners and investors should prioritize financing contingencies since it helps lessen financial risks linked to business operations and investments. These are some of the reasons why you should have an economic contingency plan:

1. Protects against financial uncertainty

A financing contingency protects firms and investors from unanticipated financial issues such as market volatility, changes in client demand, or unforeseen costs. It provides a safety net to navigate through uncertain times.

2. Helps ensure financial stability

By preparing for anticipated financial issues, businesses and investors may preserve financial stability and avert bankruptcy or other financial disasters.

3. Improves access to financing

Lenders and investors are more likely to fund businesses and investors with robust financial contingency plans. A well-thought-out plan demonstrates a commitment to financial responsibility and risk mitigation, making it easier to secure financing when needed.

4. Enables strategic decision-making

Businesses and investors may make strategic choices with greater confidence if they have a solid financial contingency plan, knowing they have managed for any financial risks.

5. Enhances credibility and reputation

Businesses and investors with solid financial contingency plans are perceived as more reputable and reliable, which may help them improve their reputation and establish connections with consumers, lenders, and investors.

Financing contingencies should be a top concern for business owners and investors since they help manage financial risks, provide financial stability, increase access to funding, allow for strategic decision-making, and boost credibility and reputation.

Businesses and investors may achieve their goals more confidently and reduce the effect of unexpected financial occurrences by planning for probable financial obstacles.

Common Obstacles to Managing Financing Contingency and Solutions

Managing financial contingencies may be difficult, and there are numerous frequent issues that firms and investors may encounter. Here are some issues and possible solutions:

1. Lack of contingency planning

Issue: Many organizations and investors may fail to anticipate possible financial issues and lack a risk-mitigation strategy.

Solution: To address this issue, firms and investors should develop a thorough contingency plan that identifies possible financial risks, explains risk-mitigation techniques, and sets clear procedures for responding to unexpected financial occurrences.

Prioritize creating a plan that addresses different scenarios and incorporates strategies for maintaining financial stability.

2. Insufficient resources

Issue: Lack of adequate resources, including financial and human resources.

Solution: To overcome this issue, firms and investors should effectively dedicate adequate resources to handle financial contingencies. Hiring extra personnel or working with financial professionals to build and implement a solid contingency plan may be necessary.

3. Limited access to financing

Issue: Access to capital can be difficult for firms and investors, particularly in times of economic hardship or volatile markets.

Solution: To address this issue, firms and investors can look into alternate financing methods such as crowdsourcing, venture capital, or government grants and maintain good ties with lenders and investors to acquire finance when needed.

4. Failure to update the contingency plan

Issue: Financiers often fail to keep updating their contingencies in place, resulting in an obsolete or ineffective approach.

Solution: Companies and investors should evaluate and update their contingencies regularly to compensate for changes in their business climate or the investing panorama and ensure that the strategy is still successful in lowering potential economic risks to handle this issue.

Eventually, managing financing contingencies can be difficult. However, business owners can overcome these challenges by developing a thorough contingency plan, allocating adequate resources, investigating alternative funding sources, and regularly updating the plan to account for new information.

The Advantages of Working Together with a Skilled Financial Advisor to Finance Contingency Planning

Working with a financial advisor can bring various advantages to funding contingency planning. These were some of the key benefits:

1. Expertise

A competent financial advisor is knowledgeable in financial planning, risk management, and contingency planning. As a result, they can assist businesses and investors in developing efficient financing contingency plans.

2. Objective advice

A financial advisor may offer impartial advice based on their expertise and education, allowing businesses and investors to make educated decisions about financial contingency planning.

3. Tailored solutions

An expert financial adviser may give customized solutions based on each business's or investor's objectives and circumstances. They consider your unique needs, risk tolerance, and goals to develop a contingency plan that effectively mitigates potential financial risks.

4. Access to resources

A financial advisor can give access to various financial resources, including equity investments, insurance, and financing choices, to assist firms in overcoming any financial obstacles.

5. Monitoring and updates

A financial adviser can keep track of the financial situation and update the financial contingency plan as needed, ensuring that it stays effective and relevant over time.

In addition, working with a professional financial advisor may provide various benefits for financial contingency planning, such as:

a. Knowledge

A financial consultant is knowledgeable about financial concerns, especially contingency planning. They can provide important insights and recommendations based on their knowledge and experience, helping you to make sound judgments.

b. Impartial advice

Financial counselors are normally objective and provide unbiased advice. They can objectively assess your financial condition and advise based on your requirements and goals.

c. Customized solutions

A financial adviser can customize a contingency plan to your specific needs. They consider your financial objectives, risk tolerance, and other criteria when developing a customized strategy to meet future financial issues.

d. Access to resources

Financial advisors have access to numerous information, tools, and financial solutions. They may use these resources to investigate various techniques and alternatives for your contingency plan, ensuring it is thorough and well-rounded.

e. Continual monitoring and updates

One of the primary benefits of working with a financial consultant is that they will continuously check your financial condition.

They may regularly evaluate and update your contingency plan in response to changes in your life, financial markets, or economic situations, ensuring it stays relevant and successful over time.

Working with a professional financial adviser adds knowledge, objectivity, customization, resource access, and continuing assistance to your financial contingency planning process. This can improve the efficacy of your strategy and provide you peace of mind about your financial stability.

Examples of Financing Contingencies in the Real World

There are several instances of financial contingencies in effect. Here are several illustrations and the takeaways to be learned from them:

1. Tesla's Financing Contingency

Tesla Motors was running low on cash in 2013 and needed to raise financing to keep operations functioning. To do this, they launched a $1.6 billion convertible debt offering with a financing contingency of at least $830 million to proceed.

The offering was a success, with orders exceeding the minimum threshold, and Tesla was able to raise the capital needed to keep operations running.

This example demonstrates that financing contingencies may be a helpful instrument for raising funds in difficult financial conditions.

2. Apple's Cash Reserves Strategy

Apple is well-known for its substantial cash reserve, which it uses as a funding contingency to fund R&D, acquire firms, and weather financial downturns.

Apple may avoid the need for external funding by keeping a significant cash reserve and maintaining control over its financial decisions.

This example demonstrates how keeping a large cash reserve may provide financial security and flexibility.

3. Amazon's Use of Lines of Credit

Amazon has several lines of credit with banks and other financial organizations that they can use as a backup finance source.

These credit lines give Amazon access to funds when needed, allowing them to continue investing in growth projects while weathering financial setbacks.

These real-world examples emphasize the importance of incorporating financing contingencies into financial planning.

By considering different funding options, setting minimum thresholds, maintaining cash reserves, and establishing credit lines, businesses can better manage financial risks, seize opportunities, and ensure long-term stability.

Important Things to Think About When Creating a Financing Contingency Plan

There are numerous important aspects to consider while building a financial contingency strategy. Here are a few examples:

1. Financial Goals

The first stage is to identify your financial objectives and ambitions. For example, why would you need money to maintain your business operating, or are you trying to generate expenses for a long proposal?

Understanding your financial objectives can assist you in determining the best financing contingency approach.

2. Capacity for purchasing

Assess your financial resources, including cash flow, creditworthiness, and other financial resources that might be utilized as a backup plan. Determine the level of risk you can comfortably handle.

3. Industry Trends

Stay informed about industry developments and economic changes that may influence your financial contingency strategy. This includes examining matters that could affect your financial circumstances, such as interest rates, inflation, and governmental restrictions.

4. Risk Management

Identifying the risks connected with your funding contingency plan and devising mitigation techniques is critical. Evaluate possible hazards and establish measures to address them effectively.

5. Legal and Regulatory Requirements

Legal and regulatory obligations may apply depending on the sort of financial contingency plan you select. Therefore, it is critical to understand these rules and guarantee compliance.

Your financial contingency plan should be consistent with your entire business strategy. This entails assessing your emergency policy's economic impact on an organization and ensuring it is consistent with your long-term goals.

Creating a finance contingency strategy requires careful evaluation of your financial objectives, capacity, industry trends, risk management, legal and regulatory requirements, and alignment with your entire company plan.

Considering these aspects allows you to create a complete strategy that gives you financial security and flexibility.

How Financing Contingency Can Help Your Business Weather Economic Downturns

Financing contingency planning is critical for firms to weather economic downturns and handle volatility. Here are some examples of how a financing contingency plan can help your business during an economic downturn:

1. Access to Emergency Funding

Businesses with a financial contingency plan in place might get emergency cash to help pay expenses during periods of economic instability. In addition, lines of credit, short-term loans, and other finance solutions can provide a cushion to help the firm weather the storm.

2. Flexibility

A financial contingency plan allows organizations to alter their financial strategy when economic conditions change. For example, if interest rates fall, firms can use the decreased borrowing costs to refinance debt or invest in possibilities for development.

3. Improved Creditworthiness

By implementing a financing contingency plan, businesses may show lenders and investors that they proactively manage their finances and limit risk. This can help them enhance their creditworthiness and get capital during economic downturns.

4. Reduced Financial Stress

A financial contingency plan provides a structured approach to managing finances during challenging times. It helps alleviate financial stress for business owners and managers by providing a clear roadmap and strategies for navigating economic uncertainties.

5. Opportunity to Invest in Growth

Economic downturns can allow companies to expand by acquiring distressed assets or expanding into new markets. Organizations with a monetary backup plan can grab this opportunity without risking their ability to make ends meet.

A financial contingency plan may assist firms in weathering economic downturns by offering access to emergency funding, flexibility, increased creditworthiness, decreased financial stress, and growth prospects.

Businesses may be better prepared to traverse uncertainty and emerge stronger on the other side by investing in a financial contingency plan.

or Want to Sign up with your social account?