Scaling Beyond IPO

Seven Tips for Successful Growth Management

Scaling to IPO is exciting and exhausting, but scaling beyond this requires even more hard work. Sustainable growth management post-IPO is a strategically complex, laborious task that a lot of businesses aren’t as prepared for as they should be.

Alongside the daily demands that drive sustainable growth, an initial public offering, or IPO, bombards you with a bunch of new high-priority commitments. This includes tasks like intricate and punctual financial forecasting and reporting, regulatory filing, and strict Sarbanes-Oxley (SOX) compliance.

These integral post-IPO tasks increase workloads and threaten to hinder productivity and scaling potential. So, how do you successfully scale beyond this status?

Before we get into it, let’s quickly define what an IPO is.

What is an IPO?

An initial public offering (IPO) is when a private company lists its shares on a stock exchange for the first time. This allows it to sell shares of its stock to the public, essentially transitioning from private to public ownership.

There’s no denying that IPOs are the ultimate prestigious status symbol—but they’re not the guaranteed money-makers many believe them to be. IPOs are high-risk, high-reward investments that require extensive, labor-intensive dedication beyond IPO to achieve sustainable long-term returns and growth.

If you’ve already achieved an IPO, well done. But whether you’re on day two or day 200, the demands of being a public company can become overwhelming without a growth management strategy in place.

Seven tips for successful growth management

Growth management during the post-IPO stage has some unique considerations. Here are some tips and best practices to help you do it right.

1. Establish a solid foundation

While a solid foundation is needed to secure an IPO in the first place, it doesn’t guarantee long-term foundational stability. Disruptions in the early days post-IPO, such as employee departures and misaligned priorities, can weaken your roots and prohibit sustainable growth.

To maintain a robust operational foundation and solid customer base, your post-IPO business model needs to balance operational rigidity with innovative flexibility and scalability. This involves establishing stringent controls, streamlining processes, implementing rigid SOX compliance, and putting the right technologies and financial experts in place.

2. Place customer needs at the forefront

It’s not uncommon for companies to misalign and neglect customer needs after going public. One of the main issues is that the demands of significant growth can put a strain on customer service, hurting the efficiency and effectiveness of the customer experience.

And there’s another big problem. Public companies can fall into the trap of neglecting the needs of their long-term customers in favor of those of their shiny new customer: the investor.

But it’s your loyal customers who remain at the heart of your business. All growth management strategies should have a customer-centric focus that prioritizes delivering value to your buyers.

As you scale, be sure to keep up with what your customers want and need by listening to their feedback, performing market research, and staying on top of trends.

3. Adopt technological advancements

Aside from becoming a more attractive IPO candidate when you pioneer new technologies, adopting technological advancements is key to securing growth post-IPO. Specifically, it’s the continuous, proactive adoption of backend technologies that support scaling initiatives and help you manage growth from the core.

How does investing in backend systems relate to growth management? Well, backend technologies facilitate process optimization via automation and artificial intelligence (AI). This enables you to reduce human error and increase the speed and accuracy of closes, which is a critical concern for public companies.

Backend systems, like accounting and billing, need to scale with your business. Failing to adopt technologies that empower unlimited scalability can cause significant issues down the line. This mistake might even be fatal if you’ve severely neglected backend technology in favor of chasing sales and revenue.

One of the most important reasons for technological investment comes in the form of data. All growth strategies require easily accessible, hyper-accurate access to real-time data to make pivotal business decisions during every quarter.

Enlisting modern ERP software to help you conduct accounting prep for IPO and post-IPO growth is a must. An ERP can do it all and streamlines your accounting and reporting using process-optimizing automation. It implements strict financial controls that scale capabilities and also delivers real-time data via dashboards, reports, and visualizations to empower course corrections and unlock new opportunities for operational growth.

4. Create a competent leadership team

Selecting a team of experts to lead your post-IPO initiatives might be one of the most important decisions you make during this process. While it might be that your team stays the same from pre to post-IPO, bringing in new board members as your challenges and priorities become more complex is a common practice.

IPO management teams should have a CEO and CFO at the forefront. Your chief finance officer (CFO) will ideally have some IPO experience. From there, you need a team of industry veterans with expertise in IT, legal, governance, finance, and accounting, along with marketing and sales.

Between them, your team should possess the analytical and operational skills and experience needed to execute strategically complex post-IPO growth. Be sure to discuss your initiatives with potential candidates to ensure their strategic perspectives align with the goals of your company.

5. Give priority to developing talent

Hyper-growth scaling looks toward the future. So, just as you invest in future-proof technological advancements, you also need to invest in your talent.

Rather than hiring employees to meet immediate needs, realign your recruitment priorities and hire employees with the skills to meet future needs. In other words: hire talent to fit the company you want, not the company you have.

While you should enlist the expertise of industry veterans, embrace what new generations have to offer too and invest in up-and-coming talent. Build a diverse, high-caliber workforce that balances technical and creative capabilities to drive growth in the evolving business landscape.

Prioritizing developing talent isn’t all about hiring new employees. By upskilling your current workforce, you can empower them to meet your business objectives as well. Provide employees with training to equip them with the skills and knowledge needed to thrive as you scale.

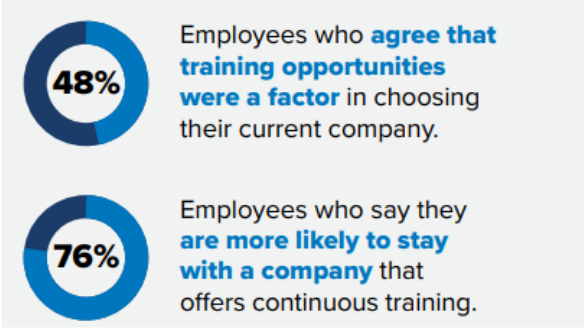

Investing in employee development comes with the added benefit of being desirable to high-quality talent. 48% of employees say training opportunities play a key role in their decision to choose an employer, while 76% say they’re more likely to stay with a company that offers continuous training.

6. Maintain financial discipline

The financial discipline needed during the pre-IPO process requires even stricter maintenance post-IPO. This is because the paradigm shift that occurs after IPO status can bring about fresh financial modeling, planning, forecasting, and reporting challenges.

Post-IPO financial planning and analysis demands stringent accuracy and end-to-end financial visibility. Businesses need to be able to collect data from every hidden corner of the company and use this to accurately communicate financial performance to investors and stakeholders.

That’s not all. In order to meet—or preferably beat—stakeholder expectations, results need to be generated promptly after closing. This means financial planning and forecasting must be performed at a quicker pace while adhering to demands of watertight accuracy, reliability, and extensivity.

Companies without an automated, scalable system in place put themselves at serious risk. A report that’s inaccurate, incomplete, or disorganized screams unprofessional and can cripple investor confidence.

An accounts payable system can centralize and automate finance tasks to give you end-to-end financial visibility and control. With automated data capture and powerful reporting capabilities, you can mitigate the potential of devastating errors and deliver hyper-accurate forecasts. This will secure investor trust as well as company share prices—all while eliminating manual tasks and maximizing productivity.

7. Encourage innovation

If you’re a public company, you’re desirably positioned to pursue innovative activities thanks to your increased access to capital. However, the paradigm shift of going public—including stricter demands, market pressures, and internal departures—can also stifle you.

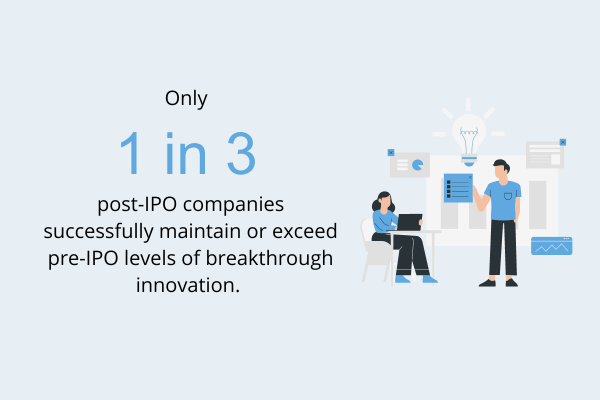

For those who achieve IPO on the back of breakthrough innovation, maintaining the same levels of innovation post-IPO can prove difficult. Research shows that only one in three public companies successfully maintain or exceed their pre-IPO levels of breakthrough innovation.

As growth and innovation go hand in hand, encouraging innovation can help avoid what’s often dubbed the “post-IPO innovation slump”.

Establish a competent leadership team and prioritize developing talent to diversify your workforce. With new ideas and perspectives flowing, you can infuse innovation into problem-solving activities.

Also, keep up with customer demands and industry best practices—technological advancements, for example, drive innovation through automation and AI.

Final thoughts

Scaling beyond IPO is challenging for many companies, even those with relatively smooth pre-IPO experiences. Luckily, there are plenty of strategies and best practices that your newly public company can adopt to manage and facilitate sustainable growth alongside your IPO commitments.

Strategize your financial planning and analysis to maintain financial discipline. Adopt the latest forecasting methods and accounting technologies to automate the process and eliminate errors. Create a diverse, unified team of competent leaders and skilled employees to solidify IPO initiatives and drive innovation.

Most importantly, place customer needs at the forefront and align these with your growth management initiatives.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?