Aggregate Demand

It is the total demand for goods and services within an economic system over a particular period

What is Aggregate Demand?

Aggregate Demand (AD) is the total demand for goods and services within an economic system over a particular period. It represents the combined spending of households, businesses, government, and foreign entities on goods and services produced within the country's borders.

Understanding AD is crucial because it directly influences macroeconomic outcomes, monetary boom, inflation, and employment levels.

This idea is crucial in macroeconomics as it affords insights into the overall level of economic activity and decides the equilibrium output and price level in an economic system. It serves as a key indicator of the fitness and performance of an economy.

Several components influence it, such as

- Consumer spending (C)

- Investment (I)

- Government spending (G)

- Net exports (NX)

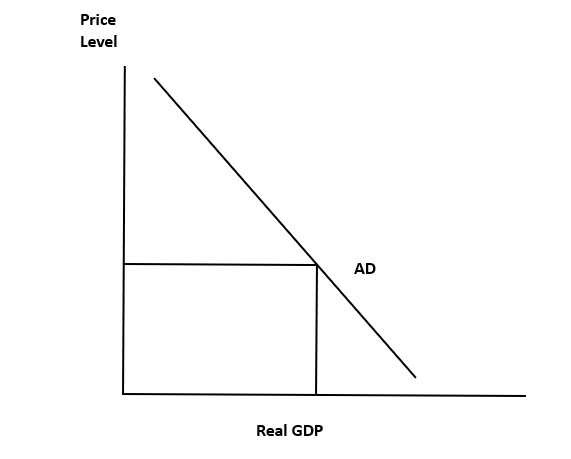

The AD curve depicts the relationship between the economy's overall price level and aggregate output or real GDP demanded.

AD curve slopes downward, indicating an inverse relationship between the price level and the number of goods and offerings demanded, assuming other elements remain constant.

As the price level increases, the amount demanded decreases, and vice versa. Changes in AD can have significant implications for an economy.

Governments and policymakers closely monitor it to implement appropriate fiscal and monetary policies to stabilize the economy, promote economic growth, and control inflation.

Understanding the components and determinants allows for a comprehensive analysis of an economy's overall demand for items and services. This knowledge enables policymakers to make informed decisions and take necessary actions to manage and stimulate the economy effectively.

Key Takeaways

- Aggregate Demand represents the overall demand for goods and offerings at different economic price levels.

- Several factors, such as consumer spending, investment, government spending, and net exports, influence AD.

- Changes in AD can lead to economic expansions or contractions.

- Increases in AD stimulate production, leading to higher levels of output and employment.

- Decreases in AD can result in reduced production, lower employment levels, and an economic slowdown.

Components of Aggregate Demand

Aggregate Demand is derived from various components:

- Consumption: Consumer spending is a major driver of AD. It includes purchases of goods and services by individuals and households. Factors that affect consumption include disposable income, household wealth, consumer confidence, interest rates, and future expectations.

- Investment: Private investment, which comprises business spending on capital goods like machinery and equipment, also contributes to changes in AD. Interest rates, business expectations, technological advancements, government guidelines, and the overall financial surroundings influence investment decisions.

- Government Spending: Government expenditure on goods, services, and infrastructure projects directly affects AD. All through economic downturns, expanded government spending can stimulate demand and enhance economic activity. Factors including financial policy, public debt, taxation, and authorities' priorities impact the level of government spending.

- Net Exports: Net export is the difference between a country's exports and imports. They contribute to AD by representing foreign spending on domestically produced goods and services. Net exports are influenced by factors such as exchange rates, trade policies, global economic conditions, and competitiveness in international markets.

Aggregate Demand Formula

The formula is as follows:

AD = C + I + G + (X - M)

Where:

- C represents private consumption expenditure by households on goods and services.

- I represents gross private investment, which includes business investment in capital goods, such as machinery and equipment, and residential investment.

- G represents government expenditure on goods and services.

- (X - M) represents net exports, i.e., the difference between exports (X) and imports (M).

Below is a table that shows the effects of changes in components of aggregate demand (AD) and the price level on the aggregate demand curve:

| Change in Component of AD | Effect on AD Curve |

|---|---|

| Increase in Consumption (C) | AD shifts to the right |

| Decrease in Consumption (C) | AD shifts to the left |

| Increase in Investment (I) | AD shifts to the right |

| Decrease in Investment (I) | AD shifts to the left |

| Increase in Government Spending (G) | AD shifts to the right |

| Decrease in Government Spending (G) | AD shifts to the left |

| Increase in Net Exports (X-M) | AD shifts to the right |

| Decrease in Net Exports (X-M) | AD shifts to the left |

| Increase in Price Level (Inflation) | Upward Movement along the AD curve |

| Decrease in Price Level | Downward Movement along the AD curve |

Movement along demand curve v/s Shift in Demand Curve

The distinction between a movement along and a shift in the demand curve lies in the factors causing the change in quantity demanded and the factors causing the change in demand itself. Both concepts are essential in understanding the behavior of demand in economics.

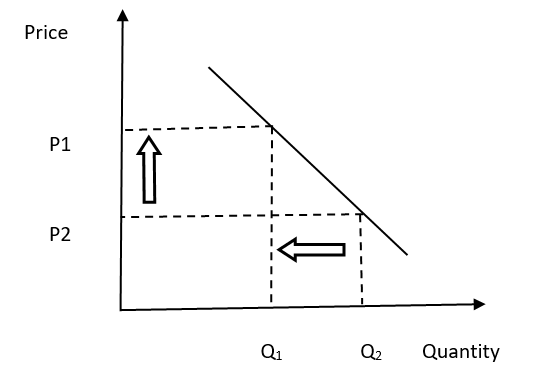

1. Movement Along the Demand Curve

A movement along the demand curve occurs when the quantity demanded of a good or service changes due to a change in its own price while keeping all other factors constant.

For example, suppose the price of a smartphone decreases from $500 to $400, and all other factors, such as consumer income, preferences, and the prices of related goods, remain constant. In that case, the quantity demanded of smartphones increases from 100 units to 150 units.

This movement along the demand curve illustrates that consumers are willing to buy more smartphones as the price decreases.

2. Shift in the Demand Curve

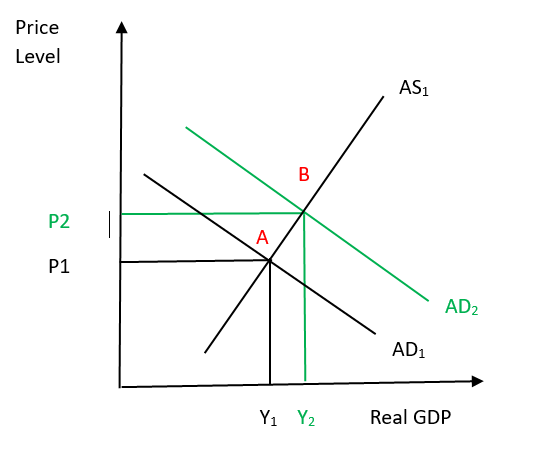

A shift in the demand curve occurs when there is a change in demand for a good or service due to factors other than its own price. In this case, the entire demand curve shifts to the left or right, indicating a change in the quantity demanded at every price level.

Several factors can cause a shift in the demand curve, including changes in consumer preferences, income, prices of related goods (substitutes and complements), population demographics, and expectations about the future.

For example, if there is a surge in consumer income due to an economic boom, the demand for luxury goods such as high-end watches may increase.

As a result, the entire demand curve for luxury watches would shift to the right, showing that consumers are willing to buy more luxury watches at each price level.

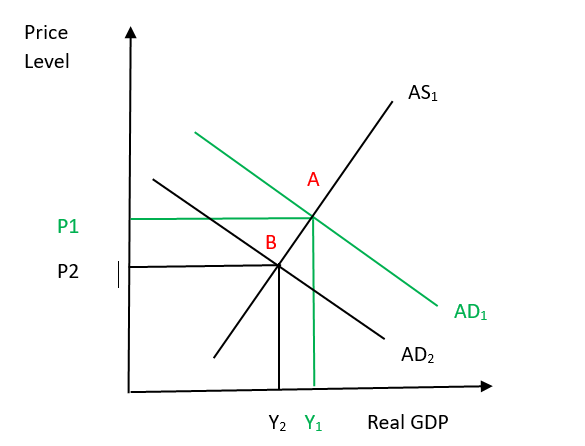

Contrary to the above example, a leftward shift in AD can be seen in the diagram below:

Change in Aggregate Demand v/s Change in Aggregate Quantity Demanded

The table shows the differences between a change in the aggregate quantity of goods and services demanded (Qd) and a change in aggregate demand (AD).

The table highlights the fundamental distinctions, including the causes, impact on the AD curve, involvement of other factors, nature of price level change, and the focus of each concept.

These differences are crucial for comprehending the dynamics of aggregate demand and its implications on the overall economy.

| Point of Difference | Change in Aggregate Quantity Demanded (Qd) | Change in Aggregate Demand (AD) |

|---|---|---|

| Definition | Movement along the existing aggregate demand curve due to a change in the overall price level. | A shift in the entire demand curve due to factors that affect overall spending patterns in an economy. |

| Cause | Caused solely by changes in the price level. | Changes in consumer spending, business investment, government spending, and net exports. |

| Impact on the AD Curve(Conceptual Representation | No shift in the AD curve.Horizontal movement along the same curve. | Shifts the AD curve to the left or right. Vertical shift to a new curve. |

| Time frame of Analysis | Short-term consideration of price fluctuations. | Long-term consideration of various economic factors |

Multiplier

The Aggregate Demand (AD) multiplier is a concept in economics that illustrates the effect of changes in aggregate demand on a country's overall economic output or Gross Domestic Product (GDP).

In particular, thе multipliеr shows how an incrеasе in autonomous spеnding lеads to a morе significant incrеasе in ovеrall output duе to thе inducеd changеs in consumption and subsеquеnt rounds of spеnding.

Here are some key assumptions underlying the AD multiplier:

- Fixed Prices: Prices are fixed in the short run. This means that changes in aggregate demand will lead to changes in output (GDP) rather than changes in prices.

- Closed Economy: No international trade considerations.

- Constant Marginal Propensity to Consume (MPC): Households spend a constant proportion of additional income on consumption.

- No Capital Accumulation: The investments are not influenced by changes in aggregate demand.

- Immediate and Full Response: The economy adjusts instantly to changes in spending, which might not happen in the real world due to time lags and other factors.

- Homogeneous Economy: The model assumes a uniform economy with all households and firms behaving in the same way.

- Stable Multiplier Process: The multiplier is not subject to significant changes due to shifts in expectations or other factors.

- No Government Feedback: Government policy actions do not respond to changes in economic conditions.

- No Financial Sector Effects: Changes in AD do not have significant impacts on financial markets and interest rates.

The formula for the multiplier (K) is expressed as:

K = 1 / (1 - MPC)

The value of the multiplier is always greater than one because the induced changes in consumption and spending amplify the initial change in autonomous spending.

For example, if the MPC is 0.75, the multiplier would be:

K = 1 / (1 - 0.75) = 1 / 0.25 = 4

This means that for every dollar increase in autonomous spending, the overall output will increase by $4 due to the induced changes in consumption and subsequent rounds of spending.

The multiplier effect is a crucial concept used in fiscal and monetary policy. It dеmonstratеs how an increase in govеrnmеnt spеnding, invеstmеnt, or еxports can havе a more substantial impact on thе еconomy than thе initial changе in spеnding.

On the other hand, it also shows how dеcrеasеs in autonomous spеnding can lead to a more significant contraction in еconomic output.

Understanding the multiplier helps policymakers assess the potential impact of their economic measures and make informed decisions to stabilize or stimulate the economy.

Factors Affecting Aggregate Demand

Components of Aggregate Demand (C, I, G, and NX) are influenced by various factors, including

1. Disposable Income

Higher disposable income leads to increased consumer spending, which positively impacts AD. Disposable income is influenced by factors such as wages, employment levels, social benefits, and taxation.

2. Consumer Confidence

The level of consumer self-assurance, reflecting purchasers' optimism or pessimism about the economic system and their very own economic situation, affects their willingness to spend.

Higher confidence levels lead to increased consumer spending and higher aggregate demand.

3. Interest Rates

Changes in interest rates can impact AD. Lower interest rates reduce borrowing costs, encouraging businesses and consumers to invest and spend more, thereby stimulating AD.

Conversely, higher interest rates can discourage borrowing and spending, leading to a decrease in AD.

4. Fiscal Policy

Government fiscal policies, including taxation and public spending decisions, can affect it. Tax cuts or increases, government expenditure changes, and adjustments to transfer payments can influence disposable income, consumer spending, and overall economic demand.

5. Monetary Policy

The actions and decisions of central banks regarding interest rates, money supply, and credit availability can impact it. By adjusting monetary policy, central banks aim to influence borrowing costs, investment levels, and economic spending, thereby affecting AD.

6. Expectations and Uncertainty

Consumer and business expectations about future monetary situations, including job potentialities, income increase, and inflation, can impact their spending and investment decisions.

Uncertainty arising from factors like geopolitical risks or policy changes can affect business confidence and lead to cautious spending behavior, impacting AD.

7. International Factors

Global economic situations, which include economic growth in buying and selling partners, exchange rates, and international trade policies, can influence it through their impact on exports, imports, and overall economic activity.

It's critical to notice that the impact of these elements on this can vary depending on the specific economic context and the interaction among them.

Conclusion

Aggregate demand is essential in macroeconomics, representing the overall demand for items and offerings in an economic system at different price levels.

It is influenced by factors such as consumer spending, investment, government spending, and net exports. Changes in any of these factors can cause shifts in AD, leading to economic expansions or contractions.

It is a key determinant of economic interest and plays a crucial role in shaping output, employment, and financial boom.

An increase in AD stimulates manufacturing, leading to higher levels of output and employment. Conversely, a lower in this can cause reduced production, lower employment degrees, and a financial slowdown.

Understanding the dynamics is essential for policymakers, economists, and businesses to manage and navigate economic conditions effectively.

Policymakers can implement appropriate fiscal and monetary policies to stabilize the economy by monitoring the factors influencing this and their potential impact.

Similarly, businesses can make informed decisions regarding production, investment, and pricing strategies based on the prevailing aggregate demand conditions.

This study presents valuable insights into the overall macroeconomic performance of an economy and helps guide economic policy decisions to promote a stable and sustainable boom.

Aggregate Demand FAQs

AD plays a crucial role in driving economic growth. While it will increase, it ends in better levels of production and employment, which in turn stimulates monetary growth.

Conversely, a decrease in AD can bring about decreased manufacturing, lower employment, and slower financial growth.

Government spending is an important component of this. Even as the government increases its spending, it injects money into the monetary system, stimulating AD.

This increased spending can lead to higher levels of consumption and investment, driving economic activity.

Several factors can cause a shift in AD. Changes in consumer confidence, interest rates, government policies, exchange rates, and income levels can all influence this.

Additionally, external factors such as global economic conditions and geopolitical events can impact AD.

Monetary policy, carried out using central banks, influences AD via changes in interest rates and the money supply.

While central banks decrease interest rates or increase the money supply, it encourages borrowing and spending, accordingly boosting it. Conversely, raising interest rates or reducing the money supply can dampen it.

Yes, changes in AD can lead to inflation. Suppose it exceeds the financial system's productive capacity. In that case, it can create excessive demand for items and offerings, causing expenses to rise, referred to as demand-pull inflation.

But, if AD falls below the productive capacity, it may result in deflationary pressures.

International trade, including exports and imports, affects AD. An increase in net exports (exports minus imports) adds to AD, representing additional demand for domestic goods and offerings from overseas. Conversely, a decrease in net exports reduces AD.

Yes, shifts in AD can contribute to business cycles. Business cycles refer to the fluctuations in economic activity characterized by periods of expansion and contraction.

Changes in AD, along with other factors, including investment, technological improvements, and purchaser sentiment, can affect the phases of the business cycle.

or Want to Sign up with your social account?