Cross-Price Elasticity

Measures the responsiveness of consumers of a particular good to a change in the price of related goods, keeping all else equal.

What Is Cross Elasticity of Demand?

Cross-Price Elasticity, also called Cross-Price Elasticity of Demand or XED, is a tool that measures the responsiveness of consumers of a particular good to a change in the price of related goods, keeping all else equal.

It is calculated as the percentage change in the quantity demanded of good X due to a certain percent change in the price of good Y.

In mathematical terms:

Cross Price Elasticity = % Δ in Quantity Demanded for Good X / %Δ in Price for Good Y

% Δ in Quantity Demanded for Good X = [QX, (t+1) - QX, t] / QX, t

% Δ in Price for Good Y = [PY, (t+1) - PY, t] / PY, t

Where:

- QX, (t+1) = New quantity demanded good X

- QX, t = Initial quantity demanded good X

- PY, (t+1) = New price for good Y

- PY, t = Initial price for good Y

It indicates how the change in the price of one product can affect the quantity demanded of another product. Depending on the relationship between goods, the degree and direction of change will vary.

The concept acts as a yardstick to measure and understand the relationships between market goods, identifying substitutes or complementary goods, along with making informed decisions about

- Production

- Pricing

- Marketing

- Strategies

- Product Positioning

XED also acts as an essential tool for firms trying to enter a new market. Understanding the cross elasticity will help them formulate a strong pricing strategy for that product. They can be competitive in the market by implementing an appropriate pricing strategy.

Key Takeaways

- Cross-Price Elasticity (XED) measures the responsiveness of consumers of one good to changes in the price of related goods. It helps gauge how changes in the price of one product affect the quantity demanded of another.

- Cross-price elasticity is calculated as the percentage change in quantity demanded of one good divided by the percentage change in price of another good.

- Positive values indicate substitutes, negative values indicate complements, zero indicates independent goods and unitary values indicate proportional changes.

- Cross-Price Elasticity provides insights into market structures and competition. It helps firms understand the degree of competition in the market and assess their market power relative to competitors.

Understanding Cross-Price Elasticity

To understand the cross-price elasticity, it is important to understand that it is measured to gauge the responsiveness of the quantity demanded of one good to changes in the price of another.

Using the formula above, we can conclude how well the quantity of X is related to the price of Y. The elasticity of the goods can be positively related, negatively related, or unrelated elasticity.

Zero-Elastic Demand

When the cross elasticity is zero, the products are not connected in any way—they are independent. This indicates that a change in the price of one good won't affect the quantity demanded for the other good.

This implies that buyers don't consider these goods substitutes or complements. Therefore, the demand for the two goods is independent.

Products without substitutes can demand higher prices because they are unavailable. However, when there are close substitutes, analysts should pay close attention to how substitutes react to this.

Positive Elasticity

When the cross-elasticity of demand is positive, the two products are similar enough for one to replace the other. This indicates that whenever the price of one good increases, the quantity demanded of other goods is affected positively, meaning the increase in the quantity demanded, and vice versa.

A positive elasticity indicates the magnitude and the degree to which the goods are substitutes.

This implies that they are substitutes because an increase in the price of one will lead to an increase in the demand for the other.

Negative Elasticity

When the cross-elasticity is negative, the goods are complementary. This indicates that whenever there is an increase in the price of one product will cause a decrease in the demand for the other good, and vice-versa.

A negative elasticity indicates the magnitude and the degree to which the goods are complementaries. This implies that they are bought and consumed together, for instance, bread and butter.

Unitary Elastic

When the value of the cross elasticity of demand is 1, the cross elasticity of demand is "unitary." This means that with a change in the price of good A, there is an exactly proportionate change in quantity demanded for good B.

For example, if good X and good Y have an XED of 1, and if the price of good X has increased by 10%, this will lead to an increase in the quantity demanded by good Y by 10%.

Thus having unitary elasticity means that the quantity demanded for a good is equal to the change in the price of another good.

| XED | Elasticity Range | Relationship |

|---|---|---|

| Infinitely negative | −∞ | Perfect complements |

| Negative | (−∞,0) | Complementary goods |

| 0 | 0 | Unrelated, independent goods |

| Positive | (0, +∞) | Substitute Goods |

| Infinitely Positive | +∞ | Perfect substitutes |

Cross-Price Elasticity of Substitute Products

Substitute goods are defined as goods that can be used in place of one another. An increase in the price of one product will give rise to the demand for the other product. Tea and coffee are examples of substitute goods.

With an increase in the price of tea, people will shift to cheaper alternatives with similar characteristics. Thus, assuming all else is equal, with an increase in the price of tea, people will shift to coffee, increasing the demand for coffee.

If the quantity demanded of tea increases by 20%, when the price of coffee increases by 10%, the cross-price elasticity coefficient is +2.

This elasticity also helps to dictate the degree to which goods have a substitute relationship. Substitute goods can show a strong or a weak relationship.

In the context of cross-price elasticity, the substitute product XED is positive, indicating that whenever the prices of one substitute increase, the demand for another substitute increases.

A general practice of consumers is that they tend to shift to cheaper substitute products when there is a price increase of one substitute.

A positive cross elasticity points out that substitute products are closely related. Whenever the price of one product changes, the quantity demanded of other substitute products changes significantly.

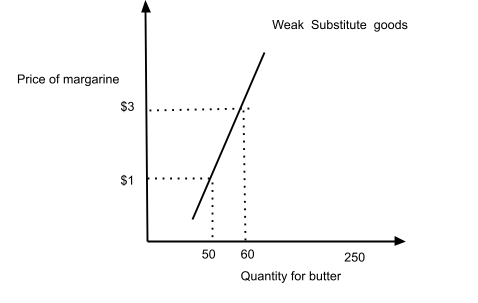

Calculating XED for Weak and Strong Substitute Goods

Let's consider the following example of weak substitute goods, where the price of margarine went up from $1 to $3, which led to an increase in the quantity demanded butter from 50 to 60 units.

% Δ in quantity demanded of good X = (60 - 50) / 50 = 20%

% Δ in price for good Y = (3 - 1) / 1 = 200%

XED = % Δ in quantity demanded of good X / % Δ in price for good Y

= 20% / 200%= 0.1

This indicates that if the price of margarine increases by 10%, the quantity demanded of butter will increase by 1%, all else equal.

Now let's consider an example of strong substitute goods. In response to rising inflation, Company A increased its flour price from $4 per kilogram to $8 per kilogram. This increased the quantity demanded of Company B's flour from 250 units to 600 units.

% Δ in quantity demanded of good X = (600 - 250) / 250 = 140%

% Δ in price for good Y = (8 - 4) / 4 = 100%

XED = % Δ in quantity demanded of good X/ % Δ in price for good Y

= 140% / 100% = 1.4

This indicates that if the price of Company A's flour increases by 10%, the quantity demanded of Company B's flour will increase by 14%.

Cross-Price Elasticity of Complementary Products

Complementary goods are defined as products that are used in combination with the main product to enhance its utility. This is because when the main product is used it may or may not have little or no value.

An increase in demand for one good will lead to an increase in the demand for another good. Airlines and fuel or bikes and petrol are examples of complementary goods.

If the price of petrol increases, people will avoid using modes of transport that use petrol as energy because the companies will pass the cost on to customers, making travel more expensive. Thus, an increase in petrol prices will reduce demand for bikes or cars which run on petrol.

Cross-price elasticity also helps to dictate the degree of complementary relationship. Complementary goods can show a strong or a weak relationship. Other complementary goods include automobiles and fuel and Samosa and Potatoes.

When car fuel prices fall and remain low and stable for a while, consumers are encouraged to purchase cars. Likewise, when fuel prices rise, consumers demand fewer cars.

On the other hand, when car prices drop, the quantity demanded of fuel rises as more consumers purchase and use cars.

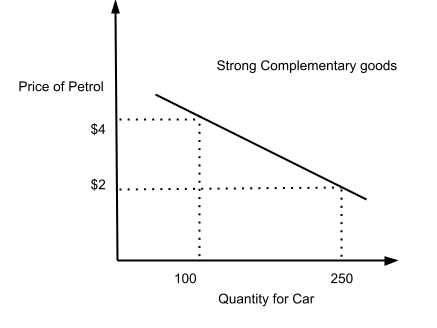

Calculating XED for Weak and Strong Complementary Goods

Petrol and cars exhibit a strong complementary relationship as the relationship is highly elastic. This is because increases in the price of petrol will cause the demand for cars to drop as driving a car becomes more costly.

Suppose due to global volatility in the price of crude oil, the cost of petrol has increased from $2 per gallon to $4 per gallon in Carlandia. This also led to a drop in the number of cars demanded from 250 units to only 100 units.

% Δ in quantity demanded for Cars = (100 - 250) / 100 = -150%

% Δ in price of Petrol = (4 - 2) / 2 = 200%

XED = % Δ in quantity demanded of good X / % Δ in price for good Y

= -150% / 100% = -1.5

This indicates that if the price of petrol increases by 10%, the number of cars demanded will drop by 15%. This indicates a strong relationship between complementary goods.

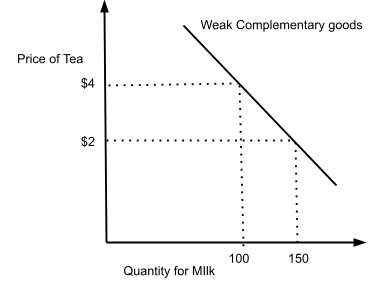

Let's now use an example to demonstrate the relationship between weak complementary goods. Tea and milk exhibit a weak complementary relationship because an increase in the price of tea only has a marginal impact on the quantity demanded milk.

% Δ in quantity demanded of Milk = (100 - 150)/ 150 = -33.33%

% Δ in price for Tea = (4 - 2)/ 2 = 100%

Cross-Price Elasticity = % Δ in quantity demanded of good X/ % Δ in price for good Y

= -33.33% / 100% = -0.33

This indicates that if the price of tea increases by 10%, there will be a 3.3% drop in the quantity of milk demanded.

Cross-Price Elasticity of Demand for Independent Goods

Independent goods are defined as goods that have a "0" elasticity of demand. Meaning, the consumption of one product is unrelated to any other product.

An increase in the demand for one good will not impact the demand for another. An example of independent goods is luxury goods and toothbrushes. Any increase or decrease in the prices of luxury goods will have no impact on toothbrushes at all.

Increasing the price of any luxury goods will not impact the sale of Colgate's toothbrushes. There is no relation between the price of luxury goods, and the quantity demanded toothbrushes.

The use of both items is independent and is not related in any way. For example, a gold ornament can be considered luxury goods. A toothbrush is necessary as it is used to clean teeth.

Speaking of price elasticity, gold ornaments are highly elastic, meaning that if the price of gold jewelry increases, people will switch to cheaper alternatives.

Toothbrushes are almost inelastic. Even if the price of toothbrushes increases, people will still buy them due to their usefulness in hygiene and the small fraction of income spent on them.

If the price of a gold necklace increases by 10%, the quantity demanded of toothbrushes will remain the same. Butter and footballs are also examples of independent goods.

The usefulness of Cross Elasticity of Demand

Now that we know the fundamentals of cross-price elasticity, let's focus on its practical uses and application.

Business Strategy And Pricing

Businesses can use cross-price elasticity to guide their marketing and pricing decisions.

For example, if a company sells several products and finds that two products have positive cross-price elasticity, it may choose to use promotional or bundling techniques to attract customers to buy both products at the same time.

Similarly, a company can modify its pricing strategy to stay competitive by knowing the cross-price elasticity between its products and those of its competitors.

Forecasting Changes In Demand

Companies can use XED to forecast the future demand for their products by understanding how changes in the price of good affects the demand another.

This information is valuable to the organization as it gives them an idea about their products' relationship with other products in the market. This provides a great deal of benefit in forecasting and anticipating demand and price changes.

Let's consider two mobile operators, one is Apple, and another is an emerging Android company operating in India. Let's also assume a strong positive cross elasticity of 1.5. If the Android company can determine its elasticity with Apple, it will be able to understand the impact on its sales caused by a change in the price of the iPhone.

By forecasting the change in demand, the Android company can efficiently allocate its capital where there is an area of growth and understand how to best market the relevant product.

Classification Of The Market

XED provides insights into market structures. It helps in understanding the nature of a product's market. If the cross-elasticity of demand between products is high, competition in the market will be higher.

Firms in monopolistic or oligopolistic markets can have significant control over the market. Understanding an organization's product and its competitors' can help assess the market power held by firms and the competitiveness of the market.

Pricing Policy

XED also helps firms understand the best pricing strategy and actions they can take in response to competitors' pricing moves. It is a great aid for policymakers to assess the impact of different pricing strategies, taxes, subsidies, or other competitive goods.

For example, if Apple decides to decrease the price of the iPhone, demand for Android phones will drop as the iPhone becomes more affordable compared to high-end Android phones.

Furthermore, cross-price elasticity is also useful when analyzing market segments. Many consumer groups buy iPhones and compete for Android phones, and each has different cross-price elasticities.

Consumer Behavior Analysis

Economists and companies can better understand customer behavior and preferences by utilizing cross-price elasticity.

By analyzing how variations in the cost of one commodity impact the demand for another, scholars can acquire valuable knowledge about consumer inclinations, income brackets, and patterns of replacement.

This becomes important for the company as consumer behavior helps determine how consumers react to the changes in the prices of goods and services.

To grow in and invest its capital in positive projects. This would ultimately help the company be profitable and maximize shareholder value. It also helps it identify competitors.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?