Price Elasticity

A concept in economics that helps us understand how changes in price affect the quantity demanded and supplied in a market.

What Is Price Elasticity?

Price elasticity of demand and supply is an important concept in economics that helps us understand how changes in price affect the quantity demanded and supplied in a market.

It is a fundamental economic concept and a crucial tool for understanding consumer behavior, making pricing decisions, and assessing market dynamics.

It provides insights into how sensitive buyers and sellers are to changes in price and helps determine the impact of price changes on market outcomes.

Price elasticity of demand measures the responsiveness of quantity demanded to changes in price. It quantifies the percentage change in quantity demanded resulting from a 1% change in price.

The formula for price elasticity of demand is:

Price Elasticity of Demand = Percentage change in Quantity Demanded / Percent change in price

Price elasticity of supply measures the responsiveness of quantity supplied to changes in price. It quantifies the percentage change in quantity supplied resulting from a 1% change in price.

The formula for price elasticity of supply is:

Price Elasticity of supply = Percentage change in Quantity Supplied / Percentage change in price

Note

Businesses must set optimum prices and maximize their revenue. By understanding the price sensitivity of consumers, businesses can determine the appropriate pricing strategies for their products.

Businesses can identify whether their products are elastic or inelastic and adjust prices accordingly. For example, lowering the price may significantly increase the quantity demanded and overall revenue if a product has elastic demand.

However, raising the price may generate additional revenue without significantly decreasing the quantity demanded if a product has inelastic demand. In addition to pricing decisions, price elasticity is also crucial for policymakers.

It helps assess the impact of taxes, subsidies, and regulations on consumer behavior and market outcomes.

By understanding the price elasticity of demand and supply for particular goods or offerings, policymakers can design effective rules that align with market forces and obtain desired outcomes.

Key Takeaways

- Price elasticity measures the responsiveness of quantity demanded or supplied to changes in price.

- Elastic demand/supply (E > 1) indicates that consumers are highly responsive to price changes, while inelastic demand/supply (E < 1) suggests less responsiveness to price changes.

- The availability of substitutes, the proportion of income spent on the good, and the time under consideration influence the elasticity of demand.

- The elasticity of supply depends on factors such as production time, availability of inputs, and flexibility of production processes.

- The price elasticity of goods can have significant implications for market outcomes, pricing strategies, and government policies.

- Elastic demand or supply may indicate a more competitive market, while inelastic demand or supply may imply market power and price distortions

Price Elasticity of Demand

Price Elasticity of Demand measures the responsiveness of the quantity demanded of a good or service to changes in its price. It quantifies the percentage change in quantity demanded resulting from a 1% change in price.

The concept facilitates us to understand how sensitive consumers are to price changes and how they affect their purchasing decisions.

It may be classified into three categories:

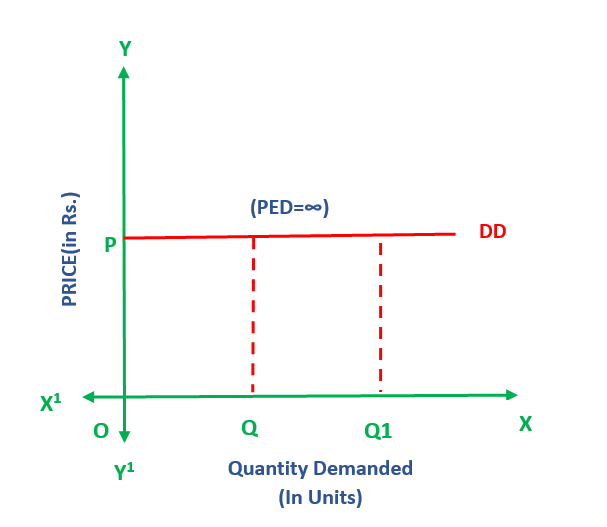

Elastic Demand

If the absolute value of the elasticity is greater than 1, demand is considered elastic.

This means that consumers are highly responsive to price changes, and a small increase in price leads to a proportionately larger decrease in the quantity demanded. Conversely, a price decrease results in a significant increase in the quantity demanded.

A perfectly elastic demand curve describes a situation where the quantity demanded of a good or service is infinitely responsive to changes in price. Here, consumers are willing to buy any quantity of the good at a specific price, but they won't buy any additional quantity if the price increases even slightly.

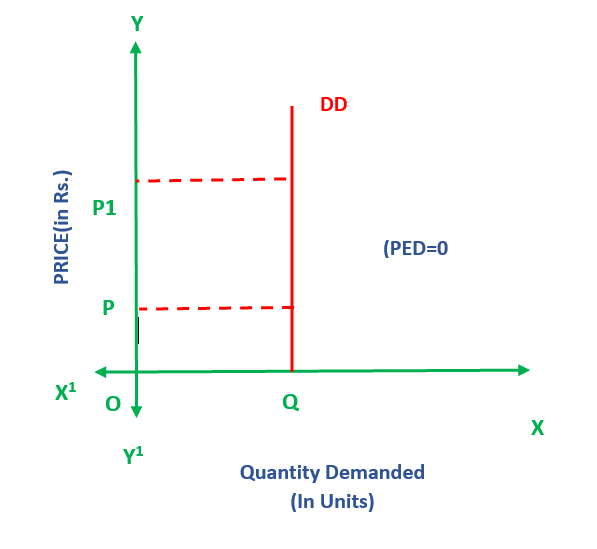

Inelastic Demand

If the absolute value of the elasticity is less than 1, demand is considered inelastic.

In this case, consumers are less responsive to price changes, and a price increase leads to a proportionately smaller decrease in the quantity demanded. Similarly, a price decrease results in a relatively smaller increase in the quantity demanded.

A perfectly inelastic demand curve describes a situation where the quantity demanded of a good or service remains constant regardless of changes in price. Here, consumers are so attached to the good that they will continue to buy the same amount despite price fluctuations.

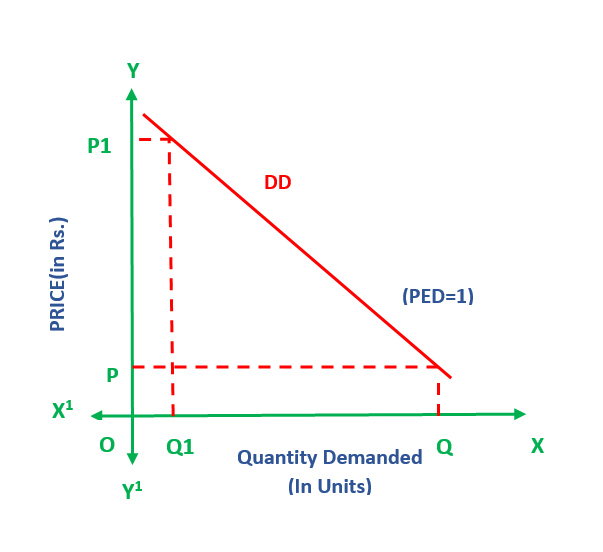

Unitary Elastic Demand

If the price elasticity of demand is equal to 1 (in absolute value), demand is considered unitary elastic. This means that the proportion change in quantity demanded equals the proportion change in price. In this case, the total expenditure or revenue remains constant as the price changes.

Factors Affecting Price Elasticity of Demand

The price elasticity of demand can vary widely for different goods and services. Several factors affect its magnitude, including:

- Availability of substitutes: The availability of close substitutes for a product influences its demand elasticity. If there are many substitutes, consumers can easily switch to alternative products when prices change, making the demand more elastic.

- On the other hand, if there are limited substitutes, demand tends to be less elastic.

- Necessity or luxury goods: The elasticity of demand is often higher for luxury goods compared to necessary goods. Luxury goods are typically more sensitive to price changes as consumers have more flexibility in their purchasing decisions.

- Necessity goods, such as food or medication, are less affected by price changes and have a relatively inelastic demand.

- Time horizon: The elasticity of demand can vary depending on the time period under consideration. In the short run, consumers may have limited options to adjust their consumption patterns, resulting in a more inelastic demand.

- However, in the long run, consumers are more flexible to change their behavior and find substitutes, leading to a more elastic demand.

- The proportion of income spent: The proportion of income that consumers allocate to a particular good or service can influence its demand elasticity. A larger proportion of income spent on a product generally leads to a more elastic demand response to price changes.

- In comparison, a smaller proportion of income spent tends to result in a less elastic response.

- Brand loyalty: Consumers who are loyal to a specific brand may be less responsive to price changes and have a relatively inelastic demand. They are more willing to pay a higher price to maintain their brand preference.

- Durability and lifespan: Products with longer lifespans are often less frequently replaced. If a product is durable and has a long lifespan, consumers might not need to purchase it as frequently, even if its price changes.

- This can result in less elastic demand because price fluctuations do not immediately affect consumers.

- Income level: Usually, lower-income individuals are more price-sensitive and have more elastic demand. In contrast, higher-income individuals may be much less sensitive to price changes and have a relatively inelastic demand.

Price Elasticity of Supply

It measures the responsiveness of the quantity supplied of a good or service to changes in its price. It quantifies the percentage change in quantity supplied resulting from a 1% change in price.

The concept of elasticity of supply enables us to recognize how producers modify their production levels in response to changes in price. Similar to the price elasticity of demand, the price elasticity of supply additionally may be categorized into three categories:

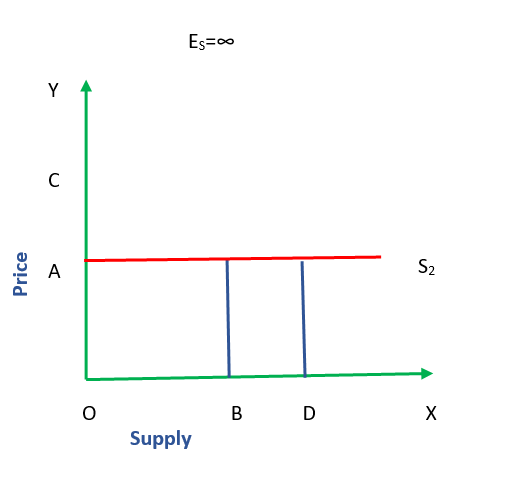

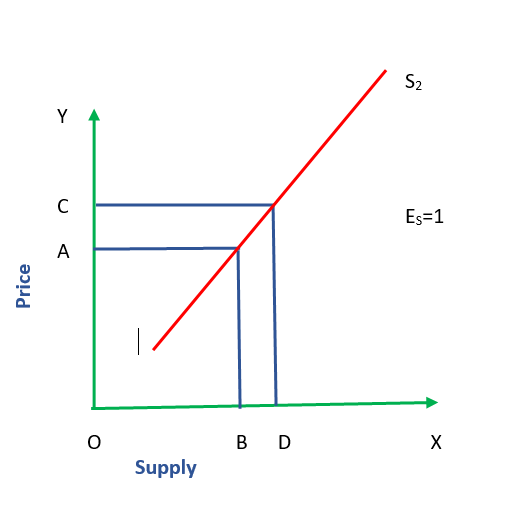

Elastic supply

If the absolute value of the elasticity is greater than 1 (in absolute value), supply is considered elastic. This means that producers are highly responsive to price changes, and a small increase in price leads to a proportionately larger increase in the quantity supplied.

Conversely, a price decrease results in a significant decrease in the quantity supplied.

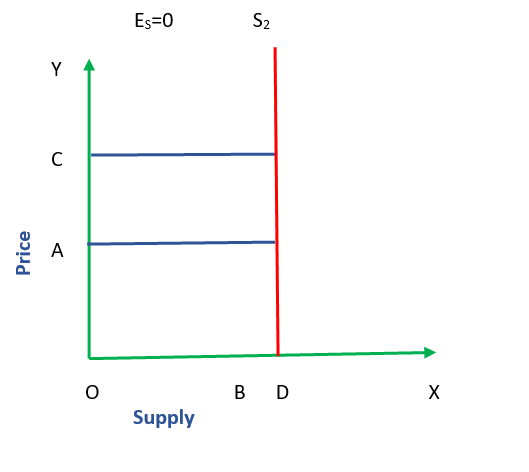

A perfectly elastic supply is a situation where the quantity supplied of a good or service can change indefinitely at a constant price. The horizontal supply curve indicates that suppliers are willing to produce any quantity of the good at a specific price but are not willing to produce any amount at a higher or lower price.

Inelastic Supply

If the absolute value of the elasticity is less than 1 (in absolute value), demand is considered inelastic. In this case, producers are less responsive to price changes, and a price increase leads to a relatively smaller increase in the quantity supplied.

Similarly, a price decrease results in a smaller decrease in the quantity supplied.

A perfectly inelastic supply is a situation where the quantity supplied of a good or service remains constant regardless of changes in price. In this case, the supply curve is vertical, indicating that suppliers are willing to produce the same quantity of the good regardless of its price.

Unitary Elastic Supply

If the absolute value of the elasticity is equal to 1 (in absolute value), supply is considered as unitary elasticity. This means that the proportion change in quantity supplied equals the proportion change in price.

Factors Affecting Price Elasticity of Supply

The price elasticity of supply can vary widely for different goods and services. Several factors can affect the magnitude of the supply elasticity of a product, including:

1. Production capacity

The availability of production resources and capacity significantly impacts supply elasticity. The supply is more elastic if a firm has excess production capacity or can quickly expand its production capabilities.

On the other hand, if production capacity is limited or takes time to adjust, supply tends to be less elastic.

2. Availability of inputs

The availability and cost of inputs required for production play a crucial role in determining supply elasticity. The supply is more elastic if the inputs are readily available and abundant.

However, if the inputs are scarce or have limited availability, it can reduce the flexibility of supply and make it less elastic.

3. Time horizon

Similar to demand elasticity, the time horizon is a crucial factor in supply elasticity. In the short run, firms may have limited capacity to adjust their production levels, making supply relatively inelastic.

In the long run, firms have more flexibility to adapt their production processes or invest in new technology, leading to a greater elastic supply.

4. Storage and inventories

The ability to store products and maintain inventories affects supply elasticity. If firms can store excess inventory or have efficient inventory management systems, they can respond quickly to changes in demand or price, making the supply more elastic.

However, if storage capacity is limited or costly, it can restrict the ability to adjust supply, resulting in less elasticity.

5. Ease of entry and exit

The ease with which new firms can enter a market or existing firms can exit affects the supply elasticity.

In competitive industries with low barriers to entry, new firms can quickly enter the market in response to price signals, increasing supply elasticity. Conversely, industries with high entry barriers or high exit costs may have less elastic supply.

6. Technology and production processes

Technological advancements and efficient production processes can impact supply elasticity. If firms have access to advanced technology and streamlined production methods, they can adjust their output levels more easily, leading to a more elastic supply.

Outdated technology or rigid production processes can restrict the ability to respond to price changes, resulting in less elasticity.

7. Government regulations

Government policies and regulations can influence the supply elasticity of certain goods and services. Regulations that impose restrictions or require costly compliance can limit the flexibility of supply, making it less elastic.

Conversely, policies that promote competition and reduce regulatory burdens can enhance supply elasticity. These factors, among others, interact to determine the elasticity of supply for a particular product.

Understanding supply elasticity is crucial for businesses and policymakers to anticipate and respond to changes in market conditions effectively.

Price Elasticity Formula

It is calculated using the following formula:

Elasticity of Demand = Percentage Change in Quantity Demanded / Percentage Change in Price

Mathematically, it can be represented as:

E = (%ΔQ) / (%ΔP)

Where:

- E = Price Elasticity of Demand

- %ΔQ = Percentage Change in Quantity Demanded

- %ΔP = Percentage Change in Price

Calculate the change in quantity demanded using the following formula:

%ΔQ = ((Q2 - Q1) / ((Q1 + Q2) / 2)) * 100

Where:

- Q1 = Initial Quantity Demanded

- Q2 = New Quantity Demanded

Calculate the change in price using the following formula:

%ΔP = ((P2 - P1) / ((P1 + P2) / 2)) * 100

Where:

- P1 = Initial Price

- P2 = New Price

Once you have calculated the percentage changes in quantity demanded and price, you can substitute these values to determine the elasticity.

Note

The price elasticity of demand is typically expressed as an absolute value, meaning that the negative sign indicating the inverse relationship between price and quantity demanded is ignored because we are interested in measuring the magnitude of responsiveness rather than the direction.

The formula for calculating the price elasticity of supply is similar to the formula for demand, but it uses the % change in quantity supplied and the % change in price.

Elasticity of Supply = Percentage Change in Quantity Supplied / Percentage Change in Price

E = (%ΔQS) / (%ΔP)

The calculations for the percentage changes in quantity supplied and price are the same as mentioned earlier.

These formulas allow economists and analysts to quantify the responsiveness of quantity demanded and supplied to changes in price, providing valuable insights into the dynamics of supply and demand in a market.

Conclusion

Price elasticity of demand and supply is a fundamental concept in economics that measures the responsiveness of quantity demanded or supplied to changes in price. It provides valuable insights into consumer behavior, producer decision-making, and market dynamics.

Understanding this is essential for businesses, policymakers, and economists alike. By analyzing the price elasticity of demand, businesses can make informed pricing decisions and optimize their revenue.

They can identify whether their products are elastic or inelastic and adjust prices accordingly. For example, elastic products may require lower prices to stimulate demand, while inelastic products can withstand price increases without significant decreases in the quantity demanded.

Policymakers can utilize price elasticity to evaluate the effect of taxes, subsidies, and regulations on consumer behavior. They can evaluate the effectiveness of policies to influence demand and make informed decisions to achieve desired outcomes.

Price elasticity helps identify market distortions and provides insights into the need for regulatory interventions to promote market efficiency. Interpreting elasticity values is crucial in understanding the magnitude and direction of responsiveness.

Elasticity values greater than 1 indicate elastic demand or supply, suggesting that quantity is highly responsive to price changes. Values less than 1 signify inelastic demand or supply, indicating a less responsive market.

Unitary elasticity, where the elasticity value is equal to 1, represents proportionate changes in price and quantity. By understanding price elasticity, economists can gain insights into the responsiveness of markets and enhance their understanding of supply and demand relationships.

Price Elasticity FAQs

It is a measure of the responsiveness of quantity demanded or supplied to changes in price. It quantifies how sensitive consumers or producers are to changes in price.

It is calculated using the formula: Elasticity = (% Change in Quantity / % Change in Price)

If demand is elastic, it means that consumers are highly responsive to changes in price. A small change in price leads to a proportionally larger change in quantity demanded.

If demand is inelastic, it means that consumers are not very responsive to changes in price. Quantity demanded changes proportionally less than the change in price.

It is influenced by factors like the availability of substitutes, the percentage of income spent on the good, and the time period under consideration.

If supply is elastic, it means that producers are highly responsive to changes in price. A small change in price leads to a proportionally larger change in the quantity supplied.

If supply is inelastic, it means that producers are not very responsive to changes in price. Quantity supplied changes proportionally less than the change in price.

It is influenced by factors like production time, availability of inputs, and flexibility of production processes.

Everything You Need To Master Excel Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?