Pigou Effect

Explains the relationship between consumption, wealth, employment, and output, particularly during economic deflation.

What Is the Pigou Effect?

The Pigou Effect is the theory that explains the relationship between consumption, wealth, employment, and output, particularly during economic deflation. Deflation occurs in an economy when the general price of goods and services falls when the inflation rate falls below zero percent.

Observed effects state that in case of deflation or price decline in the economy, employment and output increase due to an increase in wealth, and therefore consumption also increases.

This implies that the effect will automatically lead the economy to its “natural rates” after a deflationary period. A natural rate is a rate that prevails when an economy is functioning at full employment level with constant inflation.

This can be tricky to understand in one go; therefore, let’s break down the statement into parts.

The Pigou effect broadly states that when the price falls, the real money balances in the hands of the rising population since real money balances are a ratio of money supplied in the market and price.

The real money balance measures the purchasing power of a stock of money. As real money balances rise, the argument is that wealth increases, and as prices fall, goods become cheaper, and therefore, consumption in the economy increases.

This broad framework is also known as the “real balance effect.” The Pigou effect proposes that aggregate demand in the economy will automatically adjust with inflation or deflation.

This is an anti-Keynesian theory in the sense that Keynes argues when the economy is in distress, government interference is important to stabilize it. In contrast, Pigou argues that aggregate demand is self-correcting, and there is no need for government intervention.

Key Takeaways

- The Pigou effect states that in case of deflation or price decline in the economy, employment and output will increase due to an increase in wealth, and therefore consumption will also increase.

- The effect proposes that aggregate demand in the economy will automatically adjust with inflation or deflation.

- This is an anti-Keynesian theory where Pigou argues that aggregate demand is self-correcting and there is no need for government intervention.

- The effect faces much criticism since Pigou is criticized for assuming much on the propensity to save when real balances increase.

- It perceives the market ideology most simply and is inclined towards the consumption pattern only, which is viewed as negative.

- A major factor not discussed in effect is the distribution of money income of different income groups over consumption and also within different sets of assets.

history of the Pigou effect

Since the origin of economic theories, world economists have primarily emphasized the behavior of economies at times of deflations and inflationary propositions.

Economist ideas are well-explained theories, but no single theory is standardized due to the different schools of thought. However, the relevance of economic theories stays crucial with logical understanding.

For any theory to be logical, we set parameters of inclusion since inflation and deflation are inherent aspects of any economy at some point in time.

Economist Arthur Cecil Pigou gives one such theory on the economy’s behavior in periods of deflation. Economist Arthur Cecil Pigou first coined the Pigou effect in 1943 in “The Classical Stationary State,” published in Economic Journal.

Keynesian and the classical schools of thought partly influenced the explanation and analysis of the economy’s behavior under deflation or inflation.

The beginning of the model used the Keynesian framework. Still, the proposed effects advocated the classical models where the role of government is disapproved of as against Keynesian theory, where the role of government at times of inflation and deflation is considered crucial.

The Pigou model thus forms a mixed framework. He fused the Keynesian and classical models in explaining this effect.

After that, he also successfully wrecked several economic models, and one most common of them is a result of externalities, such as Pigouvian taxes.

Pigou received the Chancellor’s Gold Medal and the Adam Smith Prize in 1899 and 1903, respectively. He was generally critical of Keynesian macroeconomics and proposed a more self-stabilizing economy than Keynes had proposed.

Keynes was, in fact, critical of Pigou as well and couldn’t formulate a formula for any evaluation. Pigou later believed he missed focusing on the more important things Keynes had shown in his work.

Assumptions of Pigou’s Model

Economics is a subject that includes the whole population and is based on models that standardize some variables and associated assumptions for simplicity.

Before starting with the actual framework of the effect, it is important to know the underlying assumptions followed while developing the model.

- It assumes flexibility in wage and price levels in the economy.

- Flexibility in absolute prices is assumed.

- It is assumed that the Liquidity and Money (LM) curve consisting of money market equilibrium points) is developed concerning a constant stock of money.

- The analysis runs on strictly static terms.

- Individuals in the economy hold money balances and use some parts for consumption according to their desired ratio.

- The effect operates in commodity markets only.

The model is based on Keynesian implications of a liquidity trap. Therefore, to understand Pigou’s model, we need to distinguish between both models.

A liquidity trap occurs when economies are in a deep deflation.

This means that interest rates are at their lowest, with the LM curve being parallel to the horizontal or output/income axis.

This variably means that interest rates can only go down up to this level. In this situation, investment in the economy is also not picking up, even after low interest rates.

A Comparative study of the Keynesian theory and Pigou’s model

The Keynesian theory argues that since LM is stagnant at a position due to wage and price static behavior, we cannot increase income/output and aggregate demand further by decreasing interest rates and prices.

Therefore the economy is in a liquidity trap where people do not want to invest in government bonds, nor use the stock of money for consumption and hold it due to the uncertainty of further deflation.

In this case, Keynes proposes expansionary fiscal policy to step in and increase output, employment, and demand. The same liquidity trap situation is considered in Pigou’s model but with different logic.

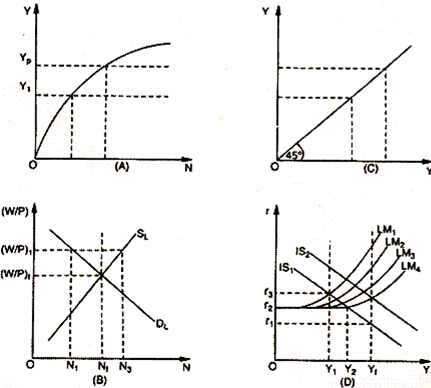

When the economy is in deflation or unemployment prevails, wages will also decline to indicate somewhat stabilization in the labor market.

When prices fall drastically, we observe a mathematical phenomenon: the real value of the money stock rises as real balances = M/P, where M is the stock of money and P is the price level.

This will lead to increased consumption since people have more real money. Alternatively, their money in assets like bonds, savings, government securities, bank deposits, etc., is also valued in real terms.

Since this makes people feel rich, they increase their consumption, increasing aggregate economic demand.

Since aggregate demand rises, output in the economy rises till it reaches full employment again.

Therefore there is no role for fiscal or monetary policy in changing the current dynamics of the economy as the system is assumed to work the adjustments on its own.

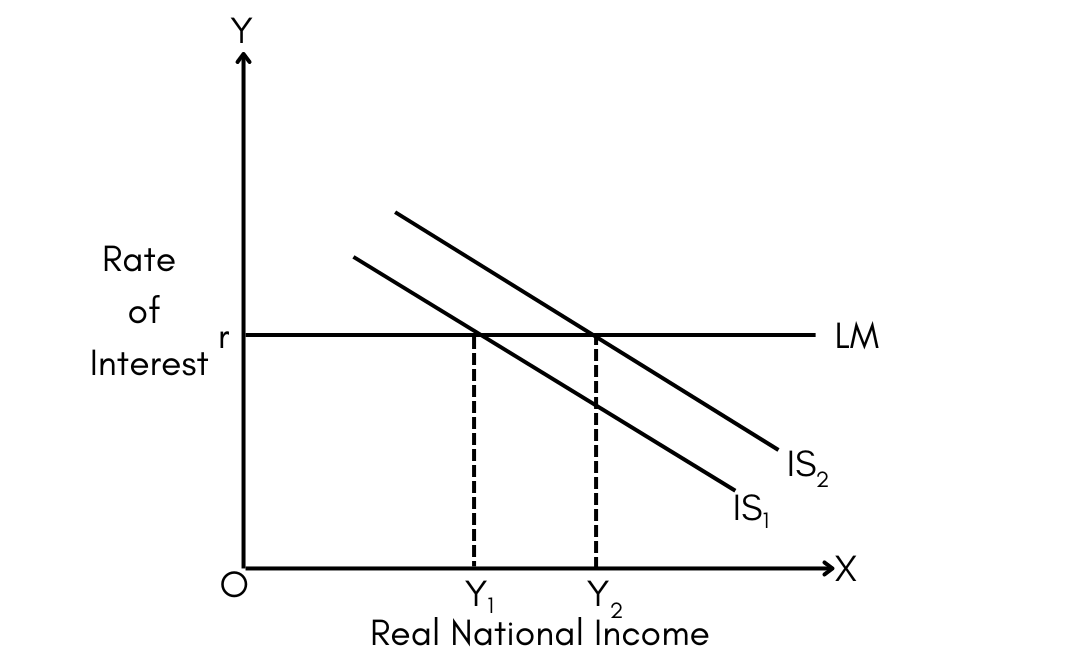

In both theories, the IS (goods market equilibrium) curve will shift upward to correct natural rates and increase the aggregate demand. Still, in Keynesian Theory, it is due to an increase in government intervention, whereas, in Pigou’s effect, it shifts due to the real balance effect or increased purchasing power.

In short, Pigou describes a situation where unemployment rises, and prices and wages fall. Since prices fall, more consumption takes place, which implies more aggregate demand, firms will now raise production and employment to meet the demand, and employment and output will grow.

The figure below depicts the Keynesian model.

The figure below depicts Pigou’s effect.

Criticism of the Pigou Effect

There are a few factors that Pigou’s model seemed to have ignored, which many other economists have put light on and criticized the model for assuming certain factors that vary from a certain prediction Pigou has assumed.

Increasing Propensity To Consume

The theory directly considers the increasing propensity to consume when wages and price levels decrease as a vague argument since not all consumers in the market need to behave deliberately toward a price fall.

As proposed by economist K.K Kurihara, it might happen that instead of the propensity to consume, the propensity to save increases due to low wages along with low prices, which will lead to no self-correction in the market.

Since there is heavy uncertainty in the market, consumers might understand the need to save more and add to their assets more to avoid any future disturbances.

Pigou is criticized because it assumes much on the propensity to save when real balances increase.

Consumption Does Not Define The Aggregate Effect

Now yet again, we argue how Pigou has perceived the market ideology most simply and is inclined towards the consumption pattern only.

However, Prof. Patinkin argues that a price decrease effect also accompanies the effect of large real cash balances on consumption on increased debt burden.

Therefore, alone consumption does not define the aggregate effect of the Pigou model; the debt burden also needs to be considered. This implies that the net effect will decide the real increase in output, if any.

Lack Of Knowledge About Income Distribution

The factor being ignored in the Pigou effect is that we don’t know the distribution of money or income across different income groups over consumption and within different sets of assets.

This is well centered that unless the lower income groups who define the actual consumption in the economy hold a large amount of money, Pigou’s effect will not capture the true relevance.

Short-Term Cycles

Since the Pigou effect is a static analysis, it follows short-term cycles.

We have established via the Pigou model that full employment will be achieved due to the decrease in price, an increase in real money balances, and an increased real value of assets

However, we haven’t yet talked about the aftermath when employment is at full level. Then, we will see an increase in prices, which would lead to a fall in real balances and the real value of assets.

Therefore the cycle or progress will be disrupted and slowly proceed backward.

Flexible Prices

Pigou’s effect ignores that prices and wages are not just flexible for once but are flexible numerous times in the process of taking the economy to full employment.

These changes are due to the price expectations of businesses and consumers. Since the price has fallen, the expectations of both parties are set accordingly for the future.

This will affect present investment and consumption several times in the process, changing the whole dynamics of the model.

Application of Pigou’s criticism

The empirical evidence of the Japanese economy has provided sufficient arguments for criticism of Pigou’s effect. This has led to a strong question about the practical usage of the Pigou effect.

In the 1990s, the Japanese economy faced great deflation with almost zero interest rates in the banking system. This is exactly a situation of liquidity trap that we have discussed theoretically above.

According to Pigou’s theory, the impact was expected to be a rise in employment and output due to a rise in consumption and, therefore, automatic stabilization of the economy.

However, the real situation did not align with Pigou’s theory. The crisis did not end following the Pigou effect and was contradicted by full-proof evidence.

The consumers did not increase their consumption with falling prices. Instead, they were seen to save the present consumption because of more future prices decline. Therefore Pigou’s model did not appear to be of much practical relevance in the real world.

Thus, in light of the above discussion, we have observed several theoretically proven factors, but the practical application denies any such usage.

In all, we have seen how Pigou has challenged the widely accepted approach of Keynes by giving a separate logic on how consumption patterns will be defined in the economy.

Using government expenditure to revive the economy using the approach of leaving the market to correct themselves via consumer behavior are two of the most extreme decisions for any government during economic distress.

Although Pigou’s model is anticipated to have a great degree of criticism, it still has significantly contributed to a new perspective to view deflation and its possible effects on the prevalent demand side of the economy.

Pigou has critically examined both classical and Keynesian approaches to form a blend of both since consumers do not rely on one type of behavior.

Therefore the strategies they follow for choosing consumption during deflation or inflation change rapidly.

The ideology that creates a connection between price, wage, employment, investment, savings, consumption, and ultimately stabilization is all combined by Pigou to propose a unique school of thought.

or Want to Sign up with your social account?