Deflation

A decline in the prices of goods and services, subsequently increasing the purchasing power of a currency

What Is Deflation?

Deflation is an economic concept characterized by a general decrease in the overall price levels of goods and services, leading to an increase in the purchasing power of a nation's currency. It represents a negative inflation rate, occurring when the inflation rate falls below 0%.

It is generally associated with a reduction in the supply of money and economic credit and with rising productivity and an abundance of goods and services. During deflation, the purchasing power of the currency strengthens, increasing the value of the currency over time, whereas inflation weakens the currency and decreases its value over time.

This shift in consumer prices is observable in the economic statistics of most nations by comparing the changes to an index.

It's important to distinguish deflation from disinflation, which denotes a slowdown in the inflation rate. In the case of disinflation, the inflation falls to a lower rate, but it is still positive.

Deflation tends to happen under specific conditions, such as when there is excess production (high supply) or reduced consumer demand (low consumption). It may also result from a decrease in the money supply due to factors like bad investment or a credit crunch or because of net capital outflow from the economy.

A steady and persistent fall in the general prices allows people to consume more and also promotes economic stability and growth by enhancing the function of money and encouraging saving.

Deflation can also occur due to too little competition in the market or too much competition in the market. However, it's important to note that under certain circumstances, deflation can lead to economic contraction.

Furthermore, deflation is normally associated with ongoing unemployment and low levels of productivity of goods and services. This strategy particularly does not prevent overconsumption among the general public, value of goods and services, which, in turn, may stimulate increased expenditure among consumers.

Most of the historical episodes are associated with an increase in productivity (increase in the supply of goods) without any increase in the supply of money, as observed during the Great Depression and certain periods in the early 1990s.

Key Takeaways

- Deflation refers to a general decline in prices of goods and services, leading to an increase in the purchasing power of money. It is the opposite of inflation.

- Main causes are decreasing money supply, falling production costs, technological improvements, and excess supply of goods. It leads to lower consumer spending and increased unemployment.

- There are two main types - "good" deflation caused by increased productivity, and "bad" deflation caused by weak economic conditions.

- Effects can be both positive (increased purchasing power) and negative (higher unemployment, deflationary spiral). It depends on the underlying causes.

- Policies to address deflation include lowering interest rates to increase money supply, implementing fiscal stimulus, and adopting non-monetary measures to boost aggregate demand.

Understanding Deflation

The nominal costs of labor, goods, services, and capital fall, but their relative price remains unchanged, which is caused by deflation. This has been a popular concern among economists for decades.

There is a change in consumer prices that can be observed in the economic statistics of most nations by comparing the changes to an index.

The most common index used for evaluating inflation prices is Consumer Price Index (CPI). The economy experiences this situation when the index in one period is lower than in the previous period, and there is a decline in prices.

This decline in prices is a beneficial thing as it gives the consumers greater purchasing power.

A steady and persistent fall in the general prices allows people to consume more and also promotes economic stability and growth by enhancing the function of money and encouraging saving.

However, the rapid decline is associated with the short-term contraction of economic activity under certain conditions.

Generally, it can occur due to debt deflation. It is when the economy is heavily laden with debts and dependent on the continuous supply of credit to inflate the prices of assets by investing credit contracts, and over-investments are liquidated.

Economists are mostly concerned about the falling prices of various sectors of the economy, especially in financial matters.

It can harm the borrowers, who are bound to pay their debts in money that is more than the money they borrowed. It can also harm any financial market participant who speculates or invests on the prospect of rising prices.

Moreover, this is generally a positive feature of a growing, healthy economy that reflects rising standards of living, technological progress, and increasing prosperity.

In mainstream economics, it is caused by a combination of the supply of money going down and the supply of goods going up.

Most of the historical episodes are associated with an increase in productivity (increase in the supply of goods) without any increase in the supply of money (Great Depression and Jan in the early 1990s).

Deflation Types

Can this be either good or bad? In western countries, most experiences are bad and damaging - it has been associated with the decline in rates of economic growth and low rates of employment.

However, a different type of decline is possible from an increase in productivity; then, it can be associated with higher economic growth and an increase in employment.

There are two different types which are discussed below:

1. Strategic Deflation ("Good Deflation"):

It is caused by lower costs and is also known as “good deflation.” This is the result of reducing overconsumption in the population, which is developed by the monetary policies of the country.

The rise in the market price of the product might be prevented by the frequency of overconsumption.

This particular strategy particularly does not prevent overconsumption among the general public, but it does help in the decline of value, eventually leading to an increase in expenditure among the general public.

Theoretically, due to an increase in productivity and decrease in value, the firms will be able to pay real wages with an increase from before.

With a particular type, we see lower values but also high outputs, higher profits, and productivity along with high wages.

Towards the end of the nineteenth century, the economies of the US and UK largely benefitted from a worldwide fall in prices due to the “Second Industrial Revolution.”

There were major productivity improvements:

- Upgraded steam engines.

- Introduction of Bessemer Steel.

- Improvement in communication.

- Age of Railways - The cheaper cost of railways.

- Transition to industrial production rather than agricultural production.

There was a rapid growth in the economy of the US during this period due to new technologies, which lowered the cost of products.

2. Circulation Deflation ("Bad Deflation"):

It is caused by the decline in prices due to weak demand causing low profitability and is also known as “bad deflation.”

It occurs when the economy of a nation is uncertain. It arises when the transitional phase of an economy hits low. Such scenarios cause huge havoc and tension among the general population.

The firms cannot raise the wages but will want to cut wages resulting in no more employment and leading to a rise in unemployment.

The beginning is mostly seen by the reduction in people’s requirements for products. Moreover, the production of similar products in excess is considered to be unnecessary, which leads to a significant drop in cost in the future.

The problems associated are:

- Purchases are delayed by consumers.

- Rise in real wage unemployment.

- A rise in real interest rates.

- Deflationary Cycle.

Example: The economy of the UK in the early 1920s. It was a period of unemployment, depression, and a decline in the UK’s economy.

Causes of Deflation

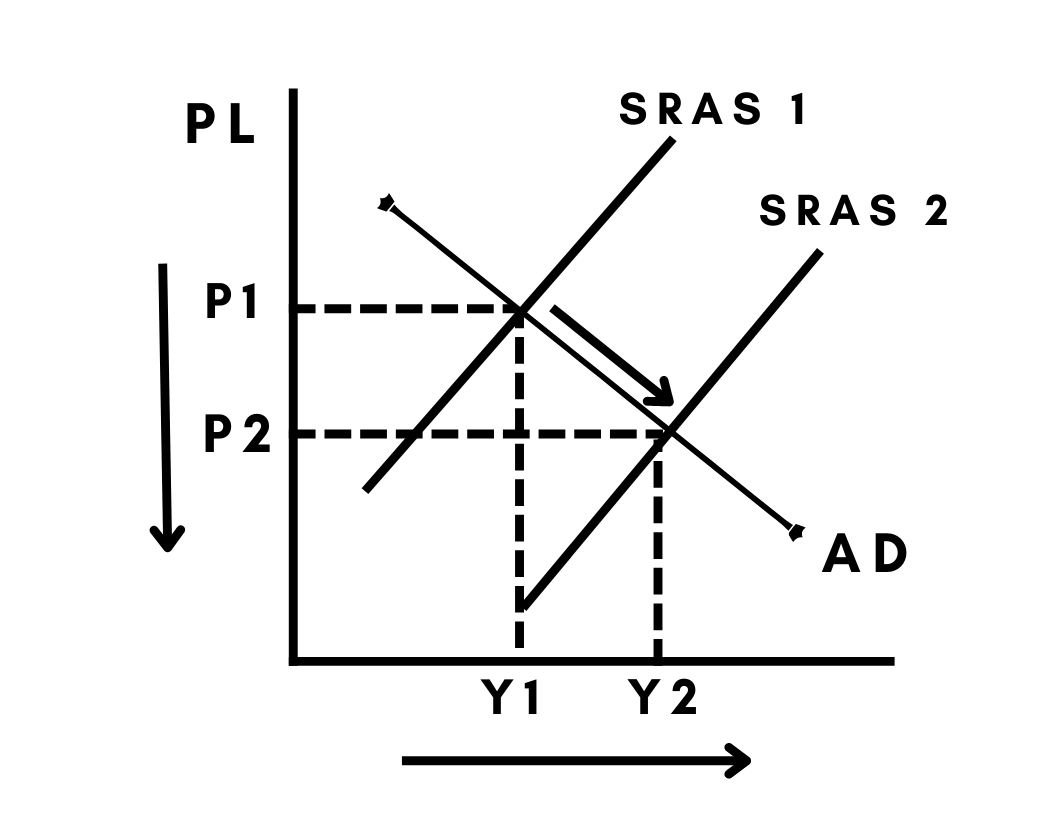

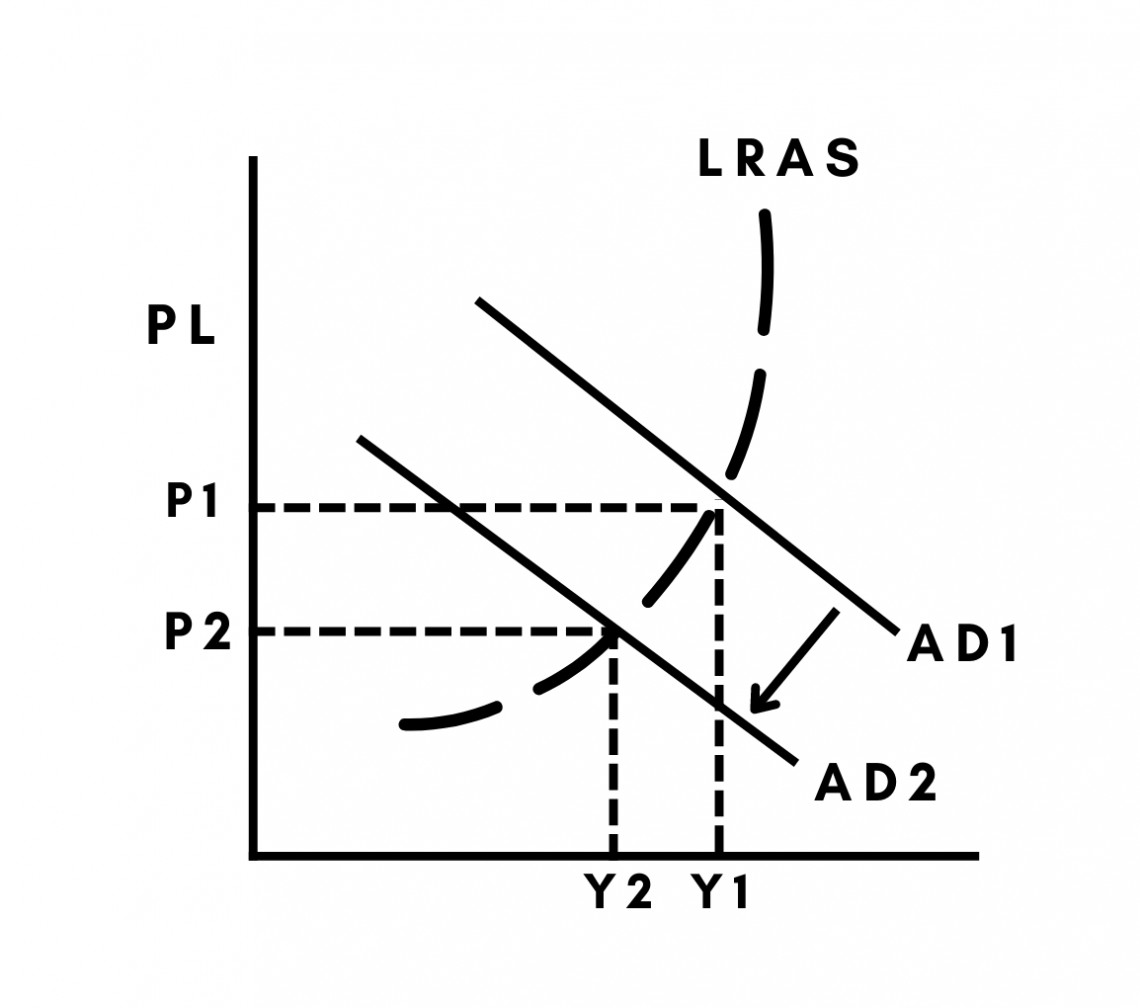

The two major causes as determined by economists are a fall in aggregate demand and an increase in aggregate supply. The other causes are described below:

1. Decrease in Money Supply: There is a fall in the supply of money to the general public as the central bank increases interest rates using a tight monetary policy. Due to this, the general public will prefer to save more of it in banks rather than spending it immediately.

Additionally, there is a rise in borrowing costs due to an increase in interest rates, leading to a reduction in expenditure in the economy.

2. Fall in Production Costs: The production costs will fall when there is a decline in the price of key production inputs (oil). The producers need to lower the prices of products for people to keep on buying them.

3. Technological Advancement: There is an increase in the application of products due to the rapid use of new technological advancements. It allows for lower production costs, thereby a decline in the price of products.

4. Increase in Supply of Goods: The supply of goods increases due to the high demand of the same from the general public.

Effects Of Deflation

When there is a rapid loss in the country, it is bound to have certain consequences. In such cases, there can either be positive effects or negative effects. The effects are mentioned below:

1. Increase in Unemployment: There is a rise in the rate of unemployment. Due to the decrease in prices of products, the producers tend to gain profit by laying off employees.

2. Increase in the real value of debt: Due to an increase in rates of interest, there will be an increase in the value of real debt. This will result in less expenditure by the general public.

3. Deflation Spiral: This is a downward price reduction in the economic crisis leading to lower production, a decline in wages, a fall in demand, and still lower prices. It is a vicious cycle where an initial problem is reinforced by a chain of events.

During economic crisis times, it is an economic challenge that further worsens the situation.

Factors of Deflation

It can be triggered by various factors. Such factors are mentioned below:

1. Offers by Bank: The banks offering high-interest rates cause a steady decline in the circulation of money among the general public. Based on this, the public will decide to maintain some of their funds in the bank instead of spending on the economy.

2. Monetary Policy: The rules and policies implemented by the central bank or authorities play an important role as a factor. If the central bank adopts strict policies resulting in high-interest rates, then people will save more and spend less. Naturally, this reduces the circulation of money in the economy.

3. Increase in Production: Due to the high demand for products, there will be an increase in production of the same. The rise in commodities will result in the downfall of the country.

4. Raise in Supply: The firms will strive to produce similar products to reach a large number of customers. Eventually, the businesses will employ various tactics to keep prices as low as possible.

5. Decrease in Demand: While producing a different variety of products, the producer does not use a proper estimation of the amount of production. As a result, the producer can plan the amount of production according to the client’s needs.

How To Deal With Deflation

There are various ways to deal with the onset of loss in a country. A few approaches are mentioned below:

1. Decrease in Interest Rates: Due to the high-interest rates, people will keep their funds safe in the bank. This will lead to a crisis because of the low monetary circulation. Therefore, it is necessary to reduce the interest rates to increase the supply of money.

2. Changes in Monetary Policies: This policy is frequently implemented by central banks like RBI to promote the circulation of public money. Along with this policy, there will be a discount rate policy. It is a needed step to reduce interest so that people can withdraw money from banks.

3. Implementation of Fiscal Policy: The current government plays a vital role in the implementation of correct fiscal policy to improve a country’s economic conditions. This can be achieved by renewing the existing expenditures.

4. Implementation of Non-Monetary Policy: Non-Monetary Policy is the best strategy to boost the supply of money among the general population. This allows it to cease immediately.

or Want to Sign up with your social account?