Baseline

It is a reference point for variables that companies use to compare data

The baseline is a reference point for many variables companies use to compare current data to previous data to track progress. It has many applications, such as project management, budgeting, and horizontal financial analysis.

It is a crucial analytical financial tool that helps managers improve company efficiency. The metric can identify key company strengths and weaknesses, allowing managers to adjust operations accordingly.

It is used in many types of financial analysis, including horizontal analysis and vertical analysis.

These two analytical methods are some of the primary valuations businesses and investors use to assess financial performance.

The difference between the two is that the horizontal analysis looks at trends over time, while the vertical analysis evaluates the relationship between current data metrics.

Additionally, it is used by investors to determine the financial performance of companies they wish to invest in. It helps them determine the return on their investment and which company would be most profitable to invest in.

What is Baseline?

It is a fixed point of reference used to compare the current performance of a company, project, or budget relatively to historical records, effectively measuring long-term progress.

It can have multiple variables such as costs, sales, units sold, etc. Therefore, it serves as a reasonable starting point for comparison purposes.

It can be used to assess the results of a change, monitor the development of an improvement project, or compare two periods. Likewise, it can be a key indicator of project failure and help managers identify improvement areas.

It is frequently employed when creating a financial statement or budget analysis. The statement or analysis compares it to the benchmark of current revenues and expenditures to determine whether a new project is successfully implemented.

Investors who want to evaluate a company's financial performance will use it before investing.

For instance, manufacturing companies can track the performance of each product line by selecting one year as a benchmark and measuring all subsequent years against it.

Which period/length of the period is chosen depends on management. However, a benchmark cannot be established without clear period data. Therefore, for a year, for example, a company can start using this metric once it has gathered 12 full months of data.

Using this metric in a company's accounting practices is advantageous because it:

- It gives the team a comprehensive view of the anticipated timeline for a project, enabling them to stay on task

- Outlines the resources that are required, their timing, and their role in the project's life cycle

- Enables accurate reporting and reflection of the development

- Enables businesses to compare their present performance to a specific benchmark based on their past performance and a benchmark established in relation to other businesses in the same industry.

- Estimates financial inflows and outflows so that resources can be managed appropriately

Applications

There are numerous applications of the concept of baselining that are used in the analysis of a company's financial factors. The applications are typical as follows:

A) Project Management

Every new project a business takes on uses a benchmark as a point of comparison. For managers to use this metric for projects, they need the following elements:

1. Milestones

These are the main project milestones that must be accomplished by a particular date or dates that fall between the project's start and conclusion dates.

2. Project Budget

This element dictates the total expenditure required and may be divided into certain parts depending on the project undertaken.

3. Schedule

The schedule dictates the timeline of the project. It identifies the project's duration and when each milestone needs to be completed to stay on track.

4. Scope

The scope identifies the project outcome, any deliverables, and what problem will be solved due to this project.

Companies and managers can monitor how a project is doing in relation to a benchmark by establishing a foundation for all four crucial elements listed above. This benchmark can then be updated in accordance with the needs and objectives of the organization.

The project's scope and the surrounding economic environment are vulnerable to changes in the market, so it's crucial to keep it flexible.

B) Budgeting

Governments typically employ this budgeting as an accounting technique to create a budget for upcoming years.

Predictions are made using the inflation and population growth rates, with the current fiscal year's budget serving as the benchmark. The formula is as follows:

Future Budget = Current Budget * Inflation Rate * Population Growth Rate

This equation assumes that the budget expands at the same rate as population growth and inflation.

Even though it might not be exact, this gives a general idea of how much money will be needed as a nation's population rises, its domestic product and service prices rise, and its economy expands.

Companies usually use this type of budgeting in project management. A cost benchmark serves as the foundation for project budgeting.

The project's approved budget is known as the cost baseline. Additionally, it is typically established by cost category and cost period.

Nevertheless, project costs inevitably vary from initial estimates when unexpected costs are incurred (in some circumstances, savings can be achieved). Therefore, actual project costs can be reflected in the cost benchmark update.

C) Horizontal Financial Analysis

A company's financial state is compared to a benchmark determined by its performance in prior accounting periods as part of a horizontal financial review. The baseline enables businesses to assess their financial development through the balance sheet and income statement.

The percentage of the benchmark is used to measure all future periods. Therefore, a period with revenue equal to the baseline would have 100% revenue.

This is a horizontal analysis of the period compared to the current period.

This practice helps identify trends, examine areas of growth or decline, and evaluate a business's overall profitability. To assess a company's ongoing performance, ratios like profit margin are also horizontally compared to the base year.

D) Vertical Analysis

Also known as trend analysis, vertical analysis is another type of financial statement analysis utilized when comparing ratios.

When comparing ratios or line items in a company's financial records over a period of time, one year's worth of entries is used as the baseline. Percentage differences in changes from that baseline are listed every following year.

This analysis is important because it makes comparing financial statements between companies and across industries considerably simpler. This is due to the fact that account balance ratios are objective.

Additionally, it facilitates the comparison of prior periods for a time series analysis, which compares quarterly and annual numbers over several years to see whether performance indicators are increasing or declining.

Importance in Horizontal Analysis

Horizontal analysis is used when inspecting the historical data from financial statements, such as ratios or line items.

Comparisons can be made using either absolute comparisons or percentage comparisons, where each successive period's figures are expressed as a share of the benchmark year's total (with 100% being the benchmark value). This concept is also known as base-year analysis.

Investors and analysts can identify trends and growth patterns by using horizontal analysis to understand what has been influencing a company's financial performance over a number of years.

It allows analysts to evaluate relative changes in various line items over time and project them into the future.

A thorough picture of operational outcomes is provided by time-series analysis of the income statement, balance sheet, and cash flow statement. It exposes what motivates a company's success and if it is profitable and functioning efficiently.

As this accounting practice involves many comparisons, these are important concepts for horizontal analysis.

This analysis is important because it evaluates prior performance and the company's current financial situation/growth.

Emerging trends can be utilized to forecast future performance. Additionally, this analysis allows a company's performance to be compared against rivals in the same sector.

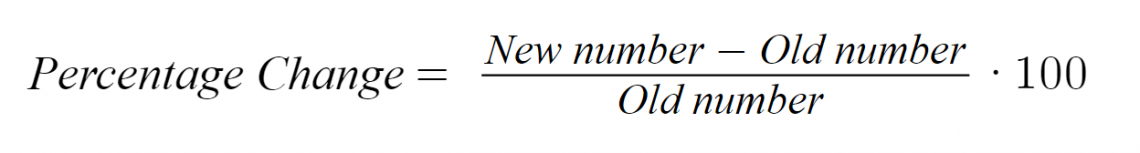

Horizontal analysis is performed in the following order:

- Select a ratio, account balance, or line item for analysis.

- Choose a base year and compare the dollar and percentage change between that year and the following years.

- Calculate the percentage change by dividing the dollar difference between the comparison year and the base year by the line item value in the base year and then multiplying the quotient by 100.

The percentage change formula is as follows:

This analysis is also beneficial for investors, as they can use it to decide if they want to invest in a firm by identifying trends in that company's financial status and performance over time.

To obtain a complete view of a company's financial health and direction, investors should combine this with other methods (e.g., vertical analysis).

Examples

As previously mentioned, horizontal analysis is a very common method employing benchmarks that businesses utilize to track their progress.

For instance, company XYZ's benchmark for profit can be $100,000, the gross profit they received three years ago.

Now, they want to compare sales to determine if they were able to sell more products and the cost of goods sold (COGS) to determine what is driving their profit.

To track their progress for each, they compare the base period to this year's numbers and calculate the percentage change as per the following table:

| Base period | Current period | Percentage change | |

|---|---|---|---|

| Gross Profit | $100,000 | $110,000 | 10% |

| Unit Sales | 156 | 149 | - 4.48% |

| COGS | $78,000 | $71,000 | - 8.97% |

Therefore, per this analysis, the company's profit has increased by 30%, its COGS have decreased by 8.97%, but its sales have dropped by roughly 4.5%.

Disregarding other factors, it can be identified that the company's profits are being boosted by its lower cost of goods sold and not by its sales. Therefore, a strength the company possesses is its low COGS, but its weakness is its inability to attract more sales.

Managers will then need to adjust company operations accordingly. For instance, one solution could be to conduct marketing research or implement customer loyalty programs.

It is also used when performing a vertical analysis, but only data from the current period is reviewed.

The benchmark for the following analysis is sales, and the other components that make up the income statement are compared to sales.

| Revenue | $500,000 | 100% |

| COGS | $100,000 | 20% |

| Gross Profit | $400,000 | 80% |

| General and Administrative Expenses | $200,000 | 40% |

| Operating income | $200,000 | 40% |

| Taxes | $50,000 | 10% |

| Net Income | $150,000 | 30% |

Frequently Asked Questions

The only way for companies to identify whether their benchmark is accurate is to establish it and adjust it as necessary. The financial health of a business depends on projections that need to be as accurate as possible.

The benchmark is just one factor that aids businesses in boosting their performance. Companies have many other ratios and accounting practices to further paint an accurate picture of the company’s progress, and all ratios and practices require adjusting for accuracy.

Comparing the company’s current numbers to those of its benchmark is a crucial part of strategy formation. Percentage changes can indicate key information on what is driving the firm’s profits, costs, sales, etc.

By identifying its own strengths and weaknesses, the firm can strategize accordingly and increase its efficiency.

All the information for comparing ratios can be found on the company’s balance sheet and income statement. This information is publicly available for companies that are listed on a public stock exchange.

Investors can access that information either on the company’s website or on trading websites.

The WSO website offers courses that can teach you a multitude of financial topics. Specifically, the Financial Statement Modeling Course and the Accounting Foundations course have material related to it and their applications.

or Want to Sign up with your social account?