Budgeting

Budgeting is the process of planning and allocating financial resources to meet specific goals and objectives.

Budgeting is a critical process for any person or organization, as it involves understanding and managing income and expenses to create a balanced budget. In addition, it involves creating a plan for utilizing financial resources to achieve specific goals.

A budgeting plan includes anticipated income and expenses, which are key components of any budget.

Anticipated income refers to the expected earnings and potential cash inflows for a person or sources such as sales, grants, donations, and investment returns for an organization.

The sources of anticipated income vary depending on whether we consider an individual or an organization.

For individuals, it typically includes sources such as salary or wages from employment, freelance income, rental income, investment returns, business profits, government benefits, and any other expected cash inflows.

Expenses, on the other hand, encompass the costs incurred by individuals, governments, or organizations. They include items such as salaries, rent, utilities, and supplies. It is essential to identify all expenses to create an effective budget accurately.

Expected expenses do not exceed expected incomes in a balanced budget. This means a company must prioritize spending to operate within its financial constraints. To free up funds for more important areas, an organization might, for instance, need to reduce spending in some areas.

Creating a budget involves identifying all the incomes and expenses incurred by an individual or associated with running an organization. These can then be categorized into groups like salary, rent, and supplies once they have been recognized.

This can facilitate decision-making by giving a clear picture of how financial resources are being distributed.

Organizations may need to adjust their spending in various areas to create a balanced budget. Cutting costs in non-essential areas like leisure or vacation could be necessary to free up funds for crucial areas like research & development or marketing.

In addition to creating a balanced budget, tracking actual expenses against the budget is essential to identify areas where the organization may be overspending. This helps to ensure that the organization stays on track financially and can adjust its spending as necessary.

Key Takeaways

- Anticipated income and expenses are crucial components of a budgeting plan.

- Creating a budget involves identifying all the incomes and expenses incurred by an individual or associated with running an organization.

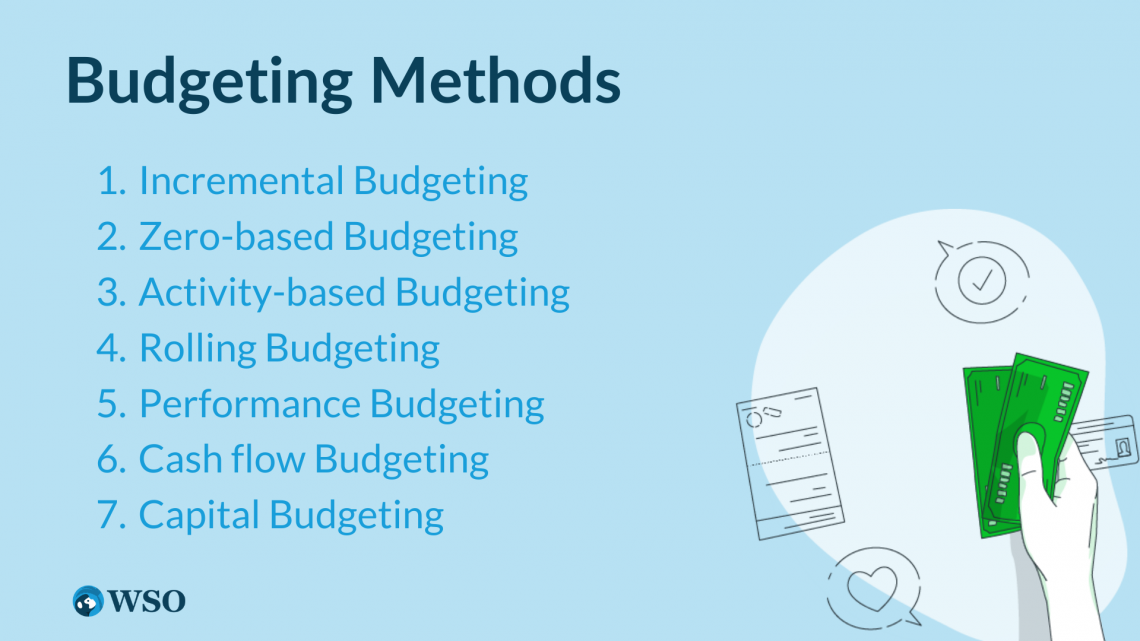

- The various budgeting methods include incremental, zero-based, activity-based, rolling, performance, cash flow, and capital budgeting.

- A good budget plays a key role in the individual success and the success of an organization or the government.

- Budgets provide a clear picture of the distribution of financial resources, facilitating decision-making.

Budgeting Methods

Organizations can utilize various techniques to manage their resources efficiently. Some of them are:

1. Incremental Budgeting

This method starts with the budget from the previous year and makes adjustments based on changes in circumstances, such as revenue, expenses, or strategic goals. While it can be relatively easy to adopt, carefully examining budgets is crucial to avoid ineffective resource utilization.

2. Zero-based Budgeting

This method creates budgets from scratch yearly, with each expense requiring justification. However, this approach can help to identify unnecessary expenses and prioritize spending on critical areas.

However, it might take a long time to adopt and take a lot of work, so it might not be appropriate for businesses with complicated operations or many budgetary items.

3. Activity-based Budgeting

This method involves identifying the activities required to achieve specific goals and then allocating resources based on the cost of each activity.

Effective and efficient use of company resources is made sure by this method. But it necessitates a thorough knowledge of the organization's processes and pursuits.

4. Rolling Budgeting

With this method, budgets are created for a shorter period, such as three or six months, and are adjusted periodically based on organizational circumstances.

Although it may necessitate more frequent reviews and revisions, this strategy can help to guarantee that budgets stay pertinent and responsive to changes in the corporate environment.

5. Performance Budgeting

This method involves allocating resources based on expected performance outcomes. This approach can help to align spending with strategic objectives and ensure that resources are used effectively.

However, implementing it can be difficult and requires a thorough understanding of performance measures.

6. Cash flow Budgeting

This method involves forecasting cash inflows and outflows over a specific period, typically a month or a quarter. It aids in ensuring that the business has enough cash flow to pay its debts and invest in expansion prospects.

However, it may not suit organizations with complex cash flows or seasonal revenue patterns.

7. Capital Budgeting

This strategy entails allocating funds for long-term expenditures like brand-new machinery, buildings, or R&D.

It ensures that resources are employed to promote the company's long-term growth and competitiveness, but it necessitates a thorough comprehension of investment opportunities and risks.

Importance of Budgeting

Budgeting holds significant importance for individuals, organizations, and governments. Here are some key reasons why budgeting is crucial:

For Individuals:

- The capability to monitor one's earnings and expenditures is one of the main advantages of budgeting for individuals. By creating a budget, individuals can identify areas where they may be overspending and make adjustments to reduce expenses.

- As a result, money becomes available for debt repayment, large-ticket purchases, or the creation of an emergency fund. It also helps individuals achieve their financial goals.

- In addition, it provides a sense of control and security over an individual's finances.

Note

Individuals may control their spending and prepare for unforeseen costs by knowing exactly how much money they have coming in and going out each month. This can ease financial pressure and enhance general well-being.

For organizations:

- One of its major advantages is the capacity to anticipate and forecast an organization's financial performance in the future.

As a result, organizations can set realistic targets and objectives by creating a budget, appropriately allocating resources, and identifying potential challenges or risks.

- It helps organizations allocate resources. Organizations can efficiently allocate resources by creating a precise plan for how the money will be used, which can aid in achieving their goals and maximizing profits.

- This can also help organizations identify areas where they may be overspending and make adjustments to reduce expenses.

- In addition, it helps organizations with cash flow management. By creating a budget, organizations can plan for their cash inflows and outflows, which can help them avoid cash shortages or financial crises.

This can help organizations improve their financial stability and reduce their risk of bankruptcy.

For Governments:

- The capability of budgeting for governments to allocate resources efficiently is one of its major advantages.

- Governments can enhance the quality of life for residents by allocating money through the formation of a budget for crucial areas. This can also help governments identify areas where they may be overspending and make adjustments to reduce expenses.

- It also helps governments with fiscal discipline. Governments can ensure that tax dollars are used properly and comply with the law by establishing a budget. This can lower the likelihood of corruption while fostering accountability and openness in government.

- In addition, budgeting helps governments with long-term planning. It can assist governments in making wise choices and achieving their long-term goals.

Note

Budgeting is a critical process for governments that enables them to plan and control their finances effectively. It involves creating a detailed plan for how public funds will be spent, invested, and saved and helps governments prioritize their financial goals and objectives.

Budgeting Process

The budgeting process is an essential part of financial planning. Here are the key steps involved:

Step 1 - Assessing the financial situation

A detailed examination of the financial status, including revenue, costs, assets, and obligations, is required when evaluating the present financial state.

Reviewing your credit report and credit score can provide a comprehensive understanding of your financial health. Identify areas where adjustments are needed and determine how to tailor a personalized strategy to your specific needs.

Step 2 - Setting financial goals

Goals are essential to track progress and keep motivation high. Such goals should be both short-term and long-term. Short-term goals cover a period of one year or less, while long-term extend beyond a year.

Examples of goals include saving for a down payment on a house, paying off debt, funding education, or planning retirement. One should consider their financial goals and the steps necessary to reach them. The objectives ought to be reasonable, doable, and consistent with values.

Step 3 - Creating a budget

A budget is a spending plan that lists funds monthly inflow and outflow of funds. By making a budget, one can find areas where spending can be reduced and direct more money toward their financial objectives. It should be reviewed and rebalanced frequently to ensure that the budget continues on track.

Step 4 - Saving and investing

Building a savings habit is crucial for achieving those financial goals. In addition, money should be set away for long-term objectives like retirement, crises, and unforeseen costs.

Another crucial component of financial planning is investing. It permits one's additional savings to increase over time. One should consider their level of risk tolerance and investing goals while choosing investment vehicles, including stocks, bonds, mutual funds, and real estate.

Step 5 - Managing debt

Debt can hinder your financial freedom, so it's important to have a strategy for managing it. Focus on paying off high-interest debt, such as credit card debt; new debt should only be taken on when absolutely required.

Strategies for managing debt include debt consolidation, balance transfers, and negotiating lower interest rates.

Step 6 - Review and adjust the plan

Financial planning is an ongoing process that requires regular review and adjustment. Life is unpredictable, and financial circumstances can change. In light of changes in life or the economy, it could be necessary to modify goals, the budget, or the investing strategy.

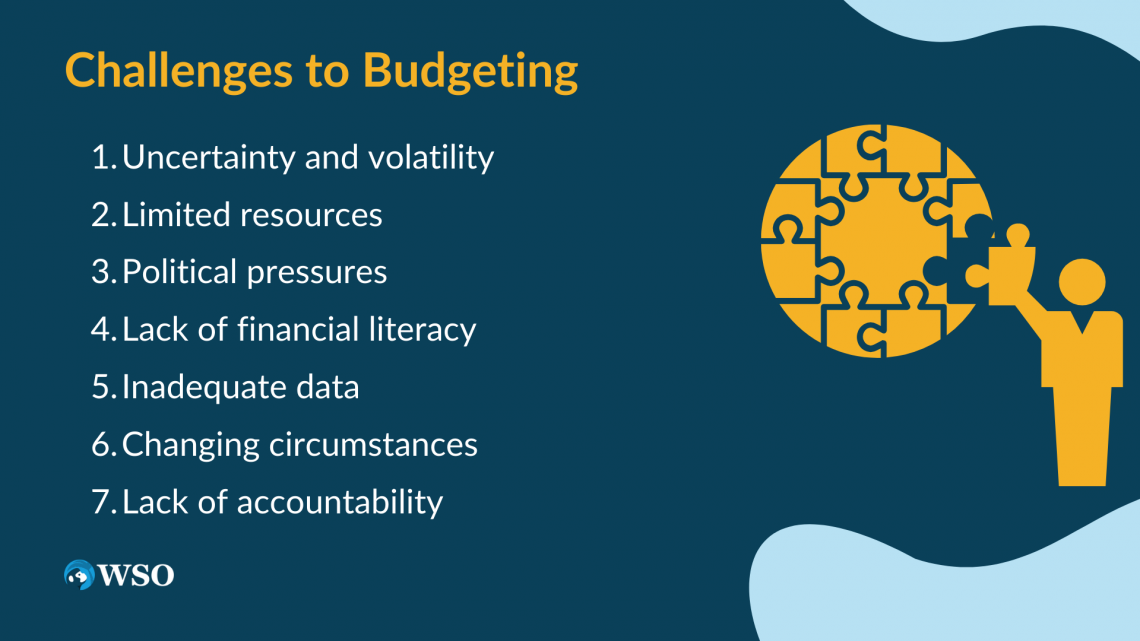

Challenges to Budgeting

There are several common issues that people, organizations, and the government in budgeting confront, while the precise challenges can vary depending on the context:

1. Uncertainty and volatility

Budgeting can be difficult due to uncertainty and volatility in the financial markets. In addition, predicting future financial demands and outcomes can be difficult since market dynamics and economic conditions can change quickly.

A company, let’s say ABC Ltd., may face challenges in borrowing money if there are sudden changes in interest rates. Similarly, just a shift in customer behavior may impact the sales of ABC Ltd.

2. Limited resources

Budgeting requires making difficult trade-offs and prioritizing certain activities over others, especially when resources are limited. This may be challenging for those with competing demands on their resources, such as people, groups, and governments.

For instance, ABC Ltd would have to choose between marketing and creating new products, and the government might have to select between spending money on healthcare and education.

3. Political pressures

Political pressures often influence government budgeting, with different interest groups and stakeholders advocating for different funding priorities. Balancing the needs and demands of various stakeholders and managing competing priorities can be challenging for governments in budgeting.

4. Lack of financial literacy

Effective financial management requires individuals and organizations to have a solid understanding of basic accounting principles, budgeting techniques, and financial analysis.

But many people lack the financial literacy skills necessary to create and maintain budgets correctly, which can lead to poor judgment and money management.

5. Inadequate data

Budgeting requires accurate and reliable financial data to make informed decisions. However, individuals, organizations, and governments may lack the necessary financial data or have insufficient data management processes, making budgeting more challenging.

For instance, if ABC Ltd. were a small firm, it might not have the resources to gather and analyze information on the purchasing patterns of its customers, which may adversely affect its budget adversely.

Similarly, a government organization might be impacted negatively if it does not have the information required to assess the efficiency of its initiatives.

6. Changing circumstances

Adapting conditions can have an impact on budgets. Such situations include the state of the economy or natural disasters. This can require individuals, organizations, and governments to adjust their budget priorities or reallocate resources to address emerging needs.

For instance, ABC Ltd may need to shift its resources to respond to a new competitor entering the market, potentially affecting its budget.

7. Lack of accountability

Budgeting requires effective oversight and measures to ensure financial resources are used effectively and efficiently. Budgeting, though, can be susceptible to fraud, misuse, and waste without effective mechanisms for control and responsibility.

This may result in improper spending of money, a decline in public confidence, and unfavorable financial effects on people, businesses, and governments.

Addressing these challenges requires proactive financial planning, regular review and adjustment of budgets, enhancing financial literacy, improving data management processes, and implementing strong accountability measures.

or Want to Sign up with your social account?