Duration

Measures the sensitivity of the value of a bond to interest rate changes

What Is Duration?

Duration is the weighted average approach to measure the sensitivity of the value of a bond to interest rate changes.

Fixed-income securities carry risks like interest rate risk, credit risk, market risk, and liquidity risk. Market participants who own fixed-income securities bear these various risks.

Interest rate risk is the sensitivity of the securities price to a change in the interest rate. There is an inverse relationship between the price and interest rate. The bond price and value drop when the interest rate rises. Similarly, the bond price and value increase when the interest rate falls.

Financial institutions and practitioners have developed modeling techniques to manage interest rate risk. Managing this risk is very important for financial institutions and market participants.

The growth of the fixed-income securities market has flourished over the years. The US bond market is valued at over $51 trillion, making it the largest. China follows it at $20.9 trillion.

A slight change in the interest rate could cause catastrophic changes in the market. Moreover, the wealth transfers between counterparties would be tedious due to their size and quantity.

The tool most commonly used to measure the exposure to the interest rate risk is the Duration.

Key Takeaways

- Duration is the weighted average approach to understanding the effect of the interest rate risk on the price of a fixed-income security.

- It is evaluated using the security’s yield, cash flows, and maturity.

- The security’s maturity is the term till the last cash flow. Therefore, the duration can never be higher than the maturity. Exceptionally, zero-coupon bond duration is equal to its maturity.

- The bonds with a low coupon rate, long maturity, and low yield have a high duration. Consequently, these are highly volatile and sensitive to the prevailing market interest rate.

- The bonds with a high coupon rate, short maturity, and high yield have a low duration. Therefore, these are not so volatile and are best included in the portfolio of risk-averse investors.

- Macaulay duration is the weighted average time to receive the bond payments. It is expressed in years and is used as a proxy for maturity.

- MD measures the percentage change in the bond price with a change in the interest rate. It showcases the sensitivity of the yield.

- ED measures the sensitivity of the embedded security’s cash flows, like a callable bond, to the relative change in the yield. The cash flow stream of an embedded option is uncertain when there is a change in the yield.

Duration For Fixed-Income Securities

It is a weighted average approach for understanding the interest rate risk and its potential impacts. It measures the bond price's sensitivity to a change in the interest rate.

It measures the average time to receive the bond coupon and is weighted by the present value of the cash flows. However, bonds have varied cash flow receipts; thus, using the average time to receive cash flows would be inaccurate.

Portfolio managers and investors rely heavily on this tool as an excellent indicator to estimate its value. It is a good indicator as several factors are considered in its calculation. The major factors involved in its calculation are the maturity, coupon rate, and yield.

It is known that when the interest rates rise, the value of the bond decreases. The duration of the bond also increases in the process. Thus, the longer the duration, the lower the value of the bond with an increased interest rate.

The importance of clearly understanding the duration is tied to risk-management strategies. For example, portfolio managers construct their portfolios by forecasting the duration based on the speculated interest rate environment.

There are primarily two types of duration, Macaulay and modified. Another type is the effective duration which considers an embedded bond's cash flow based on the prevailing interest rate. A detailed study of all the types is presented later in the article.

Duration vs. Time to Maturity

Duration and time to maturity are essential concepts when valuing a bond. Although closely related, some key differences exist, and the terms should not be used interchangeably.

Duration, in simple terms, relates to the time to maturity of a bond. However, the term in finance was created to understand the interest rate risk.

The time to maturity of a bond is the time till the bond remains active. The principal becomes due at the end of the bond term. It is a linear measure and is expressed as a specific date.

On the other hand, the bond's duration has a non-linear relationship with the value of the bond. The bond's duration does not equal the time to maturity. It is usually lower than the bond term and is expressed in years.

The maturity is always given in a bond contract, whereas the bond's duration must be calculated using the present value of the cash flows.

Duration Based on Coupon Rate

Investors choose bonds as a part of their investment portfolio primarily because they provide a regular income that comes in the form of a coupon. The amount of coupon paid is based on the coupon rate.

The coupon rate depends on the bond's price, maturity, and payment frequency. Coupons can be paid annually, semi-annually, or quarterly.

For example, if a bond with a face value of $100 pays 5% annually for five years, the investor receives $5 annually as a coupon. Alternatively, if the coupon were paid semi-annually, the investor would receive $2.5 every six months.

Bonds could also not be paying any coupon. These are known as zero-coupon bonds and are issued mainly by the government at a discount.

The duration of a zero-coupon bond is equal to its maturity. Whereas the duration of a bond, providing a coupon, maturing in n years has a duration of less than n years. The duration is much lower for bonds with a higher coupon rate.

Longer Vs. Shorter Duration

The duration of a bond is high for a security with a higher maturity and a low coupon rate. Since the bond's maturity is longer, it is more sensitive to a change in the interest rates, and the value remains volatile.

In comparison, the duration of a bond is lower for a security with a short maturity and a high coupon rate. This is because they are not as sensitive to a change in interest rates, and the value is not so volatile.

Let us look at an example to gain more perspective on the price sensitivity. Two bonds, A and B, have maturities of 5 and 10 years, respectively. Both bonds carry a face value of $100. The below table shows the volatility with a change in the interest rate.

| Bond | Maturity | Interest Rate +1% | Interest Rate -1% |

|---|---|---|---|

| A | 5 | $95 [- 5%] | $105 [+ 5%] |

| B | 10 | $90 [- 10%] | $110 [+ 10%] |

The investment choice between a longer or shorter-duration bond lies with the investor's risk appetite.

Investors should invest in bonds that have a longer duration if they believe that the foreseeable interest rates would fall.

In comparison, risk-averse investors who believe that the market interest rate would be volatile for the foreseeable period should invest in bonds with a shorter duration.

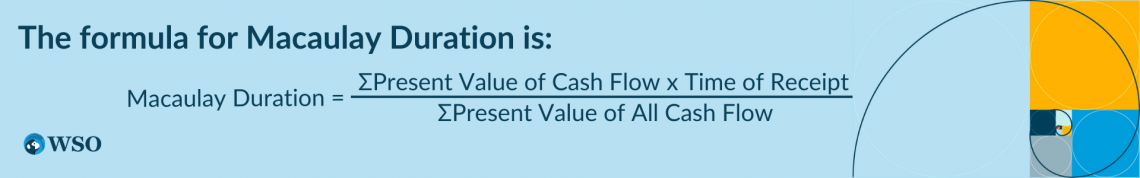

Macaulay Duration

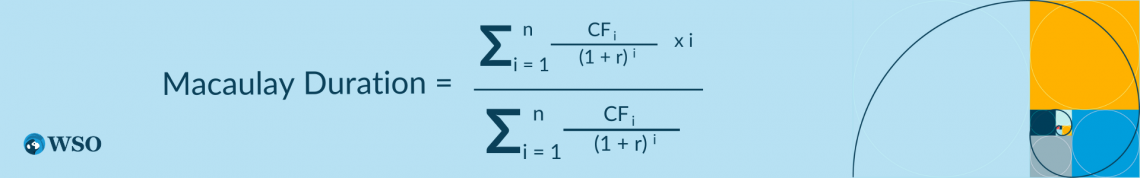

It was first introduced in 1938 by Fredrick Macaulay. The definition is the same as the duration. It measures the weighted average time for the receipt of bond coupons and final payments. Analysts widely use it to measure the speed at which payments are received.

It is measured in years and is used as a proxy for maturity. The weights are applied to the present value of the cash flows at time t.

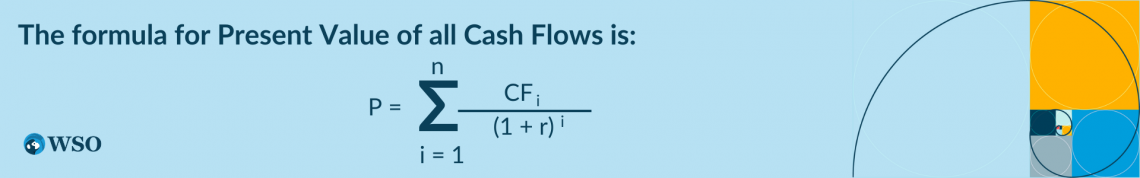

The present value of all cash flows is the price, P, of the security. It can be given as

Where

- i is the time the payment is received,

- r is the interest rate.

Thus, the equation can also be given as

Let us consider a 5-year 10% coupon bond with a face value of $1,000. The bond trades at par; thus, the yield to maturity (YTM), or r, equals the coupon rate.

| Cash Flows | Time | Present Value | Weighted Average Cash Flows |

|---|---|---|---|

| $ (100.00) | 0 | - | - |

| $ 10.00 | 1 | $ 9.09 | $ 9.09 |

| $ 10.00 | 2 | $ 8.26 | $ 16.53 |

| $ 10.00 | 3 | $ 7.51 | $ 22.54 |

| $ 10.00 | 4 | $ 6.83 | $ 27.32 |

| $ 110.00 | 5 | $ 68.30 | $ 341.51 |

| $ 100.00 | $ 416.99 |

Macaulay Duration = $416.99 / $100 = 4.17 years

The Macaulay Duration can never be higher than the bond's maturity date. Therefore, it always lies between 0 and the bond's maturity. There is no weighted average for zero coupon bonds since there are no cash flows; hence, the duration equals its maturity.

Modified Duration (MD)

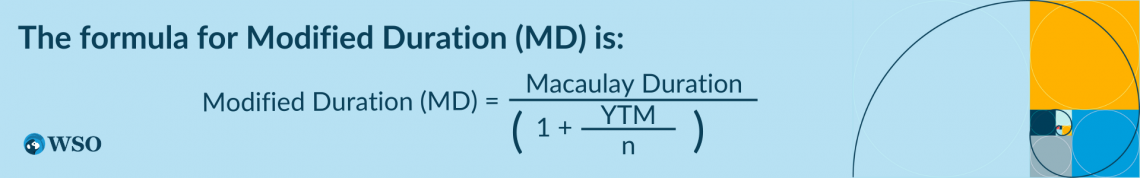

The MD measures the bond price change when the interest rate changes by a basis point. A 100-basis point change indicates a 1% rate change.

Where n equals the number of coupon payments per year.

It is just an extension to the Macaulay duration. To calculate the MD, the first step is to calculate the Macaulay duration.

NOTE

Unlike Macaulay duration, the MD is expressed as a percentage as it showcases the bond price's sensitivity to a change in the yield.

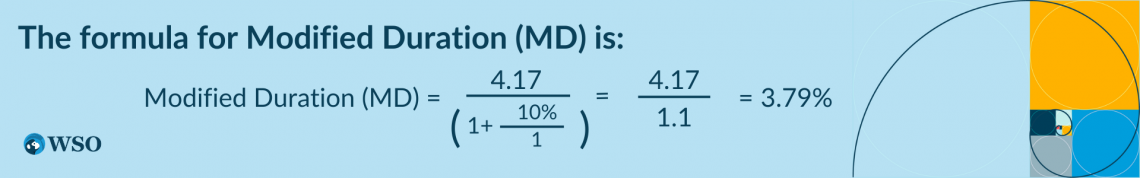

Let us look at the previous example and examine MD.

Given that the Macaulay duration was 4.17 years, and YTM is 10%, we can calculate the MD.

From this, we can infer that if the interest rate changes by 1% or 100 basis points, the 5-year 10% coupon bond value also changes relatively by 3.79% but in the opposite direction.

It is significant for investors to calculate the MD as they can skillfully assess the impact of the changing interest rates on their investments. It facilitates evaluating the accurate investment decision.

Effective Duration (ED)

The ED measures the interest rate sensitivity for hybrid or embedded securities. A security that combines the characteristics of a bond and equity is termed a hybrid.

The bond part of the instrument carries more risk providing a higher return than a pure fixed-income security. At the same time, the equity segment has a lower risk and a lower return than a pure variable equity instrument.

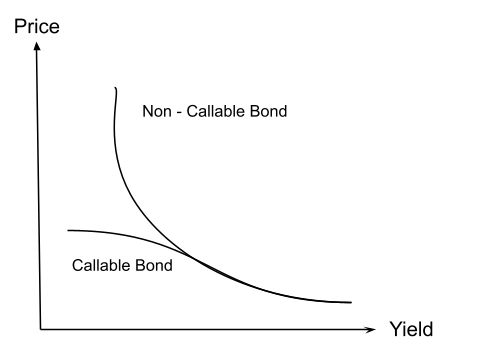

Generally, the relationship for pure fixed-income security is convex. The price and yield (P/Y) relationship differs for bonds with an option feature. With the inclusion of an option, like a callable bond, the P/Y relationship is affected.

The callable bond displays a negative convexity or is concave at low yields. The call price controls the price appreciation at low yields, causing limited movement.

On the other hand, when the market yield rises, the price appreciation is much higher.

The cash flow stream of callable bonds is highly uncertain when there is a change in the yield. It is up to the investor if they want to call the bond prematurely, thus, affecting the expectation of future cash flows.

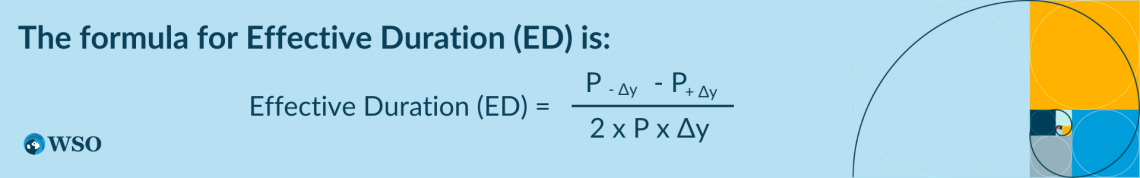

ED measures the changes in the expected cash flow with a change in the yield. MD cannot be used as a practical measure as it does not consider the possible cash flow changes.

Where

- P-Δy - Price\ of the security if the yield decreases by y

- P+Δy - Price of the security if the yield increases by y

- P - Price of the security

- Δy - Change in yield

or Want to Sign up with your social account?