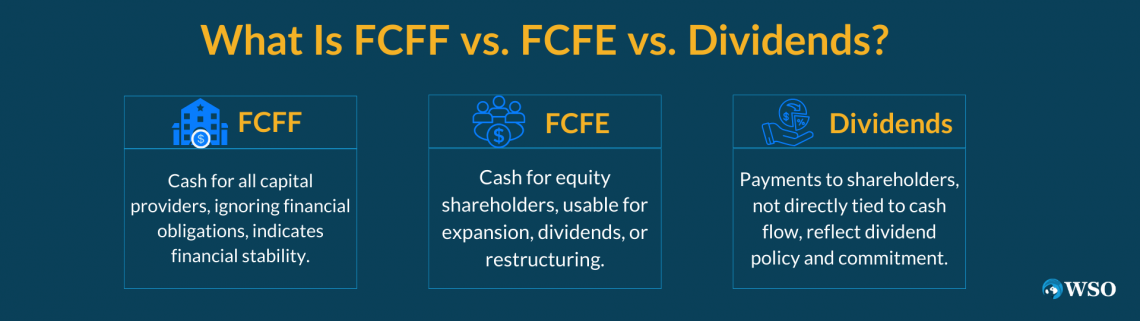

FCFF vs FCFE vs Dividends

The main differences between FCFF, FCFE, and dividends

What Are FCFF, FCFE and Dividends?

In financial analysis, these three critical cash flow metrics Free Cash Flow to the Firm (FCFF), Free Cash Flow to Equity (FCFE), and Dividends serve as crucial metrics for determining a company's intrinsic value and, also, its stock price.

While aligned in purpose, these metrics diverge in how they assess cash flows and their role in valuing a business. Let's look at a brief understanding of each concept:

1. FCFF (Free Cash Flow to the Firm)

FCFF, or Free Cash Flow to the Firm, is a critical financial metric. It reveals the cash available to all stakeholders, both stockholders and bondholders, after covering essential expenses and investments. FCFF offers a comprehensive view of a company's financial health, irrespective of dividend policies.

2. FCFE (Free Cash Flow to Equity)

FCFE, Free Cash Flow to Equity, is vital for equity investors. It encompasses cash flows available to stockholders, considering expenses in FCFF and net cash outflows to bondholders. FCFE is valuable when dividend policies are uncertain or investors significantly influence the firm.

3. Dividends

Dividends, well-known to investors, represent cash payments directly to stockholders. This metric focuses solely on income from equity investments and the consistency of dividend payouts, making it crucial for income-oriented investors to evaluate a company's investment appeal.

What Is Free Cash Flow to the Firm (FCFF)?

Free Cash Flow to the Firm (FCFF) is the real cash available to the company's owners after paying out operating expenses and capital expenditures. The remaining is available to all capital providers, including debt and equity.

It is also known as "Unlevered Free Cash Flow." Since it doesn't account for financial obligations during cash flow computation, it completely ignores the company's financial obligations.

The calculation of FCFF is important because it shows the company's financial obligation and stability. The company has a surplus after all expenses are paid if it is positive.

And if it's negative, it indicates that the company is in danger of not having enough money to cover its expenses and investment activities.

Even though cash flow and free cash flow sound similar, they are quite different. Free Cash Flow is the amount of cash coming in and going out of the business, whereas Cash Flow is the amount of disposable cash in the business.

It can be used to bring in new employees, expand operations, or invest in additional assets; it can also be put towards the acquisition and payout of dividends to shareholders.

However, excess free cash flow sometimes can indicate that the company is not leveraging its assets properly. This is because leverage can be used for the expansion of the business.

Also, negative cash flow can be a problem, as it shows that the extra money is consistently reinvested in the business and needs to be corrected by restructuring operations, raising capital by additional debt, selling equity, or investing personal funds.

Key Takeaways

-

FCFF represents the cash available to the company's owners after expenses and investments, showing financial stability.

-

FCFE is the cash available to common shareholders after expenses and debt payments, useful for equity valuation and dividend analysis.

-

Dividends are payments to shareholders, impacting financial statements by reducing retained earnings and cash.

-

Evaluate dividends using the dividend payout ratio, free cash flow, and return on invested capital.

-

FCFF goes to all capital providers, while FCFE is for equity shareholders, with different calculation methods.

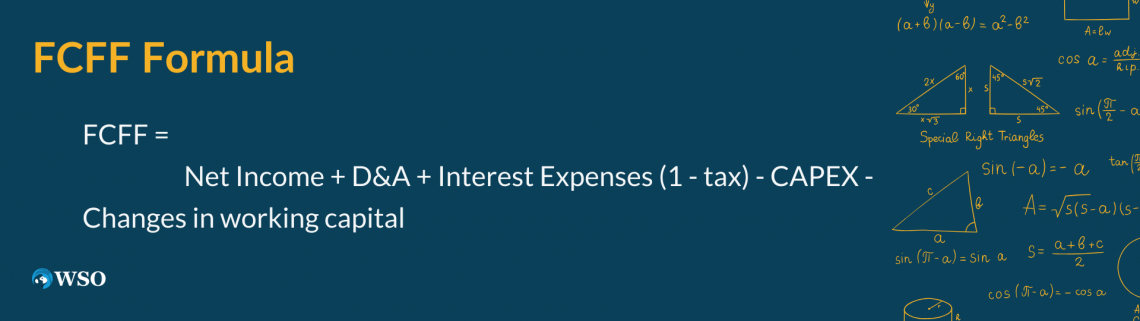

Formula and calculation for FCFF

The formula and calculation for FCFF are fundamental to assessing a firm's liquidity and solvency, providing a clear picture of how efficiently the firm is operating.

The formula is:

Free Cash Flow for Firm = NOPAT + D&A - CAPEX - Changes in working capital

Where,

- FCFF = Free Cash Flow for Firm

- NOPAT = Non-Operating Profit After Tax (i.e., EBIT-Tax)

- D&A = Depreciation And Amortization(non-cash expenses)

- CAPEX = Capital Expenditures

Depreciation and amortization are needed to be added back as they are non-cash expenses, while capital expenditures and working capital changes need to be subtracted to arrive at FCFF.

The tax must also be deducted from profit at either the marginal or long-term expected effective tax rate.

Alternatively, when it is difficult to access information, such as in the case of a private company, we use the below formula:

FCFF = Net Income + D&A + Interest Expenses (1-tax) - CAPEX - Changes in working capital

Or,

= CFO (Cash Flow from Operation) + Interest expenses adjusted for tax - Fixed capital expenditures.

Some examples are:

A) Example #1

The following is taken from the hypothetical company XYZ Co.'s financial statement.

Net Income = $5,000,000

Depreciation and Amortization = $50,000

Fixed Assets-$550,000

Current Assets-$350,000

Current Liabilities-$150,000

FCFF = Net Income + D&A - (CA - CL) - CAPEX

Free Cash Flow for Firm = 5,000,000 + 50,000 - (350,000 - 150,000) - 550,000 = 4,300,000

B) Example #2

Cash Flow from Operations = $2,000,000

Interest expense after-tax = $75,000

Fixed Assets = $500,000

FCFF = CFO + Interest expense - Fixed Asset

Free Cash Flow for Firm = 2,000,000 + 75,000 - 500,000 = 1,575,000

What is Free Cash Flow for Equity (FCFE)?

Free Cash Flow for Equity (FCFE) is the cash available to common shareholders; after all, operating expenses, interest and principal repayments, necessary capital requirements, and working capital needs have been met.

The Free Cash Flow for Equity model assists analysts in evaluating the company's investment and financial strategies and dividend policy.

It is a more straightforward method of valuing equity that should be favored over FCFF when the company's capital structure is more stable.

It is an alternative to the Dividend Discount Model for evaluating the fair value of a company's stock. It can also determine whether a company is using free cash flow to buy back stocks or pay dividends.

This is commonly referred to as "Levered Free Cash Flow" because the value of the cash flow includes the impact of financial obligations.

It is a good metric for potential stockholders because even if the company has high cash flow, most of it can go towards settling debts, leaving very little to shareholders.

Conversely, the company might be paying dividends but have a low FCFE. This indicates the company might be issuing new securities or making dividend payouts using existing capital or debt.

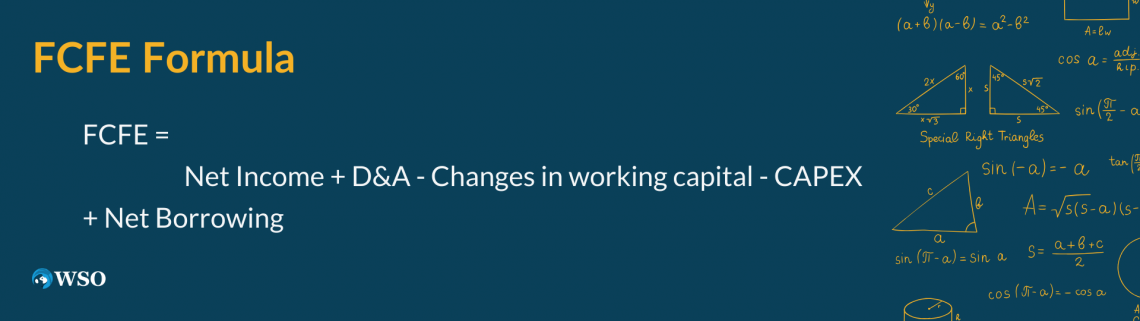

The formula and calculation of FCFE

FCFE measures the cash flow available to a company's equity shareholders after all expenses, reinvestments, and debt repayment have been taken into account.

It is an essential gauge of a company's profitability and financial stability, providing key insights into the firm's ability to grow, pay dividends, or repurchase shares.

The formula is:

Free Cash Flow for Equity = Net Income + D&A - changes in working capital - CAPEX + Net Borrowing

Where,

- D&A = Depreciation and Amortization

- CAPEX = Capital Expenditure

- Net Borrowing = debt borrowed- Debt repaid

One of the other methods of calculating FCFE is using EBIT.

Free Cash Flow for Equity = (EBIT - Interest - Tax) + D&A - changes in working capital - CAPEX + Net Borrowing

Where,

- EBIT = Earnings Before Interest and Tax

We can also calculate FCFE from CFO (Cash From Operating Activities).

Free Cash Flow for Equity = CFO - CAPEX + Net Borrowing

Some examples are:

A) Example #1

The following is an excerpt from the hypothetical company ABC Co.'s financial statement.

Net Income = $10,000,000

Depreciation and Amortization = $500,000.

Changes in working capital = $50,000

Fixed Capital purchased = $5,000,000

Net Borrowing = 15,000

FCFE = Net Income + D&A - changes in working capital - CAPEX + Net Borrowing

Free Cash Flow for Equity = 10,000,000 + 500,000 - 50,000 - 5,000,000 + 15,000 = 5465000

B) Example #2

EBIT = 15,000,000

Interest = 20,000

Tax = 50,000

Depreciation and Amortization = 20,000

Net Borrowing = 15,000

CAPEX = 5,000,000

Changes in working capital = 50,000

FCFE = (EBIT - Interest - Tax) + D&A - changes in working capital - CAPEX + Net Borrowing

Free Cash Flow for Equity = (15,000,000 - 20,000 - 50,000) + 20,000 + 15,000 - 5,000,000 - 50,000 = 9,915,000

C) Calculation using CFO

Cash flow from operations = 50,000

CAPEX = 15,000

Net Borrowing= 10,000

FCFE = CFO - CAPEX + Net Borrowing

Free Cash Flow for Equity = 50,000 - 15,000 + 10,000 = 45,000

FCFF vs FCFE

The following table summarizes the difference between FCFF AD FCFE:

| FCFF | FCFE |

|---|---|

| Free Cash Flow is available to all firms. | Free Cash Flow is available to equity shareholders. |

| Also known as "Unlevered Cash Flow" because of the lower impact of leverage. | Known as "Levered Cash Flow" because of the inclusion of interest payments to debtholders. |

| Used for calculating "Enterprise Value" or "Total Intrinsic Value." | Used for calculating "Equity Value." |

| The Weighted Average Cost of Capital (WACC) is used for the calculation. | The cost of equity is used for the calculation. |

| Preferred by companies with high leverage. | Preferred by analysts. |

What is a dividend?

It is a payment made by the company to the stockholders. They are paid regularly in exchange for investing money in the company. Dividends are usually paid quarterly, semi-annually, or monthly.

It can be paid in various ways, including cash, stocks, or other assets. The form of payment is usually decided by the company's board of directors and requires shareholders' approval. It's important to remember though that not every stock pays dividend to its shareholder.

If the corporation does not wish to pay a dividend, it can keep the earnings and utilize them to expand the business.

After paying out the creditors, the company can use all or some of the profit to pay the dividend. So if the company needs cash and has a shortage for reinvestments, it can skip out on paying dividends if they want to.

Also, a dividend is paid per share - For example, if you have 50 shares and pay $2 per share, the investor will receive $100 as a dividend.

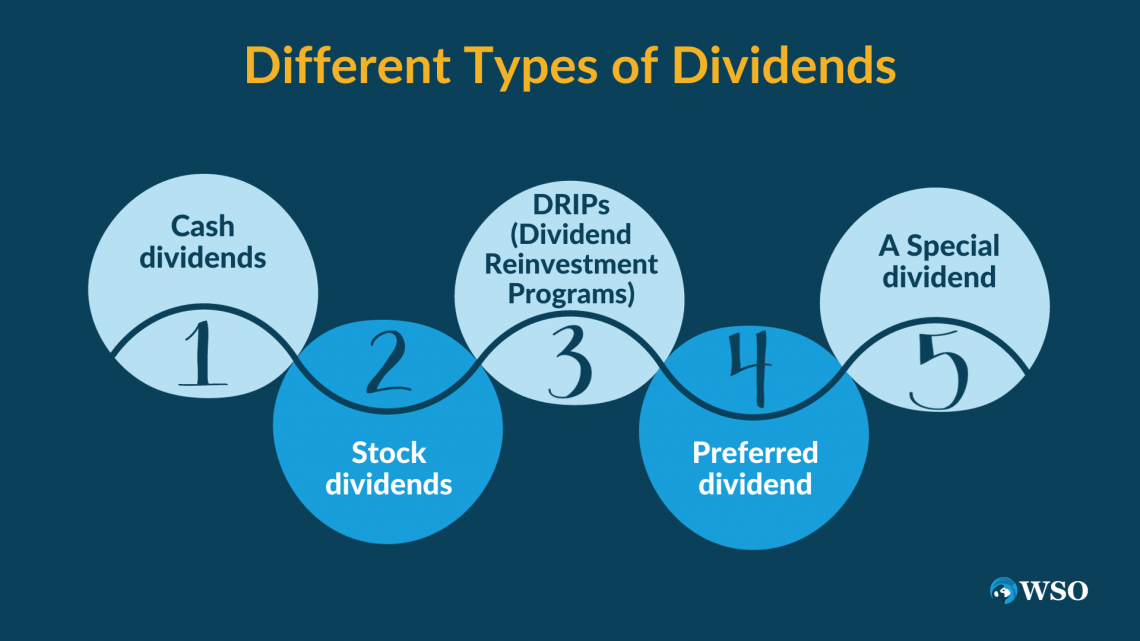

Different Types of Dividends

Dividends reflect a company's profitability and financial policies, strategic priorities, and commitment to returning value to investors. But not all dividends are created equal; there are various types, each with its characteristics.

Understanding these different types is essential for investors seeking to optimize their investment returns and companies aiming to implement effective dividend policies.The types are:

- Cash dividends: One of the most common types of dividends is where the company pays towards the stockholder's brokerage account.

- Stock dividends: In this type, the company does not pay cash but additional stocks as dividends. The company issues additional shares in proportion to the investor's current holding under the stock dividend issue.

- DRIPs (Dividend Reinvestment Programs): If a stockholder signs up for a dividend reinvestment program when the company pays a dividend, the broker buys more stocks of the underlying investments.

- Preferred dividend: It is paid to the preferred shareholders, accrues regularly, and gets paid quarterly. Preferred shares are more like bonds than stocks.

- A special dividend: It is a type of dividend that is paid when, over the years, profit piles up with no immediate need. For example, a company pays out a special dividend with excess cash profits. Furthermore, the payment under this type is higher than regular dividends. This extra cash profit could be the result of unusual or extraordinary events.

Impact of dividends on financial statements

A dividend is not an expense but an allocation of retained earnings to shareholders. It is calculated using the company's dividend payout ratio, that is, the dividend paid divided by net income.

When a company doesn't pay dividends, the dividend payout ratio is zero, and to find the retention ratio, which is the amount maintained in the company, is calculated by subtracting the payout ratio from 1.

A company's policy regarding the frequency and rate at which the dividend is paid out is known as the 'dividend policy.' So, when a dividend is paid on the balance sheet, retained earnings and cash decrease.

The cash flow statement notes the dividend under cash flow from financing activities. In the statement of retained earnings, the amount is reduced. In the income statement, there is no impact.

Dividend payments can be company and growth specific. That is, rapidly growing companies, like tech companies, often do not pay dividends because the money is invested in the company for further growth.

Steady growth companies provide small and consistent dividends to their shareholders. Some companies have long and consistent dividend policies; others may not pay dividends even though they have excellent earnings.

How to Evaluate Dividends

An investor may consider many factors before determining which company to choose and how it differs from similar companies. Some of them are:

1. Dividend Payout Ratio

The dividend payout ratio is the most common financial ratio known to investors. The dividend payout ratio measures how much a company's earnings are paid.

To calculate a company's dividend payout

ratio, divide the number of dividends it paid over a specific period by the earnings it generated.

Dividend Payout Ratio = Dividends / Earnings

2. Free Cash Flow

Without free cash flow, an organization will not likely survive in the long run.

An organization's capital uses (for example, cash spent on property, plants, and hardware) are deducted from its income from investing (for example, net gain adapted to non-cash charges like deterioration) to show up as free income.

On the off chance that an organization doesn't create free income, it doesn't have assets to get back to investors by way of profits and offer repurchases, nor does it have the feasible income to use for acquisitions or obligation reimbursements.

Organizations that fail to produce free income normally have capital-concentrated organizations with few upper hands. Therefore, we like to invest in companies that consistently generate free income in virtually every climate.

3. Return On Invested Capital

To keep things basic, that is what we get for the capital contributed. Organizations accumulate reserves (both obligations and value) to provide a return for investors.

Organizations that obtain higher yields can increase their capital more quickly and are often more appealing. In theory, organizations that provide returns that fall short of their financial backers' expectations should cease operations in the long run.

Return On Invested Capital = Net Profit After Tax / Invested Capital

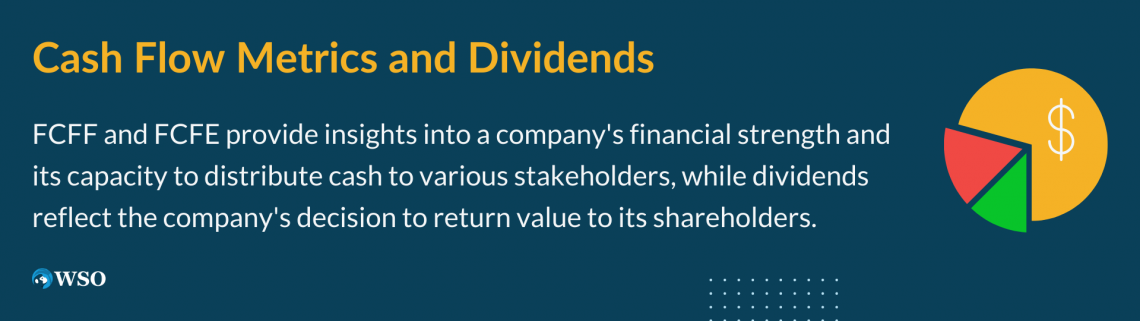

FCFF vs FCFE vs Dividends

The FCFF valuation method might theoretically be used to calculate the value for equity investors, but it can be complicated when integrating the numerous cash flows available to all investors. That's why it's also referred to as the "indirect method."

The direct method for calculating equity cash flow is free cash flow to equity.

Free cash flow to equity is the cash flow available to the company's holders of common equity after all operating costs, interest, and principal payments have been paid and necessary investments in working and fixed capital have been made.

Another way to think of free cash flow to equity is cash flow from operations, plus receipts from bondholders, fewer capital expenditures, and payments to bondholders.

Free cash flow to the firm is the cash flow available to capital suppliers. After all, operating costs have been paid, and necessary investments in working and fixed capital have been made.

Free cash flow to equity expands on FCFF and removes principal and interest paid to bondholders.

The main differences between FCFF, FCFE and Dividends are explained in the following table:

| FCFF | FCEE | Dividends | |

|---|---|---|---|

| Definition | Free Cash Flow to the Firm | Free Cash Flow to Equity | Payments made by the company to shareholders |

| Purpose | Used for enterprise valuation | Used for equity valuation | Distribution of profits to shareholders |

| Calculation | FCFF = NOPAT + D&A - CAPEX - Changes in working capital | FCFE = Net Income + D&A - Changes in working capital - CAPEX + Net Borrowing | Dividend Payout Ratio = Dividends/ Earnings |

| Cash Recipients | Available to all capital providers, including debt and equity | Available to equity shareholders | Paid to shareholders only |

| Relation to Growth | Often preferred by mature or highly leveraged companies | Preferred when the capital structure is more stable | Not directly related to growth or maturity |

| Preference by | Payments made by the company to shareholders | Preferred by analysts. | Preferred by Income-seeking investors. |

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?