Indonesian Rupiah (IDR)

It is the official currency of Indonesia.

The Indonesia Rupiah (IDR) is the official currency of Indonesia. Issued and controlled by Bank Indonesia (BI), its ISO 4217 currency code is IDR.

Indonesia has a lot of Hindi influence, which is why the name “rupiah” is taken from the Sanskrit word “Rupyakam” (रूप्यकम्), meaning the word silver.

In the foreign exchange trading market (forex) code is IDR. This means the exchange rate between the US and Indonesia is USD/IDR.

For example, today's exchange rate between $1 United State Dollar (USD) is approximately Rp 14,368.05. USD-IDR X-Rate $1/RP14,370.00.

Indonesia Banknotes

A banknote, also known as paper bills, paper money, or cash, is typically a negotiable piece of paper made by financial authorities. Banknotes are issued by governments with value and require agreement and trust from society and the government as a legal currency.

If someone wants to buy a $2 coffee, they will give a $2 bill to the cashier. If someone buys something for $5 but he only has a $10 statement, then they would receive a change for $5.

Or another situation, someone had a coupon for $15 from Store A. this means he could redeem the coupon with the item that has the same value or a few things, when combined, has a $15 value.

Indonesia Banknotes come in denominations of:

- Rp 1,000 (released in 2000)

- Rp 2,000 (released in 2009)

- Rp 5,000 (released in 2001)

- Rp 10,000 (released in 2005)

- Rp 20,000 (released in 2004 and 2011 as a revised version)

- Rp 50,000 (released in 2005 and 2011 as a revised version)

- Rp 75.000 (released in 2020 as an appreciation only)

- Rp 100,000. (released in 2004 and 2011 as a modified version)

There are also coins circulating in public:

- Rp 50 (rare)

- Rp 100

- Rp 200

- Rp 500

- Rp 1000

The government issued Rp 75.000 banknotes released as an Appreciation of Indonesia’s independence day. Although it is official money from Bank Indonesia, the amount of RP 75.000 paper released is small, so not everyone could have it.

Indonesia’s Currency

Indonesia is one of the richest natural resources countries in ASIA, but Indonesia’s economy is not stable, and Indonesia’s Rupiah is the third weakest currency in the world.

Limited foreign capital inflows caused the low rupiah exchange rate amid positive perceptions of the domestic economic outlook and the maintained supply of domestic foreign currency.

Below is the list of the weakest currencies in the world.

- Iranian Rial (IRR): [1 USD = 42, 250 IRR]

- Vietnamese Dong (VND): [1 USD = 22,650 VND]

- Indonesian Rupiah (IDR): [1 USD = 14,365.5 IDR]

- Laotian Kip (LAK): [1 USD = 11, 345 LAK]

- Sierra Leonean Leone (SLL): [1 USD = 11,330 SLL]

- Uzbekistani Som (UZS): [1 USD = 10,812.5 UZS]

- Guinean Franc (GNF): [1 USD = 9,002.5 GNF]

- Paraguayan Guarani (PYG): [1 USD = 7,089.86 PYG]

- Cambodian Riel (KHR): [1 USD = 4,065.5 KHR]

- Ugandan Shilling (UGX): [1 USD = 3,507.71 UGX]

Indonesia’s economy is expected to stabilize in the last quartal of the year, and the Rupiah currency is likely to be stable and more substantial.

Indonesian Rupiah’s Journey

Each presidency has ways to manage and control The rupiah value per US dollar.

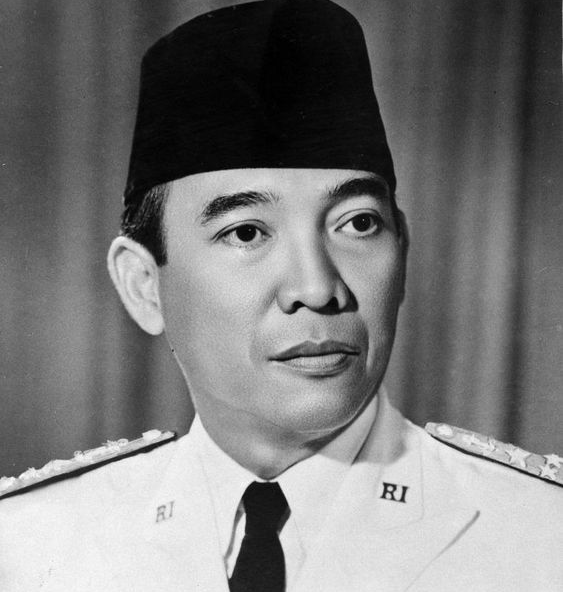

1. Soekarno

(1946-1967) Rupiah value was Rp 1/$1 to Rp 11.4/$1.

Because Indonesia was declared free in 1945, money was a new issue. So they remove foreign banks etc. Soekarno started with a Rp 1000 bill just to Rp 1 bill.

But, because of unstable political situations and wrong decision-making, Indonesia suffered 600% hyperinflation in the 1960s. Because of that, Soekarno was removed and replaced by Soeharto.

2. Soeharto

1967-1998) Rupiah value was Rp378 /$1, Rp 625/$1, Rp 702-902/$1, Rp 1.134-1.664/$1, Rp 2.501, Rp 11.000/$1, Rp 16.800/$10-2.650/$1, Rp 5.000 /$1, Rp 7.000/$.

Some of Soeharto's ways are to control foreign and national investment, increase export traffic and reduce the inflation rate from 600% to just 9,9%. However, he made similar bad choices that increased the inflation rate.

3. Habibie

(1998-1999) Rupiah’s value was Rp 6.500/$1.

The monetary sector starts with controlling the money supply, raising the BI Certificate interest rate to 70%, and implementing an independent central bank.

In the banking sector, issued bonds worth Rp. 650 trillion to bail out banks, close 38 banks, and take over seven banks.

In the fiscal sector, several infrastructure projects were canceled, special treatment for national cars, and the Social Safety Net program was financed.

Meanwhile, debt was restructured in the corporate sector through the Indonesian Debt Restructuring Agency (INDRA) scheme and the Jakarta Initiative and stopped the monopolistic practice that Bulog and Pertamina had carried out.

4. Abdurrahman Wahid

(1999-2001) Rupiah value was Rp 15.000/$1

Several policies, such as efforts to change the independence of BI through amendments to the BI Law, import duties on luxury cars for the G-15 Summit which are much lower than they should be (only 5% while it should be 75%)

Regional autonomy frees up regions to apply for foreign loans. Unpopular in society and reap protests. But at the end of his presidency, the inflation rate increased from 2% to 12%

5. Megawati

(2001-2004) rupiah’s value was Rp 8.000-10.200/$1

The fiscal sector, for example, is marked by the reform of taxation policies, efficiency in state spending, and the privatization of SOEs.

In the financial sector, the Financial Sector Safety Net was designed, divested banks from IBRA, strengthened the governance structure, and restructured the capital market, insurance, and pension fund sectors.

Then, a negative investment list was reviewed in the investment sector, simplifying licensing, restructuring the telecommunications and energy sectors, and eradicating corruption.

6. Susilo Bambang Yudhoyono

(2004-2014) rupiah’s value was Rp 9.000-12.000/$1.

To maintain the inflation rate, the SBY government has increased the allocation of energy subsidies. In 2004, the number of energy subsidies was 13.7% of the APBN, with an inflation rate of 6.4%.

When inflation increased to 17.11% in 2005, the subsidy allocation increased to 22.7% in 2008. As a result, inflation managed to drop to 2.78% in 2009. However, once inflation rose again to 8.36% in 2014, the government returned to increase the percentage of energy subsidies to 19.20% in 2014.

7. Joko Widodo

(2014-Current president) rupiah’s value was Rp 14.000-14.710/$1.

In contrast to his predecessors, who increased the allocation of subsidies, Jokowi chose to issue a policy that was unpopular with the public: Reducing energy subsidies and shifting them to productive sectors and social safety nets.

Currently, the energy subsidy fund the Jokowi government uses is Rp. 120 trillion to finance infrastructure projects, special allocation funds, agricultural subsidies,

Prosperous Family Cards and Hopeful Families, port and ship construction, Village Funds, Smart Indonesia Cards, border fleets, and Healthy Indonesian Cards.

The History of Indonesia Rupiah

Before everyone knew money, people used the trade/barter system. Because only a few people agree with the deal of trade, thus making money as a medium of exchange.

There are a lot of variations for money, it used to be silver and gold, and now it is paper and electronic.

In the early days of Indonesia’s victory, Indonesia faced several problems. For 3 decades, Indonesia had been colonized by the dutch. During that time, the currency used was “gulden,” day-to-day money from the Dutch.

In 1942, Japan had taken over Indonesia, but they used “gulden '' for military activities and “gunpyo”. The problem started with the arrival of allies to accept the handover of power from Japan.

Second, Negotiating with the dutch was harmful to Indonesia. The dutch came together with allies at the end of September 1945, wanting to regain control of its colonized country.

The Dutch replaced the Japanese currency with Netherlands Indies Civil Administration (NICA)

On October 2nd, 1945, Indonesia’s government banned everyone from using that money (NICA). And then, the Decree of the President of the Republic of Indonesia on October 3rd, 1945, stated several types of money were legal in Indonesia. This gives Indonesia four lawful money, which are

- De Javasche Bank

- De Japansche Regering

- Dai Nippon

- Dai nippon Teikoku Seibu

The Oeang Rupiah Indonesia Journey

Along with the issuance of this edict, the government plans to issue the Oeang Republik Indonesia (ORI). The Minister of Finance A. A Maramis formed the “Committee for Printing Indonesian Banknotes” on November 7th, 1945.

As a data search team, the G. Kolff printing union team searched for a printing press with advanced technology in Jakarta. They proposed to print in G. Kolff Jakarta and the "Nederlandsch Indische Metaalwaren en Emballage Fabrieken" (NIMEF) printing press in Malang as candidates who met the requirements.

ORI printing was carried out every day from 7 am to 10 pm from January 1946. However, in May 1946, the situation required that the printing of ORI in Jakarta be stopped and reallocated to areas such as Yogyakarta, Surakarta, Malang, and Ponorogo.

Through the Decree of the Minister of Finance dated October 29th, 1946, it was stipulated that ORI would come into effect starting October 30th, 1946, at 00.00. The law, dated October 1st, 1946, stipulates the issuance of ORI.

The effort to issue money itself resulted in the publishing of the First Emission of ORI banknotes on October 30th, 1946. The Indonesian government declared that date as the date of circulation of ORI.

ORI was accepted with pride by all Indonesian people. Subsequently, October 30th was ratified as the Oeang Day of the Republic of Indonesia by the President, based on the birth of the first ORI emission.

The first issue of ORI took effect on October 30th, 1946; it was stated that the issue date was October 17th, 1945. This shows a lengthy process that must be taken in preparing the issuance of ORI as one of the national identities.

The first action that was set by the Indonesian government before spreading ORI was to withdraw the currency from the public.

The withdrawal of that money is made through restrictions on the use of money and the prohibition of carrying money from one area to another area.

The spread of this new currency is difficult in some areas like West Java and Sumatra because the Dutch still occupy those areas. But in 1947, the government was forced to give authority in some areas to make their own money, called “Oeang Republik Indonesia Daerah” (ORIDA).

The money was only temporary, and most leaders in certain areas stated that the money was only available in the area. In the round table conference in 1949, the Dutch asked that NICA would be the only legal tool. But Sri Sultan Hamengkubuwono denied that request.

To have more evidence, a survey was held on what people prefer when using both currencies. The survey proves that people prefer using ORI as a legal payment tool.

Starting on March 27th, 1950, ORI and ORIDA were exchanged for newly published money and circulated by DE Javasche Bank. Thus Negara Kesatuan Republik Indonesia (NKRI) was reformed on August 17th, 1950.

Bank Indonesia is the sole publisher of the Rupiah

In December 1951, De Javasche Bank was nationalized to become Bank Indonesia (BI) as the central bank with Law no. 11 of 1953, which started taking effect on July 1st, 1953.

July 1st, 1953, was commemorated as the birthday of Bank Indonesia, where Bank Indonesia replaced De Javasche Bank and acted as the central bank.

Today, the Rupiah currency holds the signatures of the government and Bank Indonesia based on Law Number 7 of 2011 on the currency. The government, in the act of the law, is the Minister of Finance, holding the position in the 2016 issuance year.

Therefore, On December 19th, 2016, The Minister of Finance, Sri Mulyani Indrawati, and the governor of Bank Indonesia, Agus D.W Martowardojo, signed the variations of the denominations.

Exchange Rate and Inflation

The exchange rate of one country’s currency value is more or less than another country’s currency value. The exchange rate is fixed when it is pegged to the value of a country’s standards, like gold or metal.

An exchange rate is floating when there is a change in the foreign exchange market. It could also be from the import and export factors.

The term inflation measures the increase in price and services in a certain period, usually measured in a year. How quickly the goods and service prices go up is called an inflation rate.

If the inflation rate keeps increasing, then the power of money is decreasing; in other words, everything is getting more expensive.

The Indonesian Rupiah has been troubled by high inflation for most of its existence. In 1965, the inflation rate increased by an incredible 635%. Various attempts have been conducted to maintain the value of the Rupiah’s currency, but most of them have been abandoned.

The exchange rate after independence day was Rp 3.8 to US $1. Lembaga Alat-Alat Pembayaran Luar Negeri Publication No. 26, on March 11th, 1950, established the foreign exchange certificate system (FECS). By the FECS system, governments established the export rate was 7.6 and the import rate was Rp 11.4.

On January 4th, 1952, the FECS system was scrapped because the import rate determined domestic prices. This situation made profits from the export low. Hence the effective Rp 7.6/11.4 exchange rate goes back to Rp 3.8

This effect of this situation hurt the government revenue streams, and on February 4th, 1952, the Rupiah was officially devalued up to Rp 11.4.

The export tariff ranged from 15-25% on commodities in which Indonesia was strong, and from 1955 were given a premium of 5-25% to boost their export and increase revenue.

To manage foreign exchange, the government acquired various measures. Around 40% of the foreign exchange requirements of shippers were expected to pay to the government from April 1952.

From September 1952, the government chose to give a restricted measure of foreign exchange, made accessible every four months.

The national bank put significant controls on foreign exchange rates with the end goal of developing the stores the Indonesian government needed. It harmed various Indonesian businesses that needed more inventory of essential imported materials.

The national bank took a stab at fixing the Rupiah to the US dollar utilizing a "managed float," resolving to a basket of currencies. In June 1957, another framework for foreign exchange was presented.

Exporters were sent export certificates (BE) addressing the foreign currency earned and could offer them to merchants on the free market (but subject to a 20% duty). This made a free-floating rupiah.

The last demonetization of rupiah notes happened in late 1965 when expansion was assaulting the economy: trades had dropped 24% in 1959-1965, GDP development was beneath populace development, and the foreign exchange holds had fallen by more than 90%.

Expansion in 1965 was 635%. In late 1965, the 'new rupiah' was gotten, at 1 new rupiah to 1,000 old rupiahs.

The authority conversion scale was initially set at Rp 0.25 to US$1 starting on December 13th, 1965, a rate that didn't address reality, as the different swapping scale framework stayed set up until further notice.

This was trailed by the rise of Suharto, who starting on March 11th, 1966, procured chief control of Indonesia.

Suharto immediately rolled out financial improvements, laying out his "New Order", with the monetary arrangement set by the Berkeley Mafia, his group of US-instructed neoclassical market analysts.

The arrangement started to be set out in November 1966, following the agreement with Indonesia's lenders in October 1966 on obligation help and advance rebuilding.

Monetary arrangements were set up to require satisfactory bank savings, finishing sponsorships on purchaser products, end import limitations, and downgrading the Rupiah.

The 1966-1970 adjustment program was an incredible achievement, bringing about higher monetary development, supporting legitimate products (which became 70% in US terms over the period), and expanding yield (for example, the cost of oil rose multiple times when the 1950 costs were deserted, boosting new investigation). By 1971, expansion had tumbled to simply 2%.

Despite the government’s intervention, the Rupiah continued enduring devaluation until the 1990s. But, the government figured out how to keep up with cost controls over goods and raw materials, with the official oil price not changing from 1950 to 1965.

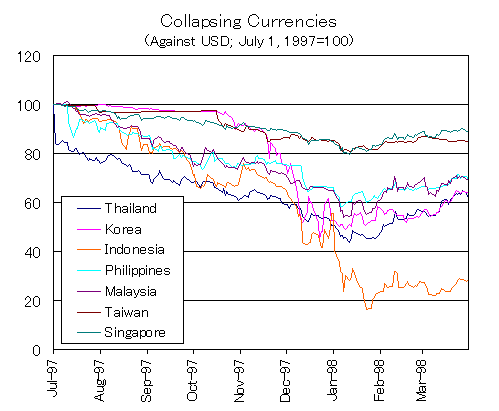

The Asian Financial Crisis

The Asian financial crisis in 1997 started in Thailand in May 1997, when the public authority found it harder to keep up with the Thai baht stake at ฿25 to US$1. By July 2nd, 1997.

Thailand deserted its safeguard of the baht, permitting it to free float. Indonesia, which had foreign reserves and was viewed as having a solid economy, responded on July 11th, 1997, by extending its conversion scale band from 8 to 12%.

Indonesia had made similar moves in the years, paving the way to the crisis. in December 1995, it increased from 2 to 3% because of the Mexican monetary emergency, and in June and September 1996, it grew from 3 to 5% and afterward 5 to 8%.

These activities had been fruitful in the past in safeguarding the Rupiah, but in this event, a more serious crisis of certainty emerged.

President Soeharto asked the IMF for their help, and the IMF came on October 13th, 1997. The IMF gave Indonesia a standby loan for $43 Million. That fund was monitored by the IMF, World Bank, and ADB.

The IMF decided if they wanted to give the fund, Indonesia would have to sign the Letter of Intent (LoL), which is the IMF’s intention to help recover Indonesia’s economy. The first was to shut 16 private “sick” banks to restore the bank sector.

But this causes more economic damage as people’s trust in the country and bank sectors start to shake. The World Bank stated that the Rupiah devalued Rp. 3.250 to Rp 4.000 per Dollar.

According to a World Bank report, the situation became even more uncertain when the state budget proposed by the government on January 6th, 1998, received a negative response from the market because it was deemed too optimistic and not credible.

In the first three weeks of January 1998, the Rupiah depreciated from Rp4,850 to Rp13,600 per US dollar, even touching Rp17,000 per US dollar.

Indonesia has a lot of journeys when it comes to its currency. Although they are rich in natural resources, they don't have a stable economy; Indonesia has to struggle to fight the dutch and japan from their colonization.

Every presidency of them has ways to deal with the inflation and devaluation of Indonesia’s Rupiah. In today's situation, Indonesia remains one of the weakest currencies in the world, caused by political problems, debt, and inflation.

Researched and authored by Ilhaam Prayudi | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?