Macrofinance

It studies the link between asset prices and economic fluctuations

What is macrofinance?

Macro finance or macroeconomics studies the link between asset prices and economic fluctuations. It works on a large scale to fulfill the financial benefits and obligations of the whole population. Asset prices and economic fluctuation are affecting business cycles.

It is a system that analyzes the link between asset prices (stock market) and economic fluctuations (recession or not). It works on a large scale to fulfill the financial benefits and obligations of the whole population of a country.

Investors are willing to take the risk in good times because the price of stocks will increase, leading to lower future returns, but asset prices and future expected returns depend on the economic situation.

Macro-finance could predict future economic conditions such as GDP, GNP, and economic growth by analyzing current asset prices and past asset returns.

The goal of macroeconomists is to explain what influences the pace of:

-

Economic growth

-

Economic fluctuation

-

Inflation

The primary measure of the economy's overall performance is its total output. This is the most common name for Gross Domestic Product (GDP).

Gross Domestic Product (GDP)

GDP is a financial measure in which everything is valued in dollars. It calculates the total market value of all final products of goods and services produced in a country over a specified period of time. Usually, it is calculated within a year.

All goods and services produced should be changed into dollar values for GDP to work.

To avoid numerous goods and services, GDP incorporates just the market worth of final goods and ignores intermediate goods, which are products either bought for resale or further handling into final products.

GDP could also avoid numerous counting by just counting the value-added at each stage. Value added is the market worth of a company's output less the value of the company's input bought from others.

Final goods and services are purchased by the end-users. GDP excludes the value of intermediate goods, which refers to a product purchased for further processing or manufacturing. GDP excludes secondhand sales (i.e., Used cars).

Gross National Product (GNP)

GNP measures the total market value of all final goods and services produced by domestic residents in a given period, regardless of where they are produced, within the borders of the country or abroad.

GNP = GDP + Factor income from abroad – Factor income to abroad

Nonproduction transactions should be excluded from GDP since they don't have anything to do with the production of final goods.

There are two types of GNP: purely financial transactions and secondhand sales.

On the one hand, purely financial transactions are payments by the government where no goods and services are received. Pure financial transactions are stock purchases and private transfer payments.

Pure financial transactions include public transfer payments like Social Security, private transfer payments (Christmas gifts), student aid, unemployment compensation, and stock market transactions.

On the other hand, secondhand sales don't contribute to current production, hence why they are ignored in calculating GDP.

Secondhand items like used cars are excluded from the GDP calculations. These items were considered part of GDP when originally sold and normally during the year they were produced.

Two approaches to GDP

GDP can be seen from two different perspectives.

-

The income approach

This approach estimates that the GDP depends on the accounting reality that all expenditures in an economy should equal the total income developed by the production of all economic goods and services.

(GDP = Total Income = Wages + rental income + interest income + profit)

-

The expenditures approach measures GDP as the sum of the money spent on buying the output.

(GDP = Aggregate Expenditure =Consumption + Investment + Government expenditure + (Export-Import))

simple Version = GDP = AE = C + I + GE + (X+M)

In theory, both methods should yield equal results. The expenditure and income approaches are two distinct ways to check the same. You could look at a dollar from each side, but it is still worth the same.

This is exactly what the expenditure and income approaches do in calculating GDP.

GDP calculates production at current dollar values, which might be an issue because a dollar's worth changes over time. A hundred years ago, the purchasing power of a dollar was a lot different than today.

Two different GDPs

To fix that problem, there are two G.D.P.s.

-

Nominal G.D.P. depends on the cost incurred when the result was produced. Measures the market worth of all single final goods and services using the current year’s price. Changes in cost and output can cause changes in nominal G.D.P.

-

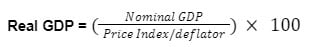

Real G.D.P. It is a G.D.P. that has been deflated or inflated to reflect changes in price levels. To calculate the real G.D.P., a base year should be chosen, and the current year’s price should change accordingly.

It measures the market worth of final goods and services utilizing the base year value change in real G.D.P. and reflects a change only in the output.

G.D.P. Deflator Equation: The G.D.P. deflator measures price inflation in an economy: it is calculated by dividing nominal G.D.P. by real G.D.P. and multiplying by 100.

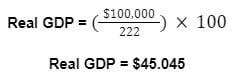

Consider a numeric example: if nominal G.D.P. is $100,000, and the G.D.P. deflator is 222, then the real G.D.P. would be 450.450 or $45.000

While G.D.P. is quite an accurate and useful measure of how the economy is performing, it has some drawbacks. Certain productive activities happen outside of any market, and for that, it is not measured traditionally.

The worth of leisure time, weekends, occasions, a day off, etc. are also excluded, yet they certainly add to the worth of the additional satisfaction they give to employees.

G.D.P. fails to catch the full value of upgrades in goods and service quality. To be honest, a thin laptop that has a 16GB Ram is a major improvement over the old, thick, 2 GB Ram model.

There is also a huge underground economy, mainly composed of illegal activities, that produces pay that is not calculated through traditional G.D.P. methods.

However, the underground economy is an illegal activity that produces revenue that the beneficiaries do not want to report to the I.R.S. and get charged by the tax.

Environmental issues and noneconomic sources of prosperity are also problematic because G.D.P. doesn’t have an approach to accurately value and report the problems.

Using G.D.P. to calculate the standard of living has some limitations:

-

Household production is not included

-

Do not consider leisure time

-

Does not consider health and life expectancy

-

The underground economy is not included

-

Do not consider environmental issues

-

Does not consider the contribution of the output

-

Does not consider political freedom and social justice.

Economic Growth

Economists measure and define economic growth in two ways.

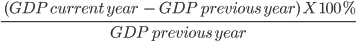

The first is a growth in real GDP throughout a few periods, and the second is an increase in real GDP per capita throughout some time. It is usually calculated as a percentage rate of development either on a quarterly or yearly basis.

During times of recession, the growth rate will be negative rather than positive. Looking at GDP per capita allows us to analyze and compare countries of various sizes.

Real GDP is more important for country-to-country comparisons, and GDP growth is considered an economic aim. The expansion of total output in relation to population improves living standards and lowers the burden of scarcity.

GDP growth rate

Factors Contributing to Economic Growth

There are five factors that, when joined, seem to make sense of changes in efficiency growth rates.

-

Innovative development represents around 40% of productivity growth and is the largest factor.

-

It is produced by new knowledge and information.

-

The amount of capital explains around 30% of productivity growth. Better plants and types of equipment make employees and workers more productive and work efficiently.

-

An increase in education and skills of workers, economic scales, and asset allocations, represent the remaining productivity growth.

-

Investment in human resources is important to increase workers' or laborers' productivity.

In 2009, there was a significant increase over the past years, where 87% of the U.S population went into high school, and as much as 27% of that 87% went into college or post-secondary education.

Economies of scale are the reduction in per-unit production costs produced from expansion in yield levels. And improved resource allocation means labor over the long run has moved from low-efficiency work to high-efficiency employment.

The long-run development that changed international trade through international agreements has worked on the distribution of resources, increased productivity in labor, and extended real results.

The Business Cycle

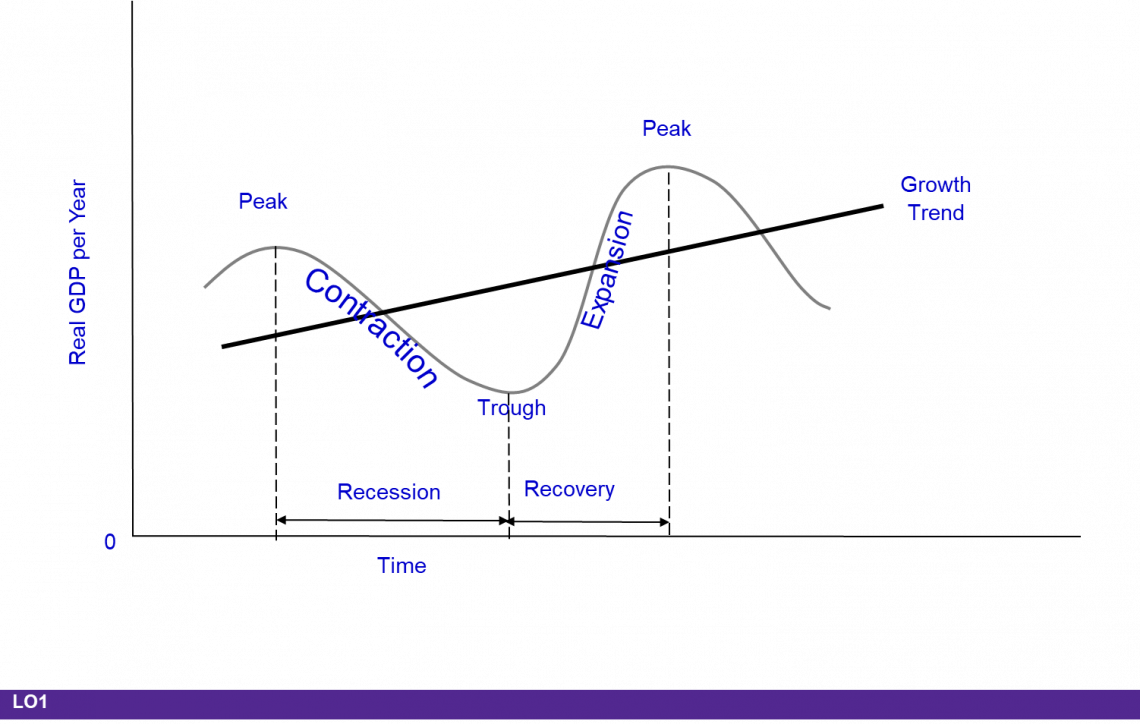

The business cycle refers to an alternative increase and decrease in financial activity after some time. Every business cycle has four stages.

-

Peak: when business activity comes to a temporary maximum with a full workforce and close to the limit yield

-

Recession: a decrease in total result, wage, employment, and trade that occurs in six months or more.

-

Trough: It is the lowest point of a recession.

-

Expansion: when the result and employment are recovering and growing towards a full-employment

Macroeconomics Issues: Unemployment and Inflation

To have a better understanding, let’s explore unemployment and inflation.

There are three types of unemployment.

1. Frictional unemployment

It is viewed as, to some degree, desirable because it shows that there is mobility as individuals change or look for jobs. Frictional unemployment is generally a momentary type of unemployment.

They are usually people who are searching for or maybe waiting for a job. Most of them are fresh graduates or people who just had an interview and are still waiting to be accepted.

2. Structural unemployment

Happens when certain skills become out of date or the geographic distribution of jobs has changed.

3. Cyclical unemployment

It is brought about by the recession phase of a business cycle. As companies answer inadequate demand for their goods and services, output and unemployment are reduced.

Cyclical unemployment is the opposite of full employment.

This type of unemployment means zero, while full employment does not mean the same.

Because these types of unemployment always happen and are natural in our economy, the full employment-unemployment rate is equal to the total frictional and structural unemployment.

The full employment rate of unemployment is also referred to as the natural rate.

The natural rate of unemployment is referred to as the full employment rate of unemployment.

When the number of people looking for a job equals the number of job applications, the natural rate is achieved when the labor markets are in balance.

The demographic makeup of the labor force and the laws and customs of the nation is being relied on by the natural rate because it is not fixed.

Natural Rate of Unemployment (NRU)

When the economy is producing at the full employment level, the unemployment rate is known as NRU:

(NRU = frictional unemployment + structural unemployment)

In the case of full unemployment, there is no cyclical unemployment. It is socially catastrophic when the individual levels and society are being spread out by severe unemployment, which leads to.

-

Loss of income and skills

-

Loss of self-respect, hope, and moral

-

Suicide, homicide, fatal heart attacks, mental illness.

-

Family disintegration and an increase in the divorce rate

-

Can lead to violent social and political change

-

Heightened racial and ethnic tensions

Inflation

Inflation means a rise in the price level. In fact, it decreases the purchasing power of money. A typical method to calculate inflation is using the Consumer Price Index (CPI), which constitutes a box of goods and services generally bought by consumers.

Not all prices are going up at the same rate, and some prices might remain the same while different prices of goods and services may fall. A decrease in purchasing power means that every payment will buy fewer things.

The CPI-U is the most used method to measure inflation. The main index is used to measure inflation.

The CPI-U is part of the media reports. The CPI is for every metropolitan consumer and is thought to cover 87% of our population's buying experience. Other prices are reported by the BLS, and each price is important to various groups.

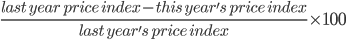

There are many ways to measure inflation, including the CPI-W, the CPI-C, the PPI, etc. Last year's cost is subtracted from the current year's price index and is divided by last year's index. To look at it as a percentage, multiply it by 100. The calculation is shown below:

Another example is, utilizing a CPI from 2007, there is a price index of 207.3, and 2006 has a value index of 201.6. You can calculate the inflation rate, which is 2.8%. The BLS rounds to the tenth decimal spot.

The "rule of 70" is used to determine the estimated time it takes for a price to double. It allows quick calculation to estimate the price. The variable growth rate is divided by 70 to determine the number of years for the price to double and determine the time for an investment to give the annual rate of return.

Here the inflation rate is 2.8, so divide 70 by 2.8, and you get 25. Therefore it would take about 25 years for prices to double at that of inflation. If the inflation rate is 7%, then it will take about ten years for prices to double.

The inflation rate here is 2.8; using the calculation, 2.8 is divided by 72, and the result is 25. If the inflation rate stays the same, it will take 25 years for the price to double. If the inflation rate is 7%, it will take about ten years for the price to double.

This means if the rate of inflation stays the same, it will take 25 years for the price to double.

Macrofinance vs. Microfinance

The differences are based on their scope.

As mentioned above, Macro-Finance is a system that analyzes the link between asset prices (stock market) and economic fluctuations (nation condition if we're in a recession or not). It works on a large scale to fulfill the financial benefits and obligations of the whole population of a country.

This means it is being tracked, studied, and analyzed by governments to fulfill the financial benefits for the people. It involves politicians providing subsidies, funding, multi-year economic operation development plans, and projects that could offer employment or start a business.

Microeconomics is the study of choices that individuals and businesses make, the way these choices interact in the market, and the influence of governments. Microfinance is focused on individuals and communities to provide financial services and businesses.

Microfinance could also help communities and individuals that need financial services but don't have much of an income stream.

Examples of macro-finance and microfinance

-

Macro-finance: to tackle traffic in the city, governments, intended to build more train stations and tracks and supply more buses so there is less traffic. Governments require economic operation development plans, and the effect is huge because it could affect high to lower-class people.

-

Microfinance: a farmer needs to borrow $1000 to buy equipment and assets for his farm. He needs it to continue producing their crops. This is simple financing for microfinance.

Fiscal and Monetary Policies

Governments worldwide rely on advice from public and private sector economics on how best to alter discretionary fiscal policy to fight recessions.

In the United States, changes in discretionary fiscal policy refer to the deliberate manipulation of taxes and government spending by Congress to alter real domestic output and employment, control inflation, and stimulate economic growth.

"Discretionary" means the changes are at the option of the United States Federal government. Discretionary fiscal policy changes in the U.S. are often initiated by the U.S. President on the advice of the Council of Economic Advisers (CEA).

You can find information on the CEA at Whitehouse website: they are found under the "The Administration" tab in the "Executive Office of the President" section.

Understanding interest rates is a key economic concept. For example, imagine a gentleman starting a new career working for an investment firm: he did not have a business background, but he was a salesman.

One evening, as he was discussing his new career with an economist friend, he told his friend that the reason his firm could offer investors a much higher return than the banks was that his firm had been around for over 100 years and, therefore, was considered "safer" than a bank and did not have to purchase insurance to safeguard depositors' funds as banks did.

The economist stopped him and had to explain that it was the opposite: his firm had to pay a higher interest rate to investors to compensate the investors for their increased risk with his firm because their investments were not insured.

Fiscal Policy

Fiscal policies are the use of government spending and taxation to influence economic situations. Governments worldwide rely on advice from public and private sector economics on how best to alter discretionary fiscal policy to fight the recession.

A macroeconomic situation includes aggregate demand for goods and services, reducing unemployment, inflation, and economic growth.

Limitation of Fiscal Policy are:

1. Recognition lags

It is the elapsed time between the beginning of a recession or inflation and awareness of this occurrence. The time it takes to assess the current state of the economy, forecast its future state, and decide that fiscal actions are needed.

2. Law-making lag

Law-making lag or administrative lag is the difficulty in changing policy once the problem has been recognized. The amount of time it takes Parliament to pass the laws needed to change taxes or spending.

3. Impact lag

Refers to the time elapsed between the policy change and its impact on the economy. The time it takes for passing a tax or spending change to the initial change in AE (aggregate economy).

Moreover, there are other problems generated by the use of a Fiscal Policy:

4. Political business cycles

Fiscal Policy is used by politicians as a political tool to win votes. This may have caused destabilization in the economy. Election years have been described by more expansionary arrangements regardless of economic conditions.

The government impacts the economy to get re-election. The economy is controlled to such an extent that unemployment and inflation are just about as low as possible, and the development of real income is as high as possible during the election.

Households might accept that the tax reduction is transitory and save an enormous part of their tax cut, decreasing the consequences of the impact wanted by policymakers.

The state and local fiscal policies may disrupt federal stabilization policies. They are usually procyclical because balanced-budget requirements cause an increase in tax rates when in recession or cut spending, making the recession even worse.

In an inflationary period, they may increase spending or cut taxes as their budget heads for a surplus.

In an inflationary period, they might expand spending or cut taxes on government expenditures as their financial plan heads for a surplus.

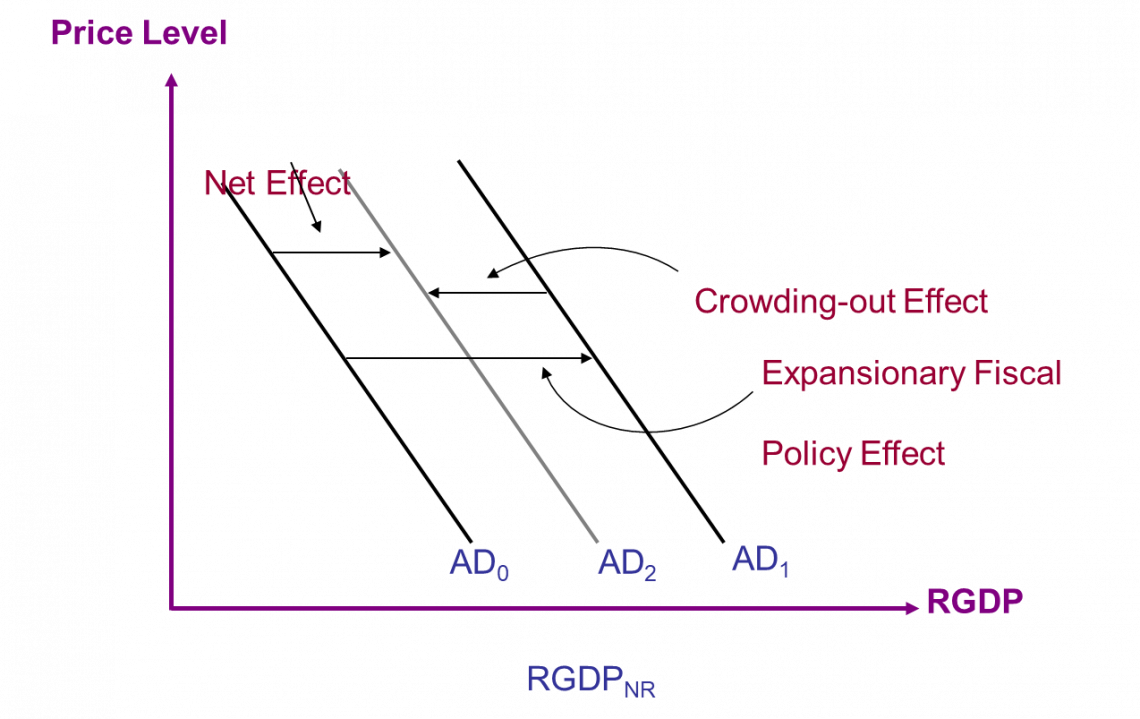

5. Crowding-out effect

During the recession, governments tend to have spending/borrowing that raises the interest rate. Therefore government spending might decrease the investment by private firms.

This might happen because of government deficit spending. It might expand the interest rate and decrease private spending, which weakens or drops the improvement of financial policies.

Automatic Stabilizers

It is a mechanism that dampens the fluctuations in real GDP without a policy action by the government. Automatic stabilizers help stabilize the economy. In fact, built-in stability came because net taxes changed with GDP.

It is tempting for spending to increase when the economy is falling and the other way around when it is becoming inflationary. Automatic stabilizers reduce instability. However, it does not erase economic stability.

Two built-in stabilizing tools:

-

Induced Taxes: Tax income shifts directly with GDP; wage, sales, excise, and payroll taxes all increase when the economy is growing and decrease when the economy is contracting.

-

Induced Transfer Payment: Transfer payments such as unemployment compensation and welfare payments change indirectly with the economic business cycles. Unemployment compensation and welfare payments decrease when the economy is in expansion.

Unemployment and compensation and welfare payments increase during economic contractions.

The size of automatic stability relies on the responsiveness of changes in taxes to changes in GDP. In fact, the more moderate the tax system, the greater the economy’s built-in stability.

A progressive tax framework implies the average tax rate falls as GDP. A corresponding tax framework implies the average tax rate stays the same as GDP rises.

A regressive tax system means the average tax rate falls as GDP increases. In any case, tax revenues will rise with GDP under both the progressive and the proportional tax system. They could rise, fall, or remain the same under the regressive tax system.

If the economy is expanding:

-

Tax revenue automatically increases

-

Household/business spending will not increase as much as one would expect.

-

Restrain economic expansion

Automatic stabilizers are designed to be the first line of defense in turning somewhat negative economic trends around since they respond almost instantly to changes in income and unemployment.

On the other hand, governments frequently use different forms of broader fiscal policy programs to handle more severe or long-term recessions or provide extra-economic relief to certain regions, industries, or politically favored segments in society.

If the economy is in recession:

-

Tax revenue automatically declines and falls in consumption (C), and Investments (I) are not as drastic as one would expect.

-

Helps to cushion economic contraction.

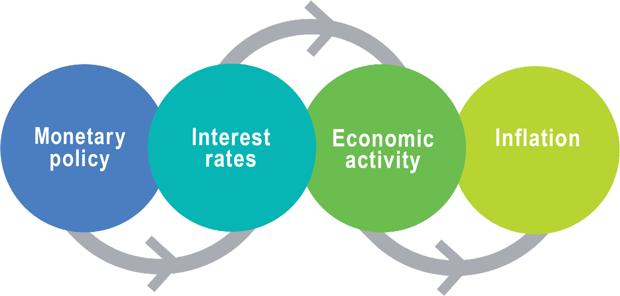

Monetary Policy

Interest rates in the economy, including lending and deposit rates faced by families and businesses, are heavily influenced by monetary policy.

The central bank uses a monetary policy to control the money supply and interest rate. The changes in interest rate would affect C+I and eventually AD.

In a recession, to reduce unemployment, the central bank should adopt an expansionary monetary policy to increase the money supply. To reduce inflation, the central banks should adopt a contractionary monetary policy to reduce the money supply.

Just like in other resource markets, an equilibrium interest rate will cause the supply of money available to equal the demand for money. This rate can be considered the market-determined price that borrowers must pay for using someone else’s money over time.

Instruments of Monetary Policy

Below are instruments or tools of monetary policy.

1. Open market operations

They are used by the Fed to increase or decrease the U.S commercial bank reserves available, which, in turn, will affect the amount of money available in the economy.

Buying and selling government securities are to influence the money supply. During the recession, to increase the money supply, the central bank buys government securities.

And to reduce inflation, the central bank will sell government securities to reduce the money supply.

| The economy in recession | Economy in inflation |

|---|---|

| Government buy securities | Governments sell securities |

| Government pays buyers (banks or public) | Buyers (banks or public) pay the governments |

| Increases money available in banks to lend out | Decrease money available in banks to lend out |

| New money is created & money supply increase | Money supply falls |

2. The Reserve Ratio (R)

-

Changes the money multiplier.

The statistic of "commercial bank money/central bank money," based on the actual observed quantities of various empirical measurements of money supply, is known as the money multiplier.

-

To reduce unemployment.

The central banks should decrease R (interest) so that the bank can loan-put more money and create new money deposits, which leads to a money supply increase.

-

To reduce inflation.

The central bank should increase (R) so that the banks have to reduce the number of loans, and this leads to multiplier contraction, which leads to the money supply falling.

3. The Discount Rate

-

Refers to the interest rate the central bank charges when commercial banks take a loan from the central bank.

The phrase discount rate can refer to the interest rate charged by the Federal Reserve on short-term loans or the rate used to discount future cash flows in discounted cash flow (DCF) analysis.

-

The central bank acts as a lender of last resort.

Discount lending is a crucial monetary policy tool and part of the Fed's role as lender-of-last-resort in the banking sector.

-

To reduce unemployment, the central bank will decrease the discount rate to increase the money supply.

The discount rate in discounted cash flow analysis indicates the time worth of money and can determine whether or not an investment project is financially viable.

-

To reduce inflation, the central bank will increase the discount rate to reduce the money supply.

During times of recession and unemployment, as in the past couple of years, the U.S fed initiated expansionary monetary policy. The idea is to increase the supply of money in the economy to increase borrowing and spending.

One of the problems with the recovery today is that while spending has increased some, borrowing is down. It seems ironic that when people save instead of borrow, it can be detrimental to the economy.

If the feds feel the economy is overheating or heading into a period of inflation, they will switch to restrictive monetary policy.

This policy involves increasing the interest rate to reduce borrowing and spending, which should curtail the expansion of aggregate demand and keep prices down.

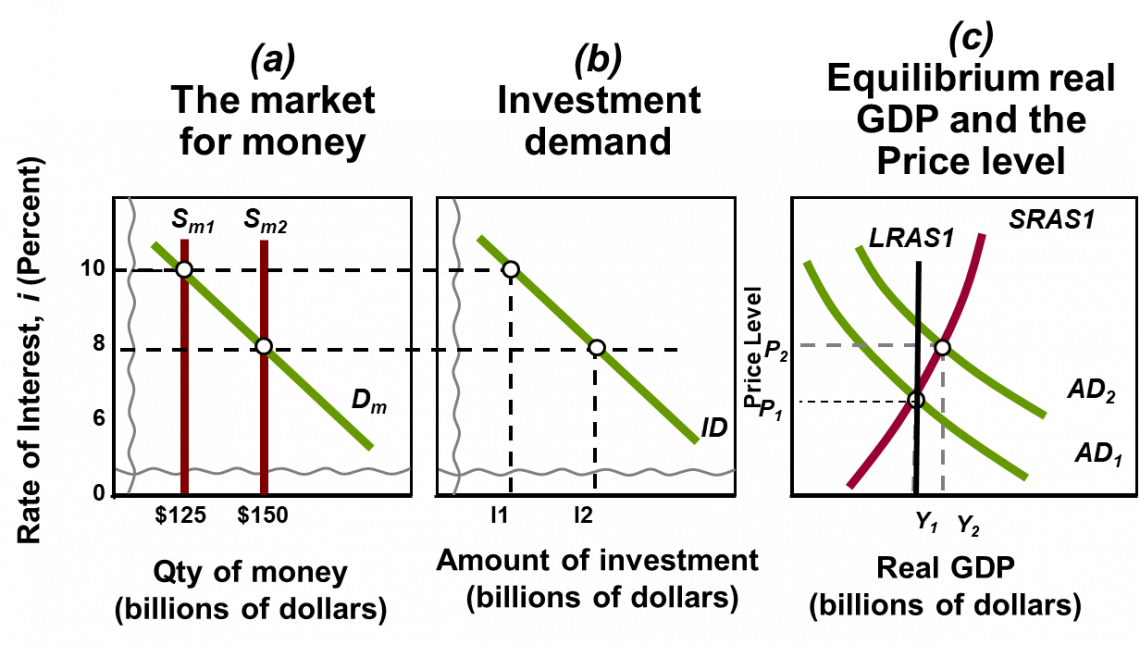

An expansionary financial approach moves the money supply curve rightward in picture A and lowers the interest rate from 10% to 8%, which brings out the investment spending in picture B to increase from $15 to $20 billion and cause aggregate demand to increase.

This moves the aggregate demand curve rightward from AD1 to AD2 in picture C, so the real output rises to the full employment level QF along the horizontal dashed line.

On the other hand, a restrictive financial policy will cause the money supply to shift leftward, expanding the interest rate and decreasing investment and aggregate demand.

Researched and authored by Ilhaam Prayudi | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?