Negotiable Instrument

The instrument must contain a name or other indication of the payee receiving the money.

A signed paper that promises to pay a certain amount to a particular person or the assignee is a negotiable instrument.

To put it another way, it is a codified IOU: a transferable signed document that guarantees the payment of a certain amount to the bearer at a specified time or upon demand.

The instrument must contain a name or other indication of the payee receiving the money. Some of these instruments may trade on a secondary market because they are tradable and assignable.

A document that ensures payment of a specific sum of money to a particular person is a negotiable instrument (the payee). It has a contract-like structure and demands payment immediately or at a certain period.

Such documents are written promises that payers and payees both sign, pledging that the former will pay the latter on the specified date or upon demand.

As the instrument bearer has an unrestricted right to reclaim the sum mentioned in the instrument from its maker, these are nothing more than evidence of debt.

These tools are used in place of cash to transmit payments between merchants and properly conduct risk-free commercial transactions.

These contracts encourage parties to trust one another with payments and repayments. They are negotiable since two parties are involved in these notes or draughts who have agreed to proceed with the transaction.

These documents must include the assignee's name despite being unconditional. Therefore, only the payee listed is the recipient of the money.

Understanding the instrument

Due to the transferability of negotiating instruments, the holder is free to take the money as cash, utilize it as they see fit for the deal, or do as they want.

The particular amount promised and required to be paid in full either immediately or at a specific time is noted in the fund amount indicated in the agreement. It is possible to transfer a negotiable instrument from one person to another.

The transfer of the instrument gives the new owner complete legal title.

The entity providing the instrument makes no additional promises in these documents. Furthermore, the bearer cannot be given any further instructions or requirements for them to obtain the money specified on the instrument.

An instrument must be marked or signed by the maker—the person providing the draft—for it to be deemed negotiable.

The drawer of money is the name given to this thing or person. A note is considered negotiable if it may be transferred to another party or assigned; a non-negotiable note is set in stone and cannot be changed or amended.

Types

They come in a wide variety. Personal cheques, traveler's cheques, promissory notes, certificates of deposit, and money orders are some of the typical ones.

A commercial document is a "negotiable instrument" that fits certain criteria and can be transferred by following the law or the local custom.

This document's legal life may be extended by further delivery or endorsement. It may also be freely transmitted from hand to hand. These instruments guarantee payment or repayment to a person or an organization.

These legally binding documents mention the recipient's name and payment date. We will be further discussing the different types of negotiable instruments, such as:

- Personal cheques

- Travelers' cheque

- Money order

- Promissory notes

- Certificates of deposits (CD)

- Cheques

- Bill of exchange

- Bearer bonds

It can also be classified in as following ways such as:

1. Bearer Instrument and Order Instrument

2. Inland Instrument and Foreign Instrument

3. Inchoate and Ambiguous Instruments

4. Demand and Time Instrument

1. Personal Cheques

Personal cheques specify the amount to be paid and the name of the cheque's bearer. They are signed and authorized by someone who has deposited money with the bank (the recipient).

Cheques are still used to make payments even though technology has increased the use of online banking. However, personal cheques have one drawback: they are a relatively slow means of payment and take a long time to process compared to other options.

Personal cheques are advantageous because some transactions still call for or benefit most from using cheques.

For instance, landlords can demand rent paid through a cheque from tenants. So if you're mailing money to someone, you might want to use cheques rather than cash because there's less chance of the money being stolen.

2. Travelers' Cheques

Another negotiable instrument designed for tourists traveling abroad as an alternative to the local currency is the traveler's cheque.

Financial institutions issue traveler's cheques with serial numbers and in pre-paid predetermined amounts. In addition, they function with a dual signature mechanism that necessitates the check buyer to sign twice: once before utilizing the cheque and once during the transaction.

The financial institution issuing the cheque will guarantee payment to the payee if the two signatures match.

Buyers can avoid worrying about taking significant quantities of foreign cash on vacation when using traveler's cheques, and banks offer security for misplaced or stolen cheques.

The use of traveler's cheques has decreased in recent years as more practical methods of making payments overseas have emerged due to technological innovation.

Traveler's cheques raise additional security issues due to potential forgery, both in terms of the cheques' signatures and the actual checks.

Traveler's cheques are no longer widely accepted by many businesses and financial institutions due to the hassle of the transactions and the fees associated with cashing them. Instead, debit and credit cards have largely taken the role of traveler's cheques as a form of payment.

3. Money Order

In that they guarantee a certain sum to the person holding the order, money orders are similar to cheques. Money orders are widely available and are issued by financial institutions and governments. However, they differ from checks because they typically have a cap on their value, usually $1,000.

For needs over $1,000, entities must place numerous orders. After purchasing the money orders, the buyer fills out the receiver's information, specifies the amount, and sends the order to the intended recipient.

Compared to checks, which only include the sender's and recipient’s names and addresses but no other personal information, money orders contain much less personal data.

Nowadays, sending money abroad is also a common practice thanks to international money orders, which do not require cashing in place of issuing. Therefore, they make it possible for a quick and easy money transfer.

It serves as a stand-in for checks when making payments immediately. A money order specifies the amount. The payer must pay a minor processing charge in addition to the money order amount to a banking institution before it can be processed.

The financial institution then issues the money order in exchange. It has long been the conventional method of sending money between parties while ensuring the highest level of security.

These are the most effective money transmission methods for people without bank accounts.

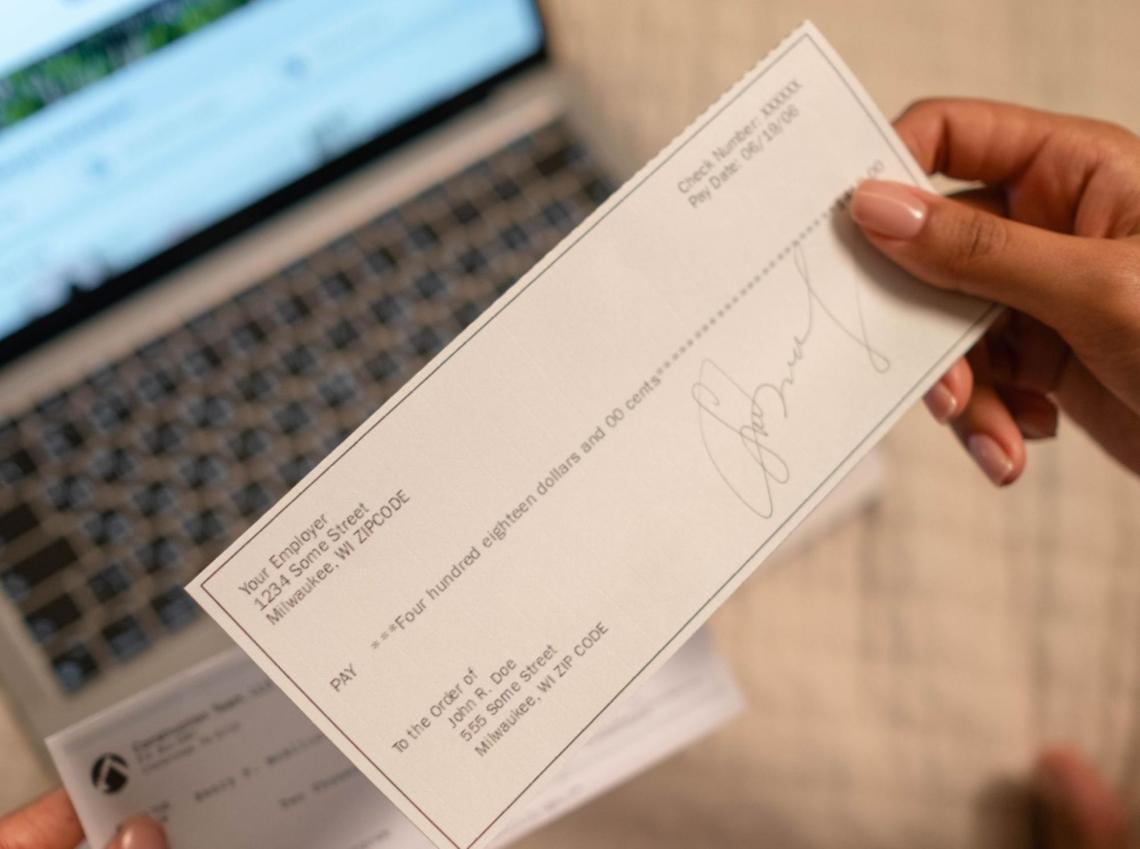

4. Promissory notes

Promissory notes are written agreements between two parties wherein one party (the payor) promises to pay the other party (the payee) a specific sum of money at a future date.

Promissory notes, like other negotiable documents, include all the pertinent details for the promise, such as the stipulated principal amount, interest rate, period, date of issuance, and payor's signature.

Promissory notes are largely used to help people and businesses get finance from sources other than banks and financial institutions. Lenders are those who issue promissory notes.

Promissory notes are not as casual as an I owe you, which only states that a debt exists. However, they are also not as strict and formal as a loan contract, which is more specific and outlines the repercussions of not paying the note as well as other impacts.

When a party signs a note with another party's name and a specific future date, they promise to pay that party a certain amount of money.

Typically employed as a short-term trade credit, the manufacturer settles the outstanding balance on or before the note's expiration date.

Commercial people regularly use it as a secure method of money transmission to ensure smooth business operations.

If the promised money is not paid, people or businesses may claim the unpaid money after the term has passed. Additionally, it is issued as a loan instrument that companies utilize to finance their immediate projects.

5. Document of Deposit (CD)

Financial organizations and banks provide certificates of deposit (CDs). This product enables clients to deposit and leave untouched a specific amount for a predetermined amount in exchange for a remarkably high-interest rate.

The interest rate typically rises gradually as the duration lengthens. As a result, the certificate of deposit must be kept until it matures, at which point the principal and interest may be taken. Hence, fines are frequently assessed as a punishment for early withdrawal.

Banks and credit unions typically provide CDs, although the interest rates, term restrictions, and penalty costs vary widely.

Because the interest rates on CDs are much higher than those on savings accounts (between three and five times higher), most individuals look around for the best rates before deciding to buy a CD.

Customers are drawn to CDs because of their high-interest rates, safety, and conservatism. This is because the interest rate is fixed for the duration of the CD. Certificates of Deposit are a type of financial product offered by banks and other financial institutions.

Customers participate in the process by depositing a set sum and keeping it secure for a predetermined period in exchange for a high-interest rate. The interest rate tends to rise steadily with a wider range of deposits.

Once the CD matures, the individuals can withdraw the principal amount plus interest. However, there would be a penalty if one withdrew too soon.

6. Cheques

A cheque is a document that details the sum that one party has paid to another. It comprises the bearer’s name and the account number where funds would be deducted. Additionally, it includes the payee's name.

As a result, even if the cheque disappears, no one else may utilize it improperly. Cheques are, in general, the most secure way to send money from one party to another or to make payments.

People still think about writing a cheque for safety reasons, even if it takes a little longer to debit the money from one account and credit it in the other. People and businesses utilize a variety of cheques, including cashier's cheques, certified cheques, cheques, and traveler's cheques.

There are different ways of crossing the cheque, such as double-crossing, account payee crossing, general crossing, special crossing, restrictive crossing, non-negotiable crossing, and canceling a cheque.

7. Bills of Exchange

Promissory notes and bills of exchange are utilized in domestic and international trade. With the aid of this document, one party agrees to reimburse another party or any other person for the agreed-upon amount at a specific future date.

Up to three parties can participate in a bill of exchange transactions. The party who pays the amount stipulated by the bill of exchange is known as the drawee. The person who gets that money is the payee.

The person who binds the drawee to pay the payee is the drawer. Unless the drawer moves the bill of exchange to a different payee, the drawer and the payees are the same.

A bill of exchange differs from a promissory note in that it can be transferred and obligate one party to pay a third party not involved in its production. Promissory notes frequently take the shape of banknotes.

The creditor issues a bill of exchange that requires the debtor to pay a specific sum within a particular time frame. On the other hand, the promissory note is a promise to pay a specific sum of money within a certain amount of time and is issued by the debtor.

8. Bearer Bonds

As the name implies, the bondholder is entitled to receive a coupon and principal payment on these unregistered bonds that the government or a corporation has issued. The issuer does not keep the original bond owner's identity on file.

The bearer bonds shall be deemed owned by the person possessing the bonds. As a result, there is a great chance that these bonds will be lost, stolen, or damaged in some other way.

Owners of a bearer bond can maintain their anonymity because it is not a registered instrument. However, anyone carrying the bond documents can receive the redemption value and coupon payment on the bond's maturity date.

The firms initially issued these bonds to raise capital and give investors a fixed income in return. However, this investment option became rather popular due to the anonymity feature, and investors now employ these bonds for other goals.

Investing in significant denomination bearer bonds allows investors to use this bond to conceal their assets and income.

It also makes transporting a sizable chunk of money abroad simpler. Evading taxes is simply because an investor can transfer the cash in these bonds, earn interest, and then fully erase it from financial accounts.

By investing a sizable sum of money in these bonds and introducing them into the system through a legitimate source, the investor can employ bearer bonds for money laundering purposes, which is a hazard to any economy.

Characteristics

This instrument refers to the fact that it can be transferred to various parties. The new possessor acquires complete legal title if it is transferred. On the other hand, non-negotiable instruments are unalterable and unchangeable.

These instruments allow their owners to receive cash or transfer money to another party. The negotiable document specifies the precise sum that the payor is pledging to pay and requires payment either immediately upon demand or at a predetermined period.

The issuer of the document signs these instruments, just as contracts.

- It is a written document that the issuer has signed.

- It is a legal agreement that either party can modify. The holder can transfer the document to another person or organization. Such instruments are negotiable due to this property.

- The payee has full ownership of the legal document as stated on the instrument. This indicates that the title is transferred when the note is given to successive parties.

- A negotiable instrument will always include the payee's name, which designates the payment being made to a certain individual or business.

- The time is ascertainable and fixed in addition to the payee. The payee can present the paperwork to be cashed, or they can choose to receive the promised payment immediately or by the deadline.

- There is flexibility since the payee can receive the money in cash or give the document to someone else to use repeatedly.

Some Illustrations

The personal check is one of the more often used forms of negotiable currency. It functions like a draught, payable in the precise amount stated upon receipt by the payer's financial institution.

Similar in function, a cashier's check serves the same purpose. However, the funds must be allocated or set aside for the payee before issuing the check.

Similar to checks, money orders can be issued by the payer's banking institution or not.

The payer must frequently provide cash before the money order may be issued. The money order may be converted into cash after the payee has received it under the policies of the issuing company.

Traveler's checks operate differently since a transaction needs to be signed by two people. The payer must sign the document at the time of issuance to offer a sample signature.

A countersignature is required as a condition of payment once the payer decides who will receive the money.

Traveler's checks are typically used when the payer is going abroad and wants to employ a payment method that offers an extra layer of protection against fraud or theft while traveling.

Bills of exchange, promissory notes, draughts, and certificates of deposit are additional typical categories of negotiable documents (CD)

Examples

For a better understanding of the concept, let's look at the following examples:

a) Illustration 1

Anne submitted a loan application to a bank for a $100,000 loan. The bank examines her credit reports, confirms her salary, and requests additional documentation to ensure she can repay the loan.

To ensure timely repayment, the bank requires Anne to sign a promissory note in exchange for repayment assurance.

The promissory note gives the bank the authority to pursue legal action against the borrower to resolve any outstanding issues in the case of default despite all verifications.

b) Illustration 2

Some governments have enacted specific legislation to ensure the moral use of these tools and the protection of the payee's rights.

To efficiently regulate the use of the instruments mentioned above, including the rights, liabilities, and duties of the parties involved in the transactions, India, for instance, implemented the Negotiable Instruments Act of 1881.

The Negotiable Instruments (Amendment) Bill of 2017 was recently introduced in India, however, to protect the rights of payees if checks are dishonored.

FAQs

A legal document that has been written and signed by one party and guarantees that the party will pay or reimburse the requisite amount within a certain time frame or on demand.

It is transferable, and an individual or organization can choose whether to cash it out or pass it forward to further payees. Checks, promissory notes, certificates of deposit, bills of exchange, money orders, etc., are a few examples of such instruments.

The most frequently used negotiable instruments include banknotes, promissory notes, checks, draughts, and money orders.

Yes, the bonds that the government and corporations issue are tradable. Only those who now hold ownership are regarded as complete owners. The initial bond owner is unrelated to the issuer.

A select few are still popular even though the majority have already undergone a downtrend and have lost favor with people and organizations.

The popularity of virtual modes of transactions has dramatically increased today. Therefore, to ensure that transactions take little time and happen instantly, people and businesses frequently use online banking channels.

Consequently, nowadays, individuals are more comfortable completing transactions with NEFT, RTGS, debit & credit cards, etc.

Modern financial instruments take less time to complete transactions, yet significant security problems remain. As a result, when transferring large sums of money, many still favor using traditional methods like writing cheques or money orders.

Researched and authored by Deeksha Pachauri | LinkedIn

Free Resources:

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?