Promissory Note

A debt instrument containing a written promise to pay the note's payee a definite sum of money from the note's issuer at a specified date.

What Is A Promissory Note?

A Promissory Note, also called Note Payable, is a finance and debt instrument containing a written promise to pay one party (the note's payee) a definite sum of money from another party (the note's issuer or maker) at a date specified in the future or on-demand.

The promissory notes will include the following content under it:

- The principal amount

- Interest rate

- Parties involved

- Date of formation

- Terms of repayment (which may include interest) and

- Maturity date

Provisions are included on the payee's rights in the event of a default, which may include the maker's assets being foreclosed.

Note payables under CPLR 5001 (Consideration of Prejudgment Interest in Evaluating the Risk of Litigation) allow creditors to recover prejudgment interest from the date interest is due until liability is established in foreclosures and contract breaches.

Writing and signing notes payable is often necessary for tax and record-keeping purposes when it comes to personal loans. A Promissory Note on its own is usually considered unsecured.

Key Takeaways

- A Promissory Note is a financial instrument embodying a written promise from one party (the payee) to receive a specific sum of money from another party (the issuer or maker) on a predetermined future date or upon demand.

- Promissory Notes differ from IOUs by containing a specific promise to pay, outlining stages and timelines for repayment, and specifying consequences in the event of non-repayment. IOUs, on the other hand, merely acknowledge the existence of a debt.

- Investors may consider Promissory Notes for fixed-rate, interest-paying investments. Legitimate note payables are typically marketed to sophisticated or corporate investors who can thoroughly research the issuers.

- In the context of promissory notes, negotiability is often a crucial feature that facilitates the ease of transfer and liquidity in the financial markets.

understanding Negotiability and promissory note

Negotiability refers to the ability of the financial instrument to be transferred from one party to another in a manner where the new holder of the instrument has the same rights and privileges as the prior one. Here, that negotiable instrument is the promissory note or note payable.

In the context of the note payable, negotiability refers to the facilitation and the ease of transfer and liquidity in the financial markets.

Key features of negotiability include:

- Bearer instrument

- Order instrument

- Endorsement

- Negotiation and delivery

- Holder, in due course

Importance of Negotiability in Promissory Note

- Marketability and liquidity

- Ease of transfer

- Encourages trade and finance

- Uniform Commercial Code

- Protection of holder in due course

Only negotiable instruments are subject to Article 3 of the Uniform Commercial Code and the application of the holder in due course rule in the US, so whether a note payable is a negotiable instrument can have significant legal implications.

- Article 3 of the Uniform Commercial Code governs negotiable instruments, draughts (including checks), and notes that represent a promise to pay a sum of money and have independent value because they are negotiable.

- An instrument is negotiable if it can be transferred to another person while still being enforceable against the person who made the original promise to pay.

- The substance of Article 3 can be traced back to the Negotiable Instruments Law, which was first approved by the National Conference of Commissioners on Uniform State Laws in 1896.

This early uniform law was revised and incorporated into the first version of the UCC in 1951, and a subsequent revision was approved in 1990.

Finally, in 2002, a set of amendments to UCC Articles 3 and 4 were approved.

Types of Promissory Notes

The different types of promissory notes are:

- Simple Promissory Note: A simple note is a basic and straightforward note payable that outlines a promise to repay a specific amount by a certain date. Often used in personal finance and lending.

- Secured Note: A note backed by collateral, like real estate and personal property, which the lender can take possession of in case of a default. Mostly utilized when the lender needs additional security.

- Unsecured Note: Unlike the secured loan, where the lender can demand collateral in the event of default, here, the lender cannot demand collateral. Typically, these kinds of notes are utilized when the borrower has a strong credit history.

- Demand Note Payable: The lender under this note can demand the repayment of the note payable whenever he wants instead of a fixed maturity date.

- Fixed Term Note: A fixed term note specifically defines the term of the note, a fixed maturity date. Pretty common in real estate transactions, personal loans, or when the repayment date is necessary.

- Installment Note: The repayment of the note is distributed over a period of time, with interest. Used when the borrower is ready to pay the note in smaller amounts.

- Bank Promissory Note: Issued by a bank and utilized in many types of financial transactions, such as debt instruments or certificates of deposit.

- Commercial Paper: An unsecured, short-term promissory note that companies issue to raise funds temporarily. Usually utilized by big businesses to cover their immediate financial demands.

Pros and Cons of a Promissory Note

When an entity cannot get a loan from a traditional lender, such as a bank, a note can be helpful. But, such notes are much riskier.

As the lender lacks the financial institution's means and scale of resources. In the event of default, legal issues could arise for both the issuer and the payee. As a result, having notes payables notarized is important.

| Pros | Cons | |

|---|---|---|

| A Borrower |

When your credit rating is insufficient to obtain a commercial business loan from a bank or other lending institution, you may be able to borrow money using a note payable. |

You will almost certainly pay a higher interest rate than with a secured loan. |

|

You can give a note payable to friends or relatives who lend you money to provide some repayment assurance. |

You will most likely pay a higher interest rate if you use a note because you do not have a good credit rating than if you obtained a commercial business loan from a bank or other institution. |

|

|

As opposed to a secured promise note, you do not pledge your property as collateral. |

If you do not have funds available when an unsecured promise note lump sum payment is due, you may be in default. You will end up in court unless you can borrow money elsewhere to make the payment or negotiate an unsecured promise note modification with the noteholder. |

|

| A Noteholder |

A note payable may offer a higher interest rate and, thus, a higher return than keeping the money in a bank account. |

Unsecured notes are typically riskier than other types of investments. If the borrower does not pay, you must file a lawsuit to collect. It takes two steps to collect an unsecured note payable. To begin, you must obtain a court judgment. The judgment must then be enforced against the borrower's assets. However, if the borrower lacks sufficient assets to attach, your judgment may be rendered null and void. |

|

If you need money, you may be able to sell the note or borrow against it. |

It is more difficult to sell an unsecured note payable than it is to sell a secured note. Unsecured note payable buyers are more difficult to find and will demand a higher discount than secured note buyers. |

Promissory Notes as Financial Instruments

Among the different types of financial instruments, Promissory Notes are one of the most used instruments, given their negotiability and transferability. Note Payables are usually used by companies as commercial papers when they need financing for a short duration.

Most often, the vendors or service providers aren't paid upfront, in whole. Rather, they are paid by the organizations a bit later during the week or tax month.

This will help the firm manage their cash flows. If the organization is engaged in these activities regularly, that is, if the organization repeatedly provides the facility for deferred payments, there is a possibility that the organization owes more than it owns.

Doing this, the organization hampers the liquidity. Making it unable to honor its debt obligations. But, by books, the organization is still solvent.

However, in states where promissory notes are accepted, the business may request that one of its debtors accept a promissory note

In this case, the promissory note's maker signs a legally binding contract promising to honor the amount specified in the note (typically, all or part of the company's debt) within the predetermined time frame.

The promissory note can then be taken by the lender to a financial institution (usually a bank, though this could also be a private individual or another business) so that it can be exchanged for cash.

Typically, the promissory note is cashed in for the amount stated in it, less a small discount.

A Brief History of Promissory Notes

A debtor must repay a creditor on a schedule with a maturity date specified in written contractual terms, according to Hammurabi Law 100.

- Law 122 required a depositor of gold, silver, or another chattel/movable property for safekeeping to present all articles and a signed contract of bailment to a notary before depositing the articles with a banker.

- Law 123 required a banker to be relieved of any liability arising from a contract of bailment if the notary denied the contract's existence.

- Law 124 stated that a depositor with a notarized bailment contract was entitled to the full value of their deposit. Law 125 stated that a banker was liable for the replacement of stolen deposits while it was in their ownership.

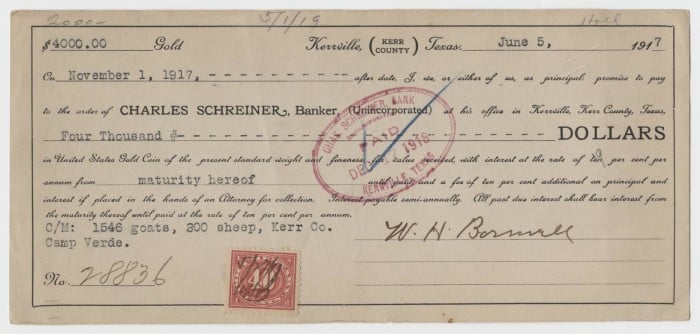

- Law 100 of the Code of Hammurabi stipulated that a loaner must repay a loan. Promissory Notes first appeared in China during the Han Dynasty in 118 BC and were made of leather.

Promise Notes may have been used by the Romans as a long-lasting, lightweight substance in 57 AD, as evidence of a promise was discovered among the Bloomberg tablets in London at the time.

Promise Notes have long been used as a form of privately issued currency. For example, during the Tang dynasty (618–907), flying cash, or Fei Qian, was a Note Payable.

Chinese tea merchants frequently used flying cash, which could be exchanged for hard currency in provincial capitals. Marco Polo introduced the Chinese concept of Note Payable to Europe.

According to legend, a Promise Note was signed in Milan in 1325. Small pieces of cloth were used as a means of trade. According to Ibrahim ibn Yaqub's travelog of a visit to Prague in 960, these clothes had a set exchange rate versus silver.

Before embarking, pilgrims left their valuables at a local Templar preceptory. They were given a document stating the amount of their deposit. Upon arrival in the Holy Land, they must retrieve their funds in an equal amount of treasure.

Adasse, a Jewish creditor in Gorlitz, Germany, owned notes payable for 71 marks around 1348. Note payables were also issued in 1384 between Genoa and Barcelona. Unfortunately, though, the letters themselves have been lost.

The same is true of the 100 florins issued by Bernat de Codinachs in Valencia in 1371. This was for Manuel d'Entença, a merchant from Huesca (then part of the Crown of Aragon).

Due to transportation issues, notes were used as a rudimentary system of paper money in all of these cases. In Medina del Campo (Spain), Ginaldo Giovanni Battista Strozzi issued an early form of notes against the city of Besançon in 1553.

However, there is evidence of notes being used in the Mediterranean trade before that date.

After years of development, the Korean Ministry of Justice and an alliance of financial institutions announced the launch of an electronic notes payable (eNote) service in 2005.

It allowed entities to make promises to pay (notes payable) in business transactions digitally rather than on paper for the first time.

The Electronic Signatures in Global and National Commerce Act (E-signature Bill) of 2000 and the Uniform Electronic Transactions Act made eNotes possible in the United States (UETA). An eNote must meet all the requirements to be considered a written promissory note.

Types of Promissory Note Repayment Options

The different types of promissory note repayment options are discussed below.

Installment Payments

Installment payments are commonly used to finance large purchases such as cars, boats, and appliances. Payments are usually made in equal monthly installments, including interest until the principal balance (the total amount borrowed) is paid off.

If borrowers can afford it, they can make a down payment on an installment loan to reduce the total amount of interest they pay.

Installment Payments With A Final Balloon Payment

Balloon payments are common in mortgage loans. Short-term borrowers prefer them because they have lower interest rates than long-term loans. A balloon payment is when a borrower agrees to pay a low-interest rate for a set period, such as five years.

They only repay a portion of the principal balance during that time. Then, if the borrower can afford it, they can either reset the loan (possibly at a higher interest rate) or pay off the massive remaining balance (the balloon) at the end of the term.

Due On Demand

Due on-demand notes are typically used for inter-family or inter-friend loans. These loans are sometimes called open-ended loans because there are no specific payment terms. Instead, borrowers can repay the loan when they're financially secure.

Lenders can rest assured that they will have a steady source of income if needed. If there are no payment terms on a note, it's considered due on a demand note.

Failure to state payment amounts and schedules can lead to misunderstandings, unmet expectations, strained relationships, and even legal action.

Due On A Specific Date

Borrowers and lenders can agree on a specific payback date (for smaller loans). Borrowers will not have to worry about monthly payments.

Lenders will know exactly when they will receive their payments. Instead, the borrower pays back the entire loan amount. This includes the principal and any interest on a set date.

Investing in Promissory Notes

Investing in the promissory notes can seem like a very interesting choice. The notes are a legitimate investment option, but the investor should be aware of the risks encompassing its uses.

Note payables are a form of debt that the companies use to raise finances for their operations. Apart from this, investors provide notes to companies to earn a fixed periodic income.

These notes can be secured or unsecured. They can be registered with the SEC to add credibility to the notes.

One of the primary risks involved with promissory notes is that the majority of the notes marketed to individual investors are a scam.

To minimize the risk, the parties should register the note with the SEC. Or, even consider notarizing the note so that its on the public record.

Advantages Of Investing In The Promissory Notes

- Fixed income

- Diversification

- Asset-backed Securities

- Potential for higher yields

- Private lending opportunities

- Customizable terms

Risks and Considerations

- Credit risk

- Lack of liquidity

- Market conditions

- Interest rate risk

- Legal and regulatory risk

- Collateral evaluation

- Due diligence

Promissory notes are an investment that should be made with great thought and research. To ensure compliance with applicable regulations and to limit risks, it is advisable to collaborate with legal and financial professionals.

Furthermore, it is advisable for investors to maintain a diverse portfolio and avoid devoting a substantial percentage of their capital to a single promissory note or private lending arrangement.

or Want to Sign up with your social account?