Operating Asset Turnover Ratio

The ratio helps determine how often current assets are turned over annually.

What Is Operating Asset Turnover Ratio?

The ratio measures the relationship between the company's revenues and assets. The ratio shows how effectively a business uses its operating assets to produce revenue. This evaluation metric falls under the total asset turnover ratio and is also known as the efficiency of the current assets turnover ratio.

Assets that are necessary for a business's daily operations are known as operating assets. In other words, operating assets are the resources that a corporation uses to generate regular revenue.

In this analysis, operating assets are the assets linked to the business's volume or daily operations that directly impact the income of the company's services or goods.

Below are some examples of some operating assets (relevant to the discussion):

- Cash

- Prepaid Expenses

- Accounts Receivable

- Inventory

- Land

- Plant, Property & Equipment (PP&E)

- Patents and licenses (if required for Business Operations)

To further distinguish the operating from the non-operating assets, we can determine the type of asset by analyzing its role in the business operation processes and deciphering them accordingly.

Below is a list of what is not relevant to calculating the current asset turnover ratio as they are not contributing to the generation of sales directly, therefore being fixed or non-operating:

- Loans receivable

- Marketable securities

- Restricted cash

- Short-term investments

- Interest income from fixed deposits

- Unallocated or underutilized cash

- Idle equipment

- Unused assets

- Vacant land

In the latter list, the components fit under the non-operating or fixed asset calculations.

The ratio helps determine how often current assets are turned over annually. In addition, this calculation helps evaluate the effectiveness of how a corporation uses its resources to generate revenue.

Key Takeaways

- The ratio helps assess the revenue generated by sales and the assets a company has to determine how efficiently businesses allocate resources to grow their income streams. Although less commonly used for evaluation, the metric deciphers current from fixed assets.

- Current assets include PP&E, inventory, cash and cash equivalents, and accounts receivable, among others. Other assets that are unused or do not directly contribute to sales, like loans receivable, marketable securities, idle equipment, or vacant land, are excluded.

- Remember that there is a difference between total asset turnover, which includes both operating and fixed, and current asset turnover when calculating the values.

- The current asset turnover ratio is used by individuals like investors, institutions like creditors, and departments like asset management. In asset management, some other ratios compare a company's sales or revenue with its assets.

- The other ratios measure the efficiency of the company's use of resources to generate revenue, including the fixed asset turnover, inventory turnover, and even the receivable and accounts payable turnover ratios.

- Other rates include capacity utilization rate, cash conversion cycle (operating cycle), days inventory outstanding (DIO), days payable due (DPO), days sales great (DSO), and defensive interval ratio (DIR).

Understanding operating asset turnover ratio

When using this ratio as a metric for analyzing a company's efficiency in production and effectiveness in strategizing its financial allocations, higher rates directly correlate to the more productive the company's assets are in generating revenue.

To find the necessary component values for calculation, we can do the following by using the company's financial statements:

- Find the value of assets of the company on the balance sheet at the start of the year.

- Find the value of assets of the company on the balance sheet at the end of the year.

- Find the sum of the beginning and ending values of assets from the previous steps.

- Divide the sum by two to find the average operating assets value throughout the year.

- Find the total sales or revenue on the income statement for that year.

- Divide the operational assets by the total sales to find the quotient.

Formula and Calculation Of Operating Asset Turnover Ratio

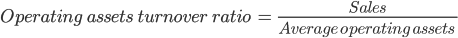

To find the ratio, expressed in percentage form, of a company, we can use the following equation:

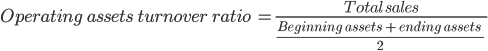

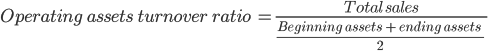

Here is a more specific version to calculate the average for the denominator, where beginning and ending assets are included in the equation:

In this case, total sales are the sum of annual sales, whereas the beginning assets signal the assets at the start of the year and the ending assets at the end of the year.

Is it better to have a high or low asset turnover? Since higher ratios resemble greater efficiency and the use of resources to maximize sales and revenue, having a high asset turnover is more desirable than a low one. C

onversely, investors and creditors may think there are managerial or corporate problems if the score is too low.

What is a good asset turnover value? The value varies significantly by industry depending on how big companies' asset bases are in proportion to the sales generated. Notably, some industries, like retail companies, have higher ratios due to smaller assets required to operate on their sales.

On the other hand, companies heavily reliant on assets or machinery like manufacturing, real estate, or even utilities have comparably lower values when compared to their sales.

Limitations Of Operating Asset Turnover Ratio

Since the value is evaluated on an annual basis, corporations and industries that are seasonally sensitive may be disadvantaged at the time of reporting the ratio. This value also does not capture the general trend of a company's performance.

For example, a business may have performed better in previous years but poorly in recent ones due to an external factor like the pandemic. Thus, investors and analysts should review the trend through a larger time frame before judging a company's outlook and overall efficiency.

There may also be stages in a company's growth or self-evaluation timeline that led to a surge in asset bases before the number of sales and generated revenue increased. For example, this may occur when a business believes it will have a more extensive customer base or traction.

Can businesses manipulate the ratio?

Whereas some companies may unintentionally weaken their turnover value due to anticipation of more growth, other businesses may intentionally inflate the ratio to provide a false sense of solid performance for investors and creditors.

An example is offloading assets while maintaining a somewhat steady but slowly declining revenue stream.

How to improve the ratio?

Since higher values mean greater efficiency, companies may want to increase their rates to demonstrate proficiency in creating a maintainable and effective strategy to address demand, limit excess or hindrance, and maintain a consumer base while preserving credibility.

If capable, companies may reduce spending on assets while preserving the same volume of production that does not disrupt revenue generation. For instance, companies may find and reinvest in a more efficient strategy to coordinate the supply chain or production line.

Other ways to raise a lower ratio include identifying and stocking or supplying more popular goods or services to stimulate and maintain demand. Another method is shifting operation hours to accommodate customers' work schedules or improving marketing campaigns.

Liquidating assets that are not used can help drive down the asset base and potentially be used for internal investments into a company's weaker departments. Inventory management enhancement is another way to deduct unnecessary space used for storage.

Companies also find ways to increase efficiency by implementing the just-in-time (JIT) inventory to align supply with production chains. In other words, the company tries to manage the stock so that supplies arrive around when production is necessary.

This practice limits excess and makes the assets more efficient in generating income. An example of such is in the automobile industry, where a company may bring stocks of wheels right before the manufacturing process for creating the cars begins to reduce asset spending.

Examples of companies using JIT

Some notable companies have been using this system to improve their efficiencies, including Toyota, Apple, and McDonald's, as the three case studies. However, please note that a lot of companies have been using JIT as well.

Toyota

As one of the first companies to use the JIT method dating back to the 1970s, Toyota minimized inventory spaces for raw materials until they received an order from a customer. Then, during the assembly line, there are limited to no spare parts, strictly following the model's needs.

Given the lack of unused assets and efficient material allocations at each production station, Toyota is capable and susceptible to customer demands, lowering the risks of overstocking an unneeded material that otherwise would have provided financial burden and inconvenience.

Apple began using the JIT system to create effective dropshipping and outsourcing strategies to reduce operating costs and prevent potential overstocking. The company only has one central warehouse in Elk Grove, California, and plenty of critical global suppliers and retail stores.

By using this management strategy, Apple could reduce storage and shipping costs, using the online platform to arrange purchases and deliveries.

McDonald's

Although not technologically or manufacturing-based like the former two corporations, McDonald's found ways to address the consistently high levels of customer demand while reducing costs. This includes making the food when the order is taken and not beforehand.

Furthermore, food is fresher when the meal is not pre-prepared, which increases customer satisfaction while limiting food waste.

Example of how to use the asset turnover ratio

Here is the established equation to find the value from earlier:

We can use the example of Company Z's financial statement information to calculate the ratio with the table that outlines all the necessary data needed for the formula:

| Type of Data | Company Z |

|---|---|

| Beginning operating assets | $190,000,000 |

| Ending operating assets | $211,000,000 |

| Average total operating assets | $200,500,000 |

| Revenue | $430,000,000 |

| Operating Asset Turnover Ratio | 2.1446x |

When calculating the average, we can divide the sum of the beginning and ending asset values by two. We can then use the revenue from sales and divide that by the average value to find the rate. Again, ensure that this calculation's assets are current and not fixed.

In this case, Company Z has a rate of 2.1446, meaning that for every dollar in assets, the company generates $2.1446 in revenue from sales.

Using the asset turnover ratio with DuPont analysis

The DuPont Analysis, developed by the DuPont Corporation, is a mechanism to find and assess the factors that determine the return on equity (ROE) for a company so that investors can use this information to make decisions based on financial performance and outlook.

Other metrics to find ROE include operating efficiency, asset use efficiency, and financial leverage. However, please remember that in this example, the DuPont Analysis considers all assets, including fixed ones.

Formula

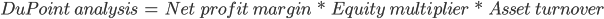

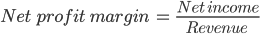

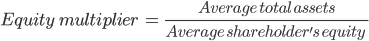

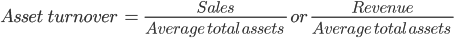

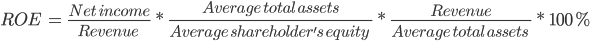

The DuPont calculation is based on finding the product of the three following components: net profit margin, equity multiplier or financial leverage, and asset turnover.

To find each part of the equation, we can use these quotients:

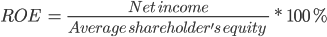

We can also rewrite the equation with the broken-down division formulas to set up an equation for ROE and multiply it by 100% to find the percentage value:

For simplicity, the ROE equation above cancels out revenue and average total assets, therefore rendering a result composed only of net income and average shareholder's equity. If we rewrite the equation, it would be as such:

Please note that although the abridged equation above could be a shortcut to calculating ROE, it could only be done if all the information is presented. The sole objective of the calculation is to find ROE and nothing else (e.g., profit margin as another reference source).

Example

Using the equation above, we can calculate the ROE for any company. In this case, we will use Company S as a case study:

| Year 1 | Year 2 | |

|---|---|---|

| Net Income | $2,000 | $2,300 |

| Revenue | $17,500 | $18,200 |

| Profit Margin | 0.1143 | 0.1264 |

| Revenue | $17,500 | $18,200 |

| Average Assets | $8,300 | $8,200 |

| Asset Turnover | 2.1084 | 2.2195 |

| Average Assets | $8,300 | $8,200 |

| Average Equity | $3,300 | $3,300 |

| Financial Leverage | 2.5151 | 2.4848 |

| ROE | 60.6114% | 69.7098% |

This means that Company X has a 60.6114% return on equity for year one and a 69.7098% return on equity for year 2.

Alternate Calculations

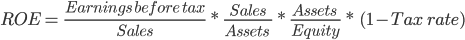

There is another version to calculate return on equity through a five-step verification process identified as follows that includes tax rate and earnings before tax:

Researched and authored by Max Guan I LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?