Revenue Run Rate

It is a technique used to predict annual income based on a brief period of financial data

What is Revenue Run Rate (RRR)?

The revenue run rate (RRR) is a technique used for predicting annual income by extrapolating and annualizing financial data over a short period of time, ranging from a week to a quarter.

RRR provides firms and investors a general estimate of how much money they may anticipate generating in a year, assuming that business is steady.

It simply takes a small period of earnings and extrapolates it out for the entire year. There are several ways to achieve this.

RRR = Earnings During Period * Number of Periods in a Year

Or

RRR = (Earnings During Period / Days in Period) * 365

Where,

- RRR = Run Rate of Revenue

- Earnings During Period = The amount of revenue that a company generated in a specific amount of time

- Number of Periods in a Year = The number of times the specified period happens in a single year

- Days in Period = The number of days within the given period

Regardless of the formula used, the result should be the same. The run rate of revenue finds how much money a company would make for the entire year if they consistently generate the same revenue.

Key Takeaways

- The run rate of revenue (RRR) is a technique used to predict annual income based on a brief period of financial data.

- RRR extrapolates and annualizes financial data over time intervals (e.g., a week, a quarter) to estimate the annual revenue.

- It is useful for forecasting future earnings, especially for young or rapidly growing companies with limited earnings history.

- It can also be used in situations such as a change in management or when a company wants to attract investors with little financial history.

- RRR has limitations and should not be the sole factor in predicting a company's performance.

- It assumes a constant rate of return, which may not be accurate for rapidly growing or fluctuating businesses.

- Market changes, seasonality, and one-time events can affect a company's earnings and make RRR unreliable.

- Revenue and run rate of revenue are different measures, with revenue representing actual net cash flow, while RRR estimates future earnings based on present financial data.

Revenue Run Rate Example

It is easy to understand it in practice. Imagine a rapidly growing company, and you’d like to use its most recent quarter’s revenue to forecast the year’s revenue.

Imagine this most recent quarter (91.25 days); the company has generated $1.6 million in revenue. We can calculate the RRR using the formulas mentioned above:

RRR = 1.6 million * 4 = 6.4 million

or

RRR = (1.6 million / 91.25) * 365 = 6.4 million

The second formula is best used in cases where a year is not easily divisible by the observed period.

Assume you wish to compute a company's run rate of revenue based on its present financial performance. The run rate of revenue estimates a company's yearly revenue based on current revenue over a shorter time.

To compute the revenue run rate, multiply the quarterly revenue by the appropriate factor to approximate the yearly revenue. In this case, the run rate of revenue would be:

Revenue run rate = $2 million * 4 = $8 million

Based on the company's success in the first quarter, it implies that it may produce $8 million in sales for the full year.

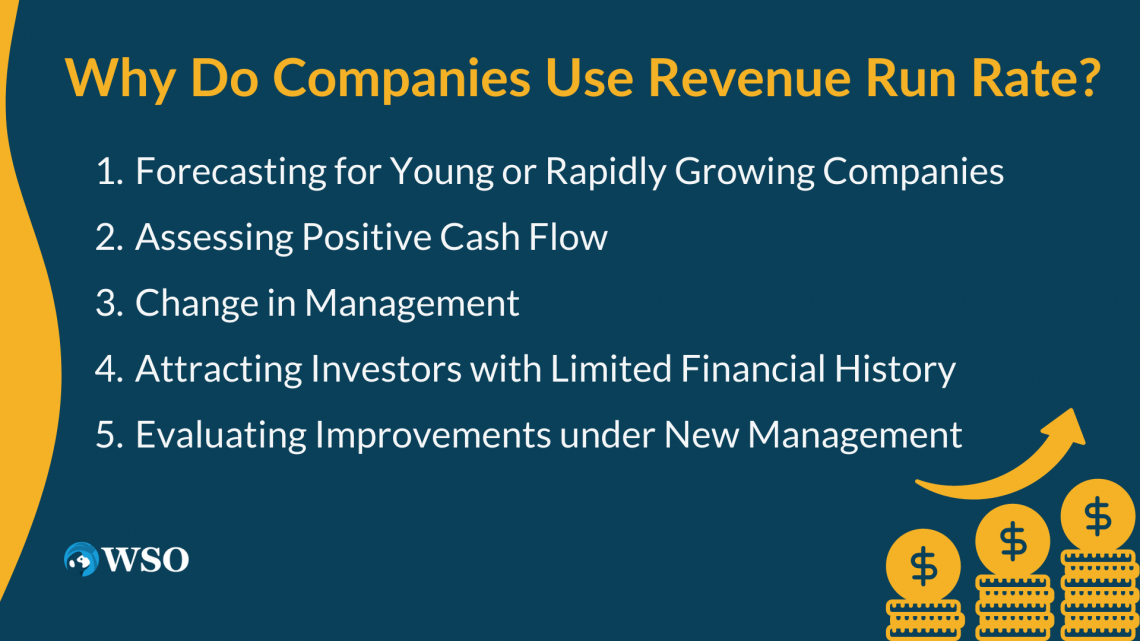

Why Do Companies Use Revenue Run Rate?

It is used to forecast future earnings for a company. This is typically used when forecasting earnings for a very young company with a small earnings history or growing rapidly.

It is utilized in various scenarios, serving multiple business purposes. Some common use cases include:

1. Forecasting for Young or Rapidly Growing Companies

It helps young or rapidly growing companies forecast their future revenue based on their current performance. By extrapolating revenue over a shorter time period, such as a quarter, they can estimate their annual revenue and set realistic targets.

2. Assessing Positive Cash Flow

It is valuable for assessing positive cash flow. It allows businesses to gauge their ability to generate consistent revenue and maintain healthy cash flow levels over time.

3. Change in Management

When a company changes management, the revenue run rate can be used to evaluate the impact of new leadership.

Note

By comparing revenue run rates before and after the management change, it becomes easier to assess the effectiveness of the new team in driving revenue growth.

4. Attracting Investors with Limited Financial History

Startups or companies with limited financial history often rely on this rate to attract investors. It provides a snapshot of their revenue potential and helps investors evaluate the business's growth prospects.

5. Evaluating Improvements under New Management

It is useful in assessing improvements made under new management. By comparing the revenue run rates before and after the change, businesses can determine if the new management has successfully enhanced revenue generation.

While it offers valuable insights, it's important to consider other factors, such as seasonality, market conditions, and overall financial health, to comprehensively evaluate a company's performance.

Limitations of Revenue Run Rate

Although useful for estimating a company's future cash flows, the revenue run rate is subject to certain limitations that should be considered. These include:

1. Assumption of Constant Rate of Return

It assumes a constant rate of return, projecting future revenue based on short-term performance. However, this assumption may not hold true in dynamic business environments, where revenue trends can fluctuate due to various factors.

2. Impact of Market Changes

It does not account for potential market changes that can significantly impact a company's revenue. Shifts in consumer behavior, competitive landscape, or economic conditions can influence revenue generation, making the revenue run rate less reliable in such situations.

3. Seasonality

It does not consider the seasonal variations that many businesses experience. Certain industries have peak seasons or specific periods of increased demand, while others may face slower periods.

Note

Ignoring seasonality can lead to inaccurate revenue projections.

4. Impact of Specific Events or Promotions

It does not capture the impact of specific events or promotions that may temporarily boost or dampen revenue. Significant marketing campaigns, product launches, or one-time events can distort the revenue run rate and affect its reliability for long-term forecasting.

5. Influence of One-Time Events

It may be affected by one-time events not representative of the company's ongoing operations. For example, a large contract or a major customer acquisition can significantly inflate the revenue run rate but may not be sustainable in the long run.

Note

To mitigate these limitations, it is essential to complement revenue run rate analysis with other forecasting methods, consider market dynamics and seasonal trends, and evaluate the impact of specific events or one-time occurrences.

By taking a comprehensive approach to financial forecasting, businesses can better understand their future revenue potential.

Revenue vs. Revenue Run Rate

Revenue and revenue run rate are two different measures. Revenue is the actual amount of net cash flow a company generates. This is the money a company has historically and currently been able to bring in.

On the other hand, the run rate of revenue is not a measure of the present. It uses the present financial data of a company over a smaller period of time to estimate what the company’s earnings will be for the entire year.

Although revenue and run rate of revenue are financial measurements used to evaluate a company's success, they reflect various ideas.

1. Revenue

The total amount of money a company makes via its commercial operations during a specific period is known as revenue, often known as sales or turnover.

Note

It is the top line of a company's income statement and contains all revenue from selling products or services, less discounts, refunds, or taxes.

2. Revenue Run Rate

Based on current revenue over a shorter time period, a revenue run rate forecasts the annual revenue of a corporation. It extrapolates the current sales trend to anticipate revenue for the full year.

According to this forecast, the company's current success will continue into the following year at the same pace.

Note

The run rate of revenue is frequently used to give an overview of a business's revenue potential or to project future results. It can be useful when a company has seen fast growth or transition, such as startups or rapidly shifting industries.

Understanding that the revenue run rate is merely an estimate and shouldn't be used to guarantee future performance is essential.

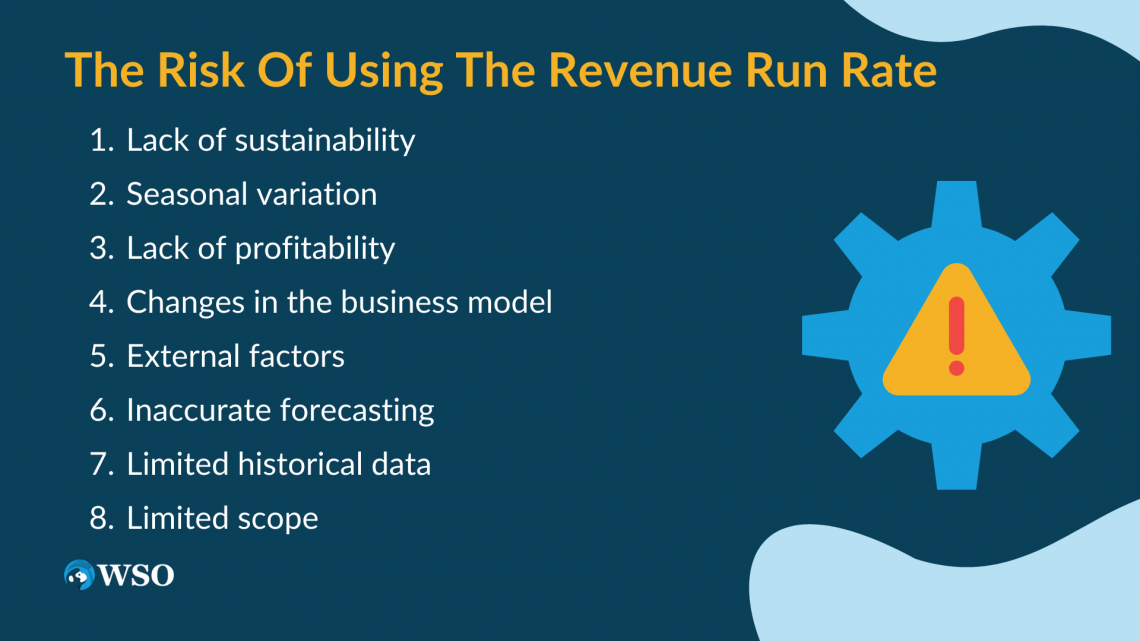

The Risk of Using the Revenue Run Rate

It is a financial metric that estimates a company's future revenue based on its current revenue. It is computed by projecting the company's current sales for a specified time (such as a quarter or a year) to anticipate yearly revenue.

While the revenue run rate can provide a quick snapshot of a company's revenue growth potential, it also comes with certain risks that should be considered:

1. Lack of sustainability

One of the risks in investment and financial planning is relying on the assumption of a constant rate of return. Failing to account for this variability can lead to inaccurate projections and unsustainable financial plans.

2. Seasonal variation

Many businesses experience seasonal fluctuations in their operations and revenues. This can pose a risk when making financial projections, as it may result in periods of higher or lower income than anticipated.

Note

Failing to consider these seasonal variations can lead to inaccurate forecasting and financial instability.

3. Lack of profitability

A significant risk in any business venture is the potential lack of profitability. Even with thorough planning and analysis, there is no guarantee that a business will generate sustainable profits.

Factors such as market competition, changing consumer preferences, or unexpected costs can affect profitability and potentially jeopardize financial plans.

4. Changes in the business model

Changes in the business model can introduce uncertainty and may impact the financial projections and expectations.

Note

Failure to account for these changes can lead to inaccurate financial planning and potential financial risks.

5. External factors

These factors are often beyond the control of individuals or organizations and can introduce unpredictability and risk into financial planning.

6. Inaccurate forecasting

Financial planning heavily relies on accurate forecasting of future events, including revenue projections, expense estimates, and market trends.

Note

Forecasting is inherently challenging and prone to errors and biases.

7. Limited historical data

Financial planning typically utilizes historical data to inform future projections and decision-making. However, in certain situations, limited historical data may be available, especially for new ventures or emerging industries.

8. Limited scope

Financial planning may have inherent limitations based on the scope of analysis and available information. For example, it may focus primarily on financial aspects while overlooking other critical factors such as operational risks, human resources, or technological advancements.

Failing to consider the broader scope of factors can lead to incomplete financial planning and potential vulnerabilities.

Note

Recognizing and addressing these risks and limitations is important when conducting financial planning and investment analysis.

Applying appropriate risk management strategies, incorporating flexibility in financial models, and regularly reviewing and adjusting plans can help mitigate these risks and enhance the effectiveness of financial planning.

Revenue Run Rate FAQs

Run Rate of Revenue is a method used to estimate a company's annual revenue based on its performance during a specific period, such as a quarter or a month.

It extrapolates the revenue generated in that period to project the company's revenue for an entire year, assuming the same performance is maintained.

Companies often use RRR to forecast future earnings, especially when they have a limited financial history or are experiencing rapid growth.

It helps provide a general estimate of potential revenue and can be useful for young companies, companies with recent management changes, or those seeking to attract investors.

It can be calculated using different formulas, but the basic approach involves taking the revenue generated during a specific period and extrapolating it for the entire year. One common formula is

RRR = Earnings During Period * Number of Periods in a Year

Another formula adjusts for the number of days in the observed period:

RRR = (Earnings During Period / Days in Period) * 365

Revenue run rate should be used with caution due to certain limitations. It assumes a constant rate of return, which may not hold true in a dynamic business environment. It may not account for seasonality or one-time events that can skew revenue figures.

Additionally, it focuses solely on revenue, overlooks expenses and profitability, and relies on a limited period of data, which may not capture long-term trends.

No, the Run rate of revenue should not be the sole predictor of a company's performance. It provides a rough estimate and is best used in conjunction with other forecasting methods and metrics.

Consideration should be given to historical data, industry trends, market conditions, and potential risks to obtain a more comprehensive analysis of a company's future performance.

The frequency of recalculating the run rate of revenue depends on the specific circumstances and needs of the company. Recalculating it quarterly or annually is common as new financial data becomes available.

However, significant changes in the business environment, such as market disruptions or shifts in strategy, may warrant more frequent recalculations to ensure accurate projections.

While it is often used for young or rapidly growing companies, it can also be used for mature companies in certain situations.

For example, if a mature company undergoes significant changes, such as entering a new market or launching a new product, using a revenue run rate can provide a snapshot of the potential impact on future revenue.

However, in mature companies with a stable operating history, other forecasting methods based on historical performance may be more reliable.

or Want to Sign up with your social account?