Sources of Funding

Act of acquiring resources of different nature

What are Sources of Funding?

Sources of Funding are the act of acquiring resources of different natures (money, talent, tools, time, effort, etc.) to fulfill a need in a program, project, or organization that has operations. This act can be done through internal or external sources.

Before the rise of start-ups and their era, funding was primarily done through personal networks and groups of mutual interests. This has changed with time as the need for heftier sums of funding began to soar, and the frequency of such requests in the financial sector has increased accordingly.

Funding can be provided in different forms. It can be through providing cash, knowledge, time, effort, and other resources, but in this article, we will cover the financial nature of funding.

Financial funding occurs when start-ups require and seek cash-based assistance to grow and launch their products and services to markets.

Funding is a crucial step for start-ups, businesses, and even big organizations that strive to scale and conquer more markets and acquire a wider customer base.

This financial act is done not only to launch businesses but also to grow them. We will cover more points on the styles of funding and their differences throughout this article.

Start-up Funding

Start-up funding is raising capital (Cash) to support a start-up or a company to grow or scale its operations and enhance its products or services.

Depending on the operations size or product/ service complexity, the management of the start-up will decide the type of funding they need.

The current trend of start-up funding is through external sources, which vary from seed funding rounds to initial public offerings (IPO).

Crowdfunding is also becoming a trend as it has fewer negative prints on start-ups and their founders.

Start-up funding will always change with time, and also it will adapt to the changes and needs of the financial markets and the nature of funding needed by the new businesses and their targeted markets.

Funding has allowed many start-ups and businesses to come to life. It is a great and valuable tool if utilized and understood properly. Through its different tiers and sources, this financial tool is designed to provide financial value to all types of businesses and start-ups.

What are the sources of funding, and how to get funded?

Funding sources vary between internal and external sources. Depending on your resources need, ability, readability, and size of operations, these sources will provide the needed funding accordingly.

We can categorize funding sources into three tiers:

-

Tier A (External sources)

- Corporate partners

-

Tier B (External sources)

- Debts

- Grants

- Angels

- Accelerators

- Crowdfunding

-

Tier C (Internal sources)

- Bootstrap

- Personal resources

- Family and friends

At the primary stages of your start-up, only you and your partners will know which sources of funding are needed.

How can I become funded?

Building a business or a start-up isn’t a simple job. Developing an idea is one part, and building the idea into a physical or usable form is another. Usually, start-ups go through stages such as:

-

Ideation

-

Business planning

-

Building prototype

-

Proof of concept phase

-

Launch

These steps may vary depending on the start-up and its intended product or services to be provided, yet some steps such as building your prototype are crucial for the success of your funding requests.

Now to answer the primary question: how can I fund my start-up? The experts and founders would tell you to build your idea, develop your prototype, develop a business plan, complete beta testing, and then approach an appropriate funding source.

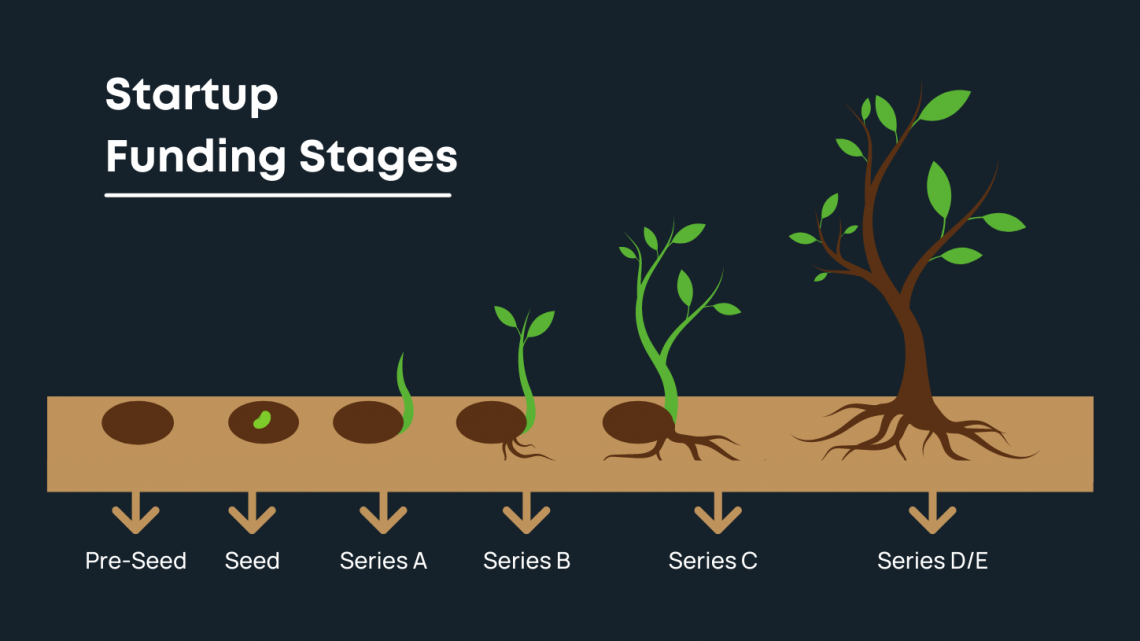

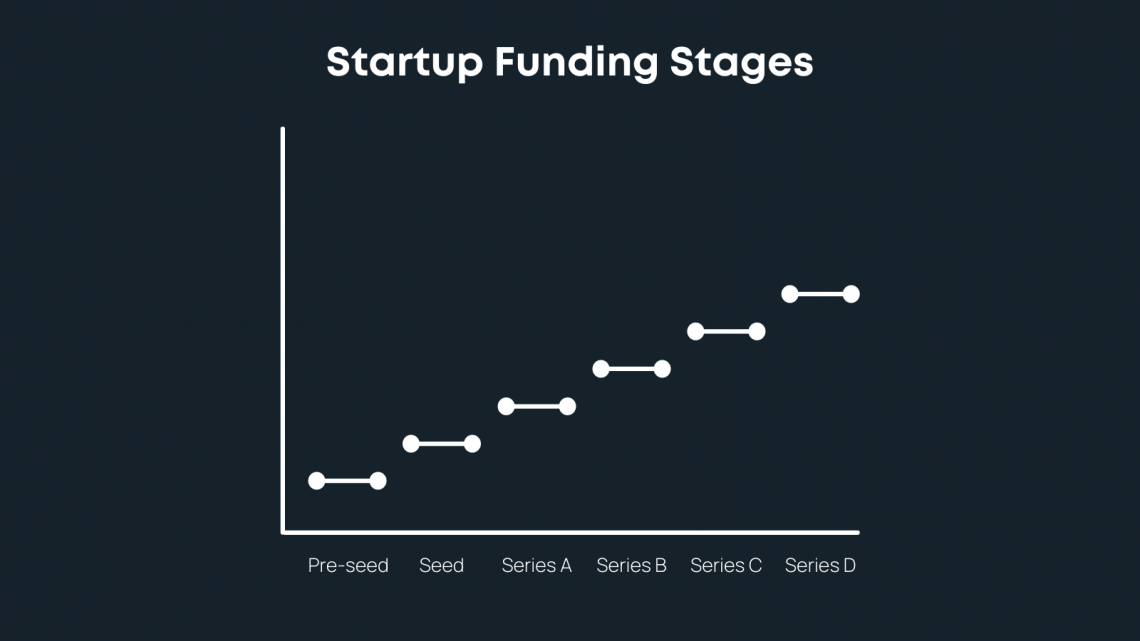

Start-up funding rounds

Whether you are creating a new start-up or running a mid-size to a large start-up, there are rounds of funding that will meet your financial or resource needs. These rounds are designed to meet the financial needs of start-ups and businesses based on their size and growth rate. There are five types of rounds:

-

Pre-seed

-

Seed

-

Series A

-

Series B

-

Series C

Pre-seed funding

This level of funding usually occurs at the early stages of a start-up formation. The sources could be internal meaning from family and friends, personal savings, etc. This type of funding could also be from external sources, but it will require a more well-structured start-up formation.

Usually, at this stage, the start-up is still at the ideation stage, and its level of operations is almost zero in terms of providing its product or services to the market. We could think of it as the first stage after the founders write down their idea on a piece of paper.

Something to understand about the pre-seed stage is that internal sources are usually better as founders can manage to save big portions of their shares of their start-ups, in contrast to external sources at this stage, which usually lead to founders giving up big portions of those ownership shares.

Seed funding

This is the first official financing stage, and it's crucial for the growth and flourishing of the start-up in terms of product development, market research, marketing to a target audience, and launching a product. This stage is usually tied to an equity exchange.

We can think about seed funding as a literal seed. This seed is planted, and with the right ecosystem, it will grow into a tree or maybe not.

Seed funding carries higher risks for the investors. Hence it's usually funded by angel investors as they are keener to take riskier endeavors.

Seed funding can come from either internal or external sources, and the amounts raised vary from $10,000 to $1,000,000, depending on the start-up nature and financial need.

On average, companies that go through a seed financing phase are valued between $3 million to $6 million. During the past two years, the median pre-valuation of start-ups at this stage was $6 million.

Series A

Once a start-up or a business utilizes its seed funding to develop a product, service, or customer base, it's usually time to acquire bigger pots of finances to help it grow its customer base and acquire more portions of the targeted market.

At this stage, investors from traditional private equity firms, like Sequoia Capital, Accel Partners, and many others find attention in those businesses or start-ups at this stage.

The reasons why these equity firms find interest in start-ups or businesses at this stage vary, but we could list the following:

-

Risk levels are lower than the initial risk

-

The founders and teams are more experienced now

-

The start-up has a real audience

-

Financial projections can be realistically evaluated

Capital raised during Series A rounds can vary between $2 million to $15 million, but due to the increasingly high valuations in the tech industry, high-growth companies have raised significantly more in this round.

Series B

At this stage, financing a start-up or a business would not be for the same elements mentioned in the above series. Rather it would be to solidify the already established customer bases or to boost sales, marketing, tech developments, or customer support.

We could say a company receiving series B funding would not still be in the initial start-up stage, but rather it's at a fully operational stage where it's thinking of scalability and growth rather than initial launching or market segmentation issues.

The acquired finances in this series are valued between $30-$60 million, and start-ups usually raise an average of $33 million. Start-ups with an attractive business plan and performance tend to attract the same interested investment firms from series A and much larger private equity firms.

For series B funding, investors usually prefer the option of receiving convertible preferred stocks rather than common stocks. This is due to the fact that preferred stocks have an anti-dilution feature if the company undertakes another series or a round of funding.

Series B is usually provided by private equity investors, venture capitalists, crowdfunding equity, or credit investments.

In addition, investors at this stage pay higher prices for shares, and this can be a good indicator of the fact that the company is performing well, and investors are willing to pay these higher prices to still try and be part of this successful company.

Series C

This series is mainly to help a business or a start-up create new products, expand into new markets, hire talents, and other purposes related to major expansion and scalability. At this stage, it's easy for start-ups to secure this finance series as it's less risky.

We could conclude that businesses at this stage are no longer start-ups or start-ups in their initial phases but rather well-established business that generates high levels of revenues and cash flows.

Firms like private equity firms, hedge funds, secondary market groups, or investment banks that want to acquire shares in striving and successful firms are likely to participate in this stage.

At this stage, start-ups are usually valued at $118 million and beyond, and they try to enhance their performance as much as they can before an IPO.

angels vs. venture capitalists

We can explain both of these groups through simple terms by saying that angel investors are those who invest their own money into business endeavors, and start-ups and venture capitalists usually are risk capital managers who invest in others' capital.

Deciding whether to seek an investment from an angel or a venture capitalist solely depends on your financial needs and the expected style of this long-term partner who will be assisting and also monitoring your performance.

There are multiple differences between angel investors and venture capitalists. Some of them are major, and others are noticed based on personal experiences. The major differences can be:

1- Angel investors operate individually, while venture capitalists operate through firms and a specific hierarchy

2- Angel investors usually invest smaller amounts than venture capitalists as the risk is strictly shared between the start-up and the investor.

3- Angel investors may also play the role of mentors to founders, whereas venture capitalists seek strong and well-established teams and start-ups.

4- Due diligence for angel investors can sometimes be overlooked as they analyze the risk on their own, and they are more inclined towards riskier starts.

On the other hand, venture capitalists tend to do thorough due diligence to analyze the risk to the nearest point possible and also to analyze the performance level of the teams running the start-up.

5- Angel investors can be less hostile than venture capitalists in terms of acquiring more shares in successful start-ups. In addition, venture capitalists usually influence the way a start-up operates, while angel investors tend to be more flexible.

Conclusion

Starting your own business or start-up can be tricky, as it requires knowledge, patience, and a healthy leadership style. As tricky as it could be, it's also a fun journey to take as it will allow you to put your touch on the world through a product or a service.

When you are at the ideation stage of your start-up, it's always good to think about the reason why you are trying to start your own start-up, whether it's for personal reasons or because you have a pain that could be resolved through a product or services and there is a market or a niche market for it.

The people or the partners who will join you at your early stage, think of them as individuals who are here to provide value more than simply joining forces with them because they are your friends or family.

Once you have a clear understanding of what you want to deliver to the market, start building its elements and features in a way that makes it easy for you to build your prototype. It would also be great to conduct simple market research about the need for your product or services in the market you are targeting.

As you have your prototype and initial numbers that you can build your financial projections or give you a glimpse of the market size you are targeting, start developing your business plan and case.

Once you are ready with your prototype and business plan, start looking for investors or funding. Understand the exact need for the funds, where you will allocate them, and their size. When you have these basic clarifications, it will be easier to choose your funding phase and type (angel vs. venture capitalist).

It would be best if you always remembered that your first investors would make you or break you, as they will directly or indirectly influence your decisions and make you more excited to grow your start-up or make you feel like you want to exit this activity.

A mistake that most entrepreneurs make is that the first thing they think they need is funding before they clearly understand their product or service or even before understanding their targeted market, audience, readiness, capabilities, and, most importantly, realizing their level of commitment.

The beauty of today’s world is that you can have access to all sorts of learning tools and knowledge with just a click, read more before you conduct your equity split between you and your partners, and understand more before you approach investors.

Experience and knowledge are two of the main factors that will contribute to the success of your start-up. Wall Street Oasis happens to be one of the best knowledge providers through its online courses. This course recommended will allow you to have a good fundamental understanding of funding and its sources.

Written by Ahmed Fagiry | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?