Ansoff Matrix

It is a matrix that helps marketing leaders identify business growth opportunities for their marketing strategies .

What is the Ansoff Matrix?

The Ansoff Matrix is used when considering the relationship between Marketing strategies and a company's general business strategy. It is also known as the Market Expansion grid.

In other words, this is a strategic planning tool paving the way and Framework for the company's future growth for senior management and leadership.

Also known as the Product/Market Expansion grid, it's generally used with other management tools like the BCG matrix and Porter's five forces to analyze the problem.

It helps various stakeholders of the concerned situation assess risks associated with the various growth strategies.

Origin and Paper by Igor Ansoff

The Ansoff Matrix was developed in 1957 by Igor Ansoff, also known as one of the fathers of strategic management as an applied mathematician and business manager.

He published it in the Harvard Business article review of 1957, featuring a monumental shift from marketing strategies like Blue Ocean Strategy to Ansoff Matrix.

Ansoff defined it in the paper as "a joint statement of a product line and the corresponding set of missions the products are designed to fulfill."

To formulate more accurate reports on drivers of business growth, Analysts use this matrix with other industry and business tools such as PESTEL, SWOT, and many others.

Mentioning the underlying concepts as basics, Ansoff wanted analysts and readers to interpret them as originally intended.

Termed as one of the best marketing models, it focuses on the growth of business models through various prescribed alternatives, where each alternative possesses multiple risk levels.

Understanding Ansoff Matrix

In the 1957 Harvard Business Review article "Strategies for Diversification," the Ansoff Matrix hypothesis made its debut. H. Igor Ansoff, a Russian-American business manager and applied mathematician, created the matrix.

The matrix serves as the foundation for formulating marketing and commercial strategies centered on both new and current goods and services as well as markets.

Since its inception, the idea has aided companies in recognizing prospects for expansion and evaluating the risks involved with such growth.

They can therefore create backup plans with potential long-term problems in mind. Additionally, by combining future and current products, businesses can create novel approaches like product creation, market expansion, diversification, and market penetration—all of which are combined to form the Ansoff Growth Matrix.

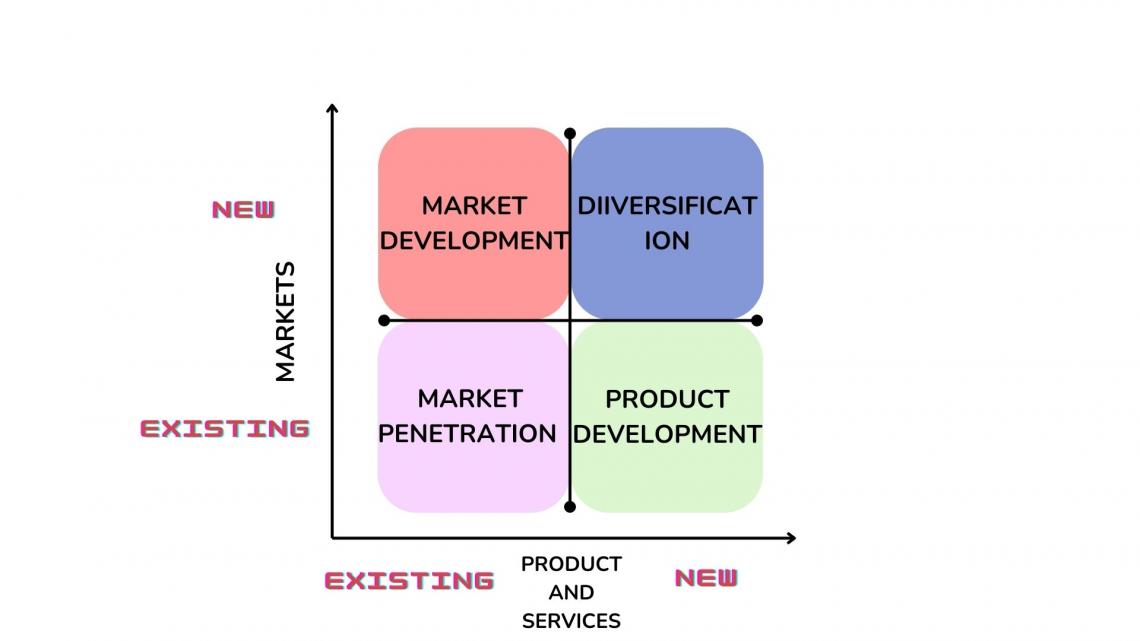

Globally, business schools instruct students on the Ansoff Matrix as a foundational paradigm. It is an easy-to-use method for visualizing the levers a management team might pull to explore potential areas for growth. Markets are shown on the Y-axis, while Products are shown on the X-axis.

Division of Ansoff Matrix and Components in Quadrants

The matrix is divided into four quadrants. Each holds a strategy that can be used by the organization to grow in the foreseeable future.

Strategies along the axes of the matrix also showcase mounting risk.

Featuring products on the X-axis and Markets on the Y-axis, term markets can be subjective as per the question in the situation. For example, it can be geographical territories of a country or continent or specific customer segments and target audiences.

Four different approaches to execution:

a) Market Penetration

A business growth strategy with the least risk involved as it aims at increasing the sales of existing products to the present customer base of the business.

Increasing sales to the existing market can be achieved by increasing stores' opening hours, providing discounts on existing products, reducing order processing time, etc.

This strategy is generally used to achieve a larger customer base in the existing market or sell more products to existing customers.

Some more ways through which businesses can achieve market penetration are:

- Acquiring competitors in that market

- Realigning the supply chain

- Increasing expenditure on marketing and promotional activities.

For example, imagine a company focusing on both rural and urban markets. But now, management has decided to penetrate urban markets and get the upper hand.

They decided to shift supply chains fully to urban markets as it can be analyzed that these markets were running out of stocks and closing inventory piling up in rural markets.

b) Market Development:

The market development strategy is considered the 2nd least risky strategy and lies in the second quadrant of the matrix. It focuses on entering new markets and businesses.

This strategy is considered less risky than the one mentioned above because there is no investment in R&D or product development. Meanwhile, it allows management to push their existing products into untapped business markets.

With this strategy adopted, a business may:

- Enter into new foreign markets

- Expand into domestic markets

- Differentiate customers into segments.

For example, a domestic firm of a country is looking to expand its existing product line to the international market.

The rewards of adopting this are pretty much higher if management can enter new markets with a Unique Selling Proposition and increase output without negatively affecting the firm's finances.

c) Product Development Strategy:

Climbing the risk ladder, this strategy aims at providing new offerings to the existing customer base. Management may think of playing on the brand value through loyal customers.

By adopting various alternatives available to achieve this strategy, an organization will be providing customers with an expanded product line to choose from, and it can be done through:

- Buying manufacturing rights for a new product developed by another firm

- Investing in the company's R&D to innovate and produce products.

For example, X Ltd analyzes that the spare part manufacturing market is dominated by A Ltd. There is so much room available if it invests in innovative R&D and rolls out better products.

d) Diversification:

This strategy with the highest risk focuses on completely changing the present product line and structure into new markets.

The reason for it being considered the riskiest is that you are entering a new product line altogether into a new market structure with no prior experience in it.

There are two types of diversification:

- Related Diversification: Generally, when the new line of business products relates to the old businesses of the firm, even a little bit is known as related diversification.

For example, North America's single largest whiskey producer decided to venture into the wine segment.

In this case, the industry is the same, i.e., alcoholic products, so management knows about the general business strategy in the liquor industry. However, the manufacturing process and investment in R&D will be needed.

- Unrelated Diversification: When the new offerings are outside the business's capabilities and old product line, it is known as Unrelated Diversification.

For example: when a stationery producer decides to venture into the cloth manufacturing business—shifting from one industry to another and having no prior experience in the product line.

Advantages And Disadvantages of Ansoff Matrix

It first appeared in the Harvard article review of 1957. The Ansoff matrix is based on a two-dimensional matrix. The Ansoff matrix is a simple tool that can be used to lay out the future growth of the organization.

To achieve Business growth, One line of axes is for the old existing product lines of the business, and on the other lies the new diversified business segments of the firm.

The four quadrants have four different strategies for management teams to achieve their business growth goals. Now it is subjective to the business firm and its management regarding which strategy will be adopted.

After evaluating your options and analyzing the firm's risk appetite and fund availability, it is chosen.

- Advantages

a) Ensuring all four growth strategies are considered.

b) Evaluation of options based on risk appetite.

c) Easy to understand.

- Disadvantages

a) Excludes performances of competitors from the same industry.

b) It doesn't provide the Framework to value risk-reward.

Conclusion

This Framework is not only good but also comes with a bit of criticism, as one can argue that the Framework lacks basic structures wherein competitors' moves and the dynamic nature of the business sector/industry are accounted for.

Also, some analysts question the logical sense of the matrix as the components on the quadrants don't always equate, creating chaos.

Providing management with four alternatives to achieve growth objectives, the Ansoff matrix is a simple tool that can be used to lay out the organization's future growth. Diversification is the best risk-return option for identifying various growth options.

As the danger scale rises, this approach seeks to provide new products to the current clientele. Management could consider leveraging brand value through devoted consumers.

It is regarded as one of the greatest marketing models since it focuses on developing business models through various prescribed choices, each of which carries a different amount of risk.

or Want to Sign up with your social account?