Bargaining Power of Buyers

The pressure that consumers can apply to businesses to get them to provide higher quality products, and better customer service at lower or competitive prices.

What Is The Bargaining Power Of Buyers?

A buyer is a person who purchases and pays for the products and services offered by a company. A firm’s profits are directly proportional to consumer behavior.

Buyers often demand high-quality products at low prices. Lowering prices may affect revenues, while improving quality could inflate production costs.

The power of buyers determines how a company sets the prices of its products or services. Knowing the bargaining power of customers creates a strong competitive advantage for an organization.

The bargaining power of buyers refers to the pressure that customers/consumers can apply to businesses/companies to get them to provide higher quality products and better customer service at lower or competitive prices.

The analysis of the buyer’s power of bargaining is conducted from the seller's or the company’s perspective.

For instance, consider the airline industry. Various websites are available in the industry, such as Booking, TripAdvisor, and Agoda, which offer competing prices to travelers. Buyers can have more bargaining power since the switching cost is minimal.

Customers can easily check & compare the prices of different airlines and book a flight through the website, offering a higher discount percentage with more amenities.

Key Takeaways

- The bargaining power of buyers refers to the influence customers have in negotiating prices, quality, and terms with suppliers or companies.

- Factors that affect the bargaining power of buyers include buyer concentration, percentage of sales contributed by buyers, availability of substitutes, switching costs, backward integration, access to information, price sensitivity, and product differentiation.

- Strong bargaining power of buyers can lead to lower prices, better quality, and more favorable terms for customers, while weak bargaining power gives suppliers more control over pricing and terms.

- Analyzing the bargaining power of buyers is essential for understanding industry competitiveness, profitability potential, and making strategic decisions.

- To mitigate the strong bargaining power of buyers, suppliers can differentiate their products or services, create switching costs, leverage social costs, offer attractive pricing and incentives, customize the customer experience, and provide appealing upgrades.

Determining Factors: Bargaining Power of Buyers

Buyer power is the pressure that buyers create on the suppliers or companies to lower the prices or improve the quality of products or services they offer. But when we talk about buyers, they are not always the end users of the product or services being offered!

End users are the buyers who consume the products or services businesses offer. For instance, a pet owner purchases food for their dog. In such a case, the pet owner is the buyer, while the dog is the end user.

Buyer power is affected by the following industry-specific determinants:

1. Buyer concentration

It refers to the number of customers who buy goods and services from a producer. If the buyer population is low compared to the number of sellers or businesses, then buyers will have more power.

They can pressure businesses to reduce prices or improve the quality of the products or services offered. While on the other hand, a densely populated client base reduces buyer power.

2. Percentage of Sales

It is related to the percentage of a customer in the company's annual revenue. For instance - A buyer who frequently purchases in bulk quantities will have more power than one who contributes to a small percentage of the company’s revenue.

3. Undifferentiated products

If more sellers in the market offer the same or similar products, then buyers will have low brand loyalty. They will look for the best deal in the market & will easily switch to the sellers offering higher discounts.

4. Switching Costs

The costs of switching from one provider to another are referred to as switching costs. It includes various financial or relational costs. The buyer has to overcome a series of obstacles in the process of switching to a new provider.

Thus, high switching costs can reduce buyer power.

5. Backward Integration

When a buyer begins manufacturing a product or service in-house, he or she no longer needs to purchase it from a provider.

It also refers to when an organization merges with a vendor or supplier supplying raw materials, which implies a significant cost reduction. This is referred to as a threat of backward integration.

6. Access to Information

Their access to information also influences buyers' power to bargain. For example, customers who know too much about a product's features and production costs may request reduced prices.

7. Price Sensitivity

Price sensitivity influences buyer price sentiment. Price changes may cause sensitive buyers to switch providers offering competitive prices. In such a case, sellers can keep the customers by providing better quality products at better prices.

8. Substitutes

Substitutes are the market alternatives that serve the same purpose. For example, coffee is a substitute for tea. Customers with a wide range of product options outnumber businesses selling them & so they have more power.

Strong Bargaining Power of Buyers

Buyers have the power to influence the price or quality of a product or service. Consider, for instance, booking a hotel for vacation.

The buyer usually enters the check-in & check-out date, accommodation type, nearby locality, distance from public transport, other amenities, etc. & looks for the best deal in the market.

Moreover, you are not obliged to use a particular website or seller; you can try out a new one every time you plan your vacation & thus, no switching costs are involved.

There are a lot of substitutes available in every sphere of service.

For instance - Agoda, MakeMyTrip, Trivago, TripAdvisor, etc., are some of the available substitutes in the hospitality industry. Customers are primarily concerned with the price of the product rather than the brand offering the product or service.

Also, the products offered by different brands are almost identical, giving consumers high bargaining power, so the sellers need to retain their customers.

A buyer has strong bargaining power if:

- Buyers are relatively fewer than sellers

- Switching costs are low

- Backward integration is attainable

- Availability of substitutes

- Buyers are very price sensitive

- Products are not differentiated

- Buyers get the product in bulk

Weak Bargaining Power of Buyers

Buyer possesses weak power to bargain where there aren’t many alternatives available in the market, products offered by different sellers are differentiated, and higher switching costs are involved in shifting to a new vendor or when a higher number of sellers are involved.

For example, a customer wants to buy a product from a few market sellers.

Moreover, he wants the supplier to offer a discount. Still, the supplier has a fixed price for that product or service and is unwilling to offer any kind of discount or cashback on purchasing that product or service.

In such a competitive environment with limited availability of substitutes, the supplier is always ready to sell the products at a fixed price and only gives discounts in the event of a technical emergency. In such a case, the customer should understand how much the product is worth.

The customers must keep in mind that the high costs of switching to other products & products offered by distinct sellers are differentiated in nature, giving the customers weak bargaining power.

A buyer has weak bargaining power if:

- Buyers are more than sellers

- Switching costs are high

- Backward integration is unattainable

- No substitutes are available

- Products are differentiated

Purpose of Buyer Power Industry Analysis

Analysis of buyer’s power becomes important in understanding the degree of competition, profit potential, identifying the opportunities and threats, and the decision-making process.

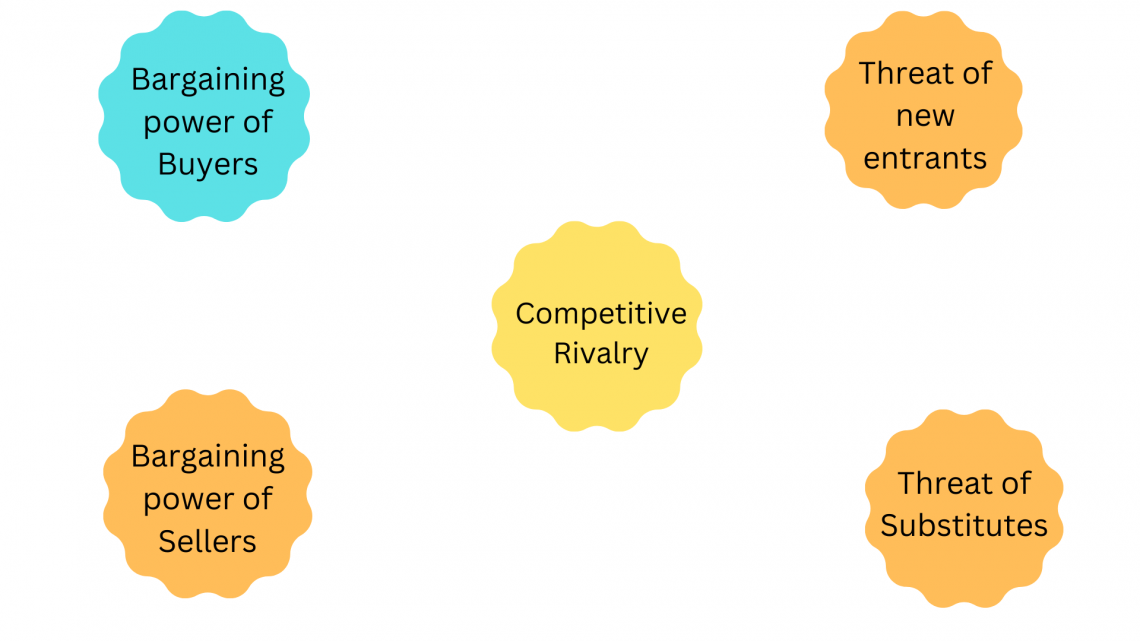

Along with the buyer’s power of bargaining, the other forces of Porter’s Five Forces Analysis, which include the supplier bargaining power, threat of new entrants, rivalry among existing competitors, and threat of substitute products or services, also provide an external analysis of an industry.

The buyer’s power to bargain is important in determining the threats & opportunities of an industry, profitability potential, decision making & the degree of competition.

1. Threats & Opportunities

These are external things that are going outside the company. Opportunities are the chances to take advantage of positive occurrences in the market.

Threats are the chances of negative occurrences that can cause damage to an organization: examples - competitors, prices of raw materials, and customer shopping trends.

2. Profitability

The presence of powerful buyers in the market reduces the profit potential. More buyers can increase the competition by forcing down prices and bargaining for improved quality, which diminishes the industry's profitability.

3. Decision Making

Buyer power of bargaining may dissuade new entrants into the industry and help existing firms to make decisions to improve the profitability of their business.

4. Degree of competition

Competitors are firms that produce similar products or services in an industry. In case of intense competition, a firm gives a variety of marketing strategies such as advertising, new offering, and price cuts to its customers.

For instance - Subway faces fierce competition from McDonald’s in the food industry.

Importance of Buyer Bargaining Power

Buyers can get preferable pricing for quality products/services, influence how a supplier produces goods, and customize how it delivers services.

This can help cultivate buyer-supplier relationships so consumers’ demands can be met, which boosts a company's productivity and improves its public image.

In comparison, understanding the buyer’s bargaining power can help organizations adapt to customer needs by providing competitive products at reasonable prices and achieving their profit objectives.

Whether a person is a wholesaler, retailer, or business seeking to understand its customers, assessing buyer power helps make the right decisions for the organization. Buyer power is important as:

- Prices should be negotiated with confidence.

- Customize products and services as per the needs.

- Suppliers can save money by providing competitive products.

- Increase the pressure on businesses to meet buyers’ expectations.

- As a result, businesses can predict long-term profitability.

- Retaining customers in the long run.

Analyzing buyer power is vital in an external analysis of an industry because it provides insight into the firm's profitability, meeting customers’ needs & expectations, winning against the competitors & becoming the market leader by investigating financial opportunities & threats.

Mitigating the strong bargaining power of the buyer

Here are some ways to mitigate a strong buyer’s power of bargaining:

1. Differentiated Products

A good product attracts as well as retains customers. When all the sellers in the market are offering similar products or services, product differentiation becomes important for customer retention. Differentiation can be done by including new features, performance, durability, or warranty.

2. Switching Costs

Sellers should focus on creating an environment that makes customers more reliant on their products or services. Switching to a different vendor may cost them.

For instance, manufacturers of health monitor bands usually build a companion website to store users’ historical health data in the cloud,, making it difficult for the buyer to switch to another vendor.

3. Social Costs

Promoting your products among influential people in the consumers’ social circles, getting key endorsements when appropriate.

4. Offers, complimentary services, and effective pricing strategies

Sellers can retain their customers by offering products at a lower price, discounts for long-term membership or freebies, price skimming, value-based and competitive pricing, free product upgrades, or after-sales services.

These are some methods through which sellers can trap customers into their business.

5. Customizing the customers’ experience

Personalizing the customers' product interactions and engaging with them is important for customer retention. If you’re offering a more personalized product, it is difficult for the buyer to switch to a competitor vendor.

For instance - Nike’s 3D sneaker customization platform allows customers to build custom-designed shoes that are made to fit their feet and style perfectly. In addition, they provide unique product recommendations making it easier for the customers to create their sneakers.

6. Offering appealing upgrades

Sellers may offer attractive upgrades to their customers for renewal at the end of the agreement. For instance - consider electronics such as mobile phones, laptops, or iPad, where sellers offer upgrades to the latest version every two years.

It is critical to understand and assess buyers' power of bargaining. A customer can bargain on various aspects of a product or service, such as technical, functional, economic, or monetary.

Whether buyers use their bargaining power or sellers and buyers share good relationships, businesses or sellers must identify and mitigate such power by using the above methods.

Bargaining Buyer Power in the Airline Industry

Consider the following determinants to know the bargaining power of the buyers:

1. More Buyers than Sellers

Initially, there were a few airline operators, such as Jet Airways, Pan Am, and Air India. As a result, there were more buyers than suppliers.

Therefore, buyers can’t put much pressure on the sellers. As a result, buyer power was low, unlikely today, with many options available.

2. Reliance on a particular vendor

The retention of customers plays an important role. A differentiated product or facility helps in retaining customers. For example, some airlines provide comfortable seats and food services while others provide a lower price; services vary between airlines (differentiated service). Therefore, the buyer has moderate power.

3. Costs of Switching

Several airlines are providing competitive prices & services to the customers. Thus, it would be difficult for the customers to switch to a different operator since the cost of switching would be less. Therefore, buyer power is medium/high.

4. Backward Integration

It is difficult for the buyers to backward integrate with the airline industry. Therefore, buyer power is low.

Buyer power in the airline industry is medium, keeping in mind the factors above. As a result, the profit potential in the airline industry is not particularly on the higher side. But buyer bargaining power alone does not determine an industry's overall profitability or attractiveness.

The other four factors of Porter’s Forces - the threat of new entrants, rivalry among existing competitors, supplier’s power of bargaining, and the threat of substitute products or services must also be considered.

Summary

Understanding and analyzing the power of buyers is a critical component in analyzing every industry. In addition, a thorough examination of the factors determining the power of buyers is important since it is very dynamic.

Moreover, other forces of Porter’s five forces model should also be considered. These include industry competition, the threat of new entrants, the supplier's power of bargaining, and the threat of substitutes.

It will help the businesses to consider the purchase of assets, development of customized products, innovation or upgradation in the existing products or services, adoption of marketing strategies, etc.

It helps explain long-term industry performance or profitability, growth opportunities or threats, competition, pricing shifts, incentives for product differentiation, and healthy customer relationships.

As we have already seen, the airline industry is highly competitive, and suppliers and customers have significant bargaining power. But, at the same time, the other two factors of Porter’s Forces - the threat of new entrants and substitute products is low.

Researched and authored by Purva Arora | LinkedIn

Reviewed and edited by Raghav Dharmarajan

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?