Employee Buyout (EBO)

A strategy in which employees purchase a controlling interest in their organization from the existing owners

What is an Employee Buyout (EBO)?

An employee buyout (EBO) is a strategy in which employees purchase a controlling interest in their organization from the existing owners.

A buyout is when an entity acquires another company. It happens when the purchasing group could buy the other company instantly or acquire a major stake of 51% or more of the company’s voting shares.

‘Employee takeover’ and ‘Employee buyout’ can be used interchangeably. An EBO's main goal is to give employees a stronger sense of ownership and control. Also, it promotes job security and safeguards the company's survival.

A buyout could occur with the cooperation of the company or by force. For example, employee dissatisfaction with the management or a struggling business can be the reason for a buyout.

EBOs are usually initiated by employees who are seeking to gain control over the company they work for. Also, to claim potential monetary benefits that come with ownership.

EBOs are appealing to employees of privately held companies or small businesses, where ownership is often concentrated among a small group of individuals.

EBOs are more commonly associated with small businesses rather than large companies. Small businesses often have a closer relationship with their employees and may be more willing to sell ownership to their staff members.

Moreover, small businesses may have fewer financing options, making an EBO a more viable choice.

Employee buyouts have become a popular strategy for employee ownership and involvement since the middle of the 20th century.

One of the early instances of the EBO strategy was when the employees of Peninsula Plywood in California bought the business from its owners in 1952. The employees were able to manage the business successfully for over 40 years and are often cited as a successful case study for the employee buyout strategy.

While the specific forms and intentions for EBOs have changed over time. Giving employees a stake in their companies and guiding their operations remains a powerful and enduring idea.

Key Takeaways

- An employee buyout is a strategy in which employees purchase a controlling interest in their organization from the existing owners.

- The main aim of an EBO is to provide employees with a stronger sense of ownership and control, promote job security, and safeguard the company's survival.

- EBOs are more commonly related to small businesses than large companies because small businesses often have a closer relationship with their employees and may be more willing to sell ownership to their staff members.

- A business may consider an EBO under various circumstances, including succession planning, financial difficulties, acquisition, and values alignment.

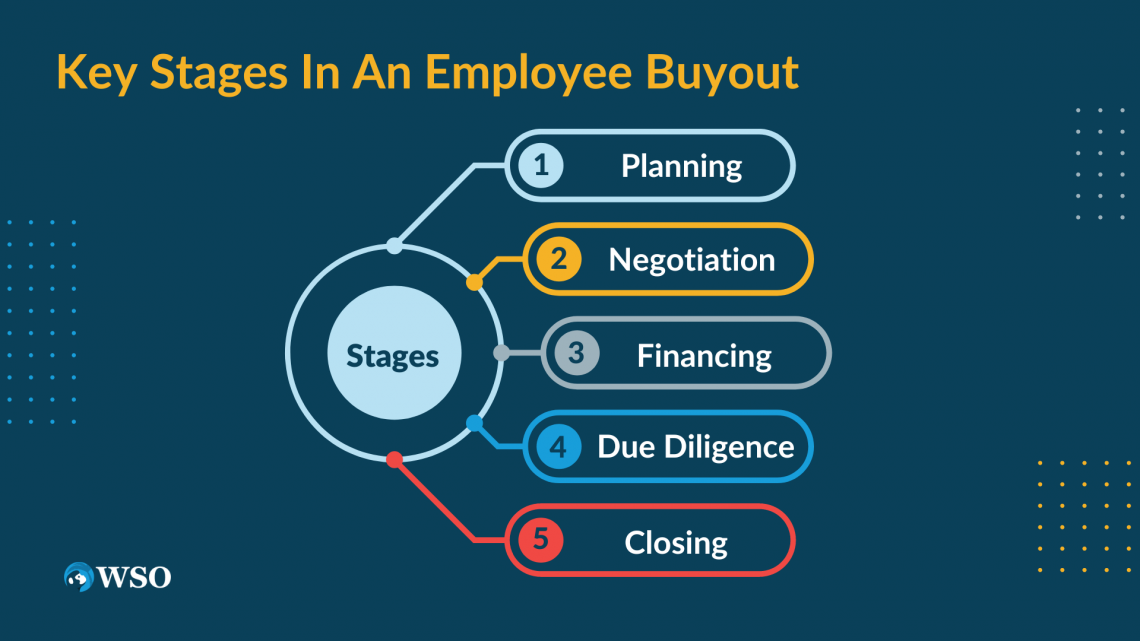

- An employee buyout typically involves planning, negotiation, financing, due diligence, and closing.

Objectives of an Employee Buyout (EBO)

The objectives of an employee takeover can vary, subject to the specific circumstances of the company and the employees involved.

However, some common objectives of an EBO may include

1. Ownership transfer

The primary objective of an EBO is typically to transfer ownership of a company from its existing owners to its employees.

2. Preservation of jobs

An EBO can be a method to preserve jobs and prevent layoffs in the face of financial difficulties or restructuring.

3. Improved performance

Employee ownership can create a sense of shared responsibility and motivation among workers, improving company performance and profitability.

4. Employee engagement and satisfaction

Employee ownership can be a manner to increase employee engagement and job satisfaction, which can reduce turnover and improve retention rates.

5. Long-term sustainability

An EBO can be a way to ensure the long-term sustainability of a company by providing a structure that encourages investment in the company's future and a sense of ownership among its workers.

Overall, the objectives of an EBO are typically centered on creating a sense of shared purpose and ownership among employees while ensuring the company's continued success and sustainability.

What to Consider When Offered an Employee Buyout

A business may consider a worker buyout under various cases:

Succession planning means identifying and developing internal employees who can take over key leadership positions when the current leadership team retires or leaves the business.

An EBO could be an excellent approach to transferring company ownership to the next generation of leaders if the owners are nearing retirement age and desire to do so.

This can provide a smooth ownership transition and ensure the business continues operating successfully under new leadership.

2. Financial difficulties

An EBO could be a solution for a firm going through financial difficulties to raise needed cash and make adjustments to the organization that would make it more long-term viable.

The employees would collectively purchase the company from its current owner(s), which can provide an injection of capital into the business and help reduce some of the monetary pressures it is facing. This can also aid in retaining key employees who may be worried about the future of the business.

3. Values Alignment

Values alignment indicates the extent to which the employee's values and goals are aligned with those of a company.

Note

When considering an EBO, It is necessary to assess whether the employees have a shared vision for the business's future and a commitment to upholding its values.

If the values are aligned, an EBO may be the right option for the business as the employees are likely to have an absolute interest in the company's success and may be more motivated to work to ensure its growth and profitability.

4. Acquisition

When a company performs poorly, it is likely to get acquired by a large company and take control of its operations.

To prevent this, an EBO could be a tactic for the employees to guide the company's operations and protect their resources and values.

Key Stages In An Employee Buyout

An EBO process typically entails several key stages, including.

1. Planning

The first stage of an employee takeover involves planning. This stage deals with stating the objectives of the buyout, evaluating the practicability of the plan, identifying potential sources of financing, and drawing a strategy for executing the buyout.

2. Negotiation

The second stage of an employee takeover involves negotiating the buyout terms. This stage includes negotiating the price of the company, the payment terms, and other relevant terms and conditions.

3. Financing

The third stage of an employee takeover involves securing financing for the company's purchase. It could be obtaining funds from multiple sources such as banks, private equity firms, or government agencies.

The fourth stage of an EBO involves conducting due diligence on the company. This consists of analyzing the financial and operational health of the company, finding potential risks and liabilities, and verifying the accuracy of financial statements.

5. Closing

The final stage of an EBO involves closing the transaction. It involves finalizing the purchase agreement, transferring company ownership to the employees, and securing approvals from regulatory agencies.

Overall, the employee takeover procedure can be difficult and drawn out. But, careful planning and execution can substantially benefit the organization and the employees.

Limitations of Employee Buyout

EBOs can be helpful in some cases. Yet, they also have some possible drawbacks:

1. Financing

EBOs generally require huge funding, and it can be challenging for some employees to secure the necessary funding. This can make it hard for employees to execute a successful buyout.

2. Risk

EBOs sometimes are viewed to be risky for employees since they are mainly investing their own money in the company they work for. If the company does not perform well, employees could lose their investment.

3. Lack of expertise

Employees may be wise about their job roles in the company but might lack the expertise required to run a business. Hence this could lead to management issues and possibly harm the company's performance.

4. Conflict

Internal conflicts can arise among employees because of employee buyouts, particularly if some do not wish to participate. Hence, the work situation and morale may get worse.

5. Limited resources

Even if the employee takeover is successful, the company may have limited resources to invest in growth and development. This can reduce the company's potential for future success and growth.

Alternatives to an Employee Buyout

There are several alternatives to an Employee takeover:

1. Traditional Sale

The business can think about selling business to an outside buyer, such as a competitor or a private equity firm.

By doing this, the company would have new potential to expand and flourish while giving the current owners a financial return on their investment.

2. Merger or Acquisition

The business can explore the possibility of merging with or being acquired by another company.

This can produce the owners with a financial return on their investment while also creating new opportunities for growth and development.

3. Recapitalization

The business can analyze the likelihood of changing its capital structure through a recapitalization. This can involve issuing debt or equity, buying back shares, or restructuring existing debt.

Therefore, the company can provide the necessary funds for the buyout without burdening the employees to purchase the company themselves.

A management buyout can be an alternative to an employee buyout. In a management buyout, the existing management team of a company buys out the current owners, either fully or partially.

This could generate numerous benefits, like greater control over the company's direction and potential financial benefits to the management team.

5. Family Succession

In a family-owned business, the owners can consider passing the business down to the next generation of family members.

Family Succession can provide several benefits for the business, including continuity of leadership and management, preservation of the business's culture and values, and potential tax advantages.

Researched and Authored By Vivek T P

Reviewed and edited by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?