Greenfield Investment

A foreign direct investment (FDI) approach is where a parent company establishes a subsidiary in another country, constructing its operations entirely from the beginning.

What Is A Greenfield Investment?

A greenfield investment refers to a foreign direct investment (FDI) approach where a parent company establishes a subsidiary in another country, constructing its operations entirely from the beginning.

This involves establishing new manufacturing facilities and constructing distribution centers, offices, and residential areas.

Greenfield investments are common in manufacturing, information technology, and services sectors, where companies need to establish a physical presence in a new market.

The term "greenfield" originates from creating a new venture entirely from scratch, comparable to preparing and cultivating a fresh, green field. Investing in a greenfield project gives the parent company maximum control over its investment.

In addition to providing maximum control, greenfield investments enable companies to tailor their operations to suit local market conditions and adhere to regulatory standards.

This level of customization can enhance the company's capacity to respond flexibly to the specific needs and preferences of the target market.

While greenfield investments demand substantial upfront investment and effort, their potential for sustainable growth, local integration, and positive economic impact make them a strategic choice for companies aiming for long-term success in new and dynamic markets.

Key Takeaways

- A greenfield investment is a foreign direct investment where a company creates a new subsidiary in a different country.

- A greenfield investment offers the sponsoring company maximum control over the venture.

- It involves higher risks and demands a significant commitment of time and capital compared to other forms of foreign direct investments.

- In a Greenfield investment, there are no intermediary demands, granting the investing company substantial autonomy and control throughout the project.

- This approach contrasts with indirect investments like buying foreign securities, which entail minimal influence or engagement by the parent company in day-to-day business operations.

Understanding a Greenfield Investment

A greenfield investment is a popular method of entering a new market when a company aims for maximum control over its overseas operations.

This approach contrasts with indirect investment, such as purchasing foreign securities, where the parent company has minimal influence or involvement in daily business activities.

Unlike mergers and acquisitions, which involve purchasing existing businesses, greenfield investments involve building new facilities in a foreign location, such as manufacturing plants, offices, or research and development centers.

This approach allows the investing company to establish operations in a new market tailored to its unique requirements and strategies.

Note

The brown-field (sometimes "brownfield") investment bridges the gap between a green-field project and an indirect investment.

Brown-field investing involves firms leasing existing facilities and land and adapting them for their purposes. Renovation and customization typically result in lower costs and a quicker turnaround than establishing from scratch.

Greenfield investments involve establishing new facilities and operations from scratch, unburdened by existing infrastructure. This approach allows companies to customize their operations according to local market demands, tailoring products and services to meet unique preferences.

Extensive strategic planning is a hallmark of greenfield investments. Companies conduct thorough market research, assessing factors such as

- Demand

- Regulations

- Labor availability

- Cultural nuances

Informed decisions about operational locations are made based on this analysis. One significant benefit of greenfield investments is their contribution to local economies.

By creating jobs and fostering skill development, these investments reduce unemployment rates and enhance the capabilities of the local workforce. They also stimulate economic growth, attracting foreign capital and increasing tax revenues for host governments.

However, this type of FDI comes with challenges. Navigating complex legal frameworks, understanding local business cultures, and managing construction and operational risks require meticulous planning and risk mitigation strategies.

Despite these challenges, greenfield investments offer companies the opportunity to promote environmental sustainability and social responsibility from the outset, implementing eco-friendly technologies and engaging in community development initiatives.

Example of a Greenfield Investment

Consider Company X, headquartered in Germany. It aims to expand globally, targeting the US market with an innovative product. Company X invested considerable time and resources in understanding the US market.

They identified a unique gap through meticulous market research – the demand for innovative artificial intelligence solutions in various industries. With few to no direct competitors offering comparable technology, Company X saw an opportunity to revolutionize the US market.

The looming threat of tariffs on German imports posed a potential obstacle, as it could increase the cost of Company X's products, potentially dissuading potential clients.

To counter this, the company's management strategically decided to establish a greenfield investment in the US.

Building a local manufacturing facility, distribution hubs, and offices could sidestep import tariffs, ensuring competitive pricing and making their technology accessible to a broader range of businesses.

The CEO views creating a foreign subsidiary as vital, enabling full control over overseas operations and brand representation.

The company will oversee all operations internally using its staff, in contrast to other forms of foreign direct investment where the investing company does not manage day-to-day operations.

Real-World Examples of Greenield Investment

Below are some real-world examples of greenfield investment:

1. Weber's Southern Poland Investment

Weber, the American outdoor cooking company, opened its first manufacturing hub in southern Poland in 2021. The 50,000 square meter facility enabled the production of high-quality barbecue products for the European market, enhancing delivery speed and service.

This investment created local jobs, stimulated economic growth, facilitated technology transfer, and bolstered Weber's European brand presence.

2. Hyundai's Czech Factory Investment

In 2006, Hyundai Motor Company gained authorization to invest approximately one billion euros in a significant greenfield project in Nošovice, Czech Republic. The company established a new production facility that hired 3,000 employees in its initial year.

To encourage this investment and bolster the nation's economy while reducing unemployment, the Czech Government offered tax benefits and subsidies.

3. Toyota's $1.5 Billion Greenfield Project in Mexico

In 2015, Toyota initiated its first greenfield project in Mexico, investing $1.5 billion in a new manufacturing plant in Guanajuato following an extensive three-year planning phase. The facility commenced operations in December 2019.

The plant's primary objective was to employ 3,000 staff members and produce 300,000 pickup trucks annually. Toyota also planned urban development, including housing for workers, known as Toyota City.

The investment was driven by reduced labor expenses and its nearness to US markets. This strategic move allowed Toyota to establish an efficient overseas manufacturing facility, ensuring cost-effectiveness and streamlined supply chains for the company's operations in the region.

Advantages of a Greenfield Investment

Below are the important advantages of a Greenfield investment:

1. High level of control

The investing company has full control over the management, operations, and decision-making processes. This level of control is essential for businesses with specific strategies and standards they want to enforce consistently across all operations.

2. Customization and Flexibility

It allows companies to build facilities and design operations from scratch tailored to local market needs. This customization ensures that products and services align with the target audience's preferences, fostering a strong connection with consumers.

3. High Level of Quality Control

It allows companies to implement stringent quality control measures right from the start. This ensures that products and services meet international standards, enhancing customer satisfaction and building a reputation for reliability and excellence.

4. Knowledge Transfer and Skill Development

This investment facilitates the transfer of technology, managerial expertise, and best practices from the investing company to the local workforce. This knowledge transfer enhances the local workforce's skills, improving the host nation's industrial and technical capabilities.

5. High Control over Brand Image and Staffing

This enables companies to enforce their brand identity consistently. The hiring and training processes are directly managed, ensuring that employees represent the brand values effectively.

This control over staffing results in a motivated and skilled workforce, contributing to the company’s success.

6. Economies of Scale and Economies of Scope

Allow companies to achieve economies of scale by producing goods or services in larger quantities, reducing production costs per unit.

Additionally, companies can diversify their product range (economies of scope), tapping into different market segments. Furthermore, centralizing functions like marketing, research, and development can lead to cost efficiencies and enhanced innovation.

7. Bypassing Trade Restrictions

By establishing local production, companies can bypass trade restrictions and tariffs that might apply to imported goods and services. This ensures smooth and cost-effective operations while catering to market demand.

8. Creating Jobs for the Local Economy

It creates employment opportunities for the local workforce. By hiring locally, companies contribute significantly to reducing unemployment rates, providing stable jobs, and improving the standard of living in the region.

This job creation has a positive impact on the overall economy of the host country.

Disadvantages of a Greenfield Investment

Below are the important disadvantages of a Greenfield investment:

1. Extremely High-Risk Investment

Greenfield investments are widely considered the riskiest form of foreign direct investment. This risk stems from uncertainties such as market acceptance, regulatory changes, political instability, and unexpected economic downturns.

Unlike acquiring an existing business, where historical data and performance can be analyzed, greenfield projects lack this crucial reference point.

2. Time-Consuming

It typically takes considerable time to plan, construct, and become fully operational. Delays in construction, regulatory approvals, or unexpected challenges can further extend the timeline, delaying revenue generation.

3. Potentially High Market Entry Costs (Barriers to Entry)

This investment often involves high market entry costs, including land acquisition, construction, equipment procurement, and initial operational expenses.

These significant financial commitments can be a barrier for smaller businesses, limiting their ability to enter certain markets.

4. Government Regulations and Policy Challenges

Foreign companies might face bureaucratic hurdles, legal complexities, or restrictions on ownership and operations imposed by the host government. Navigating these regulatory challenges can be time-consuming and costly.

5. High Fixed Costs

Establishing a greenfield location involves substantial fixed costs, including building infrastructure, installing machinery, and hiring skilled labor.

These fixed costs are incurred regardless of the actual market demand, potentially leading to financial strain if the business performs differently initially.

Green Field Investment vs. Brown Field Investment

The below comparison provides a comprehensive understanding of the differences between a Green Field Investment and a Brown Field Investment.

| Aspect | Greenfield Investment | Brownfield Investment |

|---|---|---|

| Definition | Establishment of new operations in a foreign country from scratch. | Acquisition or redevelopment of an existing facility or business in a foreign country. |

| Starting Point | Blank slate, building from the ground up. | Existing infrastructure and facilities. |

| Control | Complete control over design, operations, and strategy. | Limited control due to existing structures, processes, and culture. |

| Risk Level | High risk due to uncertainties and initial setup challenges. | Lower risk as existing operations and market presence provide insights. |

| Time to Operation | Longer time is required for planning, construction, and setup. | It takes a shorter time as facilities are already in place. |

| Flexibility | Highly flexible; operations can be customized according to needs. | Limited flexibility due to existing structures and processes. |

| Costs | High initial costs for land, construction, and equipment. | Potentially lower initial costs, but renovations and upgrades may be needed. |

| Market Entry | New market entry, often into emerging or untapped markets. | Expansion within existing markets or entry into stable, established markets. |

| Local Impact | Generates new jobs: supports local suppliers and contributes to economic growth. | Preserves existing jobs: might lead to modernization and increased efficiency. |

| Environmental Impact | Potential environmental impact due to new construction and development. | Environmental impact is often related to existing site conditions and potential cleanup efforts. |

| Flexibility in Location | Can select an optimal location based on market analysis and strategic planning. | Limited to the existing location, relocation might be challenging. |

| Strategic Approach | More suitable for companies seeking specific customization and market dominance. | Suitable for companies looking for quicker market entry and lower initial costs. |

Greenfield investment trends in 2022- 2023

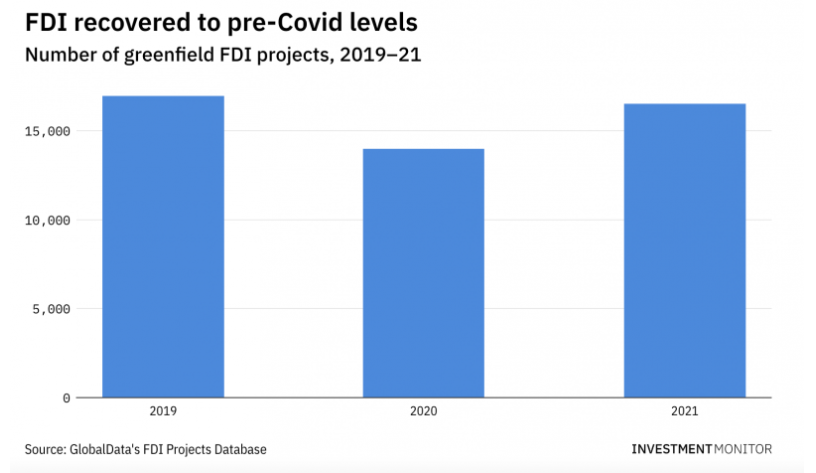

As countries began to recover in 2022, investors reacted rapidly, and worldwide FDI levels rebounded significantly.

According to The Global FDI Annual Report 2022, there will be 16,516 greenfield FDI projects in 2021, an increase of 18% over the previous year. This is slightly below the pre-pandemic level of 16,965 projects in 2019.

According to World Investment Report 2023, greenfield investment project announcements increased by 15% in 2022, with growth in all regions and industries.

The electronics, semiconductors, automotive, and equipment industries experienced a rise in project activity, while investment in digital economy sectors declined.

In the year 2022, businesses faced several challenges that impacted plans. Supply chain disruptions, changing consumer tastes, and persistent global tensions made it difficult for companies to make new investments from scratch, especially in environmentally friendly projects.

With economic conditions remaining challenging, foreign direct investment (FDI) levels are anticipated to decline in 2023, with the first half of the year experiencing a more significant impact.

Greenfield Investment FAQs

Assessing greenfield investments involves a comprehensive analysis of market prospects, regulatory landscape, infrastructure, labor market dynamics, land accessibility, construction expenses, supply chain factors, and possible risks.

Businesses must conduct in-depth studies and assessments to determine the investment's feasibility, costs, and anticipated profits.

Foreign direct investment (FDI) comes in two primary forms: greenfield and brownfield investments.

Greenfield investment means a company constructing entirely new facilities from the ground up. On the other hand, brownfield investment occurs when a company acquires or leases existing buildings or properties for its operations.

Under certain situations, starting from scratch in a new country can be the optimal business choice.

For example, they can take advantage of incentives provided by the local government, such as subsidies, tax breaks, or other advantages tailored to specific industries, thereby encouraging foreign direct investment.

or Want to Sign up with your social account?