CAC40 Index

A market index that represents the top 40 companies listed on the French stock market

What Is the CAC 40?

The CAC 40 is a benchmark stock market index in France, comprising the 40 largest French companies in market capitalization.

Created in 1987 by the Paris Stock Exchange, the CAC 40 became an indicator of France's economic and financial health and a major investment tool for national and international investors.

However, the CAC 40 is also a subject of debate and controversy. Some detractors point out that the index is biased toward the strongest companies to the detriment of SMEs and sections of the real economy.

Some denigrators are also concerned about the concentration of economic and financial power in the hands of the biggest companies. This article will examine how the CAC 40 works, what is at stake, and the criticisms and prospects for the evolution of this emblematic French index.

Key Takeaways

- CAC40 represents the 40 largest French companies in terms of market capitalization.

- CAC40 doesn’t illustrate the French economy perfectly.

- CAC40 stands for « Cotation Assistée en Continu 40 ».

- The composition of the CAC 40 is reviewed every quarter.

- Foreign investors represent a significant portion of the CAC 40's market capitalization.

- CAC 40 is too focused on short-term financial profits.

Understanding the CAC 40

The CAC 40, or Cotation Assistée en Continu 40, is France's benchmark stock market index. It comprises the 40 largest French firms in terms of market capitalization (the total value of their shares on the stock market).

The composition of the CAC 40 is reviewed every quarter by a scientific committee of NYSE Euronext, the operator of the Paris Stock Exchange.

To be eligible for the CAC 40, companies must meet certain entry criteria, including a minimum market capitalization, sufficient trading volume, and satisfactory liquidity.

The composition of the CAC 40 includes companies from a variety of services, such as:

- Financial services (BNP Paribas, Credit Agricole, …)

- Energy (ENGIE, Schneider Electric, …)

- Healthcare (L’Oréal, Sanofi, …)

- Telecommunications (Bouygues, Orange, …)

- Building materials (Veolia, Vinci, …)

- Cars (Renault, Thales, …)

The evolution of the CAC 40 is closely watched by national and international investors, as well as by economic analysts and the media. Indeed, the CAC 40 is a key indicator of France's economic and financial health and a major investment tool for financial market players.

The performance of the CAC 40 is often compared to that of other international stock market indices, such as the Dow Jones in the United States or the Nikkei in Japan.

The CAC 40 is a major stock market index in France, comprising the 40 largest French companies in terms of market capitalization. Its composition is revised every quarter according to strict entry criteria.

Note

The CAC 40 is considered a key indicator of France's economic and financial health and an important investment tool for financial market participants.

CAC40 Index Companies

In the previous section, we introduced the CAC40 and how it works, but what companies composed the CAC40?

The CAC 40 companies' ranking can vary according to market capitalization, revenue, profitability, growth, market value, etc. Therefore, it is crucial to remember that the rankings can frequently change depending on the results of the companies.

To argue what we just said, here are the top five CAC 40 companies in terms of market capitalization as of April 8, 2023, according to data provided by Euronext:

- Total Energies: The French gas and oil company is currently the top CAC 40 industry in market capitalization, with an estimated value of more than 126.8 billion euros. Moreover, this company is present worldwide because it has several subsidiaries.

- LVMH: LVMH is known everywhere worldwide because the most famous French luxury group owns brands such as Louis Vuitton, Dior, Givenchy, and Fendi; it is currently the second-largest company on the CAC 40 in terms of market capitalization. The group LVMH constitutes approximately 119.7 billion euros.

- Sanofi: Most people have had to deal with one of their products because they are involved in many treatments; this pharmaceutical company is currently the third largest company in the CAC 40 in market capitalization, with around 92.9 billion euros.

- L'Oréal: This cosmetics corporation is nowadays the fourth largest company in the CAC 40 in terms of market capitalization. It has an estimated value of more or less 77.3 billion euros.

- Schneider Electric: The French energy management and automation company is currently the fifth largest CAC 40 company in terms of market capitalization, with an estimated value of around 70.7 billion euros.

These companies are pillars of the French economy, creating enormous wealth in France and many jobs worldwide.

Note

In 2023, Mr. Bernard Arnault was elected the richest man in the world, and Mrs. Françoise Bettencourt was elected the richest woman. They are, respectively, majority shareholders of LVMH and L'Oréal.

Impact of CAC 40

The CAC 40 plays an important role in the French economy and the international financial markets. Indeed, CAC 40 companies are key players in the French economy, representing a significant share of GDP and employment.

In addition, the performance of the CAC 40 has a significant impact on investor confidence in the French economy and companies' investment decisions.

The CAC 40 is also an important player on the international financial scene. Foreign investors represent a significant portion of the CAC 40's market capitalization, which shows the importance of the index for international investors.

Furthermore, the performance of the CAC 40 is often compared to that of other international stock indices, which reinforces its importance on the global financial scene.

However, the CAC 40 is not only important for investors and companies. It also has repercussions on our society in general. CAC 40 companies are often major employers and key players in their industry.

Their performance, therefore, impacts employment, wages, and working conditions. In addition, CAC 40 companies often have an important role in corporate social responsibility by being attentive to environmental and social issues.

The CAC 40 plays an important role in the French economy and the international financial markets. It significantly affects investor confidence in the French financial system and industries' investment decisions.

Moreover, CAC 40 companies often significantly impact society in general, being major employers and key players in their industry.

Limits of the CAC40 Index

Let's now look at the negative sides of the CAC40! Despite its importance in the French economy and international financial markets, the CAC 40 is subject to several limitations and criticisms.

First, the composition of the CAC 40 is based on market capitalization, which means that the largest companies in terms of market value are included in the index.

It can cause an over-representation of the biggest industries at the expense of the smallest, which may have strong financial performances but need to be more substantial in terms of market capitalization to be included in the CAC 40.

The structure of the CAC 40 is revised every quarter so that we can see significant fluctuations in the composition of the index and, therefore, significant fluctuations in the performance of the CAC 40. This can make it difficult to compare the performance of the CAC 40 over a long period.

To argue what we just explained, the performance of the CAC 40 may be influenced by external factors such as monetary and economic policy, geopolitical events, and exchange rate fluctuations.

This can make it difficult to predict the performance of the CAC 40 and thus make informed investment decisions. Moreover, some detractors denounce that the CAC 40 is too focused on short-term financial profits at the expense of long-term value creation.

This can conduct CAC 40 companies to focus more on short-term profit maximization rather than long-term investments in research, development, innovation, or corporate social responsibility.

Overall, it should be noted that the CAC 40 has to face many criticisms, such as:

- the over-representation of companies like LVMH or TotalEnergies

- the significant modifications in the structure of the index

- the external factors that influence the overall performance of the CAC 40

- the emphasis on short-lived returns at the expense of long-term value creation

Note

These limitations and criticisms must be considered when analyzing the performance of the CAC 40 and making investment decisions.

Outlook for the CAC 40

Even if it has to face limitations and criticisms, the CAC 40 is expected to play an important role in the French economy and international financial markets in the future.

First, global economic growth is expected to continue to drive the performance of the CAC 40, particularly in sectors such as information technology, biotechnology, or renewable energy.

In addition, CAC 40 companies are increasingly aware of the importance of corporate social responsibility and are increasingly engaged in sustainable development initiatives.

Then, the French government launched initiatives to enhance France's attractiveness to foreign investors. This could generate an increase in the market capitalization of French companies and, therefore, improve the performance of the CAC 40.

In addition, the COVID-19 pandemic has spurred the adoption of technologies such as digitalization and cybersecurity, which could lead to an increase in the performance of CAC 40 companies in these areas.

Finally, regulatory changes such as implementing a European Green New Deal to combat climate change could create new investment opportunities for CAC 40 companies in renewable energy and clean technologies.

Note

Despite the bad remarks, the CAC 40 is set to play an important role in the French economy and international financial markets in the future.

Factors that could boost the future performance of the CAC40 are:

- Global economic growth

- The increasing commitment of CAC40 companies to corporate social responsibility

- Government initiatives to enhance France's attractiveness to foreign investors

- The increased adoption of technologies such as digitalization and cybersecurity

- Regulatory changes related to sustainable development

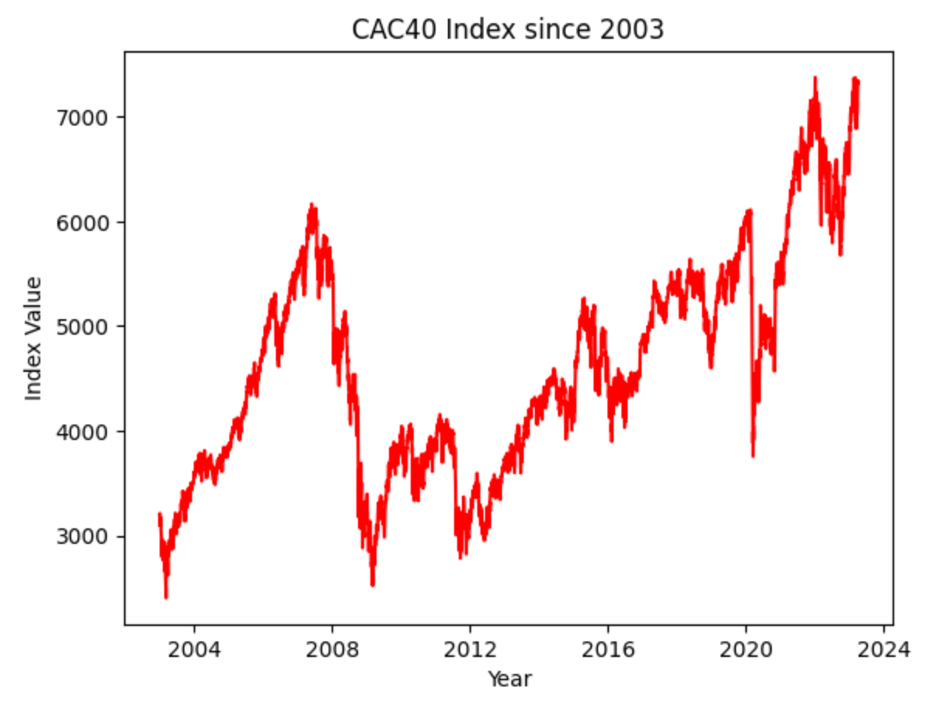

CAC40 Values Between 2003 and 2023

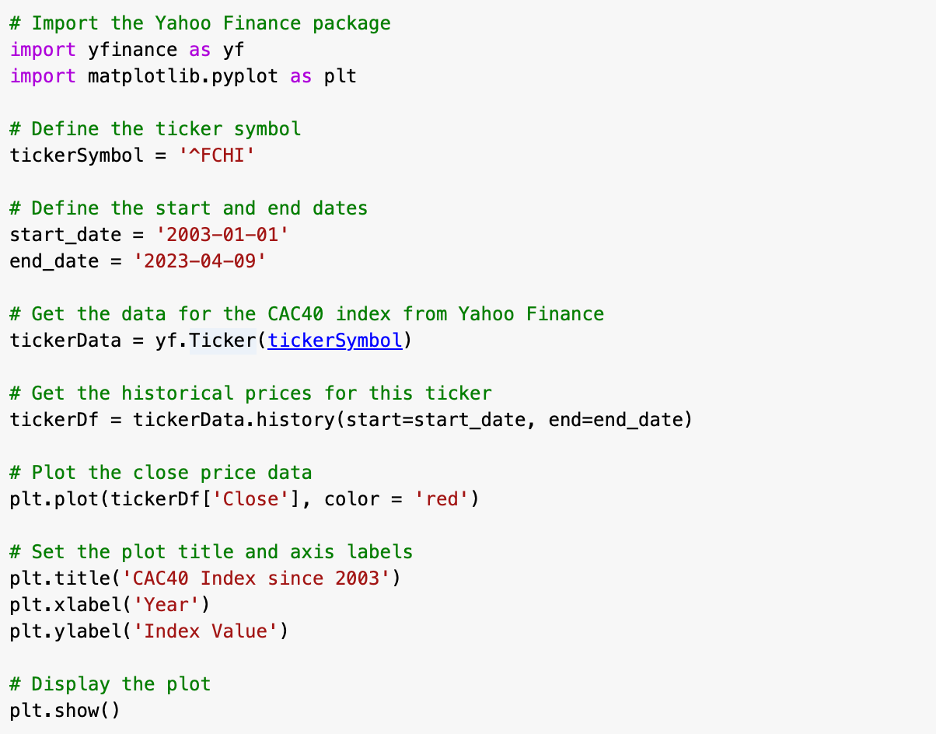

Using different libraries in Python, we can display the values of the CAC40 since 2003. The CAC 40 is sometimes known as the "FCHI," short for the "French index." In addition, with the "yfinance" package, we can collect financial data, which is very useful when you work in finance.

The "yfinance" package is not affiliated, endorsed, or vetted by Yahoo, Inc. Instead, it is an open-source tool that manipulates Yahoo's publicly available APIs and is intended for research and education.

If this package is not installed on your notebook, you can write the following instructions on a bash terminal before running the code below: "pip install yfinance."

On a Google Colab Notebook, we write the following code. Here the first step consists in importing the different packages. Then we declare the CAC40 symbol and the limit dates because we don't want to see all the data.

Next, we download the CAC40 data from Yahoo Finance with the function "yf.Ticker()". Finally, we build and display the plot with the function "plt.show()." When you run the code on your notebook, you will obtain the following graph.

If you want to learn more about the CAC40, click Yahoo Finance.

Image source: Screenshot of a notebook by Sacha Fiereder

Image source: Screenshot of a notebook by Sacha Fiereder

Conclusion

In conclusion, the CAC 40 is a stock market index representing the 40 largest publicly traded French companies. However, this index is often criticized for focusing only on a limited number of companies and needing more sectoral diversity.

It remains a crucial indicator for measuring the performance of the French stock market. The CAC 40 reflects the French economy and the performance of French companies. It is influenced by macroeconomic factors such as

- Global economic growth

- Government policies

- Regulatory changes

It is also impacted by company-specific factors such as financial performance, management, and strategy.

Despite limitations and criticisms, the CAC 40 is expected to play an important role in the French economy and international financial markets.

In summary, while the CAC 40 is not without its limitations and criticisms, it remains an important indicator for measuring the performance of the French stock market and a benchmark for domestic and international investors seeking to invest in publicly traded French companies.

or Want to Sign up with your social account?