Currency Risk

Refers to the risk that occurs due to fluctuations in exchange rates when buying or selling currencies denominated in a foreign currency

What is Currency Risk?

Currency risk, also known as exchange-rate risk or foreign exchange risk, is the risk associated with changes in the value of one currency compared to another. In this case, the risk arises from the possibility of losing money due to unfavorable changes in exchange rates.

It is possible to hedge against this risk via forex, futures, options contracts, or other derivatives. Forex is the global electronic marketplace for trading foreign currencies. Essentially, it’s like a global stock exchange but for international currency.

This risk can be reduced by investing in countries that have strong currencies. A currency's strength is determined by the:

- supply and demand in foreign exchange markets

- interest rates of the country's central bank

- inflation

- growth of its domestic economy

- the country's trade balance.

Key Takeaways

- Currency risk, also known as exchange-rate risk, refers to the potential financial loss due to unfavorable changes in exchange rates between two currencies. It's crucial to understand how these fluctuations can impact investments and transactions.

- Investors can employ various strategies to hedge against currency risk, including forex, futures contracts, options contracts, and derivatives. These instruments help lock in favorable exchange rates and minimize potential losses.

- Strong political systems, low debt-to-GDP ratios, and stable economies can reduce currency risk. Countries with these attributes are generally safer for investment due to their ability to withstand crises without drastic currency depreciation.

Calculating Currency Risk

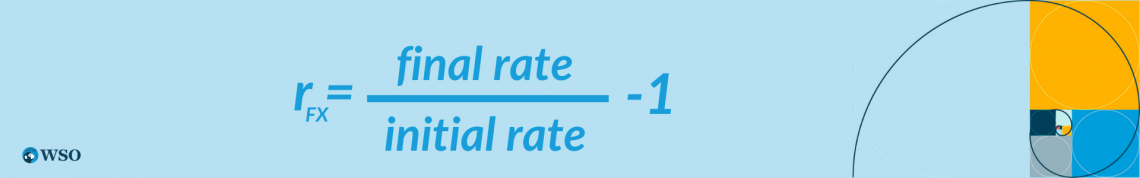

The return based on the foreign exchange can be calculated with the following formula:

rLM = (1 + rFM) (1 + rFX) - 1

Where:

- rLM: is the return in local currency

- rFM: is the return in foreign currency

- rFX: is the foreign exchange conversion rate

For example, suppose you invested in a Japanese company that had a 10% return. This return is in yen, so you want to know the equivalent return in local currency (US dollar). If the exchange rate is 2%, the equivalent return in US dollars is 12.2% (excluding exchange costs).

rUS$ = (1 + 0.10)(1 + 0.02) - 1 = 0.122 = 12.2%

In this case, the exchange rate was known. However, we can also determine the conversion rate by determining what the exchange was when the investment began and what the exchange rate was at the end of the investment via the percent change formula.

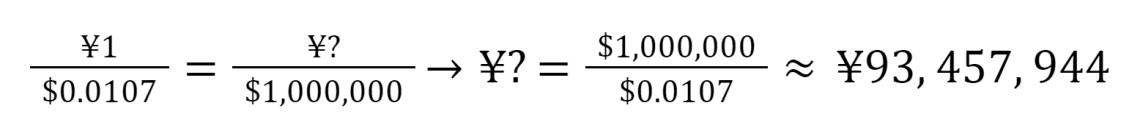

For example, on 3/01/2013, ¥1 ≈ $0.0107; on 3/01/2023, ¥1 ≈ $0.0073. This would give an exchange rate of approximately -31.8%.

rFX = (0.0073 / 0.0107) - 1 ≈ -0.3178 = -31.8%

In this case, the yen has depreciated with respect to the dollar. This is because ¥1 was worth more US dollars ten years earlier. This means exchanging yen for dollars would result in a lower return (excluding exchange costs).

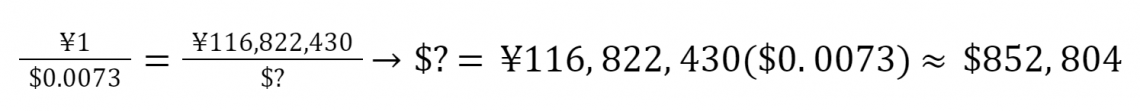

Suppose you invested $1,000,000 in stocks of a Japanese company on 3/01/2013. At the exchange rate, you bought ¥93,457,944 worth of stocks (excluding exchange costs). If, after 10 years, the company had an average return of 25%, you could sell your stock for ¥116,822,430.

¥93,457,944(1 + 0.25) ≈ ¥116,822,430

However, exchanging ¥116,822,430 on 3/01/2023 yields $852,804. In this case, even though the stock had an average return of 25%, you still lost $147,196 when exchanging from yen to dollar (excluding exchange costs and inflation).

Once the exchange rate was calculated, this result could have also been calculated using the local currency exchange formula.

rLM = (1 + 0.25)(1 + (-0.318)) - 1 = -0.1475 = -14.75%

return = $1,000,000(1 + (-0.1475)) = $852,500

Examples of Currency Risk

Unfavorable changes in exchange rates can result from multiple situations. Let’s say you’ve invested in stocks from a Japanese company. If there are positive returns in Japanese stocks with no change against the US dollar, you have positive returns.

Similarly, if there are negative returns in Japanese stocks with no change against the US, you have negative returns. However, this is a common risk associated with investing in stocks. The currency risk becomes a factor when the currency exchange varies.

This can create multiple scenarios of varying outcomes. You could have a positive return in Japanese stocks but a disfavorable foreign exchange between the yen and the dollar. However, if the return on stocks is higher than the loss of exchange, you have an overall positive return.

Similarly, if Japanese stocks have a negative return but there is a favorable foreign exchange between the yen and the dollar, you can still have an overall positive return.

However, having a positive return in Japanese stocks but a significantly disfavorable foreign exchange between the yen and the dollar could result in an overall negative return. Same with having a negative return in Japanese stocks with a disfavorable foreign exchange.

For example, let’s say the Japanese company you invested in had a 10% return this year. But, the yen depreciates 12% against the US dollar. This would result in a loss - excluding costs associated with trading.

This is because you’d have to sell your stocks on the Japanese stock exchange, where each transaction is in yen. Then, you must trade your yen into US dollars through a currency exchange through a bank, credit union, or online currency exchange bureau or converter.

Note

This currency exchange service comes at a cost, which is another consideration when converting from yen to dollar. Therefore, it’s possible to have lost more than 2% of your investment due to the currency exchange even if the company generated positive returns.

However, the inverse is also possible. Suppose the company didn’t perform as well as expected, but the exchange rate is favorable. You might get a positive return from the currency exchange after selling the stock (depending on the exchange costs).

For example, suppose a Japanese company had a 5% return this year, and you consider it has underperformed. So you consider selling your stock. If the yen appreciates 8% to the US dollar, selling the stock and then exchanging yen for the dollar could generate even higher returns.

In the previous example of investing $1,000,000 in a Japanese company on 3/01/2013 and selling the stocks on 3/01/2023, even though the company had an average return of 25% at that time, the loss on exchange was enough to yield a negative return.

Factors Affecting Currency Risk

As previously mentioned, currency risk can be reduced by investing in countries with strong currencies. Therefore, the stronger a country’s currency, the lower the currency risk.

However, other factors affect this risk - even if the country has a strong currency. Two such factors are:

- Its political system

- Debt-to-GDP ratio.

The debt-to-GDP ratio measures a country's public debt to its gross domestic product (GDP). In other words, it compares what it owes to what it produces. Thus, it indicates its ability to pay back its debts.

A country with a low debt-to-GDP ratio presents a low risk of investment because it presents a low default risk. This is because it can pay back its debts without defaulting.

Note

If a country defaults on its bonds, its currency will be affected and lose value compared to other currencies, such as the US dollar. If a country has a stable political system, then it has a low risk.

The stability of a political system refers to its ability to survive crises without internal conflict. For example, countries with multiple civil wars and coup d'états present extremely high risk and should not be invested in.

However, even if a country doesn’t have civil unrest or internal conflict, warring with other nations might still increase the risk of investing in it. For example, days after Russia invaded Ukraine in February 2022, the ruble (Russia’s currency) declined 30% in less than 4 hours.

Inflation is another key factor that affects currency risk. But inflation in and of itself is another factor that is considered when investing. For example, the domestic inflation rate is always a factor even when investing in companies in one’s own country.

Inflation usually affects currency conversion rates in a downward direction. This is because high inflation reduces the currency's purchasing power.

The US Currency Market

The US dollar is currently the world's reserve currency. This means that it tends to be the preference of other countries when they want to hold fiat money. Fiat money is inconvertible paper money made legal tender by government decree.

The Japanese yen (¥) and Euro (€) are international currencies attracting interest among currency traders. This is due to the strong economy of Japan and the European Union. This means that these countries have a low currency risk.

When the euro was developed in 1999, it replaced the currencies of the individual countries within the European Union. It was meant to compete with the US dollar, creating a more balanced foreign exchange market.

For a time, the euro was worth more than the US dollar. However, as time passed, various socioeconomic and political crises in Europe have weakened the appeal of investing in and holding onto euros. It remains a low risk, though.

Since then, the US dollar has remained the world’s reserve currency. This means that, for foreign investors, the US has a low currency risk.

The value of the US dollar on the foreign market is such that, on the day before Russia invaded Ukraine in 2022, Russia's central bank sold $1B to support the ruble.

The Dollar Index is the main instrument used for tracking its value compared to other foreign currencies.

Currency Risk FAQs

Currency risk is the risk associated with the change in the price of one currency with respect to another.

To calculate the rate of return in local currency, we use the following formula:

rLM = (1 + rFM) (1 + rFX) - 1

rLM is the return in local currency

rFM is the return in foreign currency

rFX is the foreign exchange conversion rate

To calculate the foreign exchange conversion rate, we use

rFX = (final rate / initial rate) - 1

or Want to Sign up with your social account?