Efficient Frontier

A fundamental concept in financial economics and portfolio theory serves as a framework for identifying the range of optimal portfolios that offer the highest expected return at a given level of risk.

What Is The Efficient Frontier?

The efficient frontier is a fundamental concept in financial economics and portfolio theory. It serves as a framework for identifying the range of optimal portfolios that offer the highest expected return at a given level of risk.

In simpler terms, it outlines the perfect equilibrium between risk and return within an investment portfolio.

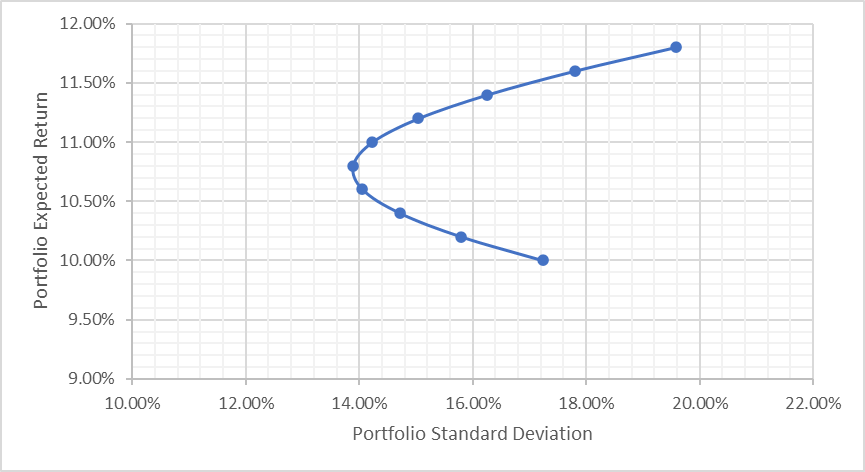

The efficient frontier is typically depicted on a graph with expected return on the vertical axis and risk on the horizontal axis. Each point on the graph represents a different portfolio allocation of assets.

Portfolios lying on the upper part of the curve are considered efficient because they offer higher returns for a given level of risk. Conversely, portfolios located below the curve are considered inefficient because they have a lower return for the same level of risk.

Investors and portfolio managers use this concept to construct diversified portfolios. They aim to optimize their risk-return trade-off according to their

- Risk tolerance

- Investment objectives

Investors achieve this by crafting a blend of assets, including stocks, bonds, and various other investments.

Modern Portfolio Theory (MPT), developed by Harry Markowitz, introduced the concept as a cornerstone of rational portfolio construction.

The theory proposes that investors can potentially increase returns or decrease risk by spreading their investments across various asset classes, thereby crafting efficient portfolios along the frontier.

Nevertheless, it's crucial to remember that past performance doesn't guarantee future outcomes, as this concept relies on historical data and assumptions that may not be universally applicable.

Key Takeaways

- The efficient frontier helps investors and portfolio managers find the optimal balance between risk and return in their portfolios.

- It represents portfolios that offer high returns for a given risk level or low risk for a specific return target.

- Diversification across asset classes is a common strategy for constructing efficient portfolios and reducing risk by spreading investments.

- The concept serves as a foundation for Modern Portfolio Theory, which emphasizes the importance of diversification in managing risk.

- The theory/concept has limitations, including overlooking real-world market factors and investor behavior.

- The efficient frontier provides a structured framework for making informed decisions about portfolio composition, aiding investors in achieving financial objectives while prudently managing associated risks.

Understanding The Efficient Frontier

Understanding the efficient frontier involves grasping some fundamental concepts in finance and portfolio theory. Here are some points to help you understand the concept better:

- Risk and Return Trade-Off: Pursuing greater returns means taking on higher levels of risk, while choosing lower-risk investments results in more modest returns.

- Risk Measurement: Risk is commonly quantified using metrics like volatility or the standard deviation of returns. These metrics help assess the extent of potential value fluctuations in an investment over time.

- Expected Return: The expected return is the average return an investment is likely to generate over a certain period. This is based on historical performance and future expectations.

- Efficient Frontier Graph: It is plotted as a graph with expected return on the vertical axis and risk (standard deviation) on the horizontal axis.

- Portfolio Possibilities: Each point on the efficient frontier represents a different combination of assets in a portfolio. These combinations are known as portfolio possibilities and play a pivotal role in modern portfolio theory (MPT).

- Risk Tolerance: Risk tolerance is a critical factor in determining where you should be on the graph. It depends on your financial goals, time horizon, and willingness to accept risk.

- Portfolio Optimization: Portfolio optimization aims to find the mix of assets that aligns with your risk tolerance and investment objectives. You aim to select a portfolio that maximizes the expected return for your level of risk.

How Does The Efficient Frontier Work?

The Efficient Frontier is a cornerstone of modern portfolio theory, outlining a range of ideal portfolios. These portfolios aim to maximize expected return for a certain risk level or minimize risk for a given expected return. Here's an overview of how it functions:

1. Balancing Risk and Reward

The concept illustrates the trade-off between risk and return when constructing a portfolio of assets. In finance, risk is measured as the standard deviation of returns. Return refers to the expected or historical rate of return.

The concept emphasizes the benefits of diversification. Portfolio diversification involves having a variety of assets in your investment mix, like stocks, bonds, real estate, and other investments.

This strategy combines assets with varying levels of risk and returns to potentially lower the overall portfolio risk while targeting a specific return level.

3. Optimal Portfolios

The efficient frontier consists of portfolios that represent different combinations of assets, each with its risk-return characteristics.

These portfolios are optimal because they offer the best risk-return trade-off within the given set of assets. The optimal portfolios are positioned on or near the upper boundary of the frontier.

4. Risk-Free Rate

It incorporates a risk-free rate of return, often represented by the yield on a government bond. This rate serves as a baseline for measuring the attractiveness of portfolios on the frontier.

Portfolios to the left of the Capital Market Line (CML), which connects the risk-free rate to the optimal portfolios, represent inefficient portfolios because they offer less return for the same level of risk.

5. Capital Market Line

The CML is a tangent line that touches the Efficient Frontier at the risk-free rate and extends into the set of optimal portfolios.

The point at which the CML touches the Efficient Frontier represents the Tangency Portfolio. This portfolio offers the highest return for a given level of risk and is often considered the optimal portfolio for an investor with a certain risk tolerance.

6. Investor Risk Preferences

Investors have different risk tolerances and return expectations. Investors choose a portfolio that aligns with their risk-return preferences. Risk-averse investors may opt for portfolios to the left of the Tangency Portfolio, while risk-seeking investors may select portfolios to the right.

7. Portfolio Allocation

Once an investor knows how much risk and return they want, they can pick the best mix of assets from the Efficient Frontier. The allocation will specify the percentage of each asset or asset class to include in the portfolio.

This concept provides a framework for constructing portfolios that balance risk and return. It helps investors make informed decisions about asset allocation and portfolio diversification. This allows them to achieve their financial goals while managing risk.

How Is The Efficient Frontier Constructed

The efficient frontier is constructed using mathematical models and optimization methods. It identifies the optimal portfolio combinations that offer either the highest expected return for a specific risk level or the lowest risk for a particular expected return.

The steps of construction are as follows:

1. Asset Selection

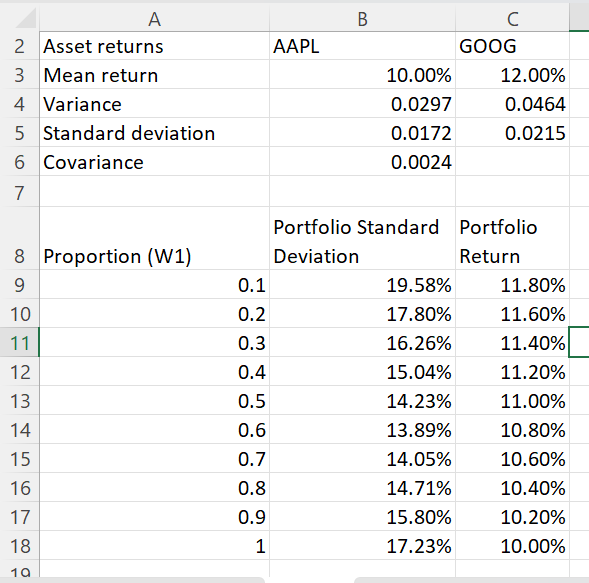

In our example, we consider two stocks, Apple and Google. We gather data related to these assets.

2. Portfolio Formation

Portfolios are created by varying the weights allocated to each asset. Different combinations of weights result in different portfolios.

3. Risk and Return Analysis

Each portfolio has its own standard deviation and expected return. By analyzing the risk and return of these portfolios, we visualize the construction of the efficient frontier.

4. Balancing Risk and Reward

The efficient frontier plays a pivotal role in illustrating the delicate balance between risk (measured by standard deviation or volatility) and potential rewards (evaluated through expected returns) in portfolio construction.

5. Graphical Representation

This balance is visually represented by charting diverse asset combinations on a graph, where each data point corresponds to a specific portfolio allocation.

6. Insight into Risk-Return Characteristics

Through this graphical representation, we gain insight into how various combinations influence the risk-return trade-offs of the overall portfolio.

7. Optimal Portfolio Selection

The efficient frontier represents the set of portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given level of expected return.

It aids investors in making informed decisions about portfolio diversification to achieve their desired risk-return trade-offs.

Note

Constructing the efficient frontier is a simplification of reality, as it relies on historical data and many assumptions.

Market conditions and asset correlations can change over time so that the efficient frontier may shift. As such, it is a dynamic concept that requires ongoing monitoring and adjustment to maintain an optimal portfolio.

Criticisms Of The Efficient Frontier

While the efficient frontier is a valuable concept in portfolio theory, it has its criticisms and limitations. Some of the main criticisms include:

1. Assumption of Rational Investors

This concept operates on the premise that investors act rationally to maximize returns while minimizing risk.

However, in reality, investor behavior can be swayed by emotions, biases, and various factors, occasionally resulting in less rational decision-making.

2. Static Assumptions

Another assumption is that asset returns and volatilities remain stable over time. In practice, market conditions, economic factors, and asset prices are ever-changing and dynamic, making it challenging to rely solely on historical data for making predictions.

3. Single-Period Analysis

This theory is usually based on a single period of historical data. Investors often have long-term investment horizons, and a single period may not capture the full range of market conditions and economic cycles that can affect returns.

4. No Consideration of Taxes or Transaction Costs

The theory does not account for taxes or trading costs associated with buying and selling assets. These costs can significantly impact an investor's actual returns.

5. Normal Distribution Assumption

The theory assumes that asset returns follow a normal distribution, which implies that extreme market events are rarer than they are observed in reality.

However, real-world financial markets have seen more frequent extreme events, such as market crashes, than a normal distribution suggests.

6. Homogeneous Risk

The theory treats all types of risk as equal and assumes that risk can be quantified solely by standard deviation. In reality, different types of risk, such as systematic (market) risk and unsystematic (company-specific) risk, have varying impacts on portfolios.

7. Market Frictions

Real-world markets have frictions such as liquidity constraints and restrictions on short-selling. This can limit an investor's ability to construct a portfolio that aligns with the efficient frontier.

8. Data Reliance

The theory relies heavily on historical data, which may not indicate future market conditions. Historical returns and correlations can change over time. This makes past data less reliable for future predictions.

9. Psychological Factors

The theory doesn't account for psychological factors that influence investor decision-making, such as herding behavior, overconfidence, or fear of loss.

10. Dynamic Investment Environment

Economic and financial conditions are constantly evolving. The concept does not provide a framework for adapting to changing market dynamics or unexpected events.

Despite these flaws, the efficient frontier remains valuable for portfolio optimization and risk management. However, investors and portfolio managers must recognize its limitations and consider real-world factors when making investment decisions.

Conclusion

The efficient frontier is a fundamental concept in finance, serving as a guiding principle for investors seeking to navigate the delicate balance between risk and return within their portfolios.

This critical framework identifies the optimal combinations of assets that present either elevated returns for a particular level of risk or reduced risk for a designated level of return.

However, it is crucial to recognize that the efficient frontier, while highly valuable, does have its constraints. It places significant reliance on historical data and specific assumptions, and these factors may not consistently correspond with the complexities of real-world financial markets.

Factors such as unforeseen economic events, sudden market shifts, and alterations in investor behavior can all influence its application.

Despite these potential complexities, the efficient frontier remains an indispensable tool for those engaged in portfolio optimization and risk management.

Its enduring relevance stems from its ability to provide a structured and analytical framework for investors to make informed decisions about the composition of their portfolios, ultimately aiming to achieve their financial objectives while prudently managing the associated risks.

or Want to Sign up with your social account?