Hedge Ratio

It gives you a percentage value that indicates how much of your total investment is hedged

What is the Hedge Ratio?

Hedging is a type of financial strategy used to reduce the risk of your investments and protect yourself from losses. A hedge is an investment that reduces the risk of unfavorable price movements of assets by taking an opposing direction to your current investment.

Common hedging techniques are diversification or opposition, which counterbalance the original investment. However, with the reduced risk also comes reduced profits.

There is a trade-off between risk and reward. It is up to individuals to find a balance between how much risk they are willing to take on for certain rewards. But, most investors would rather combat unmeasurable losses and risks with some losses in profitability.

Hedging, in everyday words, can be seen as buying insurance to mitigate risk. If forest fires are prone in your area, you may buy extra insurance to protect, aka hedge, your house against the risk of a fire.

Thus, you are effectively buying yourself more protection, and while your house might never catch on fire, it’s better to be prepared than not.

Key Takeaways

- Hedging is a financial strategy that helps reduce investment risk by taking an opposing position to the current investment, similar to buying insurance to mitigate risk.

- There are two common hedging strategies: short hedge, used when expecting a decline in asset prices, and long hedge, used when anticipating an increase in asset prices.

- Hedging can be static (no changes to the hedged position) or dynamic (adjustments made to the hedged position), allowing investors to manage their risk exposure effectively.

- The hedge ratio is a mathematical calculation that compares the value of the hedge position to the total position, indicating the percentage of the investment that is hedged and protected from risk.

- The optimal hedge ratio, also known as the minimum variance hedge ratio, helps determine the optimal number of contracts to be bought or sold to minimize risk. It is used in cross-hedging strategies involving assets with positively correlated price movements.

Types OF Hedging

An understanding of the different types of hedges is needed to understand hedging ratios.

When hedging, investors can follow one of two strategies:

-

Short hedge

-

Long hedge

A short hedge is an investment strategy used when investors believe the price of an asset is going to decline in the future. It involves taking a short position in an asset that you already have a long position in or buying a derivative contract to hedge against potential losses by selling at a certain price.

A long hedge is an investment strategy used when investors believe the price of an asset is going to increase in the future. It involves taking a futures position on an asset in order to have price stability when purchasing. Long hedges are often used by manufacturers to reduce the risk of unstable prices for required parts.

Besides strategies, there are two main types of hedges:

-

Static

-

Dynamic

A static hedge is when the hedged position does not change, meaning hedging contracts are not bought or sold, even if there is a movement in the price of the hedged asset.

A dynamic hedge, on the other hand, is where the hedged position changes, meaning hedging contracts are bought and sold. This is done to bring the hedge ratio closer to the target ratio.

Understanding Hedge Ratio

This ratio is a mathematical formula that compares the value of a position that is being protected using a hedge to the value of the total position. It gives you a percentage value that indicates how much of your total investment is hedged. The percentage reflects the amount of risk your hedge covers or how much risk you are still exposed to.

It is an important statistical tool that can help mitigate risk and let investors make informed decisions. Furthermore, it is a relatively simple calculation that can advise one of their risk exposure.

It can also be used on futures contracts, which are investments that let individuals secure a set price of an asset for a future date. The ratio can compare the value of futures contracts to the value of cash or units being hedged.

For futures contracts, most people use the optimal hedge ratio, which is also known as the minimum variance hedge ratio. This ratio indicates the optimal number of futures contracts that should be bought or sold to maintain a position. In other words, how much of your investment should you hedge to minimize risk?

The optimal Hedge Ratio is often used when cross-hedging. Cross-hedging is a strategy used in futures contracts where investors use two assets with positively correlated price movements to manage risk.

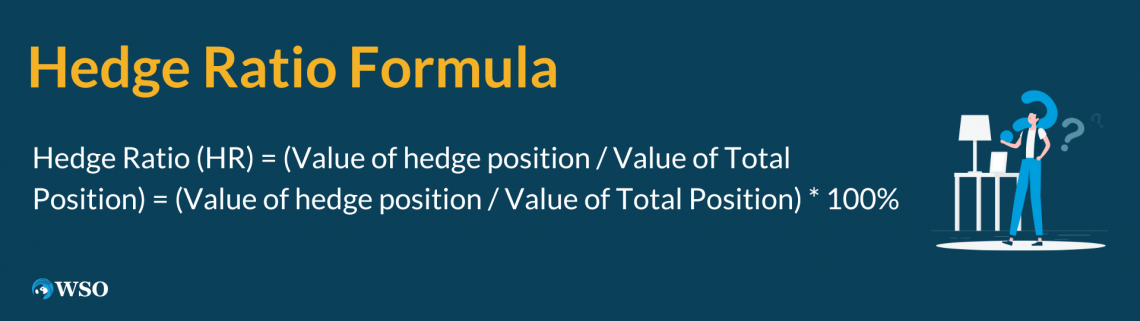

Hedge Ratio Formula

Hedge Ratio is a simple calculation that only involves two variables - the value of the hedge position and the value of the overall position.

Thus, this is the ratio between the value of the hedge and the total position. Assuming the value of the hedge position stands at $65 and the total position is $120. So the HR is 54.12%.

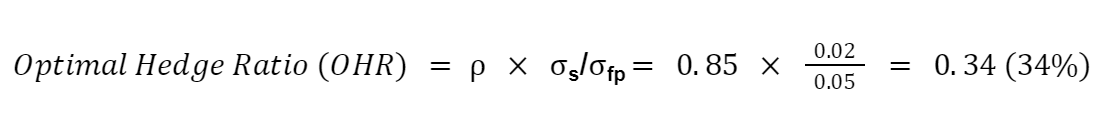

The other ratio, the optimal Hedge Ratio, is more complicated and uses three variables - the correlation coefficient of changes in spot and futures prices, the standard deviation of the changes in the spot price, and the standard deviation of the changes in the futures price.

Spot price and futures price are both quotes for a commodity contract. The main difference is whether it is effective immediately or sometime in the future. Spot prices are the current prices, meaning the payment and contract must be fulfilled on the spot, hence the name.

The futures price is the cost for that commodity sometime in the future, thus one is trying to secure a certain price for a contract that will be fulfilled at a later date.

Thus, the optimal hedge ratio, also known as the minimum variance hedge ratio, is the product between the quotient of:

σs / σfp and ρ.

In this case:

-

σs = spot price standard deviation

-

σfp = futures price standard deviation

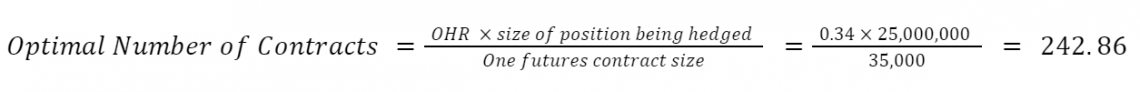

The optimal HR can be further used to calculate the optimal number of contracts needed to hedge a position and minimize the variance in your hedge.

The optimal number of contracts is calculated by taking the product of the optimal hedge ratio and the size of the position being hedged and then dividing that by the contract size of one futures contract.

Interpreting the Hedge Ratio

Since the calculation results in a ratio or percentage, using the formula will give an answer ranging between 0-1 or 0-100%. Both tell the same story.

A value of 1 or 100% means that the position is fully hedged. This means that the investment is fully covered, but this is difficult to obtain. As the ratio approaches 1, the risk associated with the asset decreases.

A value edging towards 0 means that the investment is not covered, and the risk associated with the asset increases. A value of 0 means that the investment is unhedged, meaning it has no protection.

For example, if the ratio comes out to 0.7 (or 70%), this means that 70% of the investment is hedged and protected from risk. The remaining 0.3 (or 30%) is unhedged and exposed to risk.

If the HR is closer to 0, for instance, 20%, this means that only 20% of the investment is protected from risk, and the remaining 80% is not.

In terms of the optimal HR, the answer will also range between 0-1 or 0-100%. This number indicates how much of your investment you should hedge.

Thus, a value of 1 or 100% means you should hedge the total value of your investment. As the ratio decreases, this means you need to hedge less of your investment to protect against and minimize risk.

Furthermore, the optimal numbers contract indicates how many contracts should ideally be bought to in order to hedge your position.

Hedge Ratio Examples

Here is a comprehensive example that will go through all the steps of calculating Hedge Ratio and the potential conclusions that can be made from them.

Note all the numbers are not accurate depictions of market conditions and are used solely for this example.

Investor A has a surplus of money and is looking to invest in a foreign market. Investor A decides to invest a total of $100,000 in China, but they know that dealing with a foreign market exposes them to currency risk.

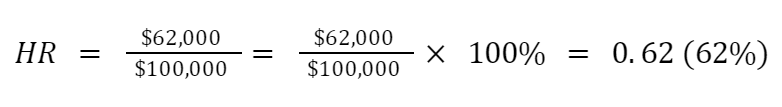

Thus, the investor decides to hedge their position to protect against potential currency devaluation losses. To protect against exchange risk, Investor A hedges $62,000 of its equity position.

| Value of the hedge position | $62,000 |

|---|---|

| Value of the overall position | $100,000 |

By hedging $62,000 of your investment, Investor A gets a ratio of 62%. This means that 62% of their investment is protected by currency risk, while the remaining 38% is not.

Now say that you want to calculate an optimal Hedge Ratio for a cross hedge. A common cross hedge is between crude oil and jet fuel prices that airline companies use to protect against price increases in jet fuel since they have a high correlation.

Let’s say the correlation between jet fuels and crude oil is 0.85. The standard deviation (SD) of crude oil futures is 5%, and the SD of the spot price of jet fuel is 2%.

The airline company would like to buy 25 million gallons of jet fuel in the next few months but want to hedge its position. The crude oil futures contract is 35,000 gallons.

| Correlation coefficient | 0.85 |

|---|---|

| The standard deviation (SD) of crude oil futures price | 5% |

| The standard deviation (SD) of spot jet fuel price | 2% |

| Size of the position being hedged | 25 million gallons |

| One futures contract size | 35,000 gallons |

Therefore, the optimal HR is 34%. This means that you should only hedge 34% of your investment.

The optimal number of contracts is approximately 243. This means that the airlines should purchase 243 crude oil futures contracts to hedge their position and minimize risk.

If this is a static hedge, then only 243 contracts would be hedged, and there would be no changes regardless of movements in price. However, if this is a dynamic hedge, investors can buy or sell more contracts in response to price changes.

Applications of the Hedge Ratio

To summarize, Hedge Ratio is a simple mathematical tool that investors use to determine their risk exposure and has several uses.

1. Statistical tool

The ratio is used as a measure of how much risk an investor faces related to specific investments, and how much hedging a certain position would help protect against that risk. The higher the ratio, the less exposed an investor is to risk.

2. Guiding Measure

Since the ratio informs investors of the potential risk of investments, it serves as a guiding measure that individuals can use to make decisions. Depending on the type of investor you are, it can help you determine what position you want to take on.

For instance, a risk-averse investor may want to limit their exposure as much as possible, even at the cost of forgoing some profit. While another investor may choose to take more risk for the chance at a greater reward.

The ratio is an important calculation used to reduce and mitigate risk, and plan investments.

Hedge Ratio FAQs

While there is not a good hedge ratio per se , an investor can calculate the optimal HR and an optimal number of contracts by using their receptive formulas.

In general, a higher HR indicates that more of the investment is covered and there is less risk. Depending on the type of investor you are, you are able to strive for a suitable hedge ratio.

It would not make sense for the hedge ratio to be negative since the inputs are dollar values. However, the optimal HR can be.

Since standard deviation can’t be negative, this would mean that the correlation coefficient is. A negative correlation coefficient indicates a negative relationship between the spot price and the futures price.

Mathematically, both the HR and the optimal HR can be greater than 1, but it would not make much sense. As an investor, you would not hedge more than 100% of your investment because all the risk is already covered and the extra does not help.

In terms of optimal HR, you hedge more the closer is to 1 and the larger the variance of the standard deviations (s/fp). This could also mean the optimal HR is greater than 1.

Researched and authored by Pooja Patel | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?