Icahn Lift

The term is used to describe the increase in stock price that happens when seasoned investor Carl Icahn starts buying shares in the underlying business.

What is the Icahn Lift?

The Icahn Lift is a term related to activist and billionaire investor Carl Icahn. When Carl Icahn or other well-known activists publicly disclose a sizable investment in a company and declare their desire to influence its management or strategy, that company's stock price tends to rise.

Investors frequently respond favorably to Icahn's engagement because they think he will unleash shareholder wealth by exerting pressure on the business to make adjustments that will improve its performance and profitability.

This can involve pushing for managerial changes, asset sales, share buybacks, or other business decisions that might increase shareholder value.

The term "Icahn lift" underscores the idea that when Icahn becomes involved with a firm, his reputation and track record can increase investor confidence and raise the stock price.

It's crucial to remember that not all instances of activist involvement result in positive outcomes and that there are dangers and unknowns in such circumstances.

Key Takeaways

- The "Icahn lift" refers to the increase in a company's share price attributed to the involvement of activist investor Carl Icahn as a major stakeholder.

- Icahn builds up a sizable stake in a business he thinks is undervalued and then publicly explains the reason (along with his suggestions).

- Billionaire investor Carl Icahn has adopted the contrarian investment approach by purchasing shares of companies that "no one wants."

Understanding the Icahn Lift

The term "Icahn lift" describes the increase in a company's share price that results from Carl Icahn, a prominent activist shareholder, acquiring its stock.

There are several theories as to why the Icahn lift occurs:

1. Recognition of Undervaluation

Many other investors think Icahn has discovered an undervalued firm because of his reputation as a successful investor.

2. Pressure for Change

Icahn's public campaigns for change may put management under pressure to act, which may result in improvements for the business and its shareholders.

3. Management Improvement

The stock price may also increase due to Icahn's propensity to take over businesses that he thinks are not being handled well.

The stock price usually appreciates when word spreads that Icahn has invested in a company.

The market is aware that a seasoned investor thinks the firm is undervalued, and investors are aware that Icahn will exert significant pressure on the company's management to run it more efficiently and in the interests of the shareholders (rather than the management).

Icahn's reputation frequently attracts institutional investors to follow his lead, further boosting share prices due to increased interest.

His standing means that once he sets his sights on a firm, institutional investors follow his example and invest in his chosen company. The share prices climbed as a result of the higher interest, giving Icahn a boost.

It is crucial to remember that there are hazards associated with the Icahn lift. Icahn's change-related campaigns can be expensive and disruptive for businesses. The stock price can also decrease if Icahn's attempts to influence a corporation are ineffective.

Brief Backgrounder on Carl Icahn

Carl Icahn is an American investor, businessman, and philanthropist. He was born in Queens, New York in 1936. Carl Icahn gained his fame because of his corporate raiding in the 1980s. He is considered one of the best and most powerful figures in the financial world.

He targets underperforming companies through aggressive investing methods to effect positive transformation and raise shareholder value. Icahn's wealth skyrocketed throughout his corporate raiding career, accumulating an impressive $10 billion in assets.

Icahn founded Icahn Enterprises, where he is a major shareholder in the firm and served as an economic adviser to President Donald Trump in 2017.

Icahn's strategy, which places a significant emphasis on value creation, includes shareholder activism as a crucial component. He works closely with a company's management to enhance performance and increase shareholder value.

His core theory centers on using management intervention to improve corporate governance and strategic objectives.

Examples of the Icahn Lift

Some prominent examples of Icahn Lift are:

1. Apple Inc.

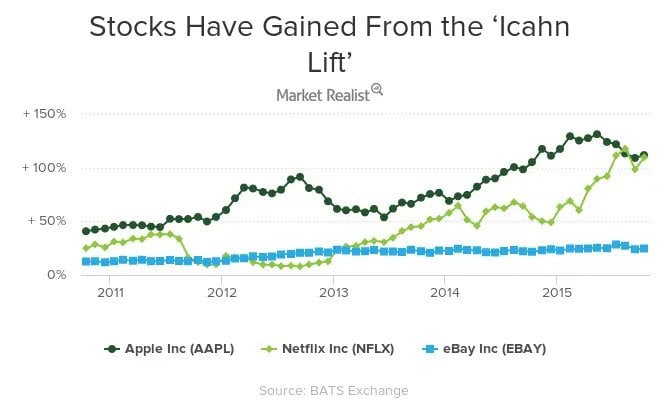

In 2013 and 2014, Carl Icahn began a conversation with Apple Inc. Icahn amassed a sizable holding in Apple in this lawsuit and publicly argued in favor of an aggressive share repurchase scheme to boost shareholder value.

Investors responded favorably to this action, which raised the price of Apple's shares significantly.

Investors expected higher share earnings and a more appealing investment. Icahn's lobbying led to Apple announcing a significant expansion of its share buyback program in April 2014, pledging to repurchase $30 billion worth of its shares and raising dividends.

Investors enthusiastically received the decision, and Apple's stock price saw an "Icahn lift."

2. Netflix

Another major example is when Carl Icahn said in 2012 that he owned 10% of the Netflix business. Within a day of making this news, the stock price of Netflix increased by 14%. The Icahn lift had a significant effect, causing Netflix's stock price to rise and reach previously unheard-of heights.

Icahn’s Influence on Corporate Decisions

Icahn also appears to have a keen eye for spotting promise in major Wall Street companies and profiting handsomely from them. He is renowned for his analysis of what a business ought to do. Icahn contributed to and was somewhat responsible for:

- Oracle’s (ORCL) takeover of the business intelligence development company BEA Systems

- Google’s acquisition of Motorola Mobility

- PayPal’s spin-off from eBay

The reputation of Carl Icahn on Wall Street is still unrivaled. Market analysts have observed that a company's stock price tends to increase when Icahn starts investing in it.

Conclusion

The "Icahn Lift" effectively illustrates the considerable power that activist investors like Carl Icahn may exercise in the financial industry.

This phenomenon, illustrated by Icahn's involvement with Apple Inc., demonstrates how a well-known investor's public involvement can boost market confidence and cause a significant increase in a company's stock price.

Activist shareholders can influence corporate choices and affect stock performance by promoting strategic changes predicted to increase shareholder value.

However, it is crucial to recognize that the "Icahn lift" is not without its complexities and uncertainties and that results may differ depending on the particulars of each instance.

The structure of Icahn's business is a master limited partnership. It is a diversified holding firm with operating divisions in the following seven sectors: investment, energy, automobile, food packaging, real estate, home fashion, and pharmaceuticals.

or Want to Sign up with your social account?