Multi-Asset Class

It refers to an investment that consists of multiple asset classes

What Is a Multi-Asset Class?

The term "multi-asset class" refers to an investment that consists of multiple asset classes (such as cash equivalents, equities, or bonds).

Such investment, also known as an investment strategy, always includes more than one asset class, resulting in a collection of assets that adds diversification to a portfolio.

The weights assigned to each asset class and the types of asset classes are often determined by the investor's preferences.

Its main goal is to increase portfolio diversification by distributing investments across multiple asset classes.

Rather than exposing an investor to the dangers of a single asset class, multi-asset portfolios invest across assets that are not perfectly correlated. This increases the portfolio's risk-reward potential and results in a less volatile investment experience.

Fund managers in these funds rebalance the portfolio based on market movements, taking profits from performing assets and lowering exposure to poor ones.

This reduces overall portfolio risk, also known as volatility, but may also reduce potential returns.

A multi-asset investor, for example, may invest in bonds, cash, equity, and assets, whereas a single investor may only invest in stocks.

In reality, one asset class may outperform for some time, but different assets have historically performed at different times and rarely occur simultaneously.

The different types include:

- Personal Portfolio: Investors with sufficient capital may elect to become their asset managers and construct a multi-class portfolio. Family offices also give their clients personal asset allocation based on the investor's preferences.

- Risk tolerance funds: These are funds that are designed for an investor's perceived risk tolerance.

- Target date funds: Some companies provide multi-asset class investments that vary asset allocations based on a time horizon.

- Hedge funds: Hedge funds employ a multi-asset class investment strategy, investing in both traditional and alternative asset classes.

- Multi-asset class investments blend various asset types like stocks, bonds, and cash equivalents to enhance portfolio diversification and mitigate risk.

- Target-date funds adjust asset allocation based on investors' time horizons, gradually shifting towards more conservative strategies as the target date approaches.

- Benefits of multi-asset investing include capturing market opportunities, cushioning against downturns, and achieving steadier returns through diversified assets.

- While multi-asset funds offer advantages like volatility management, they may underperform single-asset funds in certain market conditions and often come with higher management fees.

The growth of multi-asset investing

Such investing has become increasingly popular in recent years. This is due to several driving factors, such as:

1. The global financial crisis in 2008

This event demonstrated to investors that just diversifying your portfolio with shares and bonds was insufficient to avert a significant loss of wealth.

Equities and bonds dropped in lockstep, prompting investors to seek alternative options that were diversified and blended a wider variety of less tightly correlated asset types.

2. A focus on investors' solutions

As investors seek assets that may satisfy their objectives, there has been a rise in demand for a more outcome-focused investment approach.

These might take the shape of a steady income, a combination of capital growth and income, or total returns.

3. Demand for an off-the-shelf solution

Multi-asset funds enable investors to delegate all investing choices to a professional, who will manage their assets in accordance with a predetermined result and risk level.

This has proven especially successful in wholesale, freeing financial advisers to focus on customer relationships and other aspects of their business models, such as financial planning.

Multi-asset class investments often encompass equities, fixed income products, real estate, commodities, and alternative investments like hedge funds or private equity, providing a broad investment scope.

4. Current market conditions

Due to the changing economic and political environment and increased market volatility, investors have turned to multi-asset funds to help them navigate these choppy waters.

5. The shift from active to passive management

Segregated, index-based investment mandates and index-tracking mutual funds and exchange-traded funds (ETFs). This move has given investors relatively easy and low-cost access to a broader range of asset types.

As a result, the breadth of passive investing alternatives in asset classes formerly the domain of active managers, such as emerging market debt, commodities, real estate, and infrastructure, has grown significantly during the last two decades.

6. Constructing portfolios using risk premia

This pattern illustrates the emerging agreement that factor risk premia, whether in stocks or other asset classes, drive the majority of long-term investment outcomes.

As a strategic asset allocation aim, a popular former strategy for such investment would have emphasized a 60% - 40% split between equities and bonds.

Asset allocation in a multi-asset class portfolio is carefully calibrated to meet an investor's financial goals while diversifying risk across various market segments.

However, investors currently seek to include a greater range of systematic risk strategies into their long-term asset allocation and target the corresponding risk premia.

This has increased managers' ability to assess diversification across risk spectrums other than the typical asset class range.

Risk tolerance funds

Many mutual funds offer asset allocation funds designed to perform based on the investor's risk tolerance. The funds are available in various styles, from aggressive to conservative.

When an investor's risk tolerance is high, he or she will put a more significant percentage of their money into equities, sometimes as much as 100%.

When risk tolerance is low, investors can put their money into bonds, treasury notes, and fixed income, considered less risky than equities.

An aggressive fund is the Fidelity Asset Manager 85% Fund. The 85-15 rule ensures that 85% of funds are allocated to equities and 15% to other assets such as fixed income and cash.

For many conservative investors, the Fidelity Asset Manager 20% Fund, which has 20% stocks, 50% fixed income, and 30% short-money market funds, may be a better option.

A well-constructed multi-asset class portfolio can enhance risk-adjusted returns by harnessing the unique characteristics and cyclical behaviors of different classes in varying market conditions.

The target-risk fund's manager ensures that the risk exposure of the fund is within acceptable limits.

Other companies that offer such funds include:

1. Black Rock-Global Multi-Asset Income Fund

- Invests in debt securities and assets that are dominated by various currencies

- Changes in the exchange rate may affect the fund assets

- Invests in certain emerging markets

- Invests in non-investment grade or unrated bonds

2. Capital Group - Capital Income Builder

- The objective is to achieve a current income level that exceeds US stocks' average yield and provides income growth.

- 75.8% in equity, 20.1% in fixed income, and 4.1% in cash equivalents

3. Morgan Stanley - Global Multi-Asset Opportunities Fund

- Seeks to provide an absolute return while actively managing portfolio risk

- Measured in euros

4. Wellington - Multi-Asset High-Income Fund

- Looks beyond traditional income-producing assets to provide alternate diversifying sources of return

- Volatility management and drawdown controls are integrated into the investment process.

Target date funds

These are funds that invest according to the investor's time horizon. This means that multi-asset funds will adjust their investment allocation based on the time horizon of their investors. As a result, investors usually choose a fund that matches their time horizon.

A target-date fund is for investors looking to invest for the long term and have a specific 'target date' in mind, such as retirement. When the 'target date approaches, this fund is meant to be used as an investment withdrawal plan.

For example, if an investor is not retiring or has a time horizon of more than 30 years, he or she would choose one of the 2052 or later target funds: the more recent the fund's launch date, the more aggressive the fund's initial investment strategy.

Multi-asset class portfolios are designed to optimize performance based on an investor's risk tolerance, investment objectives, and market conditions, offering a balanced approach to capital allocation.

A 2050 target-date fund typically invests over 85% to 90% in equities and the rest in fixed income.

As the target date approaches, the fund's allocation will typically shift to a more conservative approach, with a decrease in stock allocation and an increase in bond, cash, and cash equivalent allocations.

As a result, investors with a shorter time horizon may prefer to invest in recently matured funds. This would put more money into fixed income, lowering overall risk and concentrating capital preservation.

After reaching the target date, a target-date fund may or may not be terminated. Some investors may wish for the fund to be managed by fund managers in accordance with their revised investment objectives and policies on an ongoing basis.

Benefits of Multi-Asset Class Investments

Let us take a look at some of the pros of multi-asset class investments:

1. Market Volatility Advantage

Multi-asset managers can capitalize on market volatility by adjusting allocations across different asset classes in response to changing market conditions.

2. Upside Market Capture

By diversifying investments across multiple asset classes, investors can participate in the upside potential of various markets, including stocks, bonds, commodities, and real estate.

In times of market turbulence, the integration of multiple asset classes can foster portfolio stability and minimize the impact of severe fluctuations in any one area.

3. Enhanced Diversification

Multi-asset portfolios offer increased diversification benefits compared to single-asset portfolios.

By spreading investments across a range of asset classes with low correlations, investors can reduce overall portfolio risk and minimize the impact of adverse events in any single asset class.

4. Steadier Returns

The balanced allocation of assets in a multi-asset portfolio helps smooth out investment returns over time.

As different asset classes may perform differently in various market conditions, the combined effect is a more stable and consistent return profile, reducing the overall volatility of the portfolio.

Drawbacks of Multi-Asset Class Investments

The cons of multi-asset class investments include:

1. Complexity

Managing multi-asset class investments can be complex, requiring a deep understanding of various asset classes, their correlations, and how they interact with each other.

2. Increased Risk

While diversification across multiple asset classes can help mitigate risk, it also introduces new types of risk, such as correlation risk and liquidity risk. Correlation risk arises when assets within different classes move in tandem during market downturns, reducing the effectiveness of diversification.

3. Higher Costs

Additionally, maintaining diversified portfolios may require the use of various investment vehicles, such as mutual funds, exchange-traded funds (ETFs), and alternative investments, each of which may come with its own set of fees and expenses.

4. Performance Drag

In some cases, multi-asset class investments may underperform compared to a more focused portfolio, particularly during periods when one asset class significantly outperforms others.

Conclusion

Multi-asset class investing has emerged as a favored strategy for investors seeking diversification and risk management. By blending different asset classes, these investments offer the potential for steady returns while cushioning against market volatility.

The popularity of multi-asset investing continues to grow, driven by factors such as the aftermath of the 2008 financial crisis, evolving investor preferences for outcome-focused solutions, and market conditions marked by increased volatility.

Furthermore, the trend towards constructing portfolios using risk premia underscores the importance of incorporating diverse systematic risk strategies beyond traditional asset classes.

This approach offers managers increased flexibility in assessing diversification across risk spectrums, potentially leading to more robust long-term asset allocation strategies.

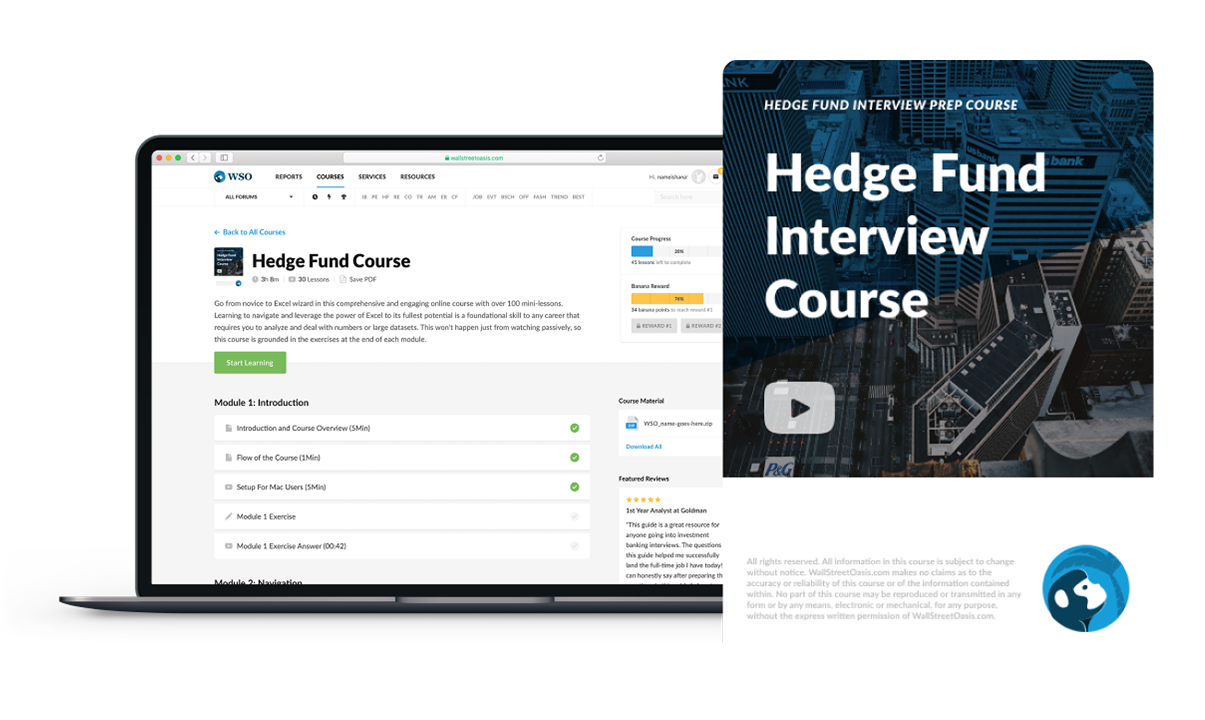

Everything You Need To Break into Hedge Funds

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?