NIFTY 50 Index

A benchmark stock Index of the top 50 companies as per the latest market capitalization listed

What is the NIFTY 50 Index?

Nifty 50 is a benchmark stock Index of the top 50 companies as per the latest market capitalization listed in the Indian stock exchange operated by the National Stock Exchange. It is owned by NSE Indices Limited.

It had an agreement with Standard and Poor’s for co-branding the Index until 2013. It is the world’s most actively traded commodity. It also has futures and options based overseas listing in the SGX Nifty, which is listed on the exchange Singapore.

The following is the weightage of particular services in the Nifty Index -

-

Financial services (39.47%)

-

Energy (15.31)

-

IT (13.01)

-

Consumer Goods (12.38)

-

Automobiles (6.11) and

-

Zero percent to the agricultural sector.

November 3rd of 1995 marked the completion of one year of operations from NSE. Thus, making it the base year with appropriation as 1000. As the companies grow in market capitalization, old companies become obsolete, and new companies enter the Index.

The Index has the most trade volume in the country, overtaking the Bombay Stock Exchange, the only other benchmark.

The benchmark was considered to be in line with the US Dow Jones; however, due to the rapid increase in the new startups in India and rapid economic expansion, the Indian Indices are finally seen as decoupling from the Western Markets.

Despite the slow decoupling of Indian markets, we cannot ignore the biggest fall in the Nifty 50 Index, which came in 1997 due to the Asian Financial Crisis. The Index fell 7.87% or 88.20 points because of the widespread contagion during the deregulation of the Thai baht.

However, the two next biggest falls are due to domestic national elections. Global conditions had a great degree of impact on the Indian markets as the economy was relatively new to globalization and at its primary stage before the early 21st century.

Nifty 50 also had an 8.70% fall, followed by a 5.94% fall after the US subprime mortgage crisis, famously known as the Global Financial Crisis of 2008. The Index has become somewhat of a stable instrument as it grows in market capitalization.

The parent company has rolled out many sectoral indices such as Nifty IT, Bank Nifty, Nifty Energy, and many more, which has eaten into the market share of the Nifty 50 Index in the Futures and Options market for Indices.

Nifty 50 can be summarized by saying that it is a benchmark index that consists of the 50 biggest blue-chip companies in the Indian market. The Index is rebalanced every year twice on the last date of January and the last date of July.

The top three companies with the highest displacement weight in Nifty as of the 3rd quarter of 2020 were HDFC Bank Limited, Reliance Industries Limited, and HDFC Limited. In 2021, The Nifty 50 had a market capitalization of little more than INR 136 Trillion (13.6 lakh crore rupees) or almost USD 1.8 Trillion.

Key Takeaways

-

It is the world’s most actively traded commodity.

-

The Index has the most volume of trade in India, overtaking the Bombay Stock Exchange, the only other benchmark.

-

Nifty 50 was considered to be in line with the western markets. However, due to the rapid increase in the new startups in India, it is finally seen as decoupling from the Western Markets.

-

The parent company has rolled out many sectoral indices such as Nifty IT, Bank Nifty, Nifty Energy, and many more.

-

It is a benchmark index that consists of the 50 biggest blue-chip companies in the Indian market.

-

It is rebalanced every year twice on the last date of January month and the last date of July month.

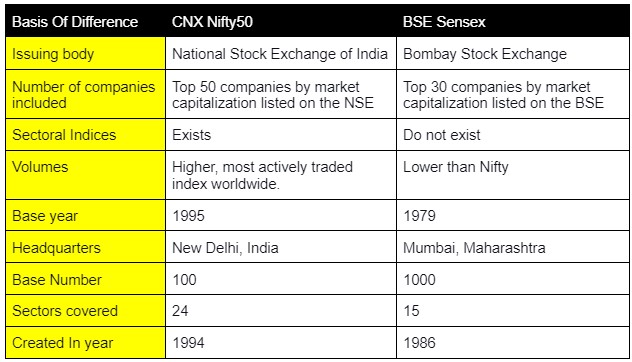

NIFTY 50 index Vs. SENSEX

Indian markets also have another Benchmark Index in the BSE Sensex. Sensex is one of the oldest and the most iconic market indexes today, which has been operational since 1986.

Sensex's name is derived from "SENSitive" and "IndEX." It is now referred to as S&P Sensex after it signed a branding agreement in 2013.

For decades, Sensex was the most prominent Index in the Indian Markets, representing the high-end liquidity of the Indian Markets. Somewhere around 2020, the market capitalization of the Sensex even crossed the GDP of the nation, which sparked nationwide concern.

Sensex does not have sectoral indices like the Nifty, which has multiple sectoral indices consisting of almost all the important sectors in the Indian economy.

The Sectoral Indices Of CNX

CNX also released many sectoral indices after the success of its main benchmark CNX Nifty, which all have also gained a positive market response.

Bank Nifty, Nifty IT, Nifty Metals, and Nifty Energy are the terms you constantly hear in Indian market analysts' mouths and on market news channels.

Sectoral Indices provide a more detailed and tailored benchmark view for Indian sector performance, whereas the Nifty50 and other broad Indices like Nifty100, Nifty200, Nifty500, etc.

They provide a broader view of the Indian markets as a whole and are also compared with the Indian economy as a whole.

Some more key points to note are:

-

Certain sectors react to certain news and situations differently, so Indies are used to getting a bird's eye view of the respective sectors.

-

Also, these sectoral derivatives are used to reap the benefits of sectoral movement along with selected stocks.

-

For example: If someone is bullish on the Banking sector in India and at the same time they are bearish on the IT sector, instead of just trading on the benchmark Nifty50, they can make positions in both the sectoral indices, Call on Bank Nifty and put on Nifty IT.

-

In these sectoral indices, some stocks carry a huge chunk of the index weight. Like the case of nifty metals, Tata Steel has a major chunk of weightage around the 20-22% mark, so high net worth investors can hedge their investments by investing in Nifty Metals rather than putting all their eggs in Tata Steel.

-

World Geopolitical events tend to impact a particular sector significantly, and these indexes can be used in times of global uncertainty.

-

Some stocks can perform well due to their fundamentals, but the Index is more predictable as it moves after considering the sector as a whole.

For example: If someone is bearish on the Fast Moving Consumer Goods(FMCG) sector and places a bet on some FMCG company but announces a merger with their biggest competitor, thus forming a cartel, now the stock will rally, but this will cause a loss to the investor.

Following are some of the different broad Indices of the Nifty and their symbols:

-

Nifty50 - NSEI

-

Nifty100 - NIFTY100

-

Nifty200 - NIFTY200

-

Nifty500 - NIFTY500

-

Nifty Next 50 - NN50

Following are some of the most prominent sectoral Indices of the Nifty and their symbols:

-

Bank Nifty - CNXBANK

-

Nifty IT - NIFTYIT

-

Nifty Energy - NIFTYENR

-

Nifty Metals - NIFTYMETALS

-

Nifty FMCG - CNXFMCG

-

Nifty Auto - CNX AUTO

-

Nifty Oil and Gas - CNXOILANDGAS

-

Nifty Pharma - CNX PHARMA

-

Nifty Media - NIFTY MEDIA

What Is The CNX VIX

NSE also launched the CNX VIX in 2014, which is a volatility index. It shows the market volatility at different points in time. It is linked to derivative and options trading in the Nifty, which shows how the markets are performing at a particular time.

Generally, a higher VIX indicates high market volatility, which can mean panic selling or bullish markets. Low or normal volatility shows that there is not so much movement in the market, and the markets are somewhat stable.

The Chicago Board Options Exchange(CBOE) was the first to initiate trading on a volatility index in 2004. Its popularity has grown immensely over the years, which is a good sign for the India VIX operated by the NSE, which is very similar to the one designed by CBOE.

Higher volatility provides a higher reward in the VIX.

Some more important indicators of VIX:

-

The symbol for this derivative is: INDIA VIX

-

A higher VIX, like 30, indicates that the Index will move between the range of +30 to -30 for 30 days. This indicates higher volatility.

-

Whereas a VIX score of 10 will indicate relatively less movement from the mean.

-

Whenever one is uncertain about the market conditions, they should use the VIX derivate to trade.

However, these indices are very confusing and difficult to master, and you can always have a head start with the help of our affordable quality courses available for a very limited time. Tune into our ecosystem for a better understanding of complex topics.

Researched and authored by Aditya Murarka | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?