Straddle

It is a trading strategy utilizing both call and put options with the same exercise price and expiry date

What Is a Straddle?

A straddle is a trading strategy that involves options. To use this strategy, a trader buys and sells a Call and a Put option simultaneously for the same underlying asset at a certain time, provided both options have the same expiry date and strike price.

Options trading is a strategy that allows an investor to bet on the price movement of a security without predicting the price movement’s direction. In other words, if investors think security will experience increased volatility, they can enter a long trading position to benefit from the security’s price change.

Let’s take an instance whereby an investor believes Tesla’s earnings will significantly impact its stock price and hence buys call and put options at the same strike price. Both expire 24 hours after the earnings announcement.

If Tesla’s shares move significantly above the strike price, you have the call option, which makes it possible for you to buy the shares at a lower strike price. Likewise, If Tesla shares move significantly below the strike price, you have the put option and can sell them at a higher strike price at a profit.

An overall profit is realized at expiry if the total move-in Tesla shares exceed the sum paid for the call and put option.

Understanding the importance of the financial market

We must first understand market volatility to understand why, how, and when we use the latter. Volatility is defined as fluctuations and variations in stock prices and is measured with statistical tools like standard deviation, variance, and beta.

These variations are very strong in the short and long term and intensify the probability of loss, thereby conveying risk. The variations stem from several factors that influence market movements.

However, using a combination of call and put options can use volatility to one’s advantage.

We can also say that buying a put-and-call option is a strategy that allows investors and traders to benefit from volatile markets.

Numerous sophisticated trading strategies, such as iron condors, are designed to help traders succeed regardless of whether the market moves up or down.

These sophisticated strategies require complex buying and selling of multiple options at various strike prices. The end goals are to make sure a trader can generate profits no matter where the underlying price of the stock, commodity, or currency ends up.

Fortunately, this strategy, one of the least sophisticated options, can accomplish the same objective with much less hassle. In addition, these trading strategies present a more practical way for traders since they only require purchasing or selling one put and one call to become activated.

Straddle Key Elements

This strategy involves the following:

- Either buying or selling of call/ put options

- The options should have the same underlying asset

- Options should be traded at the same strike price

- Options must have the same expiry date

We will analyze the two types of option trading strategies and understand how they can achieve their desired purpose.

Straddle Types

Some of the types are:

1. Long Straddle

This strategy involves buying a call and put option with the same underlying security, expiry date, and strike price.

The premium and commissions paid when buying the options comprise the cost of a trade. This is particularly used when the market is expected to show significant movements/ high volatility.

The investor can exercise the call option when the market increases and let the put option expire. Similarly, the investor can exercise the put option and let the call option expire if the market goes down.

For this strategy to be useful, the market must show large movements to yield adequate profits after covering trading costs.

In many long options trading scenarios, the investor believes that an upcoming news event ( for instance, an acquisition announcement or scandal) will push the underlying stock from low volatility to high volatility. The trader’s aim here will be to profit from the large move or fall in price.

2. Short Straddle

The latter is the reverse of the long trading strategy and is implemented by selling a call and put option with the same underlying security, strike price, and expiry date.

Here, the trader can collect the premium as a profit when selling the options.

Unlike its counterpart, a short trading strategy is useful if the market does not show any significant movement or volatility during the option tenure and the underlying security closes near the strike prices of the options sold.

When an unforeseen event shocks the market and results in high volatility, a short strategy will not be useful, and the total premium collected will be in jeopardy.

How to Create a Straddle

Let's understand how to create a straddle

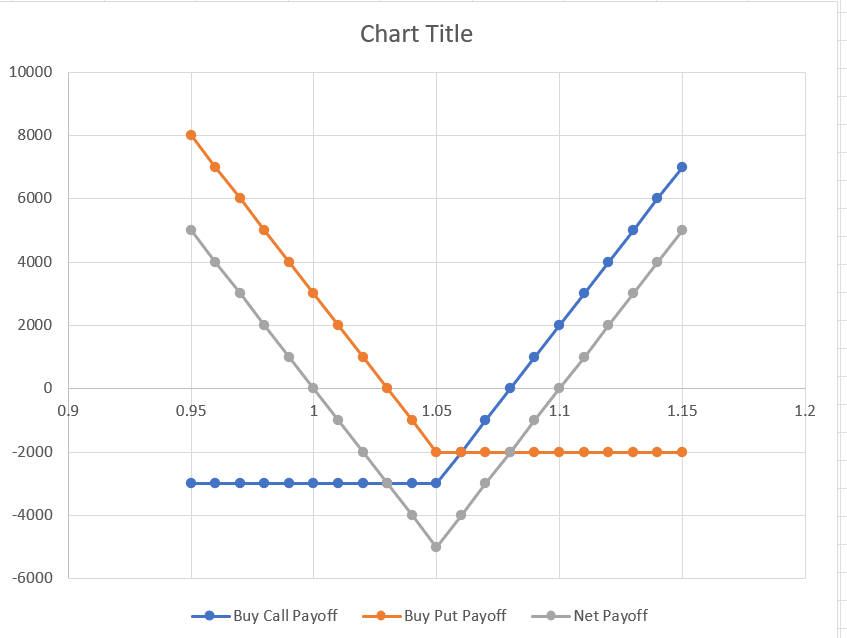

1. Constructing a Long option strategy

Example: A straddler finds that the put and call option for May 2019 Dollars with a Strike Price of $1.05/Euros is available at the following prices:

- Call option premium = $0.03 per unit

- Put option premium = $0.02 per unit

- One contract = 100,000 units

A straddler can construct the latter by buying the call option and the put option together.

| Long Straddle | |||

|---|---|---|---|

| Spot price | Buy Call Payoff | Buy Put Payoff | Net Payoff |

| 0.97 | -3000 | 6000 | 3000 |

| 0.98 | -3000 | 5000 | 2000 |

| 0.99 | -3000 | 4000 | 1000 |

| 1.00 | -3000 | 3000 | 0 |

| 1.01 | -3000 | 2000 | -1000 |

| 1.02 | -3000 | 1000 | -2000 |

| 1.03 | -3000 | 0 | -3000 |

| 1.04 | -3000 | -1000 | -4000 |

| 1.05 | -3000 | -2000 | -5000 |

| 1.06 | -2000 | -2000 | -4000 |

| 1.07 | -1000 | -2000 | -3000 |

| 1.08 | 0 | -2000 | -2000 |

| 1.09 | 1000 | -2000 | -1000 |

| 1.10 | 2000 | -2000 | 0 |

| 1.11 | 3000 | -2000 | 1000 |

| 1.12 | 4000 | -2000 | 2000 |

| 1.13 | 5000 | -2000 | 3000 |

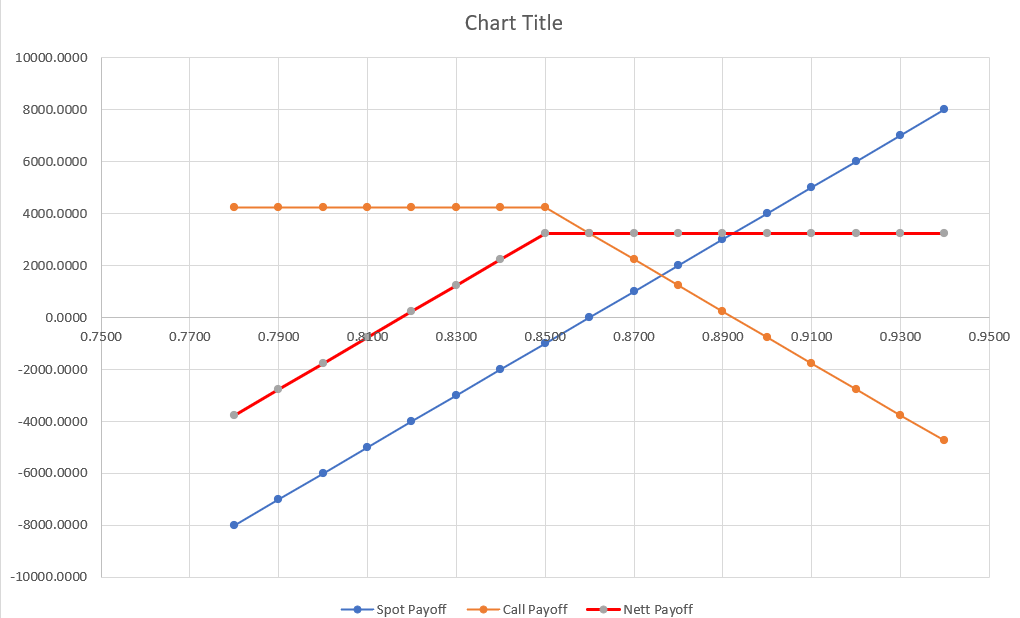

2. Constructing a Short trading strategy

A straddler finds that the put and call option for May 2019 Dollars with a strike price of $1.05/ Euros is available for the following prices:

- Call Option Premium= $0.03 per unit

- Put Option Premium= $0.02 per unit

- One contract= 100,000 units

A straddler can construct the latter by writing( selling) the call option and the put option together.

| Short Straddle | |||

|---|---|---|---|

| Spot price | Write Call Payoff | Write Put Payoff | Net Payoff |

| 0.95 | 3000 | -8000 | -5000 |

| 0.96 | 3000 | -7000 | -4000 |

| 0.97 | 3000 | -6000 | -3000 |

| 0.98 | 3000 | -5000 | -2000 |

| 0.99 | 3000 | -4000 | -1000 |

| 1.00 | 3000 | -3000 | 0 |

| 1.01 | 3000 | -2000 | 1000 |

| 1.02 | 3000 | -1000 | 2000 |

| 1.03 | 3000 | 0 | 3000 |

| 1.04 | 3000 | 1000 | 4000 |

| 1.05 | 3000 | 2000 | 5000 |

| 1.06 | 2000 | 2000 | 4000 |

| 1.07 | 1000 | 2000 | 3000 |

| 1.08 | 0 | 2000 | 2000 |

| 1.09 | -1000 | 2000 | 1000 |

| 1.10 | -2000 | 2000 | 0 |

| 1.11 | -3000 | 2000 | -1000 |

| 1.12 | -4000 | 2000 | -2000 |

| 1.13 | -5000 | 2000 | -3000 |

| 1.14 | -6000 | 2000 | -4000 |

| 1.15 | -7000 | 2000 | -5000 |

Understanding Long straddles

The profit potential is unlimited on the upside because the stock price can rise indefinitely. On the downside, the profit potential is substantial because the stock price can fall to zero.

The potential loss is limited to the total cost of the latter in addition to commissions. A loss of this amount is realized if the position is held to expiration and both options expire worthlessly.

It is the strategy of choice when the forecast is for a big stock price change, but the change direction is uncertain. The latter is often purchased before earnings reports, before new product introductions, and before FDA announcements.

These are typical situations in which good news could send a stock price sharply higher, or bad news could send a stock price sharply lower.

The risk is that the announcement does not cause a significant change in stock price and, as a result, both the call price and put price decrease as traders sell both options.

It is also important to consider that the price of calls and puts- and therefore the price of long option strategies- contains the census opinion of option market participants regarding how much the stock price will move before expiration.

The same logic applies to options prices before earnings reports and other announcements.

Dates of announcements of important information are generally published in advance and are well-known in the market. Therefore, those announcements will also likely lead to a dramatic change in stock price.

As a result, prices of calls puts and straddles frequently rise before such announcements. In the language of options, this is known as an “increase in implied volatility.”

A rise in implied volatility increases the risk of trading options as buyers have to pay higher prices and risk more.

For buyers of these options strategies, the higher the option prices, the farther apart are breakeven points, and consequently, the underlying stock price has to move further to achieve breakeven.

Sellers of short options strategies also face increased risk since higher volatility means a higher probability of a big stock price change and, therefore, a higher risk that an option seller will incur a loss.

“Buying a straddle” is intuitively appealing, given the scope of making money if the stock price fluctuates in either direction. However, the reality is that the market is often efficient, implying that prices of the latter are an accurate measure of how much a stock price is likely to move before expiration.

Like all trading decisions, we can say that buying a call and put option is highly subjective and requires good timing for both the buy and sell decisions.

Other considerations

Long straddles are often compared to long strangles, and traders frequently debate the “better strategy.”

Long trading strategies involve buying a call and a put with the same strike price. For instance, buy a $100 Call and a $100 Put.

Long strangles, on the other hand, involve buying a call with a higher strike price and buying a put with a lower strike price. For example, buying a $105 Call and a $95 put.

Neither strategy is better in an absolute sense. There are tradeoffs.

There are three advantages and two drawbacks to using the latter. The first advantage is when the breakeven points are closer together for a straddle than for a comparable strangle. Secondly, there is a lower probability of losing 100% of the latter’s cost if held till expiration.

Thirdly, they are less sensitive to time decay than long strangles. For instance, when there is little/ no stock price movement, they will experience a lower percentage loss over a given period than a comparable strangle.

The first setback of a long option strategy is that its cost and maximum risk are greater than for one strangle. Secondly, fewer can be purchased for a given amount of capital since they are more expensive than strangles.

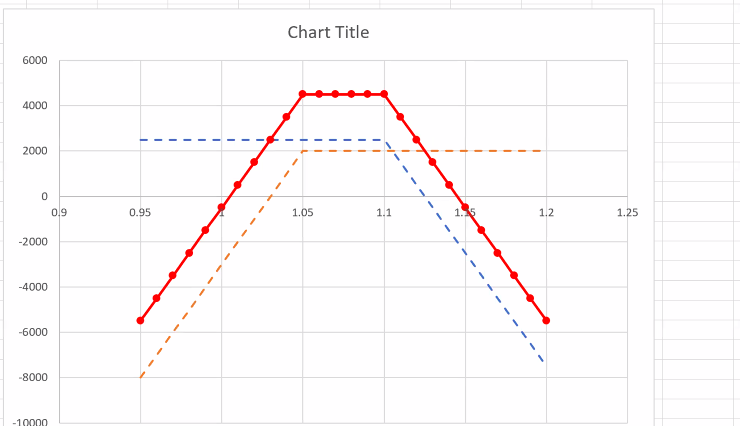

Understanding short straddles

The profit potential is restricted to the total premiums received minus commissions. A maximum profit is earned if the short option strategy is held to expiration, the stock price closes exactly at the strike price, and both options expire worthlessly.

The potential loss is unlimited on the upside because the stock price can rise endlessly. On the downside, the potential loss is substantial because the stock price can fall to zero.

The latter is the strategy of choice when the forecast is for neutral, or range-bound, price action. But unfortunately, they are often sold between earnings reports and other publicized announcements that have the potential to cause sharp stock price fluctuations.

We must remember that the prices of calls and puts- and therefore the prices of straddles- contain the consensus of options market participants regarding how much the stock price will move before expiration.

This means sellers of a short option strategy believe that the market census is too high and that stock prices will stay between the breakeven points.

Selling a straddle is intuitively appealing to some traders because you collect two option premiums, and the stock has to move by a high magnitude before you lose money.

The reality is that the market is often efficient, which means that prices of the latter are frequently an accurate measure of how much a stock price is likely to move before expiration.

Like all trading decisions, selling a put and a call option is subjective and requires good timing for both the sell and buy decisions.

Other considerations

Short straddles are usually compared to short strangles, and traders frequently argue which is the better strategy.

Short trading strategies involve selling a call and put with a comparable strike price. For example, sell a $100 Call and sell a $100 Put. Short strangles, however, involve selling a call with a higher strike price and a put with a lower strike price. For example, sell a $105 Call and sell a $95 Put.

There is one advantage and three setbacks when selling a put and a call option. The benefit derived from a short straddle is that the premium received and maximum profit potential of the latter is greater than for one strangle.

The first setback is that the breakeven points are closer together for the latter than for a comparable strangle. Moreover, the likelihood of a straddle reaching its maximum profit potential if it is held to expiration is lower than that of a strangle.

Thirdly, they are less sensitive to time decay than short strangles. As a result, when there is little or no stock price movement, they will experience a lower percentage profit over a given timeframe than a comparable strangle.

Straddle FAQs

It is possible to buy and sell with this strategy to make money. In a long option strategy, you buy both a call and a put option for the same underlying stock, with the same strike price and expiration date.

If the underlying stock moves significantly in either direction before the expiration date, you can make a profit.

The potential loss is limited to the total cost of the latter plus commissions, and a loss of this amount is realized if the position is held to expiration and both options expire worthless.

The riskiest of all option strategies is selling call options against a stock that you do not own. This is referred to as selling uncovered calls or writing naked calls. The only benefit you can gain is the amount of the premium you receive from the sale.

A fixed 12-month or longer expirations, Buying call options is the most profitable, which makes sense since long-term call options benefit from unlimited upside and slow time decay.

Researched and authored by Alvin Dookhony | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?