Timberland

It involves investing in land that produces timber or lumber

What Is a Timberland Investment?

Timberland investments involve investing in land that produces timber or lumber. Timber wood is classified into ‘Softwoods’ and ‘Hardwoods.’

Softwoods are used in plywood, pulp, and paper-related products, while hardwoods are used for furniture, construction, flooring, etc.

Investments can be directly into trees, forests, managed plantations, or even through investment firms that specifically deal in timber investments.

Investment in timber is seen as a good diversification for a portfolio as it is not highly correlated with stocks, bonds, or any traditional assets. It also provides a hedge against inflation.

As an investment, this can be classified into a few asset classes; at its core, it is essentially a commodity/natural resource investment. Being classified and viewed as a commodity is the reason it proves as a good hedge against inflation.

The reason commodities are a good hedge against inflation is because their prices tend to go up with rising inflation.

Land ownership is also a part of the investment, which makes it similar to putting money into real estate. Finally, the yields are very stable, so they can be valued as long-term bonds with stable cash flows.

The reason there is a constant yield and steady cash flow is because of the product. Timber and lumber have almost inelastic demand, meaning that the value of these products rarely changes with price or cost changes.

The United States is the largest producer, followed by other countries like China, Canada, Russia, etc. Russia has the largest forest cover of any country.

Along with direct investments, several other investment vehicles allow investments, such as ETFs, which are comprised of companies that own forests and produce timber-related products.

Understanding Timberland Investment

The reason timber is a popular investment is due to its inelasticity and various uses. Lumber, which has been in constant demand, continues to be in high demand with a steady rise throughout the years.

The reason for its constant demand is timber’s usage, which is in various products like paper and pulp, plywood, fuel, construction, furniture, decorative items, etc.

It also has very little correlation to the majority of the popular asset classes like stocks, bonds, and real estate. This attracts large investors like pension funds, sovereign funds, and even individual investors looking for diversification.

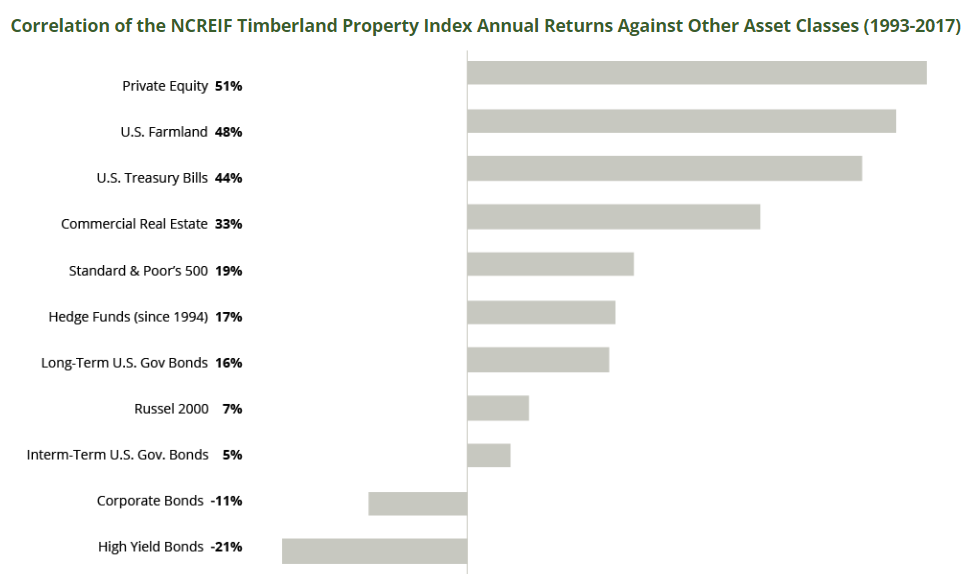

The above image showcases its correlation with other popular asset classes. It has shown the highest correlation between Private Equity and High Yield Bonds.

When compared with security market instruments like T-Bills, broad market indices, and long-term bonds, the correlation is relatively lower. This is what makes this asset a good addition to the portfolio for diversification.

Several ETFs and REITs specifically invest in it that also can be bought by investors. Assets like ETFs and REITs are good for retail investors with lower entry restrictions.

The iShares Global Timber & Forestry ETF is an ETF that primarily invests in companies that either own timberland or produce timber and forestry-related products.

Real Estate Investment Trusts (REITS) are similar to mutual funds, but instead of owning securities, their assets are invested in real estate, usually commercial. There are specific REITS for almost any type of land, such as timber REITs exclusively invest in this asset class.

Weyerhauser is a timberland REIT within the US with the largest value of total assets

The majority of this kind of investment in the US is owned by private individuals and families, followed by private investment corporations.

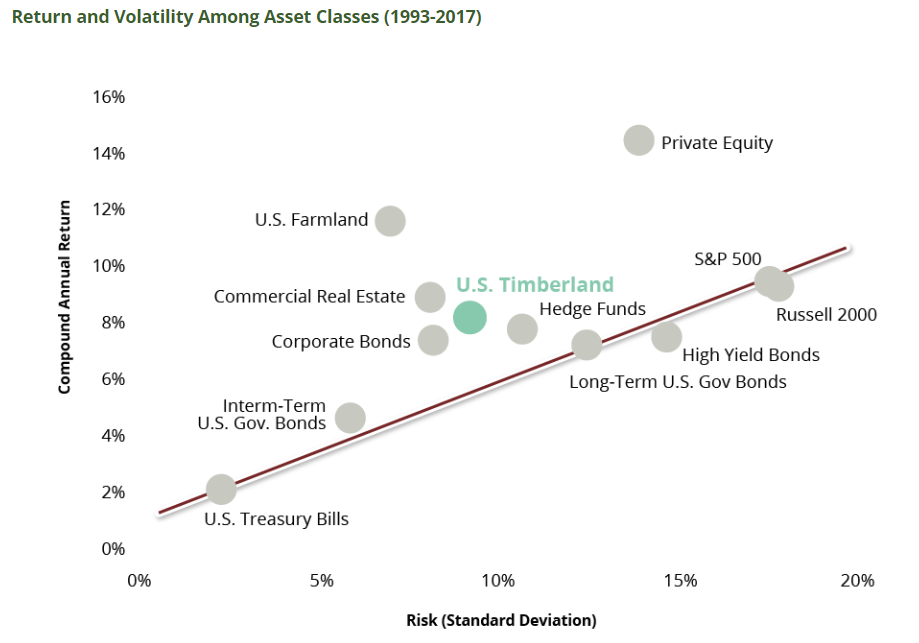

U.S. Timberland has managed to almost match the returns of the S&P 500 with a lower risk standard deviation. This means the timber has lower volatility compared to the S&P 500.

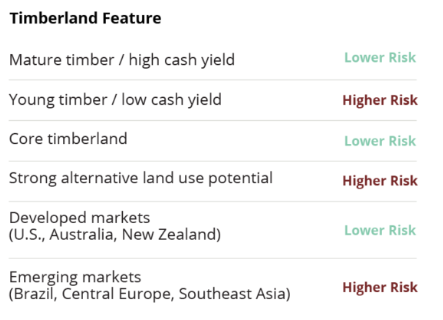

One thing to make a note of is that returns can vary depending on geographical location, maturity, and other factors.

Emerging markets like Brazil and Southeast Asia, which have tropical forests, have lower maturity periods as the trees grow quicker in a warmer climate and thus overall provide a higher appreciation.

This also comes with risks that are a product of other emerging market investments, like currency risk, political instability, etc.

Timberland Investment Mechanics

Timber is classifiable as a natural resource asset class. The natural resources asset class includes oil & gas, solar, minerals, etc.

As an asset class, it has shown lower volatility and better risk-adjusted returns than the majority of the popular assets.

It has provided slightly lower returns in comparison to assets like the S&P 500, the Russel 2000, Commercial Real Estate, and Private Equity (PE) funds, but it has shown lower volatility and steady cash flows, which is why it is looked upon favorably as an investment.

The major focus of this investment is capital preservation, strong yields, and lower volatility. This can be achieved because of the constantly growing demand for timber worldwide.

There are a few different types of appreciation and costs that come with this kind of investment. Also, softwood and hardwood trees have different maturity periods and applications, so they also need different production setups.

There are a few ways the investment appreciates.

Biological Growth

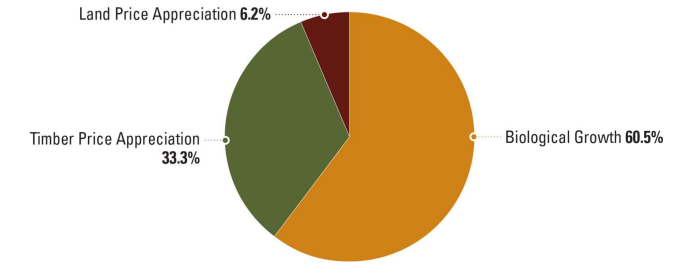

Biological growth accounts for the majority of the appreciation of the investment, and the asset class experiences biological growth from 2% to 8% per annum. The volume growth is stored in the stump of the tree.

Biological growth contributes to around 60% of the total appreciation of timber.

Biological growth is constant. This means that even if the harvest is postponed for a particular time due to unfavorable market prices, there will be some level of growth in the overall volume of the trees.

The aspect of biological growth is what gives timber its low risk and low correlation profile, as it will grow biologically at a steady rate regardless of the economic situation.

Another aspect of biological growth is that even though the volume and the output of timber produced increases, the storage costs don't as the volume is stored in the tree itself, and the trees do not expand outwards with age.

Older trees are typically used to produce high-value products, as mature wood is more durable and thus expensive.

Trees move up the financial value chain as they mature. Younger trees with diameters below 8 inches are used as pulpwood to manufacture paper, packaging, and pellets.

Trees with 8 -12 inches diameters are used to produce intermediate-value products like building panels, boards, etc.

Mature trees over 12 inches are used in high-value products like plywood, flooring, furniture, decorative veneers, etc.

Price Appreciation

Price appreciation contributes to almost 30% of the total growth in timber. Price, by far, is the most volatile aspect of timber.

As timber is used majorly in construction in the form of furniture wood, plywood, flooring, and in packaging, paper & pulp industries. The demand for the product is directly related to global economic activity.

As the per capita income rises, demand for wooden products, which usually are high-ticket items, will go up.

A variety of external factors like rainfall, business cycles, credit cycles, interest rates, and exchange rates affect the price of timber.

The major factors that affect pricing are the forces of supply and demand. Timber demand has barely been able to keep up with the supply, and the demand is projected to increase while the supply is expected to stagnate over the next years, which could drive up the prices.

One of the major reasons for the expected stagnation of timber is the reduction of forest cover due to urbanization.

In recent years, demand from the packaging industry, mainly sustainable packaging, which depends on recyclable materials like wood pulp, has shown an increase with the advent of e-commerce.

Paper and allied products are the lowest in the timber value chain giving about $8-$12 per tonne compared to other intermediate and high-value items poaching $17 - $30 per tonne. This may impact the overall yields if there is not enough volume.

Land Appreciation

Land appreciation contributes the lowest to the overall gain in timberland investment at about 6%

Land prices and appreciation vary according to the area. In some cases, land prices can shoot up a lot, even more, compared to biological and price appreciation.

Land prices historically have been stable, providing a buffer to the volatility of price movements.

The land value is only taken into account while either selling the entire investment or at the time of repurposing the area.

For example, if the forest land is closer to cities, the land can be repurposed for different uses, maybe building residential or commercial real estate. This can increase the overall value of the land substantially.

The current land prices in the US are between $800 per acre and $3000 per acre, with the northern US being at the lowest and the western being the highest.

Land appreciation is kind of like an added benefit that increases the book value of the total investment.

Risks of Timberland Investments

It is a low-risk investment that provides steady yields to its investors. Even though it is a relatively lower risk compared to other options, there are some limitations, drawbacks, and risks that come with this investment.

The risks faced are often due to external factors. Timber as a product is relatively very safe as there is a very low chance of damage, infection & or disease to the actual tree. The actual percentage of external damage is very low.

This is one of the reasons for the stability of this asset. Natural resources as an asset class are inherently less risky than other asset classes available.

The most prominent risks faced by this asset class are

-

Liquidity Risk

-

Currency Risk

-

Product Risk

These risks are common with natural resource assets due to their global demand and large-scale capital needs.

Below we will look at how each of these risks can affect the asset and how to mitigate those risks.

Liquidity Risk

The market for timberland is very illiquid, as the majority is held by individuals and families.

Another reason for liquidity risk is that investment horizon products like mature timber take over 20 years, and even lower duration products like paper and pulp require the trees to be at least 8 - 10 years old.

This creates a major issue as this does not fit the investment horizon of many investment vehicles, e.g., PE funds that have five years.

Even though many other investment vehicles like pension funds and funds specifically buying timberland exist due to the lower number of buyers and sellers, the market is overall very illiquid.

This creates liquidity risk, as the investment cannot be immediately sold. Liquidity risk asks for a higher yield and is discounted at higher rates.

If an investor is looking at timber as an investment, they should expect the holding period to be beyond a decade.

It is difficult to hedge against liquidity risk because the investment does not have any correlation with popular asset classes. So they have a higher yield compared to other more liquid assets of the same duration, like long-term US Bonds.

Currency Risk

It is a global industry with demand and supply coming from all over the globe, so it is expected that currency risk will be a big part of this investment.

Global production is concentrated in the countries of the US, Canada, Russia, New Zealand, Australia, China, SE Asia, Brazil, and Eastern Europe.

These countries produce timber, but the usage is not similar as the type of trees varies from region to region. This means they cannot dictate the price like OPEC does with oil.

As they cannot set a fixed price, all of these countries as globalized and thus are exposed to currency risk.

The best way to mitigate currency risk is through future contracts. Almost all the contracts made are over-the-counter (OTC) contracts, which means they don't trade on the exchange as they are personalized to fit the quantity and the type of product where a future price is set.

Another way to hedge against currency risk is to buy/sell the currency. For example, if someone in Australia is selling its timber to a buyer in the USA worth $10 Million.

The seller will lose money if the USD goes down compared to the AUD, so the seller will take a long position worth $10 Million in USD-AUD currency swaps to mitigate the risk.

Currency risk is the easiest to mitigate, either through currency hedging, setting a future price, or both.

Another way is to reduce the currency risk through geographical diversification, which means the exchange rate of certain countries won't have a strong influence on demand and sales.

Product Risk

The product timber is also exposed to certain risks. The product risk is the damage caused to the timberland by fires, infestation, disease, theft, etc.

The risk varies considerably depending on the geographical region.

This risk is negligible as disease and infestations are minor and only affect a small percentage of the overall product. Theft is difficult as the sheer size and volume are very large for a large-scale theft to happen.

Finally, natural calamities and events like forest fires can be insured against. Geographical diversification is also a way to counter product risks.

Other than a liquidity risk, other risks can be easily mitigated through either geographical diversification or hedging.

Liquidity risk also gives a higher yield which can be considered mitigation as the asset itself is not risky, but the yield available is similar to higher-risk instruments.

This is the reason why it is considered a popular asset used by large pension funds and other investment firms to lower portfolio risk through diversification without compromising returns on a risk-adjusted basis.

or Want to Sign up with your social account?