Trading Curb

A Trading Curb is a regulatory mechanism that stock exchanges use to halt trading when the market experiences significant price declines temporarily.

A Trading Curb, also known as a “circuit breaker," is a regulatory mechanism that stock exchanges use to halt trading when the market experiences significant price declines temporarily.

Trading Curbs are designed to allow the market to settle when it is shaken by extremely high volatility. Trading is halted momentarily to give market players time to plan their responses to major and unexpected changes in market indices or particular stocks when the restrictions are relaxed.

The rules for implementing circuit breakers vary by exchange and may be determined by the regulatory body overseeing the exchange. However, they generally apply to stock and securities markets like exchanges, ETFs, and options contracts.

However, circuit breakers generally do not apply to futures contracts because they have their mechanisms for managing volatility.

For example, they may use different mechanisms, such as price or position limits, to manage market movements and prevent extreme price swings. Since then, they have been used several times to prevent market crashes and reduce volatility.

When the thresholds are breached, the circuit breaker mechanism is activated, and trading is temporarily halted or limited for a specified period.

What are the Trading Curb Objectives?

The primary objectives of trading curbs are:

1. Provide time for investors to digest new information.

During intense market movements, it can be challenging for investors to process rapidly changing information.

The circuit breakers allow for a temporary pause, enabling participants to assess the situation, evaluate risks, and make informed decisions.

2. Prevent market manipulation and excessive price volatility.

Sudden, extreme price fluctuations can create an environment prone to market manipulation and irrational trading behavior.

Trading curbs help mitigate such risks by limiting the speed and magnitude of price movements, preventing excessive volatility.

3. Reduce the impact of panic selling or buying.

When markets experience sharp declines or surges, investors may react impulsively, resulting in panic selling or buying.

Trading curbs can interrupt this behavior, giving market participants time to regain composure and make more rational trading decisions.

- Trading curbs are measures by stock exchanges to pause or halt trading temporarily in response to significant market movements or volatility.

- Circuit breakers are designed to stabilize markets and prevent massive sell-offs or crashes.

- Circuit breakers have faced criticisms and controversies, including concerns about their effectiveness, unequal treatment of investors, and potential disruptions to market efficiency.

- Circuit breakers' future will likely involve improvements and evolving strategies considering these criticisms and controversies.

- Future directions for circuit breakers include using dynamic circuit breakers, improving transparency, international coordination, technology, and balancing efficiency and stability.

- Ultimately, circuit breakers must strike a balance between market efficiency and stability and be designed not to disadvantage certain investors or hinder market efficiency.

History and Evolution of Trading Curb

The idea behind the trading curb is to give investors time to assess the situation and prevent panic selling, which can exacerbate market declines.

The first trading restrictions were implemented in the 1980s due to a series of market collapses, notably the 1987 stock market crisis. The New York Stock Exchange (NYSE) established the trading curb, the first trading restraint, in 1988.

The Circuit Breaker was activated when the Dow Jones Industrial Average (DJIA) dropped by 250 points, indicating a 10% decrease, the Circuit Breaker was activated. Trading would then be halted for 30 minutes, giving investors time to assess the situation.

In 1997, the NYSE introduced a revised version of the Circuit Breaker, which was triggered when the DJIA fell by 10%, 20%, or 30%. Trading was suspended at each level for progressively longer intervals of time.

For example, a decrease of 10% stops trading for half an hour, whereas a decline of 30% would suspend trading for the rest of the trading day.

After the stock market collapsed in 2008, the Securities and Exchange Commission (SEC) applied new rules into a place known as the Limit Up-Limit Down (LULD) Plan.

The LULD Plan replaced the existing circuit breakers system and introduced new price bands for individual stocks, which would trigger trading halts if breached.

Today, trading curbs are widely used by stock exchanges worldwide to maintain market stability and prevent panic selling.

The rules and mechanisms used by each exchange may vary. Still, the goal is always to provide a time-out for investors to assess the situation and prevent irrational decisions that could lead to further market declines.

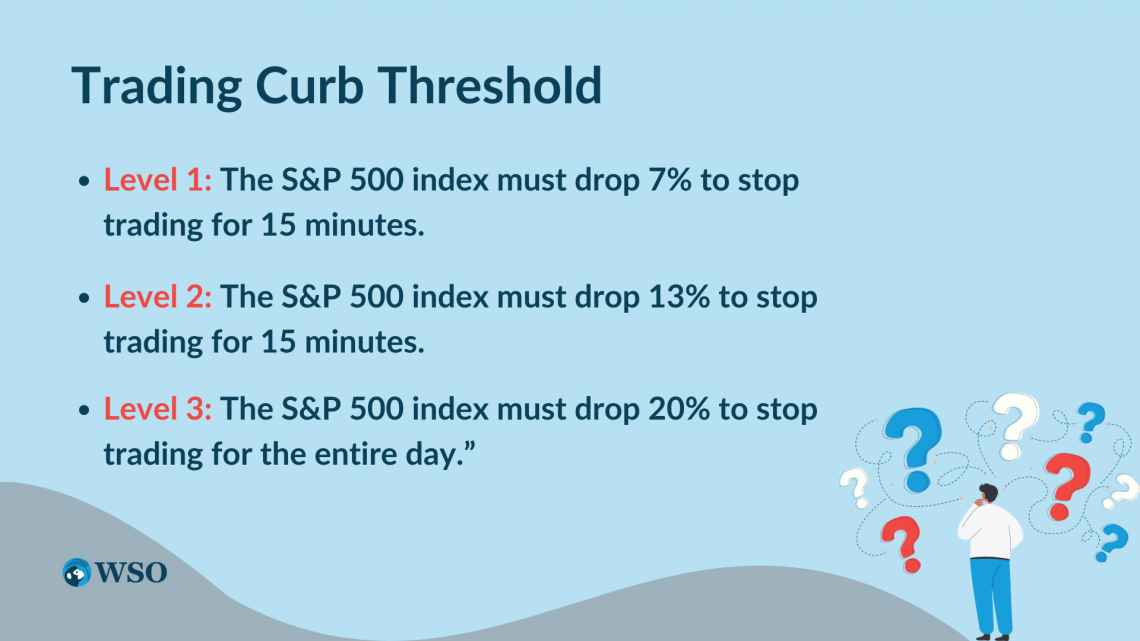

Trading Curb Threshold

The U.S. Securities and Exchange Commission (SEC) sets Circuit breaker thresholds for the major stock exchanges. The S&P 500 index serves as the basis for the current thresholds for the NYSE, Nasdaq, and other US exchanges, which are triggered at three distinct degrees of decline:

- Level 1: The S&P 500 index must drop 7% to stop trading for 15 minutes.

- Level 2: The S&P 500 index must drop 13% to stop trading for 15 minutes.

- Level 3: The S&P 500 index must drop 20% to stop trading for the entire day.

These thresholds are designed to provide a measured response to market volatility and prevent panic selling that can lead to market crashes.

When a circuit breaker is triggered, trading is halted for a set period, allowing investors to reassess their positions and prevent further panic selling.

It's important to note that circuit breakers are not foolproof and may not prevent market crashes in all circumstances. Instead, they are designed to temporarily pause trading, allowing investors to regroup and assess market conditions.

In addition, some market participants have criticized trading curb for creating a false sense of security among investors and potentially exacerbating market volatility by creating a rush to sell before a trading halt is triggered.

Despite these criticisms, circuit breakers remain key in managing market volatility and preventing extreme price swings.

Moreover, as markets evolve, circuit breaker thresholds and other regulatory mechanisms will likely continue to adapt to meet the challenges of an ever-changing financial landscape.

Trading Curb thresholds are the specific price or percentage declines that trigger a temporary halt in trading. Based on historical market data and statistical analysis, exchange officials determine these thresholds in consultation with regulators.

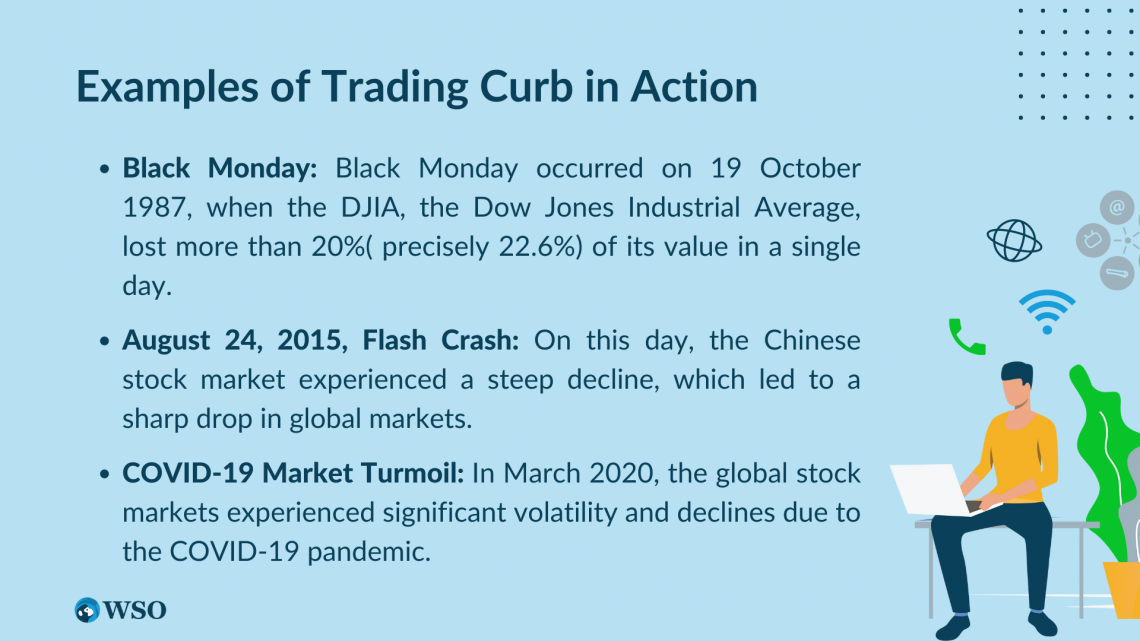

Examples of Trading Curb in Action

These are just a few examples of circuit breakers in action during past market crashes and flash crashes. As a result, circuit breakers and price limits have become a common strategy for managing market volatility and preventing further declines.

1. Black Monday

Black Monday occurred on October 19, 1987, when the DJIA, the Dow Jones Industrial Average, lost more than 20% (precisely 22.6%) of its value in a single day.

To prevent panic selling and further market destabilization, the New York Stock Exchange (NYSE) implemented a trading curb known as a "circuit breaker" that halted trading for 30 minutes if the DJIA fell 250 points (10%) or more from the previous day's close.

2. August 24, 2015, Flash Crash

On this day, the Chinese stock market experienced a steep decline, which led to a sharp drop in global markets.

In response, the New York Stock Exchange implemented its trading curb rules, which halted trading for 15 minutes if the DJIA fell by 1,300 points.

The Nasdaq also implemented similar measures to prevent further market instability.

3. COVID-19 Market Turmoil

In March 2020, the global stock markets experienced significant volatility and declines due to the COVID-19 pandemic.

To avoid more panic selling and market volatility, several stock exchanges across the globe, which includes the NYSE and Nasdaq, installed circuit breakers that suspended trading for 15 minutes if the S&P 500 Index plummeted by 7% or more from its prior close.

How Trading Curb Affect Market Volatility

Circuit breakers can have both positive and negative effects on market volatility. While they can initially exacerbate market volatility, they can ultimately help stabilize the market by providing a "cooling off" period.

Circuit breakers can have both positive and negative effects on market volatility. Let's examine how Circuit breakers can impact market volatility:

1. Initial Volatility

Circuit breakers can initially exacerbate the situation when there is a sudden and sharp decline in stock prices or a sudden upsurge in market volatility.

Investors who may have panicked and sold their shares may think before doing so if they believe the circuit breakers will prevent them from being able to sell later.

2. Reduced Volatility

However, the trading curb can ultimately lead to reduced market volatility by allowing time for investors to regroup and assess the situation.

Circuit breakers, for example, provide a "cooling off" period that can prevent panicked selling and help stabilize the market.

3. Uncertainty

Circuit breakers may make it exceedingly difficult for traders to forecast when they can purchase or sell shares by causing uncertainty and unpredictability in the market.

This uncertainty can lead to lower liquidity, further exacerbating market volatility.

4. Reduced Confidence

Lastly, circuit breakers can undermine investor confidence in the market's functioning ability.

Investors may lose trust in the market's stability and become less eager to invest, increasing market volatility if they believe that trading limits are imposed too frequently or excessively restrictive.

Criticism of Trading Curbs

While trading curbs have been implemented to stabilize markets and prevent massive sell-offs or crashes, they have also faced criticisms and controversies.

While circuit breakers have been implemented to stabilize markets and prevent massive sell-offs or crashes, they have also faced criticisms and controversies. Some of these include:

1. Limiting Market Efficiency

Critics argue that circuit breakers hinder market efficiency by limiting the ability of market participants to buy and sell stocks freely.

By halting trading when the market experiences sharp movements, investors may be prevented from taking advantage of pricing discrepancies, resulting in lower liquidity and market efficiency.

2. Delayed Reaction

Trading curbs may also delay the reaction of market participants to market developments. By pausing trading, the market is prevented from responding to new information, which could lead to a delayed reaction and potentially even larger price movements when trading resumes.

3. Unequal Treatment

Another criticism of circuit breakers is that they can create unequal treatment among market participants.

Some investors could be able to sell their holdings before the trade is halted if a certain stock or group of stocks results in a trading restriction, while others might not. As a result, different investors may be treated differently, which might be viewed as unjust.

4. Lack of Transparency

There are also concerns about the lack of transparency surrounding circuit breakers. Some detractors contend that investors may not fully comprehend the regulations controlling circuit breakers, which might cause confusion or even panic in the case of a market crash.

5. Market Disruptions

In some cases, circuit breakers themselves can cause market disruptions. For instance, if a circuit breaker trips and trading is suspended, there may be a backlog of orders that must be completed when trading is allowed to restart.

This could cause further volatility and disruption in the market.

6. Effectiveness

There are also questions about the effectiveness of circuit breakers in preventing market crashes.

While some argue that they help prevent panic selling and stabilize markets, others argue that they may delay the inevitable and even exacerbate market volatility in the long run.

The Future of Trading Curb

The future of trading curb will likely involve improvements and evolving strategies considering the criticisms and controversies at these measures. Some possible directions for the future of circuit breakers include the following:

1. Dynamic Circuit Breakers

One potential improvement to circuit breakers is the use of dynamic circuit breakers. These circuit breakers are triggered based on a more nuanced set of criteria considering trading volume, volatility, and order imbalances.

By using a more sophisticated approach to circuit breakers, exchanges can prevent market disruptions while allowing trading to continue under normal conditions.

2. Transparency

Improving transparency around circuit breakers is another area of potential improvement.

By providing investors with clear and easy-to-understand information about the rules and criteria that trigger circuit breakers, exchanges can help to reduce confusion and panic during market downturns.

3. International Coordination

There is also a growing need for international coordination regarding circuit breakers. Exchanges and regulators should collaborate to provide uniform and efficient market volatility management solutions in an increasingly globalized financial sector.

4. Technology

Technology plays a role in the future of circuit breakers. For example, advances in artificial intelligence and machine learning could allow exchanges to develop more sophisticated algorithms for detecting market anomalies and triggering circuit breakers.

or Want to Sign up with your social account?