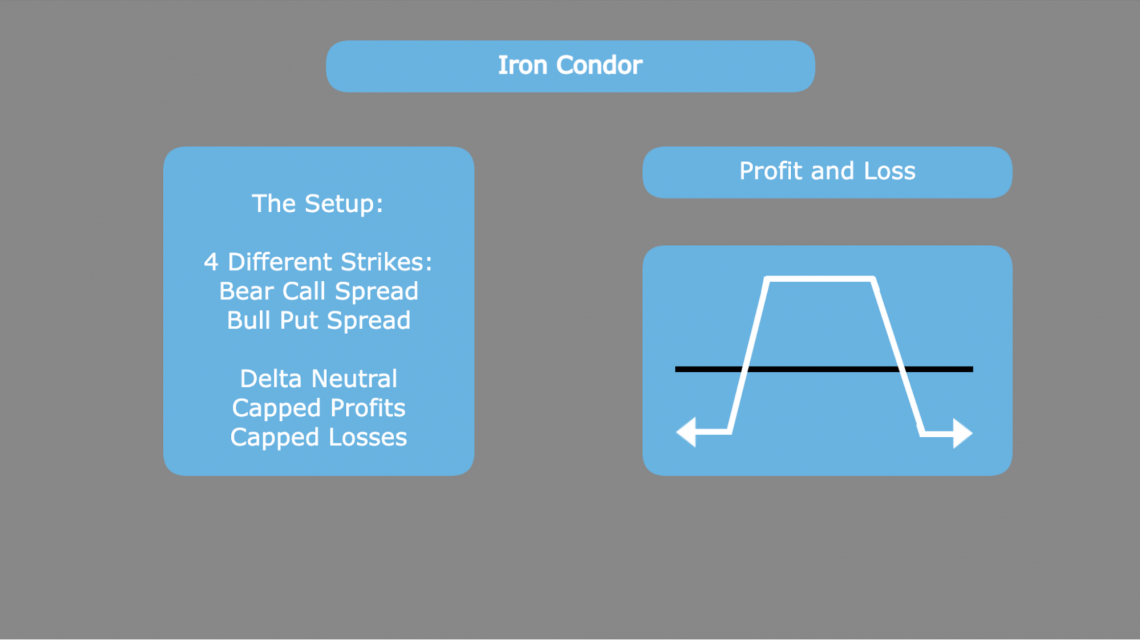

Iron Condor

An options strategy consisting of four different legs: two puts and two calls.

What Is an Iron Condor?

The iron condor is an options strategy consisting of four different legs: two puts and two calls, each of which is expiring on the same day at a different strike. These four legs combine to create a delta-neutral strategy aiming to collect a premium.

The most common setup for this includes contracts that are all out-of-the-money. This means that a vertical put spread will be sold below the current market price and a vertical call spread will be sold above the current market price.

These two spreads are individually known as a bull put spread and a bear call spread. For the bull put spread, the goal is that the underlying expires at a price above the short put. The opposite is true for the bear call spread, which sees its greatest return when spot price is below the short call’s strike.

Combining these two spreads, it is clear that the iron condor’s profit is maximized when the market price of the underlying stock falls between the two middle strikes at expiration. This will lead to a situation where both spreads reach their individual maximum profits.

Because investors want the price to fall within this range, it is said that they are expecting low volatility. A stock moving significantly would mean that the stock is more likely to expire outside of the two strikes, and, perhaps, far enough to leave the investor with a loss.

Although options traders looking to implement the iron condor as an investment strategy are typically neutral, it is also possible to construct the strategy in a slightly bullish or bearish way.

By creating it in a way that the middle two strikes are either below or above the current price, the investor would move their maximum profit range either up or down. The conviction would, therefore, be slightly bullish or bearish, respectively.

Key Takeaways

- Iron condors aim to be delta-neutral, profiting from low volatility by combining bull put spreads and bear call spreads, achieving maximum profit when the stock price stays between middle strikes.

- With capped potential for both profits and losses, iron condors offer traders a defined risk-reward profile, making them suitable for those seeking limited exposure to market fluctuations.

- Traders must consider implied volatility versus actual volatility when executing iron condors. Selling high implied volatility contracts may yield greater premiums but also increase the risk of breaching profit range.

- Early assignment risk and leverage implications are critical considerations for iron condor traders. Understanding underlying fundamentals and exercising due diligence are key to navigating potential pitfalls and maximizing profitability.

Components Of Iron Condor

The components of an iron condor options strategy consist of four different legs, each with its specific function within the strategy:

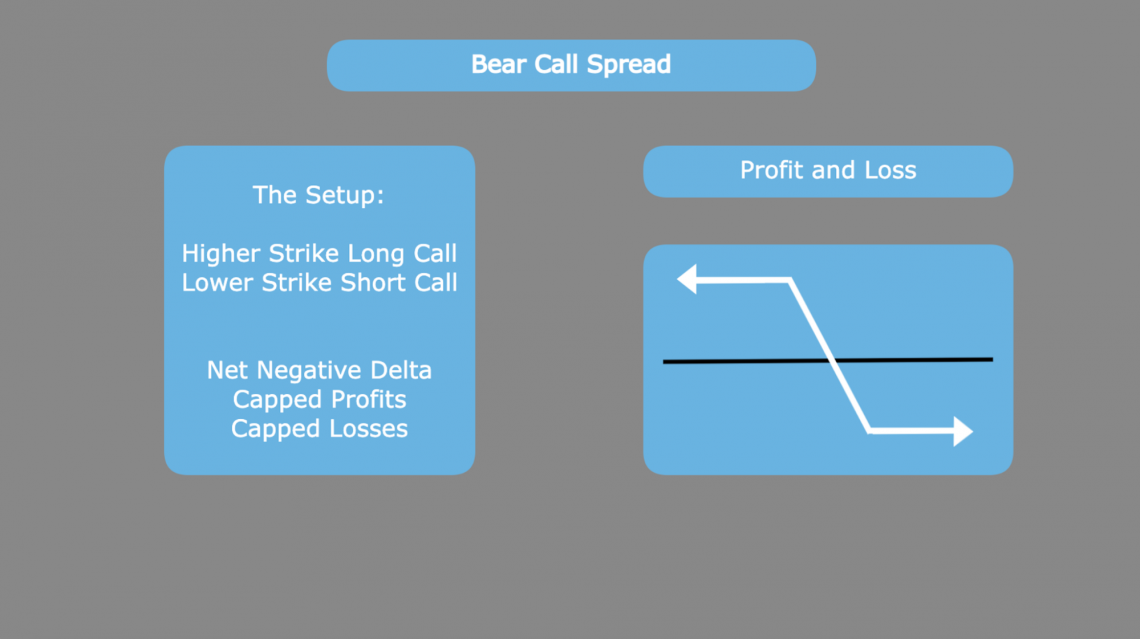

1. Short Call Spread (Bear Call Spread)

- Involves selling a call option with a lower strike price.

- Simultaneously buying a call option with a higher strike price.

- Generates a credit by collecting the premium from selling the call option while limiting potential losses with the purchased call option.

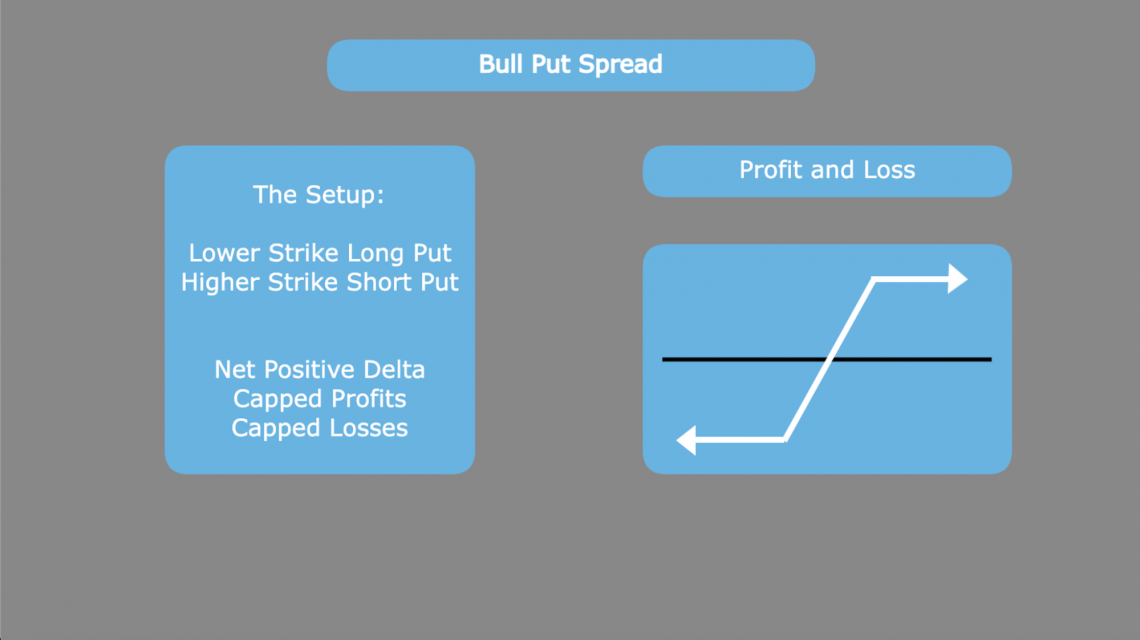

2. Short Put Spread (Bull Put Spread)

- Involves selling a put option with a higher strike price.

- Simultaneously buying a put option with a lower strike price.

- Generates a credit by collecting the premium from selling the put option while limiting potential losses with the purchased put option.

3. Strike Prices

- The short call and short put options typically have the same expiration date but different strike prices.

- These strike prices are selected based on the trader's outlook for the underlying asset's price movement.

4. Expiration Date

- All options within the iron condor strategy have the same expiration date.

- The expiration date determines when the options contracts expire and the strategy's outcome is realized.

Each component plays a crucial role in defining the risk-reward profile of the iron condor strategy.

The combination of selling out-of-the-money call and put options with buying further out-of-the-money call and put options creates a range-bound profit potential, allowing traders to profit from low volatility and limited price movements in the underlying asset.

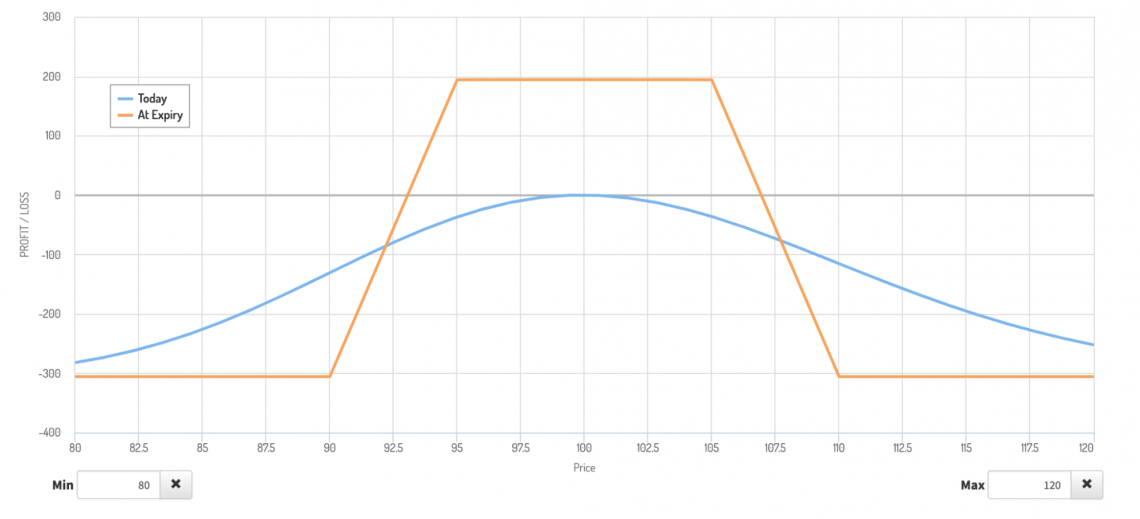

Example of an Iron Condor

For this example, stock XYZ is currently trading at a price of 100. The following call and put options are expiring in 30 days with an implied volatility of 30.

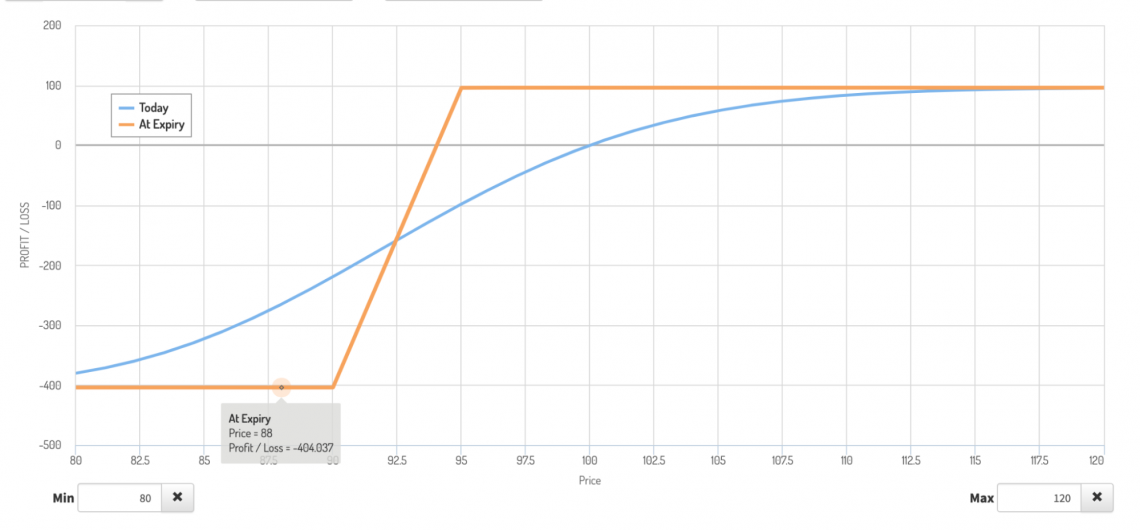

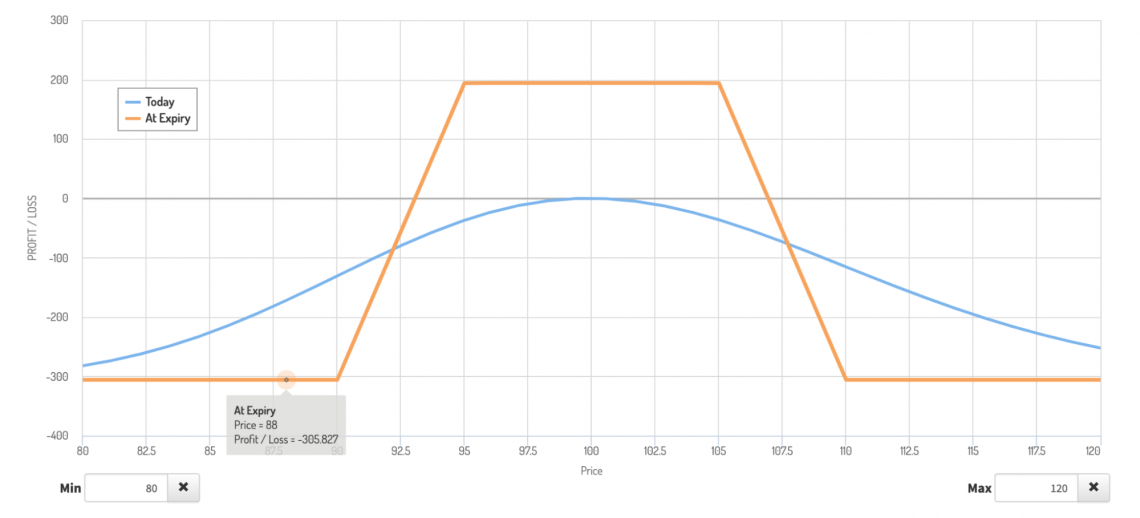

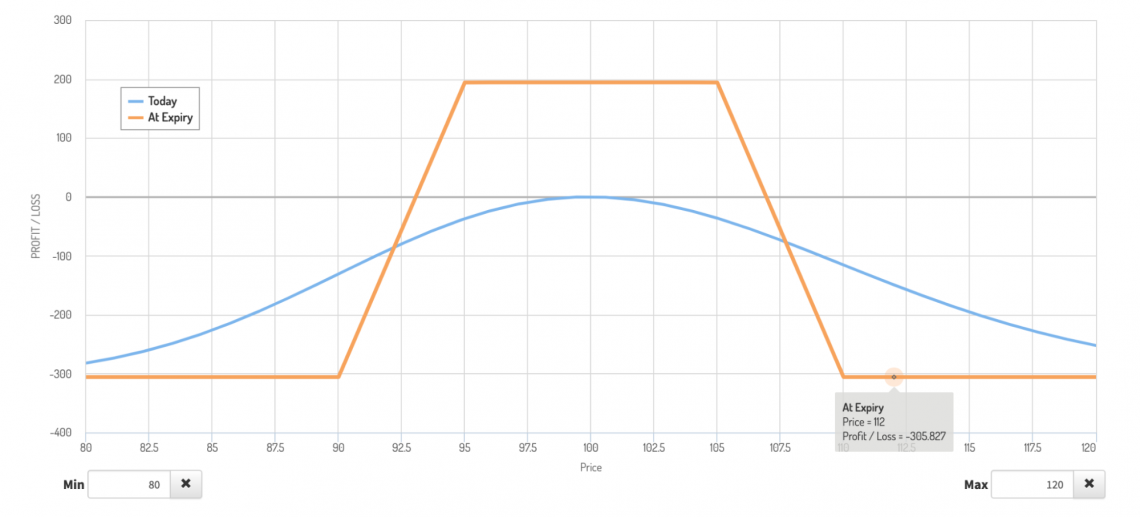

Looking at the profit and loss graph, we can see that the maximum profit lies between the middle strikes of 95 and 105.

At any point between these two strikes, the profit is simply the net premium collected from the four different contract legs. The premium collected will always be equal to the sum of individual premiums for the respective call and put spreads that are included in the contract (with net premium including any losses from either spread).

In this example, the net premium is $194.17. If we look at the bear call spread and the bear put spread components, we see that the premiums are $98.21 and $95.96, respectively.

When added together, these two premiums give us the total premium for the iron condor. Our example checks out.

Max Profit = Total Premium = Bear Call Premium + Bull Put Premium

As is the case with vertical credit spreads, the maximum loss and the break-even points are determined by the premium.

In this case, the maximum loss would occur at either point where the long call or long put becomes in the money. This is the point at which the long options begin to cover the short contract obligation, and, hence, stop the losses.

Looking at a situation where the underlying drops to $88, we see the iron condor reaches its maximum loss because the embedded bull put spread reaches its maximum loss.

Looking at the bull put spread, we see a maximum loss of $404.04. This is equal to the difference between the strikes, multiplied by 100 (as each contract controls 100 shares), minus the premium collected. In this case, $500 - $95.96 gives us our max loss.

Our iron condor, however, has a loss of less than $404.04. This is because the bear call spread expired out of the money. The additional premium from that option brings us to our actual loss of $305.83.

Looking closely, we can see that this is actually equal to the difference between the strikes and the premium collected as well. In this case, however, the extra premium collected from the bear call spread helps to lower the loss overall.

Max Loss = Strike Difference x 100 - Contract Premium

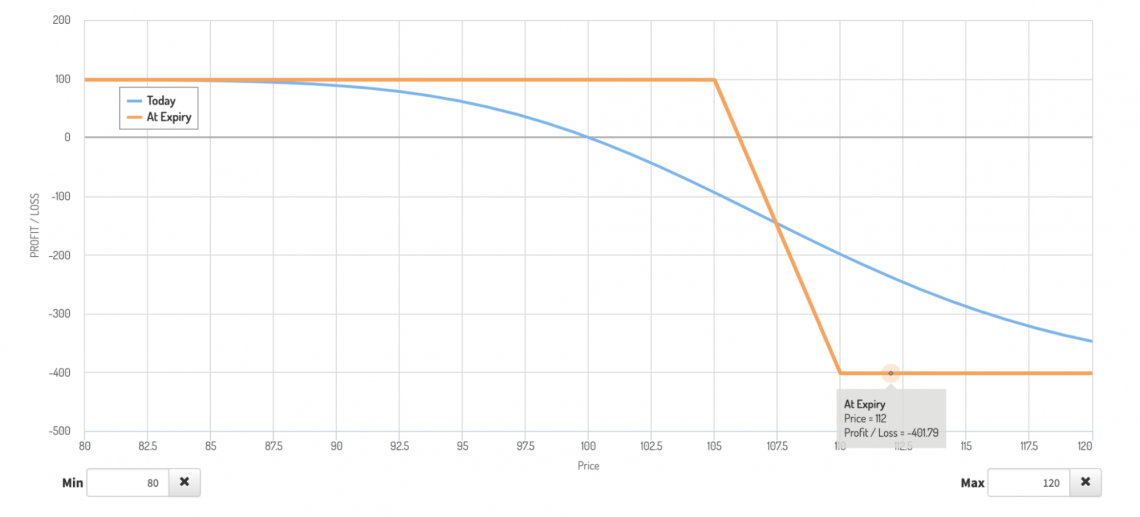

What is the downside of collecting this extra premium? At specific points, if the price rises too high, the bear call spread is in the money. This means that there is also a potential for losses if the price moves up instead of just if it moves down.

Looking past the long call $110 strike, we see where the bear call spread reaches its maximum loss.

The strike difference here is, once again, leaving the investor with a $500 loss, which is partially offset by the $98.31 in premium collected.

As was the case in the situation with a big price decline, the loss on the in-the-money spread is further offset by the premium of the opposing spread. In this case, the bull put spread is out of the money and helps chip away the loss of the bear call component.

Regardless of the direction of price movement, there is no situation where both vertical spreads are in the money. For this reason, the maximum loss is smaller, but there is a chance for a loss regardless of the price movement’s direction.

Iron Condor Considerations

While the key points regarding iron condors can be well summarized in a few points, investors looking to use this strategy must be aware of some other potential risks and factors that can affect this strategy's profitability.

First, the key points:

-

It is a delta-neutral strategy, investors do not need a directional conviction on the underlying asset.

-

Both the profit potential and loss potential for the strategy are fixed.

-

This strategy involves four legs that can be broken down into two distinct vertical spreads.

Beyond these basic points, there are a few other aspects that can affect the profitability of the iron condor strategy. These aspects must be taken into account before entering a position.

The most important of these is the difference between actual volatility and implied volatility. Every option contract has implied volatility, which can be determined by the contract price.

Supply and demand for option contracts typically make implied volatility reflect the likelihood of actual movement relatively well.

Essentially, there is more demand for options with moving underlying because there is a greater chance of profit, increasing demand, and increasing price (due to the lack of an equal change in supply.

In situations where the investor is betting on low volatility, such as the iron condor, investors would be advised to consider how the implied volatility of the contract compares to their actual volatility expectations.

Higher volatility contracts will fetch a greater premium but are also, therefore, more likely to move outside of the middle strike (profit) range.

Investors would be smart to enter an iron condor (or any other delta-neutral position) when they think that the implied volatility of the contract is higher than the volatility they expect during the contract’s lifespan.

Selling a contract with high actual volatility that is likely to have its implied volatility lowered in the future will generate an extra premium while offering less risk in the future.

Beyond understanding volatility and its implications on price, traders must be aware of the early assignment risk present with short option legs. This is especially important when there is a dividend before expiration.

This is because call option holders may decide to exercise if they think the dividend payment will be greater than the remaining time value in the contract. Conversely, put option holders may decide to exercise if they think the time value is greater than the dividend.

Depending on the account specifications, an early assignment can be quite impactful. If there is an insufficient balance in the account, liquidation may occur. This is a very real and extreme risk and has caused some traders to lose thousands of percent on their positions.

As with all options strategies, there is a greater degree of risk associated with increased leverage when using an iron condor. Beyond just understanding the setup, investors should have an understanding of equity valuation based on fundamentals.

For this strategy, it is fair to say that an investor thinks a stock will not have a drastic move in price. An investor may come to this conclusion if they feel that the fair value of the firm, based on its fundamentals, is equal to the current market price of the stock.

Feel free to check out our financial modeling course to understand these concepts better. Due diligence on the underlying and a strong conviction of price movement is a must-have when using strategies susceptible to extra volatility.

Note

Iron condors involve the simultaneous buying and selling of multiple options contracts, making them more complex than single-leg options strategies.

Market Conditions Suitable for Iron Condors

By considering these market conditions, traders can effectively deploy iron condors to capitalize on specific market environments and maximize their potential for profit while managing risk:

1. Low Volatility

Iron condors thrive in low-volatility environments where the price of the underlying asset is expected to remain relatively stable or trade within a narrow range.

This is because low volatility allows options premiums to deflate, making it advantageous to collect premium through the sale of options.

2. Range-Bound Market

Iron condors are effective in range-bound or sideways markets where there is little overall trend in the price of the underlying asset.

Traders can profit from the lack of significant price movements by strategically placing their options contracts at specific strike prices.

3. Stable Price Levels

Market conditions characterized by stable price levels, with minimal fluctuations or sudden spikes, are conducive to iron condors.

This stability reduces the likelihood of the underlying asset breaching the selected strike prices of the options contracts, maximizing the probability of the condor reaching its maximum profit potential.

Note

Iron condors can be constructed to be slightly bullish, bearish, or market-neutral, depending on the placement of strike prices relative to the current market price of the underlying asset.

4. High Implied Volatility

While iron condors are typically associated with low volatility environments, they can also be profitable in high implied volatility conditions.

However, traders must carefully assess the risk-reward dynamics and adjust their strategy accordingly. High implied volatility results in inflated options premiums, allowing traders to collect more premium upfront.

5. Near-Term Price Consolidation

Prior to significant market-moving events or during periods of price consolidation, iron condors can be effective.

These events often lead to a contraction in price ranges as market participants await new information or direction, providing opportunities for traders to profit from limited price movements.

6. Well-Defined Support and Resistance Levels

Market conditions characterized by clearly defined support and resistance levels are favorable for iron condors.

Traders can strategically select strike prices for their options contracts based on these levels, increasing the likelihood of the underlying asset remaining within the desired range until expiration.

How to Build A Short Iron Condor

For building a Short Iron Condor, follow the steps given below:

1. Select Underlying Asset: Choose an underlying asset with options available for trading. Typically, traders select assets with relatively low volatility and expect minimal price movement during the option contract's lifespan.

2. Identify Strike Prices: Determine the strike prices for the short iron condor strategy based on your market outlook and risk tolerance.

The strategy involves selling two out-of-the-money options (one call and one put) and buying two further out-of-the-money options (one call and one put).

3. Choose Expiration Date: Select an expiration date that aligns with your trading objectives and time horizon. Short iron condors are often constructed with options expiring in the near term to capitalize on time decay.

4. Sell Out-of-the-Money Options: Sell one out-of-the-money call option and one out-of-the-money put option. These options should have strike prices above and below the current market price of the underlying asset, respectively.

Note

Active management is essential with iron condors, as traders may need to adjust positions to manage risk or take advantage of changing market conditions.

5. Buy Further Out-of-the-Money Options: Purchase one further out-of-the-money call option and one further out-of-the-money put option.

6. Collect Net Premium: By selling the two options and buying the two options, you collect a net premium upfront. This net credit represents the maximum potential profit for the short iron condor position.

7. Manage Risk: Assess and manage the risk associated with the short iron condor position. While the net premium received provides a buffer against potential losses, monitor the position closely to avoid significant losses from adverse price movements.

8. Set Profit and Loss Targets: Establish profit and loss targets based on your risk-reward preferences and trading objectives. Consider closing the position when a predetermined profit level is reached or if the position moves against you and approaches the maximum potential loss.

9. Monitor and Adjust: Continuously monitor the short iron condor position and adjust as needed based on changes in market conditions, volatility, and underlying asset price movements.

Long Iron Condor Vs. Short Iron Condor

| Key Comparison Terms | Long Iron Condor | Short Iron Condor |

|---|---|---|

| Position | Long Iron Condor involves buying options contracts, while Short Iron Condor involves selling options contracts. | Involves buying an out-of-the-money put option, selling a further out-of-the-money put option, selling an out-of-the-money call option, and buying a further out-of-the-money call option. |

| Objective | Long Iron Condor aims to profit from low volatility or a range-bound market, while Short Iron Condor seeks to profit from high volatility or significant price movements. | Profit from low volatility or a range-bound market by collecting premium while limiting potential losses. |

| Risk Profile | Long Iron Condor has limited risk and potential for limited profit, while Short Iron Condor has potentially unlimited risk and limited profit potential. | Limited risk due to the capped loss potential, which occurs if the underlying asset's price moves significantly beyond the strike prices of the options contracts. |

| Market Outlook | Long Iron Condor is suitable for neutral or slightly bullish/bearish market outlooks, while Short Iron Condor is suitable for strongly bullish or strongly bearish market outlooks. | Limited profit potential, which occurs if the underlying asset's price remains within a specific range at expiration. |

| Volatility Expectation | Long Iron Condor benefits from low volatility expectations, while Short Iron Condor benefits from high volatility expectations. | Suitable for neutral market outlooks or when expecting minimal price movements in either direction. |

Exiting a Short Iron Condor

For exiting a Short Iron Condor, follow the steps given below:

1. Profit Target

Determine a predefined profit target based on the initial premium received when entering the iron condor position.

2. Loss Threshold

Establish a maximum acceptable loss level for the iron condor trade.

If the position moves unfavorably and approaches or exceeds this threshold, consider exiting to limit further losses and preserve capital for other trading opportunities.

3. Time Decay Considerations

Monitor the time decay of the option contracts comprising the iron condor. As expiration approaches, the rate of time decay accelerates, potentially eroding profits or exacerbating losses.

Evaluate whether the remaining time justifies holding the position or if exiting early is prudent.

4. Adjustment Opportunities

Assess whether adjustments to the iron condor position are warranted based on changes in market conditions or the underlying stock price.

This may involve closing out one side of the iron condor or rolling the entire position to a different strike or expiration date to mitigate risk or capture additional profit potential.

Note

Iron condor strategy is often employed in low-volatility environments, where traders expect minimal price movements in the underlying asset.

5. Volatility Changes

Monitor shifts in implied volatility, as this can impact the value of the option contracts within the iron condor.

Exiting the position may be advisable if significant volatility changes are anticipated, particularly if it increases the risk of breaching the profit range.

6. Execution Strategy

Determine the most suitable method for exiting the iron condor position, whether through individual leg orders or simultaneous closing orders for the entire position.

Consider factors such as liquidity, transaction costs, and market conditions when executing the exit strategy.

7. Review Transaction Costs

Factor in transaction costs, including commissions and fees, when evaluating the profitability of exiting the iron condor position.

Ensure that potential profits outweigh transaction costs to justify closing the trade.

8. Continuous Monitoring

Regularly monitor the iron condor position and reassess exit criteria as market conditions evolve.

Remain adaptable and responsive to changes in order to optimize trading outcomes and manage risk effectively.

Conclusion

The iron condor strategy presents a sophisticated approach to options trading, leveraging delta neutrality and volatility expectations to generate consistent returns.

By combining bull put spreads and bear call spreads, traders can construct positions with fixed risk and reward profiles, offering a degree of predictability in an otherwise volatile market landscape.

The strategy's profitability hinges on the underlying stock price remaining within a predefined range, emphasizing the importance of accurately assessing volatility dynamics and implied volatility levels.

Note

While iron condors offer limited risk, they also have limited profit potential, as the maximum profit is capped at the net premium received.

However, traders must exercise caution and diligent risk management when implementing iron condors, as early assignment risk and leverage considerations can significantly impact outcomes.

While the iron condor strategy offers a compelling opportunity for delta-neutral options trading, success ultimately rests on the trader's ability to navigate the complexities of volatility, risk, and reward.

By incorporating diligent risk management practices and staying attuned to market developments, traders can harness the full potential of iron condors to achieve their financial objectives in a dynamic trading environment.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?