Minority Interest in Enterprise Value Calculation

Why is Minority Interest added to Enterprise Value?

Why is Minority Interest added to Enterprise Value?

When determining the Enterprise Value or the Equity Value, there are several financial metrics that need to be considered. Minority interest is one of them. Minority interest can also be called minority-holding or non-controlling interest (NCI). The terms are similar, and we will use them in this article equivalently.

Mastering the concept of non-controlling interest is also beneficial for acing your banking interviews as it is a very common technical question. Cultivating a deeper knowledge of this matter would definitely impress your interviewers.

The goal of this publication is not only to give a technical definition and a superficial overview of the topic. In addition, we want to make sure you get a good grasp of the financial groundwork of minority interests.

The following sections will refer to examples of how minority interests are reported in financial statements. It will provide a good hands-on experience and help solidify your understanding further.

Key Takeaways

- Minority interests arise from a majority investment of more than 50% but less than 100%.

- Minority interests are a bridge item to consider to calculate an Enterprise Value.

- Not all companies have minority interests.

- It is more accurate to use the market value of minority interests than their book value to estimate their true value.

- Minority interests can be recorded in the income statement or the balance sheet.

What is Minority Interest (Noncontrolling Interest)?

Non-controlling interests are shares held by minority shareholders in a fully consolidated subsidiary. It is a significant but non-majority interest (less than 50%).

Let’s take a simple example. Company A owns 80% of Company B. Company A will recognize that the remaining 20% of Company B's ownership belongs to other shareholders who have nothing in common with Company A. This portion is called the non-controlling interest.

But where does this come from? Listed companies can buy and hold shares of other public companies. This situation can be referred to as cross-shareholding or cross-holding. There exist several types of cross-holding investments:

1. Minority Passive Investment

This investment characterizes ownership stakes of less than 20% ownership. As a result, they have no influence or control over how the investee is run.

- Dividends from this investment are shown in the income statement.

- The original investment value is shown in the balance sheet.

2. Minority Active Investment

This investment characterizes ownership stakes between 20% and 50% ownership. They have influence but lack control over the investee.

- The share of net income or losses made by an investee (based on the percentage ownership of an investor) is shown in the income statement (below operating profits).

- Original investment value plus any reinvested income is shown in the balance sheet. This method is called Equity Method Accounting.

3. Majority Investment

This investment characterizes ownership stakes of more than 50% ownership. As a result, they have influence and control over the investee.

- The investment is no longer shown as a financial investment. Instead, financial statements are consolidated (assets and liabilities of the two firms are merged and presented as one balance sheet, similar to other statements).

- The share of the firm owned by other investors is shown as a minority (non-controlling) interest on the liability side of the balance sheet.

In this article, we will cover non-controlling interests related to a majority investment.

Minority Interest in Financial Reporting

Let’s see a few examples of a majority investment to see how minority interest is shown in financial reporting:

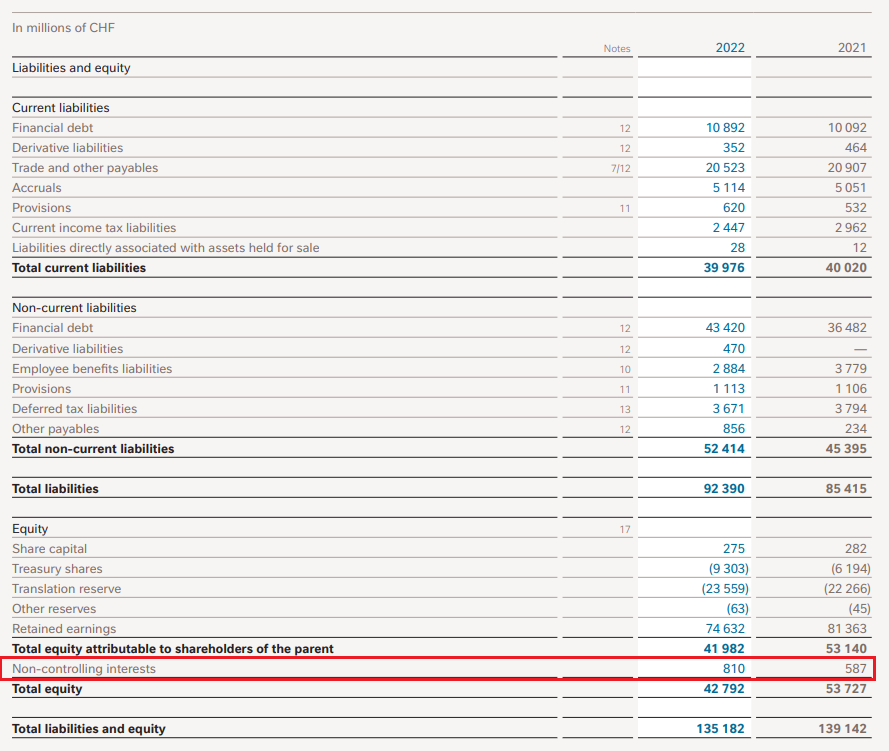

1. Minority interest on the balance sheet - full consolidation (Nestle case)

As the parent company holds majority ownership in the subsidiary, it consolidates 100% (full consolidation) of the subsidiary's assets, income, liabilities, and other financial information into its balance sheet.

The book value of equity in majority-owned subsidiaries not attributable to Nestle's shareholders is recorded on a separate line in total equity.

Following the IFRS standards (International Financing Reporting Standards), NCI is always shown in the equity section of the consolidated balance sheet. It is always presented on a separate line to distinguish it from the parent’s equity. In contrast, under US GAAP, two options are available. It can be classified as a non-current liability or part of the equity section.

Source: Nestle

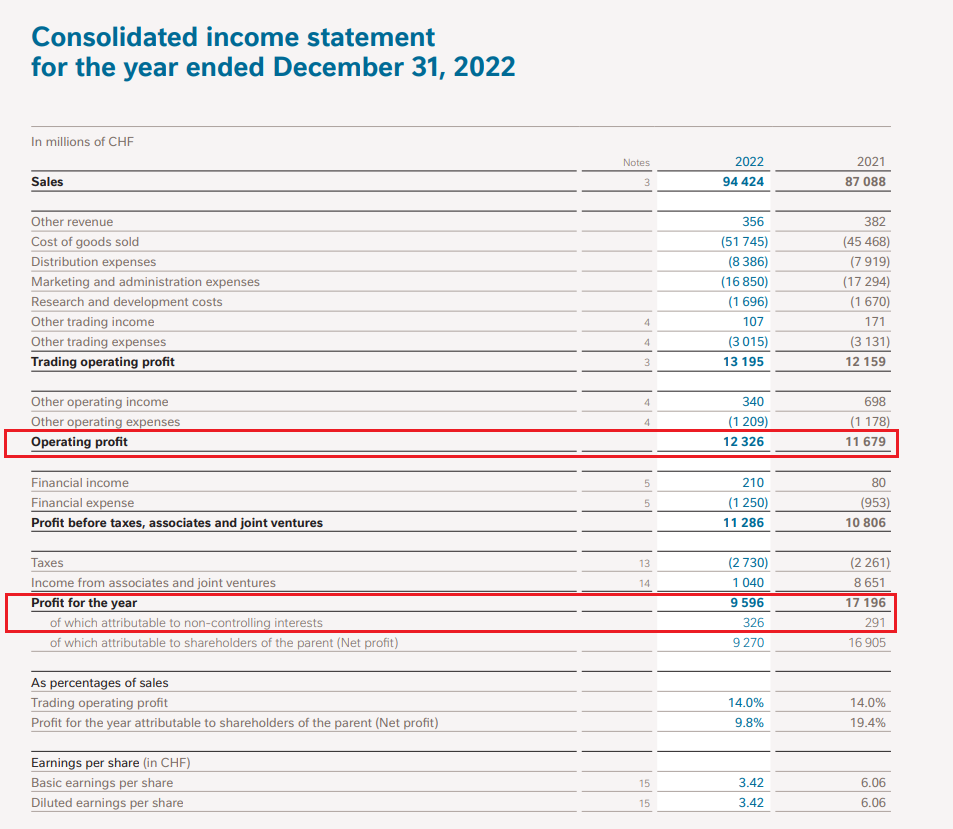

2. Minority interest on the income statement - full consolidation (Nestle case)

Nestle's total operating profit includes the full profits (full consolidation) generated by its majority-owned subsidiaries. As a result, the company's net income (profit for the year) is divided between the amount attributable to minority shareholders and the amount directly attributable to Nestle.

As per FASB standard, when calculating the net income remaining for shareholders of a group, net income attributable to NCI must be deducted. Accordingly, this is recorded as a share of minority shareholders' profit on a consolidated income statement.

Source: Nestle

Why is Minority Interest included in Enterprise Value calculation?

There are two possible answers to this question. The first is to ensure consistency of multiples (EV/SALES, EV/EBITDA, or EV/EBIT), while the second is to count it as an operating asset contributing to an operating value creation. We will discuss these two answers further.

1. What is Enterprise Value?

Enterprise value is a measure of the total value of a company. It includes all ownership interests and claims on its assets.

Enterprise Value is also considered the market value of the company's core business operations, financed by debt and equity holders, who consequently have claims on the company's assets. The commonly used formula to compute the Enterprise Value is presented as follows:

Market Capitalization + Debt + Minority Interest + Preferred Shares - Cash & Cash Equivalents

2. Why is Minority Interest added to the Enterprise Value?

As promised earlier, we are going now to detail why consistency and operating value creation explanations justify the accountability of minority holdings in the Enterprise Value.

A. Comparability purpose

We have already understood that a company will use a full consolidation method for its financial statements in the case of majority ownership (more than 50%).

For instance, its total EBITDA will contain its own EBITDA and the sum of all majority-owned companies’ EBITDA. If we don’t account for minority interests in the Enterprise Value, we will have a discrepancy while computing multiples.

Since EBITDA includes 100% of EBITDA attributable to minority interests, so should the Enterprise Value. Let’s get back to our example between Companies A and B. The Market Capitalization, included in the Enterprise Value of A, will only reflect an 80% stake in B.

Therefore, we must add a non-controlling interest to reflect a 100% ownership in EV and EBITDA.

B. Operating value creation

Due to the fact that the Enterprise Value is the market value of a company's core business operation, we should sum up all operating assets, contributing to core business operations, and subtract non-operating assets.

Majority ownership gives a parent company access to all of the resources of its subsidiary, including those linked to minority shareholders.

Thus, the controlling company can use these resources for its purposes and generate more value from its core business operations. Also, when we add the EBITDA of a subsidiary, we automatically enhance the value of the core operations of the parent company.

How to calculate minority interests?

Up to this point, you should have understood why we cannot neglect NCI in the Enterprise Value computation and what is the main rationale behind this important metric. Let’s now take a look at the practical aspect and learn how to calculate non-controlling interests that are used in the formula of EV.

First of all, we must make a difference between the book value and the market value of NCIs. This is because you can find book value in financial statements, whereas market value should be computed using M/B (market-to-book) or P/E (price-to-earnings) ratios.

This step is crucial because book value is a pure accounting measure that doesn’t say much about the true value of a given metric. Instead, you can think about it in the same way as the shareholder’s equity value of a balance sheet and market capitalization.

If you want to buy a share, you will have to pay its real price - market price and not its book price. The same principle is valid for NCIs.

Examples of minority interests

In our hypothetical example, Company A has an 80% ownership in Company B. Company A shows an NCI of $2 million in its consolidated statements.

Similar companies as B are traded at an M/B ratio of 5 and a P/E ratio of 15. How much is the estimated market value of minority holdings?

The answer is straightforward: we multiply the book value of minority holdings by their M/B ratio;

$2 million * 5 M/B ratio = $10 million.

These $10 million are the market value of 20% of minority holdings of Company B recorded on the balance sheet of Company A at a book value of $2 million. This is exactly the value we would add to the EV calculation of Company A.

The total value of Company B would amount to $50 million ($10 million * 5).

Since $10 million corresponds to 20%, we must multiply it by 5 (the inverse of the 20% ownership stake) to arrive at its total value.

But how would you deal with the Nestle case working with the financial statements we referred to earlier? For the sake of simplification, we will use the same M/B and P/E ratios. Our principal task is now to locate the necessary information and apply the right multiples accurately.

In the total equity section of the balance sheet of Nestle, we see a separate line (non-controlling interest) displaying CHF 810 million for the year 2022. Remember, if you take a figure from a balance sheet, you apply an M/B ratio. The market value would be

CHF 810 million * 5 M/B ratio = CHF 4,05 billion.

What about Nestle's income statement? The income statement shows a proportion of profit attributable to non-controlling interests of CHF 326 million for the 2022 year.

Remember, if you take a figure from an income statement, you apply a P/E ratio. The market value would be

CHF 326 million * 15 P/E ratio = CHF 4,89 billion.

Overall, you can use any of the results obtained from the previous calculations to determine the Enterprise Value of Nestle.

As you might guess, Nestle is a European company applying IFRS accounting standards to its financial reporting. Let’s also look at Walmart, the US company, to understand how to find minority holdings in its SEC filings.

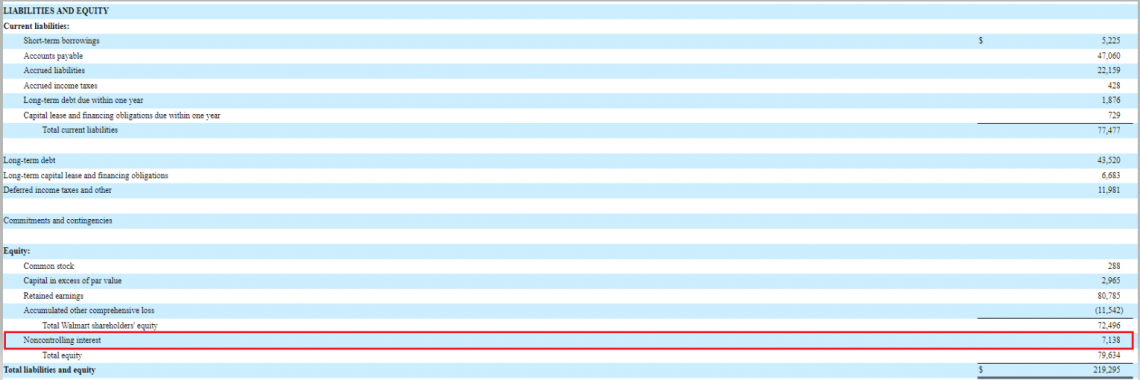

As per the below balance sheet image excerpt (fiscal 2019) of Walmart, we don’t incur any difficulties locating minority holdings. It is in the same section as in Nestle’s case.

We discussed previously that companies under US GAAP have two options to record non-controlling interests: either in the equity section or as a non-current liability. Walmart opted for the former.

Source: SEC

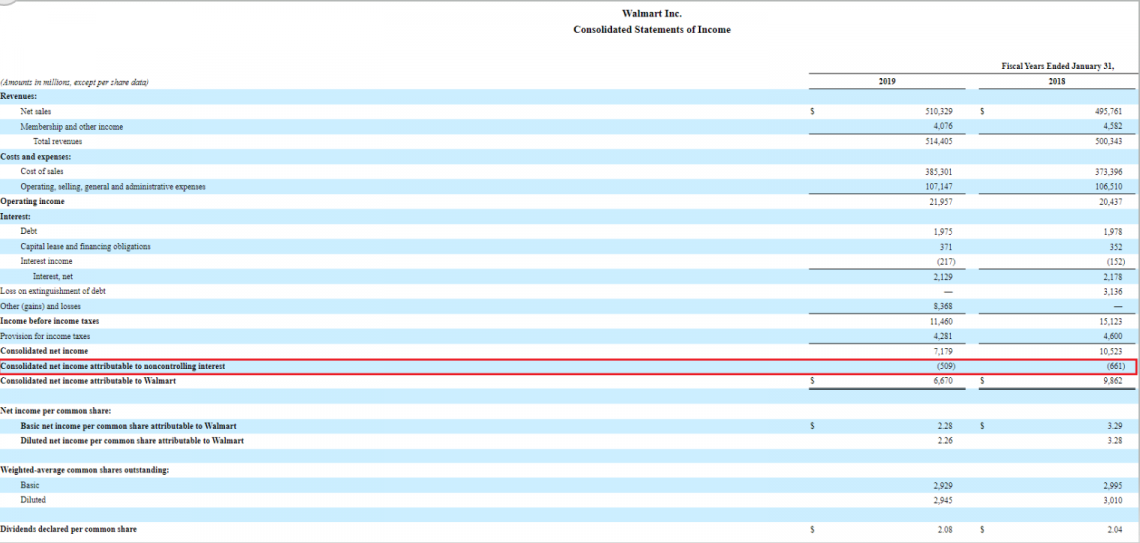

What about Walmart’s income statement? Nothing is new for us because we find the same double repartition of the total consolidated net income attributable to both minority holdings and the parent company, just like for Nestle.

Source: SEC

Negative minority interest - is it real?

As you can see, Walmart reports negative earnings attributable to non-controlling interest. Such a situation means that the minority shareholders of our subsidiary have incurred losses during a reported period.

Although minority shareholders are responsible for some of these losses, the parent company will have to absorb them.

These two examples are a good exercise for you to train to efficiently locate the relevant information in different types of financial statements that abide by European and US standards.

Therefore, we cannot always rely on the same rule and methodology.

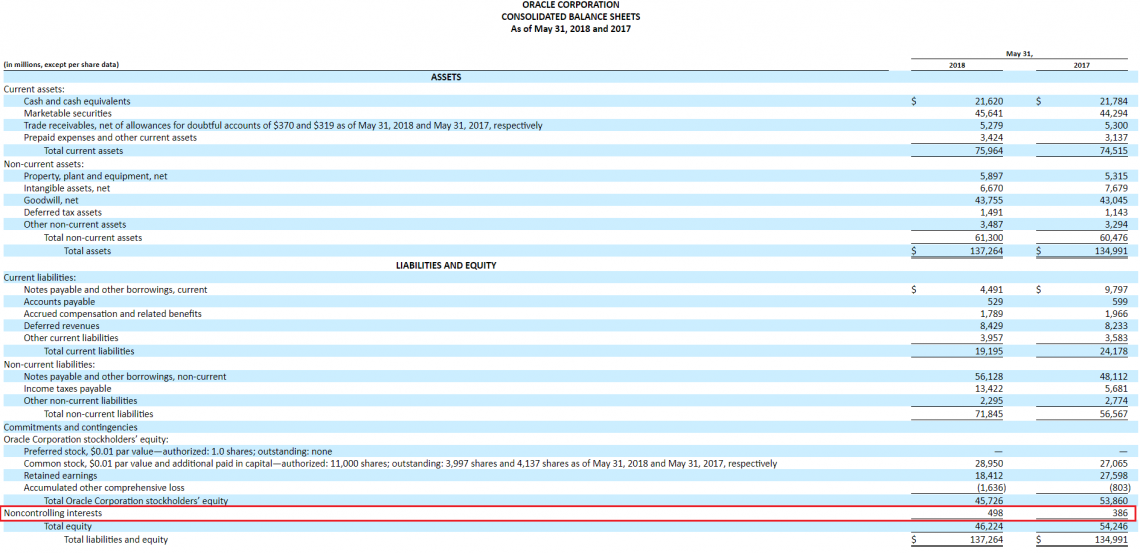

Sometimes we must have a deeper analysis of financial statements. Let’s play with Oracle's SEC filing. In its balance sheet, we already know perfectly where to find minority holdings:

Source: SEC

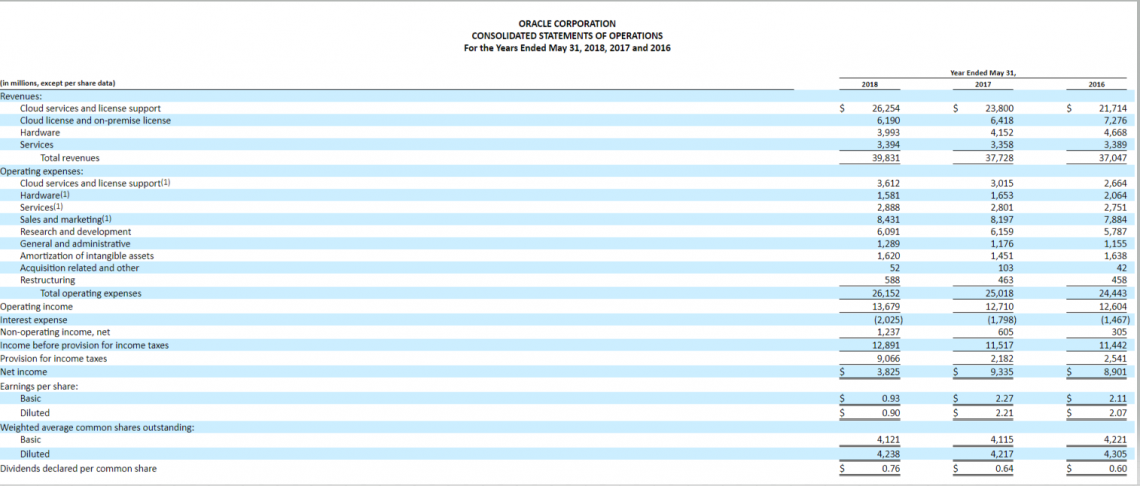

But what do we observe in the below income statement of Oracle?

Unlike in Nestle’s or Walmart’s income statements, we don’t see any minority holdings earnings reported, but we know they exist due to Oracle’s balance sheet. So is it an error, or are NCIs just hiding somewhere?

Source: SEC

To investigate this point, let’s delve into what the company says about its non-operating income. It mentions that non-controlling interests are recorded in Non-Operating Income.

This suggests that the NCI is related to entities that Oracle doesn't consider part of the core business operations.

Source: SEC

In this case, we should be careful with the Enterprise Value calculation.

If, in our previous samples, we have a standard non-controlling interest that we were adding to the market capitalization and other financial metrics, here we would rather consider it a non-operating asset that should be subtracted alongside cash & cash equivalents because it doesn’t create an operating value for the company.

However, a more prudent approach would consist in considering the specific context of the non-controlling interest and its nature before the final treatment.

or Want to Sign up with your social account?