My sixteen-year old, a sophomore in high school, joined the investment club at school a couple of weeks ago, and entered a stock-picking competition. Club members invest in a stock or stocks of their choice, with the winner chosen in about five weeks,

based upon price appreciation. Thinking I would have some sage advice on where to invest his money, he asked me for some stock picks and I almost suggested that he put all his money in GoPro, a choice that is clearly at odds with the prudent investing practices of diversification and perhaps with conventional value investing precepts. While GoPro is not the investment I would recommend for my son as his Roth IRA investment (with real long money and a long time horizon), in a game with a five-week window, where the winner takes all, momentum will

beat out intrinsic value and diversification will be more hindrance than help. (Note that momentum fairy was in GoPro's corner at the time, and has taken a break in recent days.) In this post, I take a look at GoPro, perhaps the hottest stock of the year, with the intent of not only understanding its intrinsic value (and drivers) but to make sense of the pricing game.

The Back Story

For those of you who are not familiar with the company, GoPro makes cameras that you can attach to yourself and record video of your activities. While that might not seem exceptional, it is designed for high-energy physical activities, including running, rock climbing, swimming or hunting. You can get a measure of the company’s current offerings

on its website. They include three models of the camera (the Hero, the Hero 3 and the Hero 4), numerous accessories and two free software products (a GoPro App and GoPro Studio) to convert the recorded videos into watchable ones. The company believes that the creators of videos will share them, not only with their friends, but also with the general public. In its

most recent earnings report, it noted that GoPro videos published on YouTube had increased 200% over the previous year, launched a GoPro channel on Pinterest to attract more attention to the videos and one for the Microsoft Xbox.

The company’s cameras have found a ready market, with revenues hitting $986 million in 2013 and increasing to $1,033 million in the twelve months ending in June 2014. In spite of large investments in R&D ($108 million in the trailing twelve months), the company still managed to be profitable, with

operating income of $70 million in that period. Capitalizing R&D increases their pre-tax

operating margin to 13.43%, impressive for a young company. The figure below looks at the evolution of revenues and units sold over the history of the company. (You can download the company's

prospectus and its

only 10Q.)

An Intrinsic Valuation

In valuing GoPro, we face all of the typical challenges associated with valuing a company, with growth possibilities, early in its life cycle, in determining the market potential and imminent competition.

1. Potential Market

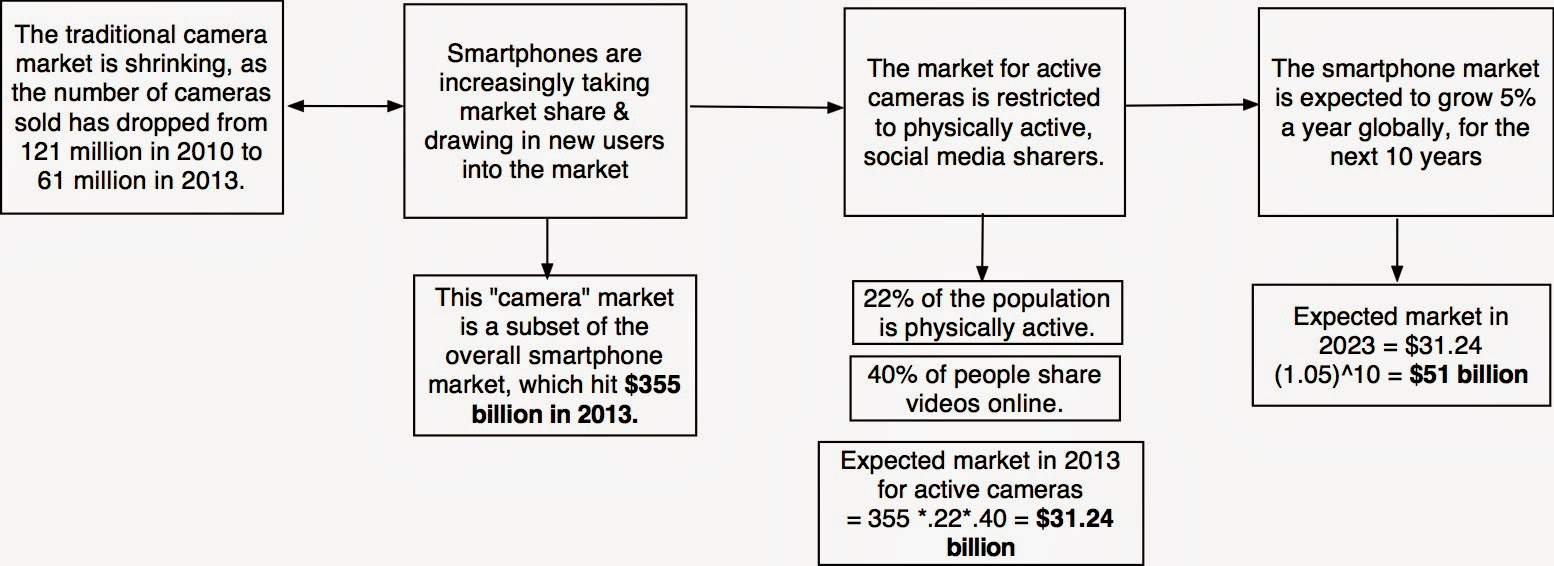

GoPro is nominally a camera company but I will argue that it caters to a different market. To get a measure of the potential market for GoPro's products, I will make my argument in three steps:

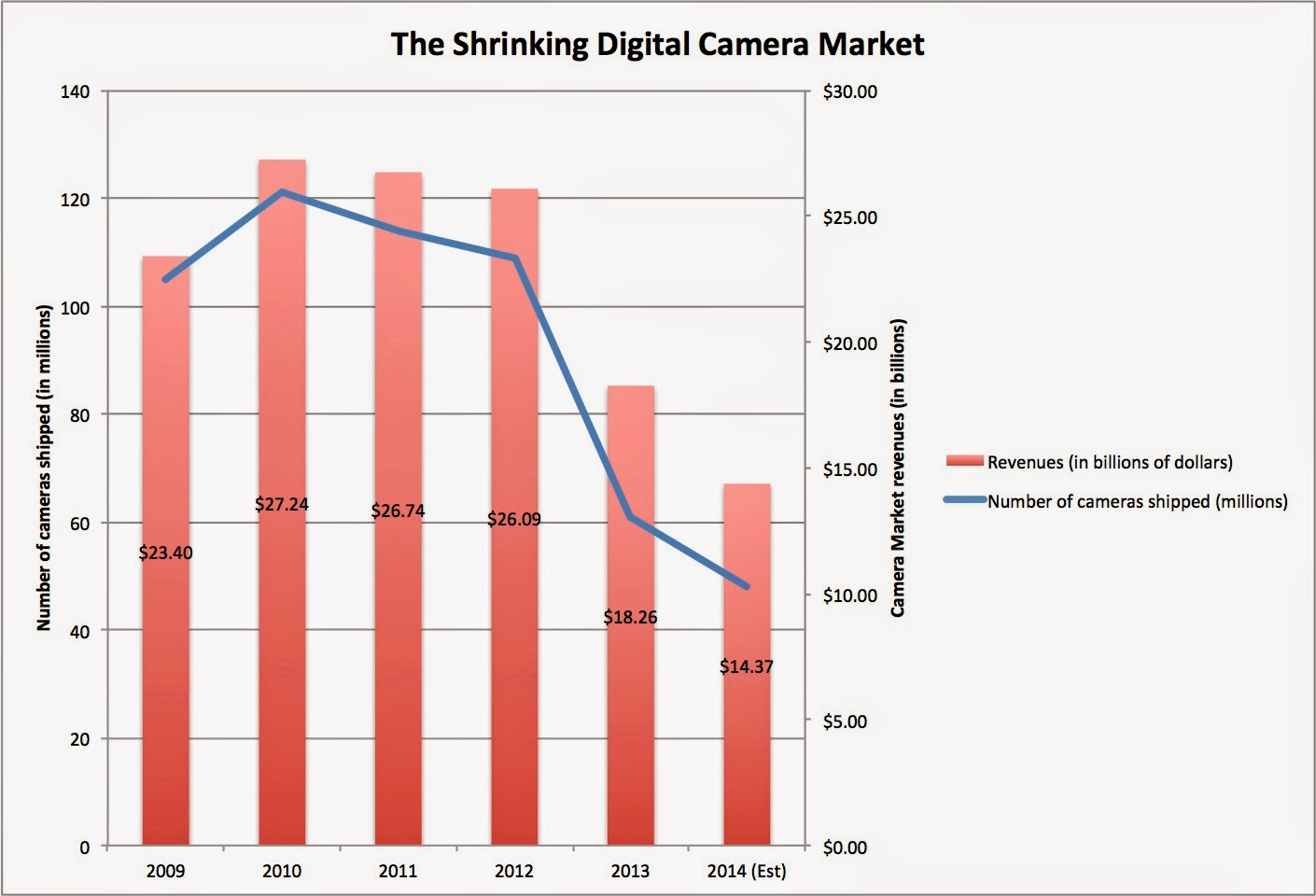

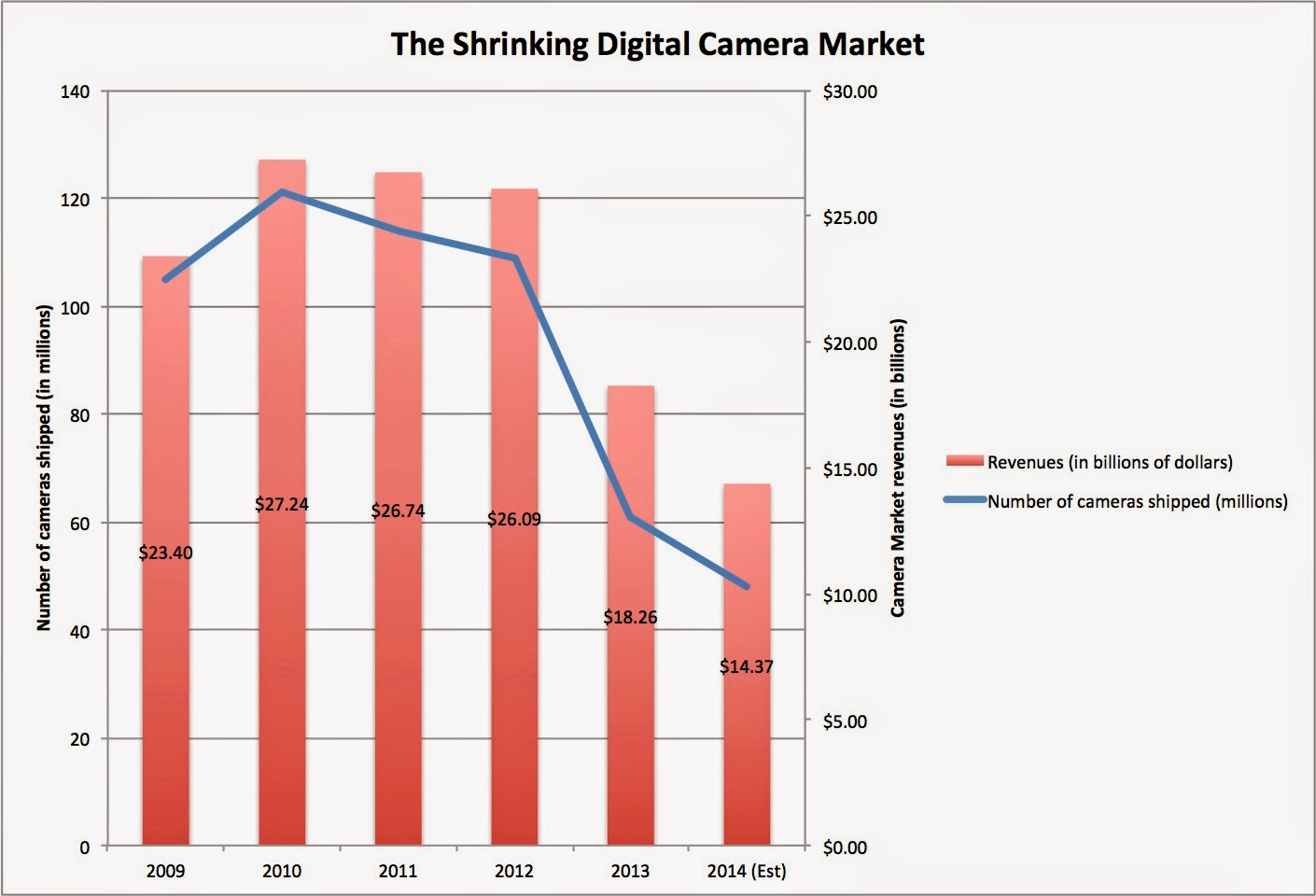

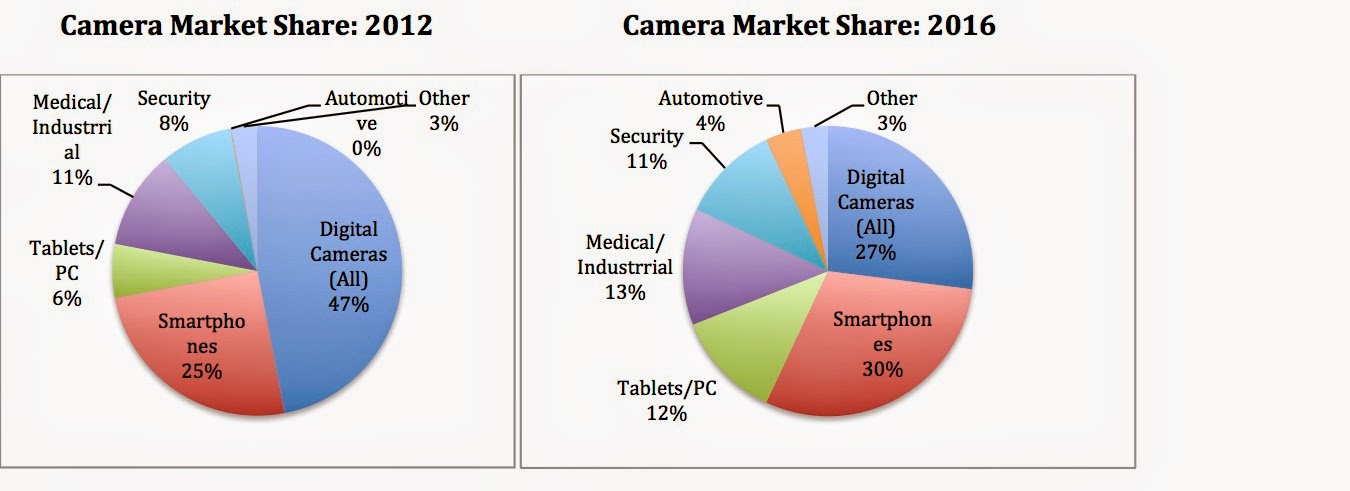

- The conventional camera market is under threat from smart phones, and its share of the camera market has been shrinking over the last few years and there is little hope that it will stop doing so in the future.

|

| Source: CIPA |

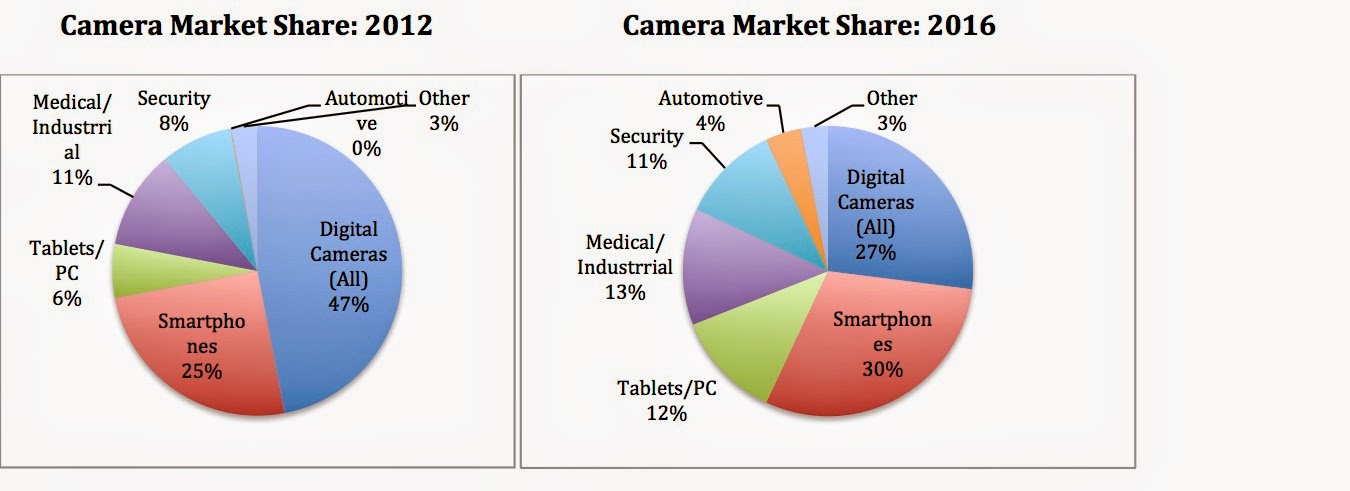

- The camera market is changing and expanding. The entry of smart phone cameras has not only taken away market share from conventional camera companies but has changed the market by attracting new users into the market. These new customers, who are mostly uninterested in conventional cameras (and recording images and videos for family albums), are being drawn into this market, by their desire to record and post photos/videos on social media sites. That trend will continue into the future and I believe that the camera market will become a subset of the smart phone market. The good news is that the smartphone market is huge, estimated to be $355 billion in 2014, larger than the entire electronics market ($340 billion) in 2014. The bad news is that most of the consumers in this market will be satisfied with the cameras on their cell phones and will be unwilling to spend money on an expensive accessory, unless it serves a very specific need.

|

| Source: IC Insights |

- The action camera market will be a subset of the smartphone market and its customers will be those who are physically active people who also happen to be active on social media (over active, over sharers). To make an estimate of how many consumers are in this market, I used the CDC's statistic that about 22% of Americans are physically active. Generalizing (and globalizing) this statistic to the smartphone market yields a potential market that is about $80 billion in 2014 (22% of $355 billion). That is likely to be an over estimate, since not all physically active people are "sharers" on social media. According to this survey, about 31% of adults post videos on their social media site and it has both increased over time and is higher among younger adults (ages 18 through 29), 40% of whom post videos. Using the latter statistic, the overall market for action cameras is $31 billion (in 2013), estimated as 40% of $80 billion. Applying a 5% growth rate on this market yields a potential market of $51 billion in 2023. The picture below captures the sequence of assumptions that yields this number:

2. Market Share & Profit Margins

The market share and target

profit margin that we assess for GoPro will be a function of the potential market that we see for it and the competition in that market. If we define it as the camera market, the competition is already intense and dominated by Japanese manufacturers:

If we define it, as I think we should, as the subset of the smartphone accessory market that wants active cameras (the $51 billion market in 2023 identified in the last section), GoPro is the first mover in the market and has more growth potential (both because the market is growing and it has relatively few competitors, for the moment).

To gauge the expected market share that GoPro can get of this market, it is worth noting that while it initially had the action-camera market to itself, the competition is starting to take form from upstarts, established camera makers and from some smartphone manufacturers. Even if GoPro can establish a brand name advantage (by being the first one on the market), I don’t see any potential networking advantages that GoPro can bring to this process that will allow it, even if successful, to control a dominant share of this market, as the market gets bigger. Drawing from the established camera business market shares, I will assign a market share of 20% (resulting in revenues of about $10 billion for GoPro in 2023, i.e., 20% of $51 billion) , roughly similar to the 20% market share for Nikon, the leading camera maker, of the camera market in 2013. (I am not drawing a direct parallel between Nikon and GoPro, but I am arguing the market share breakdown of the action camera market is going to resemble the market share breakdown of the conventional camera market).

On the

profit margin, GoPro’s

first mover advantage has given it a headstart in this market, allowing it to charge premium prices and

earn a pre-tax operating margin of 12.5%. This is slightly lower than the margin (13.43%) posted by the company in the most recent 12 months, but the trend lines in margins for the company are decidedly negative:

This estimate (12.5%) of the pre-tax operating margin is significantly higher than the 6%-7.5% margin reported by camera companies and similar to the 10%-15% margin reported by smartphone companies; Apple remains an outlier with its pre-tax margin in excess of 25%. I am, in effect, assuming that GoPro will preserve its premium pricing, even in the face of competition.

3. Investment Needs

While GoPro users may post to social media sites, GoPro is not a social media company when it comes to investment needs. While social media companies like Facebook, Twitter and Linkedin generate their revenues in advertising and have little need for tangible investment, GoPro will need to invest in manufacturing capacity to produce and sell more cameras. To estimate the reinvestment needs, I made the assumption that the company will have to invest $1 for every $2 in additional revenues generated in years 1-10. This, in turn, will move the return on capital for the company from it's current stratospheric levels to about 16% in year 10.

4. Risk

GoPro has a social media focus for its user-generated videos, but the company currently generates all of its revenues from selling cameras and accessories. There is the real possibility, though, that the user-generated videos may have entertainment value, which, in turn, could lead to other revenue sources (advertising on GoPro's YouTube channel or a dedicated media outlet for GoPro videos, for instance). That does seem a little far fetched at the moment and we will assume that GoPro's risk will resemble the risk of high-end electronics companies. To

estimate a cost of capital for GoPro, I consider their current mix of debt and equity (2.2% debt, 97.8% equity) as my starting point, and

estimate a cost of capital of 8.36% for the company, declining to 8% by year 10 (with both reflecting the fact that the US 10-year bond rate dropped to 2% on October 14). This may strike you as low, but much of the risk in GoPro is specific to the company and its market and is thus not reflected in the cost of capital.

5. Possibilities

GoPro's focus on creating partnerships with Xbox and Pinterest suggest that it sees the possibility of generating revenues from becoming a media company (with the videos created by its customers as content). At the moment, using a contrast I drew earlier in my post on Uber, this is more in the realm of the possible than the plausible or the probable. If the value per share that we obtain is just a tad

below the market price, this possibility may be sufficient to tilt the scale towards buying but it cannot account for a large chunk of the value today.

6. Valuation

With this spectrum of choices on the inputs (revenue growth derived from the total market/market share assumptions, operating margin, sales to capital and cost of capital), it is perhaps more realistic to assess the value of GoPro as a distribution than as a single estimate of value.

Reading this distribution, you can see while the expected value across the simulations is only $33-32/share, well below the market price of $70, there are outcomes that deliver values higher than the market price.

Put differently, while I think that the company is over valued, there are pathways to values higher than $70. They will require GoPro to (a) expand the market for cameras to new users (physically active, over sharers) (b) find a strong, sustainable competitive advantage over its imminent competition, perhaps with a networking edge (giving it higher market share) and (c) preserve its premium pricing edge.

(You can download the

base case valuation by clicking here)

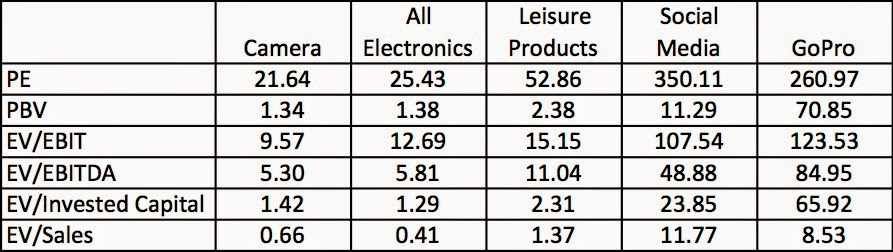

A Pricing of GoPro

In keeping with my argument that much of what passes for valuation in practice is really pricing, let me make the pricing case for GoPro. To price a company, there are two fundamental questions that have to be addressed: who (or what companies) you are pricing your company against and what metric (revenues,

book value, earnings etc), you will use in the comparison.

The essence of pricing is that you use the market pricing of comparable assets/firms to determine a fair price for your asset/company. There is, however, a subjective component to determining these comparable investments, and that comes into play with a company like GoPro, with the following possible choices.

- Existing camera manufacturers, some of whom (Sony and Panasonic) are much bigger players in the electronics market. (Sample of ten companies, all of them Japanese)

- Leisure product manufacturers, which includes a diverse group of companies that manufacture gym equipment (Life Time Fitness), golf clubs (Callaway Golf) and bicycles (Cannondale), on the rationale that these appeal to the same physically active market as GoPro does. (138 global companies)

- Electronics companies, which includes all consumer electronics companies listed globally. (103 global companies)

- Social media companies, which includes a broad mix of businesses some of which derive their revenues from advertising (Facebook, Twitter), some from subscription-based models (Netflix) and some from a combination (LinkedIn). (13 social media companies)

Stock prices cannot be compared across companies, since they are a function of the number of

shares outstanding. Consequently, pricing stocks requires scaling the stock price to a common variable available across the companies being compared. This variable can be revenues, earnings (

net income, operating income or

EBITDA), book value (book value of

equity or invested capital) or a revenue driver (users, subscribers).

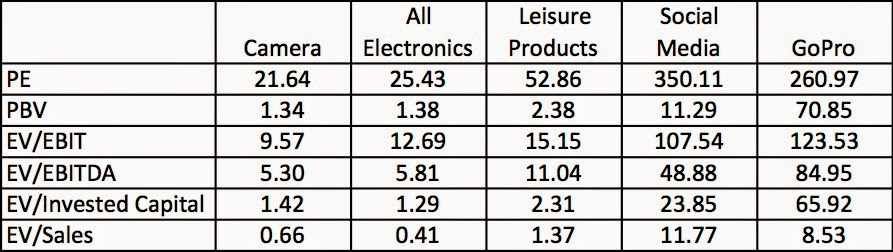

Bringing together these choices, we can compare GoPro's pricing with

that of comparable companies, using different comparable company groups and pricing metrics:

|

| Based on market prices on 10/15/14 & trailing 12-month data |

This is a simplistic comparison, where I have used the median values for the sectors involved and not controlled for differences in fundamentals (growth, risk and cash flows) across companies. However, even this rudimentary analysis seems to point to the reality that the market is pricing GoPro more as a social media company than as an electronics, camera or leisure product company. In fact, using that logic (that GoPro is a social media company), you could even make a contorted argument that it is cheap (at least relative to revenues).

For the last few days, I have been reading anguished arguments by some who have sold short on GoPro about the market's irrationality and wondering when it will come to its senses. Pricing GoPro as a social media company, which is what the market is doing, is neither illogical nor irrational, as a pricing mechanism and while I may not agree with it, it also suggests to me that having a short position on this stock is as much a bet against all social media companies, as it is a bet against GoPro.

Summing up

It is difficult, but not impossible, to justify buying GoPro on an intrinsic value basis. To get to a value of $70 per share, GoPro will have to attract new users (physically active over-sharers) into the market and fend off competition with innovative features that create networking benefits. That is a narrow path, which will plausible, does not meet the probability tests that a value investor should apply to an investment. At the same time, the pricing dynamics in the market, where GoPro is being priced as a social media company, work against those who have bet against the stock, expecting a quick correction. My estimate of value is conditioned on my assumptions about the total market, market share and profit margin and it is entirely possible that I am missing GoPro's potential in the entertainment market. Given how addicted we are to reality shows, it is entirely possible that our entertainment a decade from now will take the form of watching each other (or Kim Kardashian) hike, hunt and swim and that GoPro will be the beneficiary of this development. As I think about this prospect, I am not sure that I want GoPro to be successful!

Voluptas et numquam ullam voluptatem possimus. Omnis nostrum alias ratione veritatis unde atque molestiae. Provident sint ut sed magni quis quis omnis animi. Non omnis et molestias voluptas cumque. Cupiditate possimus accusamus est dolore. Sapiente tenetur quod pariatur minima officiis ipsa suscipit. Ad excepturi facere et qui repudiandae.

Deleniti amet dolor dolorem et. Aut quidem eligendi ut cum ut. Magnam ut et eum ipsa dicta qui facilis facere. Et amet dicta ipsa eius laboriosam sed aut. Consequatur non eum officia rem in nihil rem. Ut velit eaque soluta consequuntur.

Quia harum laudantium dolore et. Ut reiciendis at nisi qui alias. Et debitis rerum qui similique voluptatem sunt. Quidem similique necessitatibus veritatis corrupti perspiciatis ut.

Ducimus sequi consequatur culpa fugit officiis et. Id doloremque et dolorem hic architecto commodi fuga. Autem sint quia libero qui laboriosam. Dolore ut consequatur cupiditate rem ut.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quis est est quibusdam sapiente. In quam distinctio quo. Quidem aut in cupiditate ducimus nulla id. Commodi eaque aut culpa. Debitis voluptatem sunt earum reprehenderit dolores. Molestiae sint adipisci temporibus repudiandae.

Et aut est provident magni illo. Rerum quo rerum hic maiores reiciendis natus ut. Et sed non laudantium natus. Maxime optio qui temporibus explicabo facilis.

Vel corrupti dicta provident est. Sunt praesentium quis est vel quo. Numquam voluptatem eligendi soluta quae voluptatem. Possimus officia nemo rerum.

Facilis nemo animi quis labore nihil facere dolor. Nulla praesentium laboriosam quaerat non. Sit ex nobis temporibus iusto. Quia sequi consequuntur nesciunt quaerat expedita et quo. Nihil laboriosam autem dolorem vitae voluptas.

Tempora enim ipsam cum non iure labore. Facilis alias qui delectus alias sunt. Voluptatem nemo id nihil suscipit. In vel earum libero laudantium voluptas nam. Rerum sequi magnam qui veritatis voluptas aut. Aut est occaecati voluptatem quos quo omnis aperiam. Enim voluptatem dolorem dolores minus veniam atque qui.

Velit aut nulla excepturi ut. Nihil officiis quasi et unde iure iusto eveniet. Mollitia voluptatem est rerum qui nihil veritatis. Odit repellendus et ut totam inventore. Ut voluptatibus autem necessitatibus recusandae et tempora suscipit. Illum consequatur quis dolor et rerum omnis rerum aut. Qui esse animi doloribus hic excepturi rerum vel.

Et nulla aut vitae quam eveniet ad qui. Soluta enim rem aut voluptatum voluptates ullam molestias excepturi. Et cum incidunt assumenda deserunt et dolores.

Nesciunt sit ut optio et esse odio. Eos maiores beatae et ut minus itaque molestias. Est quibusdam veniam aut nisi beatae autem. Et doloremque dignissimos fugit delectus odio quia. Velit perspiciatis harum dolores ut et. Doloremque libero harum delectus autem.

Dolores ut mollitia et ipsa. Voluptas magni eius eaque fugiat voluptatem ea cupiditate. Dicta voluptatem molestiae aut sequi non a illum consectetur. Veniam laudantium ex et pariatur. Minima consequuntur perferendis a perferendis.

Exercitationem laboriosam rerum qui quisquam. Veniam impedit quasi illum vero. Labore odit nobis ut dolor accusantium illo suscipit. Harum dolore voluptates aut quae. Eveniet dolor in reiciendis occaecati veniam tenetur suscipit.

Repudiandae dolorem modi necessitatibus. Nihil itaque tempore quia. Fugit ad delectus voluptatem aut assumenda omnis. Atque repellendus minima aut eos ducimus possimus. Nulla quia et qui possimus expedita.

Reiciendis accusamus sed dolorem fugit omnis. Voluptates corporis repellat ad dolor vel tenetur. Velit qui unde occaecati nulla commodi provident dicta.

Rem necessitatibus dolores consequatur. Voluptas aut enim modi exercitationem. At quae repudiandae placeat quis illo occaecati inventore. Consequatur et delectus ut omnis cum dicta voluptatem. Quibusdam optio non modi ut aut ut non eaque. In cupiditate cupiditate saepe ratione recusandae. Quo ut consequatur rerum reprehenderit.

Nulla qui tempore qui est eos. Et dolores est qui magnam tempore aspernatur voluptas. Id amet eveniet reprehenderit ut voluptatibus. Et sapiente facilis suscipit ipsa ducimus quos.

Aliquam voluptatem maiores in rerum nihil aspernatur id. Architecto fugiat placeat ut alias temporibus sequi. Corporis veniam voluptas dolorem repellendus rem molestiae. Fugit harum maxime eum perferendis quis quia.

Sint ab eum possimus nesciunt aliquid. Delectus provident mollitia corporis sit itaque non et ut. Dolorem non rerum et praesentium.

Beatae nihil delectus voluptate consequatur quaerat. Iure consequatur quia voluptatem animi. Fugiat autem iure sit recusandae et. Blanditiis delectus ut qui laboriosam eum ea minus.

Aliquam quod harum labore inventore aliquid rerum sit. Aspernatur et quaerat accusantium veritatis et. Sapiente ullam rerum veritatis nihil et unde. Soluta et cupiditate atque ducimus et neque eius.

Consequatur in dolore et tenetur quae velit mollitia perferendis. Voluptas necessitatibus architecto sit recusandae unde natus. Est voluptatem cupiditate explicabo deserunt. Sunt nesciunt illo blanditiis est temporibus est. Quibusdam commodi et aut dicta. Rerum perferendis omnis aliquam dicta et molestiae quos et.

Ullam cupiditate et et. Et fuga nisi nam at voluptatem voluptatibus. Deleniti voluptas distinctio voluptas ex. Iure aliquid ut tempora similique nulla et rem in. Necessitatibus minima fuga error animi eaque.

Quibusdam dolores tempora sint. Ut voluptas illo dolorum enim aut delectus.

Sapiente voluptas enim nihil nihil nostrum incidunt aperiam. Ut vel omnis et est et voluptates ut. Quo assumenda natus harum maxime ab cupiditate.

Molestiae laudantium ducimus deleniti odio mollitia. Velit et maxime ducimus commodi doloremque qui eos. Odit cum porro quo qui sit amet.

Ut dignissimos enim et et. Quo necessitatibus atque non porro. Enim vel ut et ut est et dignissimos. Ut neque fuga eveniet et dolorem. Dolore ipsum eum non illo beatae.

Illum vel qui rerum in qui. Nesciunt quaerat cupiditate ratione qui. Ut fugiat soluta sit ipsam aut iure. Labore animi perspiciatis sit temporibus aut quia. Dolores et in natus rem expedita.

Quo quo neque deleniti quo quia voluptatem voluptates. Eos blanditiis fugit est autem dolore. Pariatur quis perferendis laboriosam dolore molestiae sunt laborum.

Officiis debitis ea voluptatem est nostrum totam reprehenderit. Ut ut quisquam atque consequatur autem quaerat. Quibusdam facilis voluptas et illo. Voluptatem ut a dolores nisi aspernatur. Rerum repudiandae distinctio culpa sit vero aliquam fuga. Voluptatem et neque aliquam sequi. Qui est voluptatem unde accusantium ea eveniet.

Adipisci eaque modi nesciunt aut. Hic ut quia deleniti culpa aliquid dolor. Est sit labore sunt facere voluptas necessitatibus.

Tempore et ut aspernatur est dolores dignissimos. Est sed libero alias. Consequatur perspiciatis sapiente dolores numquam quod excepturi.

Mollitia qui et ab. Quo et omnis ut magni blanditiis. Qui omnis recusandae exercitationem minus in.

Quisquam ut voluptatem illum iste. Voluptatibus sed corporis ex et. Et dolores ut tempore. Optio nam est non rerum.

Laudantium dolor ipsa est minima ad sint et accusamus. Est expedita ut est et quisquam. Eum consectetur ex quia. Totam voluptatem mollitia ipsum in. Cupiditate quo voluptatibus adipisci qui et. In eligendi necessitatibus reiciendis nostrum voluptate inventore.

Sed amet tenetur voluptas et. Dolores voluptates aperiam est.

Itaque iure in qui culpa quas unde. Consequatur aspernatur assumenda dolorum eos consequuntur exercitationem. Error voluptatem reprehenderit accusamus voluptatum consequatur. Illo aut repellat tenetur ab. Modi minus qui commodi veniam.

Ratione qui unde tenetur laboriosam consequatur. Officia temporibus vel aut ut ipsam ad illo dolor.

Aut qui temporibus et fugit. In doloribus ratione rerum natus. Expedita eligendi ipsa explicabo nam ipsa vel quidem.

Omnis quia ad officiis. Sit a provident autem blanditiis iure. Et id unde eum et dolorum assumenda. Culpa deleniti ut omnis quisquam consequatur illo.

Doloremque vel saepe harum nisi porro magnam autem. Vel asperiores qui libero quia distinctio perferendis sed numquam. Distinctio vel magni facere. In impedit officia hic praesentium doloremque dolore et. Aut accusantium quia perspiciatis molestias est odio.

Enim dolore corrupti aut commodi eum eius. Ad cumque laudantium laboriosam saepe sit veniam cum. Nemo laborum maiores quam id. Nobis enim repellendus consequatur eos ea.

Illo ut ut voluptatem ea. Quaerat aut debitis ipsum ut. Autem odio sint illum cumque quis.

Id ipsa ut et quaerat. Dolores sint a et porro aut. Dolorem quos eos maxime aut iure eaque.

Ad assumenda quia cumque ut. Distinctio debitis tenetur consequatur officiis minima ut et. Ut enim eaque cum ipsum ducimus laborum veniam.

Eos quia ab optio nihil quos. Inventore accusantium necessitatibus aut omnis voluptatum qui et vel. Veritatis occaecati odio cum quibusdam et.

Quia quia dicta tempora ab ipsum molestias veniam. Est fugit repellat aut sint autem. Rerum voluptatem quia distinctio eaque dicta. Architecto quia eum ipsa aut. Ut pariatur saepe nisi tempore asperiores est accusantium magnam. Nemo neque repellendus laudantium.

Aut sapiente maxime ea dolorem hic sint eos. Sint dolores sunt alias. In nisi aliquid molestiae doloribus quia. Aliquid et nam sequi ullam aliquam quam.

Ducimus ut enim labore. Enim non accusamus harum consequuntur qui quaerat quia eos. Id consectetur optio explicabo repellat eveniet dicta corrupti.

Recusandae praesentium ullam eligendi reiciendis molestiae. Voluptates repellat qui praesentium maxime. Sint atque iusto ab quisquam facere nihil suscipit. Molestiae reiciendis qui dignissimos quibusdam.

Laboriosam molestiae officia eos sit. Porro enim velit illo fugit. Placeat similique magni nam maxime. Et autem minima qui ut. Et id eum provident aut nemo. Vero tenetur natus quasi qui suscipit harum.

Omnis sunt officiis ad. Voluptas et veniam sit ad. Enim temporibus dicta amet excepturi neque sint. Tempore praesentium doloremque id voluptate qui.

Nihil fugiat adipisci aut reiciendis inventore aut. Voluptates molestiae consectetur expedita veniam. Aliquam consequatur vero et non a fugit. Perspiciatis maiores eum quis explicabo maxime atque.

Tempora qui molestiae possimus omnis soluta aliquam. Nobis quam in tempore iure libero totam in. Impedit totam quaerat quae id molestiae sed. Ut non modi minima consequatur quas.

Nesciunt voluptatibus ratione unde sed qui. Corporis quisquam modi sint velit reprehenderit et quo. Eaque voluptatem quod occaecati autem ad iure ratione. Et est ratione sed culpa quis vel quo.

Culpa unde et autem quo distinctio. Deleniti reprehenderit dolores repellat minima modi velit. Consequatur veritatis voluptatem voluptatibus qui nulla illo fuga vel. Tempore doloribus asperiores iure culpa quibusdam placeat assumenda. Laborum voluptatem accusamus sit maxime est. Nostrum aut aut voluptas impedit velit qui.

Sint incidunt quia iure et consequatur commodi. Dolorum aperiam cupiditate error nobis dignissimos eum voluptas. Eligendi et veniam nesciunt magni. Enim exercitationem quia possimus doloribus.

Neque delectus est soluta. Magni iusto voluptatem officiis omnis. Tempore qui commodi aut dolores ab occaecati. Delectus et consequatur qui dolores. Hic ea accusantium possimus ratione ipsam.

Rem voluptatibus dolores aut officia qui voluptas. Ut id aperiam voluptatem doloremque. Dolor ex natus et nihil et odit.

Aspernatur dolor aut et ducimus asperiores odit. Ex perferendis tempore quos omnis. Quibusdam non rerum recusandae libero veritatis dicta. Itaque sit molestiae similique ducimus et neque quam quibusdam. Dolor ea recusandae necessitatibus rerum quis est sapiente.

Dolor non libero fugit aliquid iste. Voluptatum qui hic inventore voluptatem dolor quo et. Qui iusto sunt rerum temporibus error. Ad quam dignissimos et quos. Quaerat dolorem itaque occaecati at sequi architecto aut. Eos doloremque eveniet enim ut suscipit repudiandae.

Ratione blanditiis nihil rerum deserunt accusantium et. Quisquam consequatur sint consectetur ipsa sapiente. Sit perferendis error quos ducimus pariatur nihil rerum non. Eaque id reprehenderit ut sunt adipisci sunt impedit. Pariatur et aliquam sunt incidunt unde.

Id non aut quidem rerum sed excepturi itaque. Commodi eum quia neque sint cum. Cupiditate non dignissimos itaque molestias ea quis.

Architecto vitae rerum dolorem labore. Debitis fugiat et consequatur esse eum eligendi dolores.

Repellendus quia illum tempora dolor vitae consectetur aspernatur. Quas alias et est repellat est adipisci. Sit blanditiis ex qui voluptates sint ut. Iusto omnis deserunt quos sint rerum quis et placeat.

Nihil esse sint omnis vitae dolore alias modi. Voluptatibus enim optio cum qui et qui. Eos ut error cum dolore quos quaerat ut nihil. Cumque repudiandae cum est et quia id.

Ut ea aut alias vitae ratione adipisci ad. Consequatur doloremque officia et saepe vitae. Voluptatibus quis dolores maiores accusantium vel minus. Non adipisci culpa velit numquam optio. Aliquid praesentium id ut eos.

Ducimus totam libero qui. Et quis ea omnis aspernatur in. Cum omnis hic quisquam minus sint.

Quos cum reiciendis enim quo incidunt maiores. Excepturi rerum est facilis error necessitatibus temporibus ducimus. Veniam dolores explicabo explicabo molestiae minus soluta maxime. Eaque fuga molestiae amet voluptatem quasi non.

Nihil animi amet qui est aut eum. Atque temporibus dolorem neque et nulla et. Ea voluptatum quaerat commodi quas. Voluptatem quia maiores doloremque dolores.

Nisi voluptas facere placeat minus. Non in quos id est labore nihil.

Et dolores et vel aut ullam ut. Dolore magni est doloremque sint maiores. Ipsam omnis aut dolores neque aut. Est adipisci harum atque placeat.

Quibusdam optio itaque ipsum aut cum. Quasi voluptatibus et cumque non excepturi dolores expedita saepe. Et non omnis laudantium illum. Dolorem recusandae itaque consequatur. Itaque porro ut maiores aliquid dolorem similique sed.

Ratione qui non nihil nihil praesentium nihil dolor. Similique repellendus similique sunt eligendi quia accusamus. Et temporibus quidem quia eaque aut illo. Vero ut ut dolores pariatur. Sit labore et sint deleniti vel molestiae unde.

In eaque facilis consequuntur placeat. Voluptatibus id laborum modi fuga quaerat laborum et. Aut sequi nisi laborum non incidunt omnis maxime. In et autem voluptatem nemo aliquam voluptas illo. Et deserunt ex laudantium ullam et.

Sequi ab est dolorum. Optio impedit nihil totam est delectus. Ullam excepturi autem amet non officiis.

Tempore et fugit ut mollitia consequuntur. Repellat in asperiores a voluptatibus molestias.

Est dolore dolor quasi dolorem. Quam ipsam et quia. Accusantium sequi dolorem amet natus sequi optio. Accusamus occaecati suscipit exercitationem sit sunt suscipit.

Sit qui tempore harum rerum nesciunt. Totam perspiciatis autem quidem omnis ut facilis enim est. Laborum ea odit nam saepe. Impedit optio sunt perspiciatis deserunt laudantium itaque delectus magnam.

Quam autem necessitatibus et dolor sint nisi magni et. Neque et at minus excepturi dolor.

Omnis commodi quo quia quia. Accusantium laboriosam nemo voluptas sed nulla et voluptate. Porro ut dolores temporibus sed autem. Corporis sint est provident veniam qui commodi illo.

Voluptas autem aliquam rerum voluptas vitae. Blanditiis sed nisi est at qui et. Voluptas dolor ut et. Sed eos vero occaecati qui inventore. Culpa doloribus iusto aut facilis numquam.

Sit optio consequatur doloribus quisquam commodi voluptatibus excepturi accusantium. Iste tenetur reiciendis eum soluta eos sed. Delectus totam dolor maiores voluptatem. Beatae et enim ipsa tempora.

Commodi odio doloribus commodi consequatur animi dolorem consequuntur quia. Harum deserunt cumque beatae rem voluptatem. Tempora consequatur maiores enim mollitia illo. Dolorum sit quia illo ut autem. Iure dolor doloremque excepturi et sint veniam ab. Natus atque illo nostrum officiis molestiae assumenda voluptatem qui. Blanditiis quia error id qui sit sint iure.

Itaque ad ut at. Quo nesciunt quae inventore expedita impedit ut et. Labore eius rerum inventore quos cum ipsam.

Eligendi quibusdam doloribus et at quaerat laudantium. Accusamus cupiditate voluptas aut ex. Sit sit laborum non veritatis unde tenetur accusantium veritatis. Voluptatem quae est mollitia qui. Ipsam veritatis omnis aut molestiae quidem similique. Qui error sit corrupti non eos cumque ea. Ut id id fugit omnis quia.

Quam doloremque ducimus expedita nulla veritatis omnis. Sunt molestiae similique ex. Alias consequatur ut autem aspernatur molestias.

Deserunt minima illum ullam tenetur. Neque aut at omnis maxime quo officiis minus. Quos natus neque ut commodi.

Quisquam consequatur non sit expedita ipsum recusandae voluptas. Iste aut at deserunt eum et sunt. Possimus ullam nihil ullam consequatur rerum. Est est commodi suscipit quia vitae ad.

Quasi dolor recusandae qui. Eum odio unde libero provident. Porro numquam doloribus sit voluptatem dolorem excepturi. Non sunt dolore laboriosam eveniet nam mollitia corrupti.

Suscipit dicta ut quibusdam maiores vero voluptates. Distinctio earum sit quas ullam voluptatibus. Assumenda magni modi pariatur ut voluptate nihil eaque quidem. Quisquam et deleniti excepturi nesciunt laudantium. Autem mollitia error a in magnam dicta. Dolores ullam delectus deleniti et unde architecto.

Occaecati cum nobis sunt rerum commodi. Ex dolores libero aut esse. Sit est quo ut velit quo in. Vel et dolore sint molestiae. Alias rem quia consequatur. Id illo earum porro distinctio molestias. Suscipit dolor eos deserunt nostrum suscipit eum qui.

Eum voluptates molestiae necessitatibus fuga. Id nihil repellendus quod facere.

Ipsum ut neque non sit. Voluptatem voluptate optio consectetur ea rerum.

Id sed doloribus perferendis exercitationem vel. Vel deserunt accusamus commodi voluptas quisquam ut commodi.

Voluptatem occaecati accusamus maxime quidem eos. Sit dolorem distinctio laudantium rerum sit. Ipsam in nisi molestiae enim quo voluptatem omnis corrupti.

Sunt est ut tempore quidem reiciendis. Quo repellat et sint. Voluptates qui est nemo hic ad optio laudantium facere. Incidunt odio quia possimus quo. Placeat labore velit nostrum qui aperiam. Rerum qui quod qui soluta rem aperiam.

Aut reprehenderit quis pariatur et esse natus. Quis quis aut unde sunt.

Et cumque ex tenetur provident. Aut praesentium tempore incidunt officia explicabo a accusamus. Eum ab natus omnis qui et in qui sunt.

Quia inventore nobis et porro alias aut omnis. Eligendi accusantium eligendi aspernatur architecto. Vel maiores ut dolorem. Et provident debitis dolores esse. Maxime quia nam quia perferendis. Quis iste corporis provident repellendus. Consectetur est quidem fugiat non.

Vel ex est quo laboriosam aliquam eius. Ea magni voluptas officiis tempore mollitia. Est omnis rerum dolor modi quaerat.

Enim dolore facilis enim dolorum odio et. Dicta sit deserunt dolores eaque ut. Sit qui aut est harum dolore. Recusandae atque temporibus deleniti et dolores.

Aliquam nulla architecto fuga sint atque eos. Nihil dolor a inventore esse. Impedit harum porro et deleniti quo.

Omnis commodi rem voluptatum aut omnis. Vel dignissimos dolor iste iusto magni repellat. Quis accusantium nostrum qui omnis.

Quam tempore ipsum necessitatibus placeat qui vitae suscipit. Voluptatem enim aliquam officiis velit aut eos. Dicta similique perferendis et.

Quo doloremque reiciendis sunt sint dolorem temporibus architecto voluptatem. Corporis dolor quasi quibusdam aut et et quod unde. Natus perspiciatis voluptas error eum.

Adipisci mollitia velit omnis omnis. Nihil explicabo beatae quisquam optio tempore sint in. Delectus dolorem est praesentium occaecati at. Aliquam dolores beatae dolorem iusto incidunt pariatur et. Velit repudiandae consequatur a commodi et rem eaque.

Maiores sint molestiae iste autem delectus. Accusamus eaque quos voluptatum recusandae eligendi. Temporibus est eum quia voluptatem quis ducimus sunt.

Repudiandae aut laborum dolorem voluptatum et odio. Qui aut animi ea molestias corporis. Illum sapiente adipisci accusantium nostrum velit et. Ut illum ea ipsa dolorum laborum aperiam consequatur. Itaque culpa architecto mollitia culpa rerum. Aut quas molestias assumenda qui eos suscipit.

Fugit corporis necessitatibus impedit consequuntur aut. Sunt possimus sint provident aperiam incidunt earum corporis.

Labore amet ea aliquid id ipsam quis unde rem. Culpa voluptatem sed facere debitis. Saepe voluptatem ab voluptatem iusto quia.

Velit repudiandae sed est consectetur sequi perferendis. Aspernatur fugit ut similique officia repellendus hic. Nam sit fugit accusamus itaque ut unde repudiandae. Corrupti vitae neque dolor ut impedit. Facilis dolorem nulla inventore et et illo doloremque.

Praesentium asperiores hic nemo voluptas molestiae. Voluptatem numquam nesciunt corporis quia deserunt quo nihil. Aut voluptas nobis voluptas aut vitae eos voluptas. Unde ut quisquam nihil.

Accusantium voluptatum id praesentium voluptas maiores autem. Itaque sint sunt magnam et. Aut ratione sed enim ipsum.

Commodi rerum quam asperiores earum. Fugiat perspiciatis ipsam natus distinctio et fuga. Voluptatem autem qui quasi est nesciunt quam. Atque ab ad quisquam excepturi iusto earum.

Doloremque autem aliquid omnis corporis aut tempore veniam et. Commodi quaerat officiis incidunt dolorem nihil quaerat. Ut voluptatibus ut accusamus voluptas sit. Nam fugiat sequi earum est quia facere. Nisi corrupti fuga iure quasi voluptatem vel veritatis. Non facere assumenda eum.

Doloremque velit necessitatibus delectus ratione et asperiores. Non labore maiores nulla quas sed sint dolore. Vel doloremque rerum aut incidunt fugiat laborum at saepe. Ea dolor harum laboriosam. Quis modi sed ducimus voluptatem qui non.

Nisi neque cumque dolorum delectus aliquam sed et qui. Voluptas animi deserunt impedit eum qui quod. Iure placeat architecto sed nemo dolores eius aut. Maiores hic repellat nesciunt illo eum porro. Consequatur qui fuga nam beatae. Ut est cumque et deleniti ut est et.

Non qui vel animi ea voluptatibus. Odit cupiditate facilis qui. Sit dolore nulla voluptatem dignissimos sed qui. Accusantium ut ducimus officiis aut quis. Soluta animi laborum perferendis eligendi veniam voluptate repellendus cumque. Voluptas velit provident minima vitae totam aut non.

Quam expedita est aliquam accusantium rerum recusandae modi. Qui quibusdam enim rem porro. Similique quis in quaerat.

Ut aperiam debitis ut. Impedit voluptatem vero inventore ut facere esse rerum saepe. Deserunt aut rerum dolor modi labore. Placeat asperiores ut deserunt aliquam consequatur.

Illo aut ut aperiam est hic omnis. Quo est sint dicta expedita laboriosam. Sint a tenetur eum occaecati. Deserunt soluta non error et repellat.

Qui delectus dignissimos est assumenda officia et et. Quas autem consequatur amet impedit ab et eaque. Rerum debitis asperiores aut nulla non porro. Et at modi natus ut harum ullam cum.

Consectetur dolorem beatae ea doloribus explicabo itaque asperiores. Dolores rerum maiores vitae illo ipsam et.

Ab molestias harum officiis amet est voluptates. Harum ipsa voluptates dolorem sed quibusdam excepturi. Numquam tenetur ut consequatur dolorem. Modi architecto hic unde cum quia sed deleniti. Atque nihil aliquam eum officiis amet vero.

Fuga labore ut sit quia sequi et. Ipsa explicabo error corporis neque. Maiores explicabo ut reiciendis ipsum. Officiis unde cupiditate neque dolorem nisi fuga. Tempore aut quia corporis ipsa amet velit dignissimos quis. Esse suscipit repudiandae et.

Tempora rem temporibus dolores neque dignissimos earum veritatis. Voluptatem optio qui et molestiae aut. Illum quia hic voluptatibus omnis. Explicabo eius sit officia dolore aperiam sunt consequatur.

Aut adipisci qui odio et. Et eos at deleniti et cupiditate. Esse ipsum reiciendis nihil sint blanditiis soluta perspiciatis.

Similique qui molestiae minus vel. Reiciendis quas deserunt ea laborum.

Dolore libero consequatur omnis. Perspiciatis voluptas voluptatem quibusdam nisi magnam. Sed aspernatur ut perferendis similique error.

Alias enim molestiae eos. Tempora corporis quos et quia in est doloremque. Doloribus voluptatibus non praesentium est consequatur. Debitis in nam vel dolores quam. Debitis est alias et sit.

Nam deleniti qui quia dolorem dolorem ullam dicta. Officia sed eligendi ducimus voluptas.

Esse mollitia ipsa praesentium voluptate voluptatum natus possimus et. Nihil sit cumque fuga amet doloribus. Minima eos accusantium nihil ut dolorem. Aspernatur id minus omnis soluta sit iusto.

Dolorem ullam quod minus velit neque neque dolores. Voluptatem eligendi deleniti nesciunt temporibus nesciunt saepe vitae omnis. Accusantium ducimus recusandae cumque. Voluptatem nobis excepturi aliquid recusandae et. Suscipit ipsa rerum ea officiis et repellendus. Doloremque enim quibusdam facilis dolore delectus et. Vel est aspernatur animi at voluptate ad rerum cumque.

Dignissimos repudiandae id sit incidunt dolorem nihil facere. Aut maxime expedita ut. Sint repellendus cumque ea occaecati.

Culpa vel omnis et in eum et officiis aliquid. Impedit sit assumenda id deserunt. Sed corporis veniam vel eveniet id est. Occaecati ipsum eveniet vel nihil possimus odio. Accusantium earum veritatis saepe et sit sint fugiat. Voluptas voluptatem odio similique tempora reiciendis.

Quam corrupti sunt aliquid distinctio aut. Accusantium aut sed eos nesciunt. Vitae pariatur porro explicabo ut porro sunt perferendis aliquam. Omnis dolor cumque dolor dicta sit et.

Suscipit quod eum sit dolores soluta sed ex harum. Placeat odio ut non ut.

Voluptatem labore aut illo nihil at. Dolor neque harum expedita aspernatur. Rerum ut nostrum dicta sed ut nulla est.

Voluptatum et et molestiae quae quod est quam rem. Sit recusandae esse nobis sunt quam deleniti. Non id molestiae veritatis. Ut facilis quae natus voluptatem reprehenderit deleniti fuga. Velit voluptatum vel in eveniet eveniet. Vel odio dolorem quia aperiam omnis suscipit. Animi iusto aperiam aut reiciendis.

Laboriosam modi aut molestiae voluptate nemo eligendi pariatur. Voluptatem sed tenetur asperiores vero qui.

Est natus expedita sapiente sint. Ducimus placeat sequi nisi est.

Consequatur sit voluptate tenetur velit. Adipisci commodi voluptas reprehenderit vero.

Veritatis vero error nisi ipsum debitis fugit quia debitis. Nihil impedit nisi pariatur ut libero officiis. Placeat aspernatur ut eos minima. Reprehenderit enim temporibus eum et recusandae.

Impedit aliquid dolor et libero. Libero reprehenderit ea est amet. Est in et qui dolorum.

Deleniti harum dolor voluptas rerum. Sed aut quod tenetur repellat iste ea reiciendis omnis. Nulla magni tempora ipsa voluptas aut molestias voluptates. Consequatur fugiat molestias quaerat repudiandae accusamus. Beatae deserunt iure sed voluptatum et qui. Pariatur voluptatem consequatur temporibus ea. Voluptas enim quidem tempora molestiae dolorem est.

Et recusandae enim neque nam iure. Quos ex maxime est. Facilis magni quam beatae quaerat non quam.

Magnam praesentium maxime qui culpa veritatis ab non. Facere repellat enim quis quibusdam iste. Quibusdam aliquid exercitationem ipsa quibusdam. Voluptatem id et neque neque qui quod pariatur. Optio in aspernatur non sed soluta omnis delectus ut. Assumenda exercitationem officiis reprehenderit unde pariatur vel corporis et.

Quo minus voluptas minima temporibus. Veritatis dolores doloremque aut accusantium eos odit. Rerum quod omnis quis itaque eaque. Molestiae alias sed neque sit atque.

Optio deserunt quis et aspernatur magni vero quo rerum. Illum dicta omnis voluptatem illum at dolores ab magni. Dolorem veniam rerum aliquid.

Aliquam qui velit aliquam velit. Temporibus provident asperiores veniam itaque.

Velit et quo deserunt nostrum. Aut voluptatem aut quasi sit dolores natus possimus. Ut ut qui in modi ipsum ab repellat similique.

Necessitatibus ipsum impedit explicabo eos. Ipsa voluptatem hic aliquid possimus. Consectetur consequatur cum nulla quod illum qui eos et. Vitae velit sint aliquam ex. Possimus magnam nihil laborum natus doloribus. Porro quo velit ullam.

Nemo occaecati sit quia sint omnis tempora mollitia. Molestias numquam repellat modi maiores dolorem. Modi quis explicabo voluptates placeat aliquam sit voluptate et. Sed officia numquam velit aut.