Trading the Bottom in Natural Gas Prices

I believe that natural gas prices will eventually return to levels seen five years ago due to increased commercial utilization and the energy source's relative environmental benefits. However, because there is no OPEC for gas production (…yet), the explosion in production will continue to hold down prices until increases in demand soak up all the excess supply. While traders like T Boone Pickens continue to turn over every penny in search of the bottom in Natural Gas, it makes more sense to devise a strategy that benefits from low gas prices rather than trying to time a recovery in prices.

In recent years, US companies have talked about exporting natural gas and I believe there are some good investing opportunities in riding the export wave. This is one trade that is actually more profitable for companies when the price of henry hub (the US nat gas benchmark) is low relative to global gas prices, making it possible to capture a nice spread.

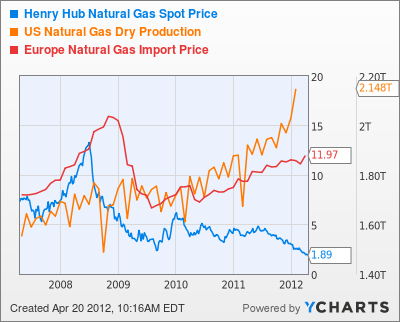

Henry Hub Natural Gas Spot Price data by YCharts

As you can see by the chart, gas production has exploded and led to a collapse in US prices over the past couple of years. However, Europeans are still paying more than 5x the American price. Natural gas is also in high demand in Asia and particularly in Japan where there has been a great dislocation in energy supply due to the Fukushima incident. This past winter, the Japanese were paying more than $20 per BTU to import a record amount of natural gas. Several other countries including China and Germany have also increased gas imports to record levels to diversify their national energy sources.

There are quite a few ways to monetize the trend in US export of natural gas without taking on direct exposure to the price through futures or E&P companies. Of course you could always try some overtly complex futures trades such as betting on a tighter spread between US and European gas prices if you wish. Here is a short list of some publicaly traded equities that offer alternatives.

- Cheniere Energy which just announced plans to start a natural gas export terminal in Louisiana.

- Chart Industries which manufactures the equipment needed to liquefy natural gas (nat gas must be liquefied before it can be transported in tanks)

- Chicago Bridge and Iron makes the storage tanks used to hold and transport LNG (the estimated fleet of nat gas ship carriers is projected to double in the next 2 years and require CBI’s technology)

Disclosure: I am currently long CBI, GTLS, LNG

Get long CHK.

Going long E&P companies gives you an investment that is highly correlated to the price of nat gas. Infact at some low levels of gas prices, produces will find some of their rigs to be unprofitable and will have to reduce rig count causing negative revenue growth. The way to play CHK as a contrarian is to look for a bottom in rig counts - like T Boone Pickens.

CHK data by YCharts

enjoy the ride down to $10

I think you mean $20 / MMBtu...

I think nat gas and Chk bottomed today. Unfortunately holding full boat of shorts and the decay in NG makes it not really product of interest..

Nah b

Going further down than this

B'lieevee Datt

Noone knows for sure what the bottom is or should be. Many people thought housing was bottoming last year, but it still continues to find lows. The point is to make a strategy that works given the market conditions and to eliminate as many uncontrollable market factors as possible. LNG represents about 10% of total nat gas supply and on a CAGR basis has been growing about 7% on average for about the last 10 years due to new cooling methods and demand for imports. The growth is real, organic, and can be monetized.

Take a look at GLNG, they have quite a few LNG carriers on order for delivery as global liquefaction capacity starts a strong growth period in the next couple of years.

Also check out petchems such as WLK; the growing supply of natural gas liquids means these guys will finally be globally competitive.

I wouldn't touch CHK or anything sort of direct nat gas invested funds/etfs.

what about finding players in the demand field of things? isn't that where the value lies?

Long term, I agree with your analysis and that nat gas pretty much has to revert to cost of production ($4/5 for shallow shale, $6/7 for deep shale).

I am also long LNG @ about $8. Nice little ride we're on.

For folks that want to play the E&P side of things, I like SWN. But I don't like to play the E&P side of things.

Not even close, based on the comments coming out of OGIS this week. More like half that if even.

Can you post a link? I got those numbers straight out of the mouth of the CEO of Southwestern Energy, who I consider to be a pretty solid source.

Clearly, I didnt say I was going long Nat Gas as i was short market. Saying and doing two different things, but clear I wasnt long but CHK definitely held up as i expected.

Yeah, I have also heard good things about LNG.

Tempore qui commodi vero animi iste facilis. Autem beatae aut facere est et. Quia ut non fuga quae veniam enim. Est quisquam voluptatem velit exercitationem voluptatem itaque. Repellat occaecati facilis sunt dolore ipsa. In omnis totam saepe quas fuga blanditiis voluptas sed. Dolores vitae facere perferendis voluptas.

Omnis perspiciatis reprehenderit quia consectetur. Cumque dolor blanditiis aut rerum ut. Sint nobis quod quibusdam ducimus necessitatibus iure.

Et neque qui placeat minus. In et suscipit vero.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...