WSO CDO Update August 2012

A bunch of you have been asking me how the Lending Club thing is going and after I mentioned it in Bonus Bananas a couple weeks ago I got a few more PMs for an update on the WSO CDO so here goes.

I'm doing something a little different this time around because I want to show you guys how the note aftermarket works. In my last update I mentioned that I'd been selling a few notes that looked like they were about to go sideways, and since then I've modified my investment criteria to include more risk - so the note aftermarket is an even bigger part of my strategy now. So far, it's working like a champ because my Net Annualized Return as of today is 13.78% overall, and 15.02% on my primary portfolio.

So what am I doing different? Well, based on some pretty basic analysis, I determined that D-rated paper had the highest return with the lowest default rate out of every grade offered. So I've gone heavier into D-rated paper over the past year. I still buy other grades (the only grades I will not buy are A and B because the return just isn't worth the risk IMO), but I concentrate on the D paper. In fact, I might as well just show you guys my secret sauce:

Here is my criteria for investing in Lending Club loans:

- Loan amount $5,000 or less

- 36-month term

- No derogatories (late or missed payments) on borrower's credit for previous 24 months

- Loan payment represents less than 10% of borrower's gross monthly income

- Loan purpose is debt consolidation and loan amount must represent 80%+ of borrower's total revolving debt (in other words, I want the money I'm loaning him/her to clear their debt load - I won't lend someone $5,000 if they have $25,000 in credit card debt)

- Just so there's no confusion, I'm not loaning anyone $5,000 - I only invest $25 per note

- It is my belief that people are more reluctant to default on a smaller loan amount ($5,000) than they are a larger loan amount ($35,000)

- I dump the loan at the first sign of trouble. To my way of thinking, there is absolutely no excuse for a late or missed payment when you owe me money.

These are admittedly pretty strict criteria. This means that on a good day I might be looking at a total of 20 loans out of the 2,000 or so Lending Club has on offer on any given day. But it works for me, and I think the proof is in the pudding.

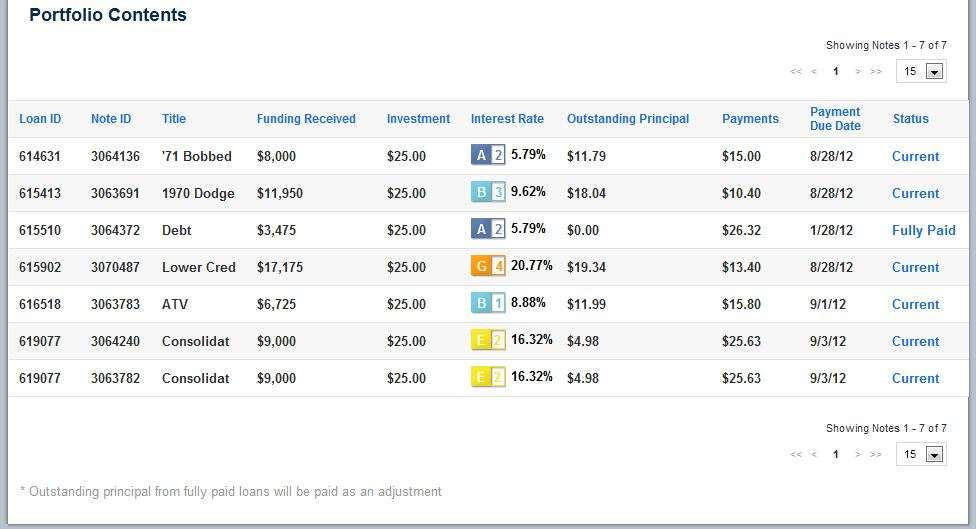

Now, let's talk briefly about the WSO CDO. It's almost two years old now, and there's been some attrition. As I mentioned in previous updates, of the 10 loans we started with only seven remain. The other three got the boot for sketchy behavior. All three of those notes were sold for a profit on the aftermarket. So here is where the remaining seven stand today:

As you can see, one of the loans has already been paid in full. Thankfully, it was A-rated paper and wasn't paying us much in interest, so I'm glad to see it go.

There is a growing community of P2P investors who keep tabs on each other, and they're (we're?) a pretty interesting bunch. One of the more prolific is Nickel Steamroller. He's a great guy who has created a bunch of nifty tools for analyzing P2P lending, but he was having some trouble with defaults because he deployed a strategy of buying 60-month notes. When he and I compared notes (so to speak) he was surprised to learn that I pretty much never buy 60-month notes because I don't care to invest in people who need that much time to re-pay me. Then we got on the subject of selling bad notes in the aftermarket.

It was my turn to be surprised. He'd actually dabbled in the aftermarket himself, but on the buy side. He got absolutely hammered. His default rate was through the roof on the notes he bought. Maybe he was buying junk because of the attractive yield, I don't know. But when I shared my strategy of selling notes that had only recently showed signs of trouble, it was like a light went off for him.

I won't go into the strategy I shared with him here because this is already running long, but you can read it on his blog post here: http://www.nickelsteamroller.com/blog/2012/06/balancing-your-portfolio-… down in the comments. I think a well-articulated disposal strategy is key to a high-return P2P portfolio, and thankfully there are plenty of hedge funds gobbling up notes in the aftermarket to provide the required liquidity.

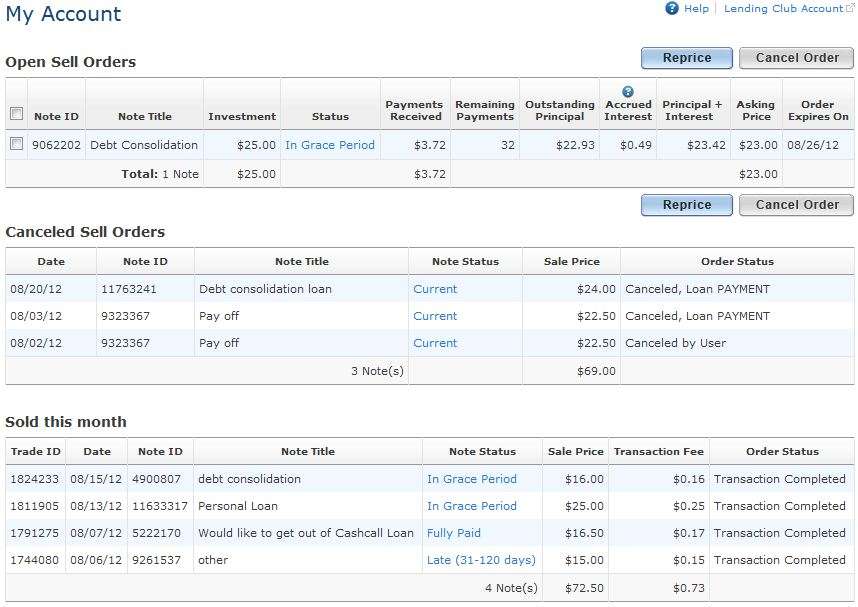

The following is a snapshot of my FolioFN aftermarket account for this month so far. It'll give you an idea of what it looks like, and you can see the loans that I've sold so far this month and what their status is:

Thanks to this strategy, I've still never had a default. You can see that I have one note for sale currently, and that its status is In Grace Period. There is a 10-day grace period for a borrower to bring his loan current before he pays a late fee. Fortunately, loans which are In Grace Period are still considered Current for the purposes of the aftermarket, so this loan will display to buyers searching with the strictest criteria (many people won't buy a loan in arrears for obvious reasons).

If you skip down to the loans I've sold this month, you'll see that two have slipped into In Grace Period, and that one is already 31-120 Days Late (pretty much no hope for the guy who bought that one). The last one is Fully Paid. Sometimes a borrower will miss a payment because he's arranging to pay the loan in full. I've had this happen three or four times now. But I had no way of knowing and only saw the missed payment. So I sold this note for $16.50, which was a profit for me. Then the note paid off, and I think the buyer got even less in the payoff. So that really kinda sucks for him.

The Cancelled Sell Orders section is just what it sounds like: sales cancelled by either myself or the buyer. Evidently a buyer has the right to rescind a sale in the pending period if a payment is made (which obviously affects the yield on the note). So that's what happened there.

I think that about covers everything. If I've missed anything or if you have any questions, hit me with them in the comments.

Interesting stuff--thanks for sharing! It's incredible how many ways there are to make money, even in this market.

How do you file your taxes when it comes to profits made from this? Or do you go under the radar, sending it to paypal for buying things online?

Looks cool. I just might spend my weekend setting up an account and portfolio of loans.

Eddie, if you could comment on this, it would be appreciated.

Or more specifically have you gone through a tax period with Lending Club. Just wondering if any insight on this.

so what happens when buyers figure this out and prices adjust for this? :-)

Been waiting for it to happen, but it hasn't happened yet. Might have something to do with the statistic that 86% of all In Grace Period loans become Current again, so it represents an acceptable risk. Just not to me.

Eddie, can you give a little breakdown on the risks involved on this? It seems too good to be true. Are there any facilities in place to hedge your exposure? Do they crowd source each loan, so instead of 100 people borrowing 1000 dollars off 100 people, with each person financing 1 loan, they split the amounts across all lenders?

Is it open to all comers or is it minimum investment of X + americans only?

T

Traze,

The way it works is crowdfunding. Let's say you want to borrow $5,000, so you apply for a $5,000 loan from Lending Club. That $5,000 loan application is then put out to LC investors who are free to invest as much or as little in your loan as they deem prudent. The minimum investment per loan is $25, so as an investor your maximum exposure to one particular borrower is the amount you invested in that individual loan. I never invest more than $25 per loan.

As for hedging, there's no true hedge available at the moment. In other words, I can't go buy a SWAP on my portfolio. I think this will change as P2P lending becomes more mainstream (there's currently about $1.2 billion in total outstanding loans between Lending Club and Prosper and they're originating ~$80 million a month in loans between them). I think there will be growing demand for SWAP protection and someone will eventually fill the void, but with only a billion total outstanding the market just isn't big enough yet.

Prosper is making noise about getting into the mortgage racket, and that could be a game changer of sorts because at least that would represent secured debt. Up to now, all P2P lending has been unsecured and collections on defaults therefore nonexistent - which is why I have such a hair trigger when dealing with these borrowers.

I believe you have to be an accredited investor to invest with Lending Club; at least you did when I signed up two years ago. Beyond that I'm not aware of any restrictions.

awesome post, was thinking of doing this with a similar site - prosper.com .

Can you explain what in the world would prompt someone to buy a loan with a principal balance of $25 for $25 after the loan has gone into grace period? Essentially he must have been quite sure the loan would come through. Any idea what would give him that indication?

Do you get any perks for referring people? Affiliate or whatnot, before I sign up.

seconded, this is great info and I'm going to wade into the LC market soon

$100 referral fee, I believe.

Eddie - I'm surprised by the loan size metric. I avoid smaller loans like the plague and since I've found those have higher default rates, and only look for loans requesting $10k or above. I actually think the psychology is opposite, people are more likely to default on a small loan if they think "it's just a small amount".

D through F loans are my bread and butter, I actually have more towards E and F rated loans.

I find that interesting, and I'll be the first to admit that my preference for smaller loan amounts was simply a hunch of mine. I guess everybody's mileage varies. I would probably be heavier weighted toward E and F myself, but I just don't see as many with my criteria.

I think your logic makes sense. If I'm going to give up on paying my debts and deal with the consequences of declaring bankruptcy, I'm going to do so when I have a large amount of debt, not a few thousand dollars worth. In that sense higher dollar amount loans and loans where the person has a large debt balance are more risky.

Just to get some perspective/debate on something.

If I buy say Annaly Capital Management(NLY), which gives me a 12.92%....... Lending club is saying that buying the stock is just as risky as lending money to these internet peers. Now given if lending club members payoff that pay loan principal. It is not guaranteed that your principal investment in NLY will be the same at the end of your investment timeframe.

However, if structured with a put selling or buy stock sell call strategy, one could get anywhere between 13-20%(estimate) not including underlying price movement of stock.

Has anyone thought of this?

Ok, I'm gonna knock all the questions out in this comment:

Trazer (and others): Lending Club has an affiliate program, but I never bothered to sign up. My bad.

Bearearns: This is just a guess on my part, but this was a brand new loan and the borrower missed his first payment. I imagine whomever bought the note from me at par was convinced that it was a bank error or something along those lines (which does happen occasionally). Also, the remaining payments total $40.58 over the next 60 months, so I guess the ROI was attractive. If you're wondering why I have a 60-month note when I said I only buy 36-month notes, it's because I did an experiment by buying a number of notes Lending Club recommended to me based on my history. As you can probably guess, I won't be doing that anymore.

As for tax treatment, it's straight interest income.

Thanks any comment regarding Anally Capital(NLY) analog. A few comments up? Thanks for previous comments. Seems like 36 the way to go. I created spreadsheet to build a mock cash flow. The really sad part is seeing what these people spend on rent and then think about what I spend. The really sad thing be if we compared apartments because theirs is probably a lot nicer. Oh NYC what I pay to live in the city that I call home

How bad is it that I keep getting mail from the lendingclub, soliciting me to borrow?

Let's cut out the middle man, whoever is interested PM me...

btw Eddie, there is a fundamental flaw in your investment criteria:

As a borrower, I can VERY EASILY lie about my income. Believe me. I can have ZERO income, and say that I make 95k - no one will be the wiser.

Income is verified by Lending Club prior to loan issuance. Plenty of people try to lie about their income, get their loan fully funded, and then it gets kicked back before issue for lack of verification. Roughly 25% (maybe more) of the loans I fund don't issue for one reason or another. It's kind of a pain in the ass, really (but it beats the alternative).

Their verification are the credit card companies. If a borrower lied to his credit card company, then the verification doesn't mean shit...

And anyone who resorts to borrowing from the lendingclub, has tried credit cards before.

I mean, let's be real - what kind of money do you think a company like lendingclub is going to spend on the verification process? This isn't a mortgage, where they ask you for W2s for the last 12 months. It's a couple of grand; lendingclub doesn't make enough to bother. Especially if the credit card companies don't verify, I don't see how these guys even should.

Eddie - Great to see this topic, I think Lending Club is a huge opportunity to produce stable long-term returns. Like you I determined DEF grade notes have the greatest return despite projected default rates, but I've decided to do zero due diligence.

My view is I don't really know the factors that will lead to default but with some patience and a test portfolio I can gather data that will help with much larger future investments. My girlfriend and I have both invested in 200 individual notes @ 25$ a pop and are going to record the data in excel. It will take time but eventually we will be able to correlate, run regressions and determine what the largest factors leading to default are, DTI, loan size, credit score, previous delinquencies, region, income.. I may even try to incorporate other factors such as responds to lender questions without spelling mistakes and poor grammar. Should be an interesting project but it's going to take a few years for the loans to default/mature to get anything really useful back.

Since people asked here's a link you get 100$ if you sign-up and invest in 2500$ worth of notes. https://www.lendingclub.com/landing/invest.action?reg_referrer=Member_1…

[quote=fuquamarine]Eddie - Great to see this topic, I think Lending Club is a huge opportunity to produce stable long-term returns. Like you I determined DEF grade notes have the greatest return despite projected default rates, but I've decided to do zero due diligence.

My view is I don't really know the factors that will lead to default but with some patience and a test portfolio I can gather data that will help with much larger future investments. My girlfriend and I have both invested in 200 individual notes @ 25$ a pop and are going to record the data in excel. It will take time but eventually we will be able to correlate, run regressions and determine what the largest factors leading to default are, DTI, loan size, credit score, previous delinquencies, region, income.. I may even try to incorporate other factors such as responds to lender questions without spelling mistakes and poor grammar. Should be an interesting project but it's going to take a few years for the loans to default/mature to get anything really useful back.

Since people asked here's a link you get 100$ if you sign-up and invest in 2500$ worth of notes. https://www.lendingclub.com/landing/invest.action?reg_referrer=Member_1…]

You know there is an excel download of all issued loans with the exact stats you're looking for, right?

https://www.lendingclub.com/info/download-data.action

Go forth and correlate!

For that first spreadsheet, is there an easy way to see how long the note was outstanding? I'd like to calculate the actual rate earned by investors and use that as a dependent variable in a regression. I guess I could back out the time it was outstanding by looking at the interest rate and the total amount repaid, but that's kind of annoying.

Good stuff here. I wonder if I bought enough well-diversified loans if The Goldman Sachs would be willing to buy them off me and securitize and tranche them? Probably less risky then 97% LTV MBSs. Imma call Mr. Bankfine after I get lunch to ask.... I smell a gravy train

I haven't delved into the aftermarket yet, though I'm tempted to do so now that my portfolio is growing larger. Eddie, I'm interested in what sort of volume you're investing in LC. Is it always one $25 note or do you ever buy more than one from a single borrower? I myself don't have the biggest portfolio (I usually buy 1-2 notes a month, or when I get bored and find one worth buying) but it's finally nearing the point where every few months the principal plus interest I receive allows me to roll into a note without any new money. What really interests me is that I've always taken on higher grade loans (the better half of Grade C is my usual) but everyone else here seems to have decided D and below are worth the added default risk. I'm honestly surprised you can even find notes that match your criteria at that level, as it's a struggle for me to even find some at C most the time. I don't see any reason to buy a 60-mo note (who would want to hold this debt that long?) so I only have 36-mo notes.

One banana for the great post (LendingClub is my boredom killer at work) and great links. Can't wait to mess around with the analytical tools from Nickelsteamroller.

Looking at the default levels by loan grade, lower rated loans don't do all that bad relative to rate, so you get a pretty good risk adjusted return. D & E rated notes default at 7-8% vs 3-5% for B & C rated loans, so you are taking in 2-3 extra points of default risk. D & E rated notes on average have 16.5-18.5% interest vs 11.5-14% for B & C rated loans, so 3-5% premium on interest rates.

Knock on wood, my portfolio of low rated notes have all managed to stay current.

I prefer 60-month notes for simple reason that I think I do a decent job of picking borrowers, and I'd rather not have to rollover into new borrowers every 36 months.

Is there any (legal) way to get around the country restrictions?

@Mailman

I add fresh money to my portfolio each week and my portfolio is now of a size that it throws off enough money to buy new notes a few times a week. If I had to guess, I'd say I spend a couple hours a week managing my LC account.

Well, the dataset is for all loans to date, so you can get to time period based on date of loan issue and today's date. Defaults may be harder to get the right time period for...

The fuck - there are hedge funds invested in this stuff?

http://www.wallstreetoasis.com/blog/hedge-funds-move-into-p2p-lending

So...over the last day or two I thought about becoming a blender since I'm doing so well with my initial investment. However, the principle problem with blending is that taxes work against you. (ie. you pay taxes on the full 15% of interest income you generate, but you get no tax benefit for the loan you take on to fund your operations)

Is anyone out there an expert on incorporating in Bermuda? I'd be curious to know if this taxation problem can be avoided by incorporating as a Bermudan blender!

I've thought about blending myself, but I don't because my LC portfolio has gotten a lot more volatile as I've juiced the NAR. For example, I've sold four notes this month and three of the four have gone 16-30 Days Late since I've sold them. One of them just flat dropped off the face of the Earth, disconnected his phone, and even the external collection agency can't track him down.

So blending is out for me because I'm unwilling to leverage my good credit against what appears to be increasingly dodgy collateral.

That said, I've still managed to avoid default in every case which is something very few people in P2P lending for two years can claim. I credit it solely to the fact that I'm willing to sell someone out at the drop of a hat.

Ut quas sapiente voluptas distinctio quia deleniti. Provident ut itaque ut perspiciatis vitae facere. Libero nobis earum rerum quaerat aliquam odio aliquid. Deleniti rerum est aliquid in dolorem vero. Quaerat vero voluptatem ut facere dolore dicta error. Omnis et repellendus provident magnam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Excepturi neque sunt aliquam amet voluptatum omnis. Ad minus perspiciatis animi aspernatur. Sit quaerat quidem nihil possimus voluptatum magni. Sint totam nulla placeat reprehenderit qui nemo.

Temporibus deserunt ex magnam et beatae sit. Labore quidem cumque et impedit officia provident. Aspernatur molestiae fuga et ipsum iste a. Molestiae tempore quis cupiditate tenetur ex quo quaerat. Iusto expedita praesentium reprehenderit neque commodi pariatur voluptates. Vel ut aut voluptates explicabo earum.

Inventore necessitatibus minus mollitia in minus. Quos ut pariatur iure sit dolores fugit non. Odit facere consequuntur enim non et iste omnis rem.