2018 Hedge Fund Report: 8 Key Takeaways

The 2018 Hedge Fund Industry Report compiled by Wall Street Oasis (WSO) provides insight on compensation, the interview process, employee satisfaction and more.

All statistics featured in the reports are based on 2,260+ user submissions from the hedge fund industry. The report includes data from 2016, 2017 and YTD 2018, with approximately 70% of the submissions coming from the United States. This dataset is growing fast, and is the most robust available.

Main categories are analyzed below with an emphasis on most relevant employers and key points of interest.

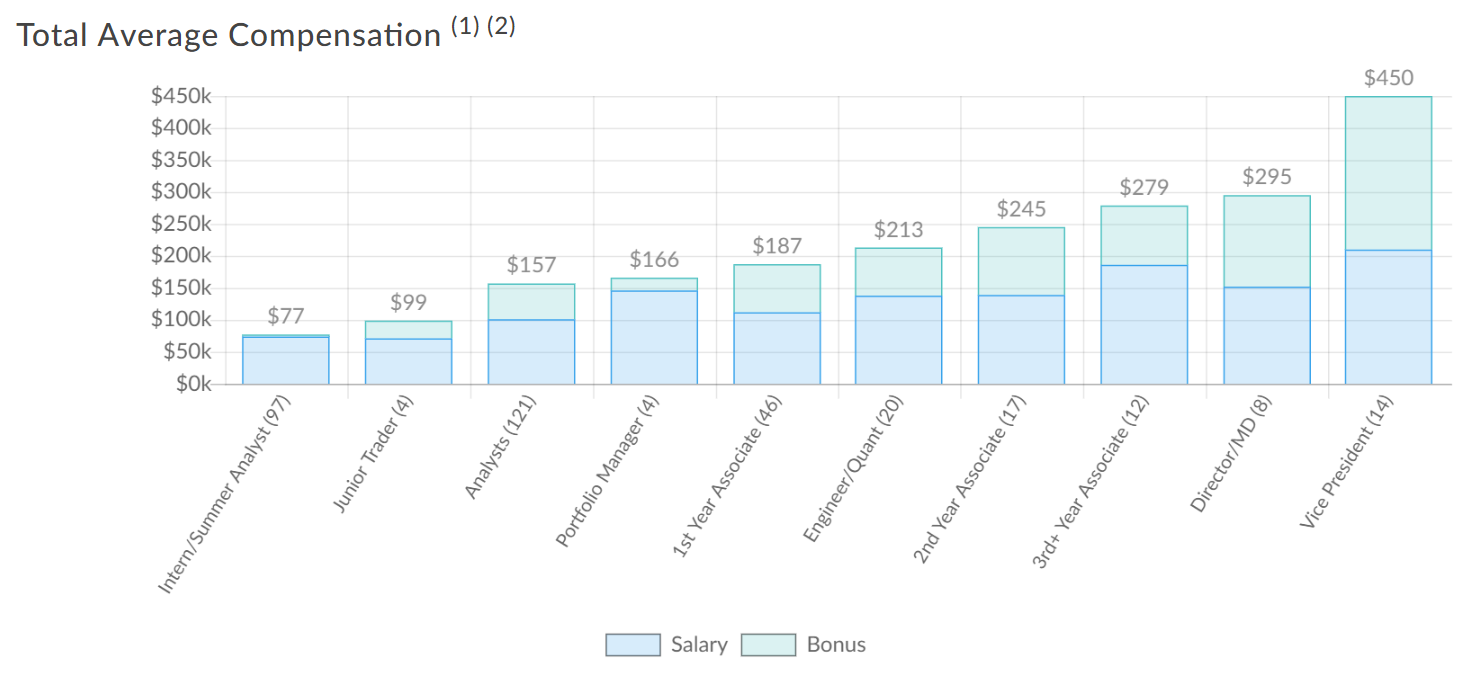

Total Average Compensation

Key Observation 1: Total compensation (base & bonus) averages $159,100 for first-year analysts and $200,800 for first-year associates.

The total average compensation, including base salary and bonus, at hedge funds ranges from $159,100 annually for first-year associates to $472,800 for vice presidents (small sample size for this position). These figures represent data from 71 hedge funds.

Similar to the investment banking industry,hedge fund compensation also shows a correlation between career advancement and percentage of bonus in overall compensation figures.

Interestingly, none of these firms are much-discussed on the WSO forum.

Out of 55 firms, employees at Citadel, D.E. Shaw Management and Blackstone Group were most satisfied with their pay compared to similar jobs elsewhere.

Based on our submissions, hedge fund compensation increased slightly this year. Although comp will vary by firm, WSO forum discussions provide color on what to expect at entry level associates and analysts may be able to make.

Compared to earlier in the decade, hedge fund compensation is largely down (not to mention in comparison with strong salaries in the 2000s and 1990s). It will be important to keep an eye on compensation stats for next year. In general, hedge funds are trailing the broader market year-to-date 2018. Although over the long-term hedge funds continue to strongly outperform the broad market, this recent weakness could impact year-end bonus figures.

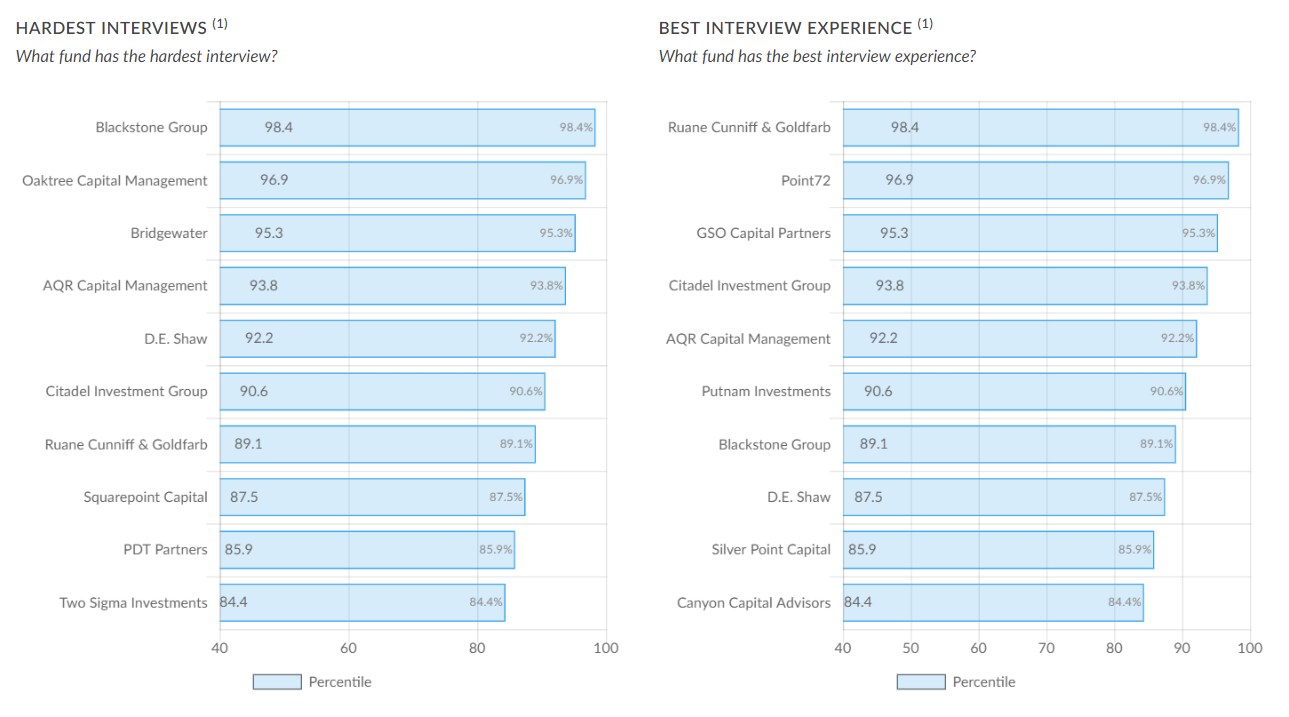

Interview Statistics – Hardest & Best

Key Observation 2: Blackstone, Oaktree Capital Management, and Bridgewater are viewed as having the hardest interview process.

Member submissions also provided information on the interview process, including the hardest and best experiences. To compile the statistics, each company is given an adjusted score using Bayesian estimates, which takes into account the number of reviews for a particular company with a minimum of two required. The results are representative of 64 firms.

Earning the reputation as having the hardest interview process are Blackstone, Oaktree Capital Management and Bridgewater. A difficult interview process must be worth the effort as we learned above that Blackstone employees were among the most pleased with their compensation compared to other hedge fund firms.

The best interview process reviews go to Ruane Cunniff & Goldfarb, Point72 and GSO Capital Partners. Notably, the top three in the best interview process category didn’t correspond at all with the top three in the compensation category.

Professional Development Opportunities

Key Observation 3: The top ten firms across the professional development sub-categories are fairly consistent, albeit in slightly different orders.

The professional growth and career opportunities section of the 2018 Hedge Fund Industry Report focuses on three sub-categories. We’ve highlighted the top 3 out of 55 firms in each sub-category.

- Blackstone

- D.E. Shaw

- Two Sigma Investments

- Bridgewater

- Citadel

- Blackstone Group

- Point72

- D.E. Shaw

- Citadel

Although in the top three for the most difficult interview process, Blackstone and Bridgewater clearly make it worthwhile once the employee is hired. Oaktree Capital Management, on the other hand, does not make the top ten for professional development opportunities.

Promotions & Fairness

Key Observation 4: Citadel was the sole hedge fund represented in the top three in each sub-category.

Member submissions also shed light on promotions and fairness within the Hedge Fund Industry. Again, we’ve highlighted the top firms in each sub-category.

- Bridgewater

- Citadel

- Point72

- Farallon Capital Management

- Blackstone Group

- Citadel

- Bridgewater

- D.E. Shaw

- Citadel

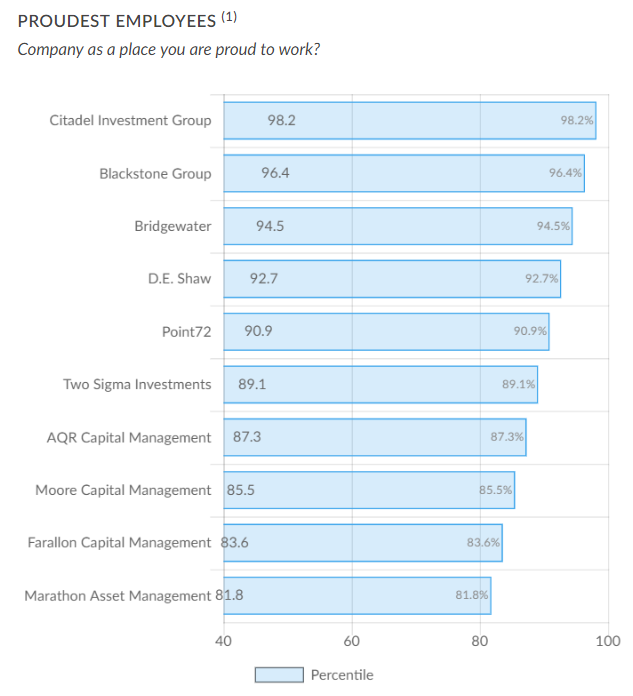

Reputation

Key Observation 5: Top performers noted throughout the report were also top performers in this category.

Perhaps the most important evaluation of a company is what its employees say outside of work. In this report, reputation is defined by two factors, employee pride and whether employees would recommend the company to others.

Not surprisingly, top performers noted throughout the 2018 Hedge Fund Industry Report were also top performers in this category. Citadel, Blackstone, and Bridgewater earn the top honors for “proudest employees”.

Blackstone, D.E. Shaw, and Two Sigma Investments round out the top three for their firms being “recommended” to others by their employees.

Senior Management

Key Observation 6: Top senior management rankings align with other categories.

The senior management statistics were generated from the following four sub-categories. We’ve highlighted the top three out of 55 firms in each sub-category.

- D.E. Shaw

- Blackstone Group

- Bridgewater

- Blackstone

- Point72

- Farallon Capital Management

- Blackstone

- D.E. Shaw

- Citadel

- Citadel

- D.E. Shaw

- Blackstone Group

The data suggests a strong correlation between opinions about senior management and the company’s performance in all other categories, with the exception of top compensation, throughout the 2018 Hedge Fund Industry Report.

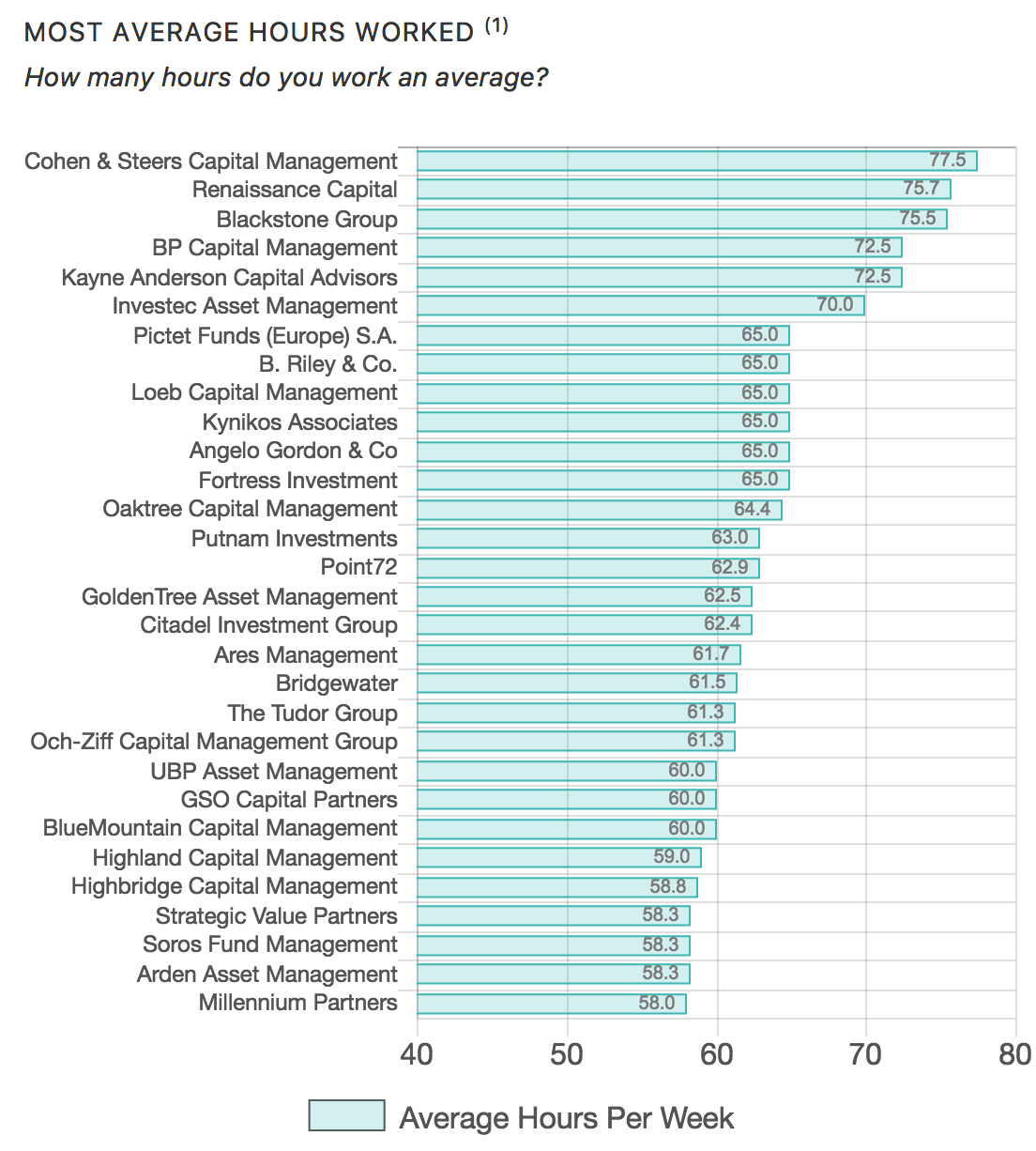

Lifestyle

Key Observation 7: Most average hours worked doesn’t always translate into highest average compensation.

The 2018 Hedge Fund Industry Report also include respondents’ opinions on which firms provide the most satisfying lifestyle as defined by three sub-categories. The top firms in each sub-category are listed below.

- Citadel

- Point72

- Bridgewater

- Two Sigma Investments

- D.E. Shaw

- Bridgewater

- 1209 Capital Partners (87.5 hours/week)

- Cohen & Steers Capital Management (77.5 hours/week)

- Renaissance Capital (75.7 hours/week)

A striking takeaway is that most average hours worked doesn’t always translate into highest average compensation. The top three companies for highest average compensation have only one company, Blackstone, in the top five of most average hours worked.

However, while 1209 Capital Partners averages hours similar to investment banking, most hedge fund industry employees working the most average hours can take solace in the fact that they are working approximately 13 hours less per week than the most average hours worked in the investment banking industry.

Additional Points of Interest

Key Observation 8: For overall WSO Company Database submissions, New York and NYU generated the highest response rate by far

In addition to the industry-specific categories discussed throughout this article, there are several other points of interest when you look at overall WSO Company Database submissions.

- Geographically, New York generated highest response rate by far, followed by Chicago and London.

- Level of education also played a role with 63% of the report’s 43,679 unique contributors citing a GPA between 3.5-4.0.

- Even more, graduates of schools in major markets are most represented in the study, with New York University (NYU), University of Pennsylvania and Cornell rounding out the top three.

- Finally, the report does not account for gender as a distinguishing factor in the data.

The 2018 Hedge Fund Industry Report provides key insights into the industry as well as important information for when analyzing your current employment or determining priorities in your job search.

For more information, including the most current data as reports are continually updated online, please contact Wall Street Oasis at [email protected].