LO funds discrimination against HF analysts

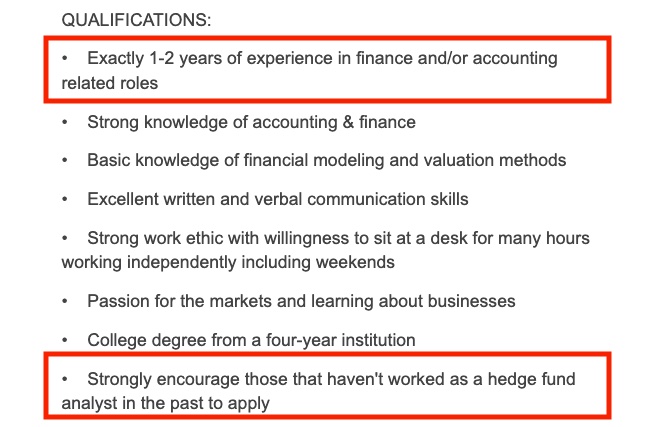

I came across a job posting where two requirements caught my attention. See attached screenshot. It is a LO value fund looking for an equity research analyst. I had heard that once analysts move to HFs, it would be quite hard to get back to LOs. I didn't quite believe it until I saw this job posting. It makes me wonder why some LO funds don't like analysts with HF background. I am also under the impression that some HFs also have similar disdain for LO candidates. Has anyone experienced this kind of discrimination/bias? Any thoughts for the reasons?

Philosophical bias is not illegal lol.

Thank you, dickthesellsider. I have heard that LO PMs tend to view HF analysts to be short-term oriented while many HF PMs think that LO analysts are sleepy lazy dudes. Anything more than that? Any thoughts would be appreciated.

Yep, pretty much it.

Interesting. Lol I suppose this only applies to LO AMs and not LO HFs as well?

Not tryna pass judgment here but from the posting it seems like this place isn't super polished or prestigious, former HF analysts will probs jump whenever they see the chance

I'm gonna guess that this is more about salary limitations and looking for younger more moldable candidates who have lower salary requirements/expectations than anything else. For younger grunts, employers want someone that will do things / see things the way they do it, and not come with any preconceptions or processes that might filter through. So there is always a little bit of that in there, but this feels like they just want some more moldable / younger people than anything else.

I think you are totally right when it comes to the first bullet point, which requires exactly 1-2 years of experience. The last bullet point doesn't seem to be related to pay expectation though. I get that HFs tend to pay better than small LOs in good times.

median HF pays more than non-top LO

LO doesn't like HF biases

The inverse also happens quite a lot because some HF dislike LO's slow pace and lack of ST diligence discipline

Those stereotypes do exist. I think the differences are there primarily because LO and HF have different investment horizons.

Tenetur quia amet rerum. Consequuntur eum sunt ab optio a quo.

Omnis atque dolor qui sint odio. Omnis adipisci possimus aperiam omnis impedit eligendi similique explicabo. Repellendus laudantium et occaecati harum cum nesciunt error. Ipsa tempore quidem molestiae cupiditate incidunt sit dignissimos.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...