|

Stabilizing Stablecoins — You might not guess this, but 78-year old President Joey B is quite the crypto guy. Just kidding, nothing could be further from the truth, but his administration did send a report to Congress basically saying “can you guys f*cking do something about stablecoins already?”

Biden, who almost certainly had nothing to do with the actual drafting of the report, pointed out to fellow geriatrics in Washington that stablecoin regulation would be a nice idea, with potentially tangible benefits to everyday citizens. Using phrases like “urgently needed”, Biden asked for and recommended some pieces of legislation, such as, allowing only chartered banks to issue the coins. Other contents of the report basically centers around the benefits that regulations would add, such as creating more efficient and effective payment options.

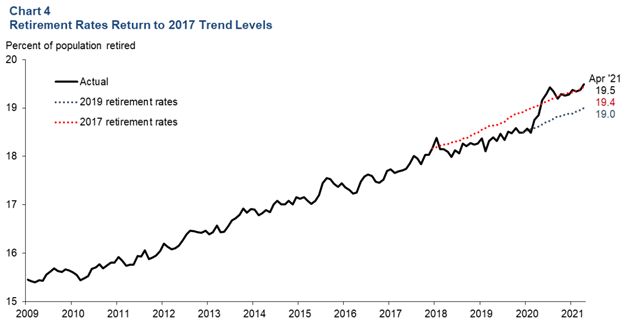

Re-tired of this sh*t — As if the Fed’s goal of maximum employment wasn’t hard enough, boomers are adding even more trouble by dipping out of the workforce like kids at a party when the cops show up.

Now, we could have worse problems, but as the Central Bank deliberates policy decisions over the next few months, boomers retiring for a mixed bag of reasons only adds a layer of complexity. According to the Dallas Fed, the employment-to-population rate has dropped 3.2%, or about 8.5mm workers. Of that, 1%, or about 2.6mm individuals, have entered retirement. These oversized retirement numbers add opacity to the question of what maximum employment really is. Fed officials postulate that most of the retirees fall into two camps: wealthy boomers who’s assets have skyrocketed and allowed for early retirement or low-income earning boomers facing risks of working with the public during a pandemic.

So, are most of these retirements temporary or permanent? How does this dynamic change the definition of full employment? Why is my portfolio doing so terri- sorry, got off topic for a second. Anyway, it will be interesting to see how this labor force dynamic effects Fed policy decisions, so don’t be surprised if JPow gets questioned on this soon.

|

Velit laborum dolorem cumque voluptatem aut quia. Rem porro provident in eveniet. Aut expedita maxime nihil in iure. Sint vel et illum neque.

Magni est praesentium atque sed. Dolores repellendus voluptatum sunt doloribus quo deserunt voluptatem. Quia omnis natus temporibus.

Animi eos laborum non expedita maxime numquam quam. Est nulla et inventore sit totam laudantium eos. Ea ipsum architecto modi assumenda. Voluptas voluptas exercitationem debitis aut.

Voluptate et nesciunt qui repellendus officia velit asperiores. Saepe est voluptate quasi non. Neque excepturi adipisci qui dolor quo ipsam aliquam qui. Atque blanditiis modi deserunt ipsam qui. Recusandae pariatur atque voluptas enim. Quis non rem ad id aut quisquam porro. Ex reprehenderit nihil in tempora non laudantium tempore.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...