|

The Paper Billionaire — Inequality is a thing, particularly when it comes to wealth. This true fact is a harsh reality of the world in which we live.

A huge preponderance of the world’s wealth is held by a disproportionate few families and individuals, mostly in the Western world.

However, some argue that many billionaires aren’t actually that wealthy. In fact, some see Elon Musk, the world’s richest man, couchsurfing and are convinced that he is a paper billionaire.

A paper billionaire is someone who is worth a lot of moolah but cannot access these funds due to liquidity challenges. For example, if Elon were to attempt to sell all of his shares of $TSLA this afternoon, shares of the EV-maker would tank.

In this scenario, not only would Elon pull out way less wealth than he had when he woke up today, but your cute little 3-share position would now be worth only 2/3s as much too.

However, billionaires routinely liquidate relatively large chunks of their shares to pay taxes, pull out cash, donate to charity, etc., and usually, the share prices of their companies don’t go to $0.

A great example is MacKenzie Scott. She’s like the world’s fourth-richest woman and has donated billions of dollars that were mostly held in Amazon shares when they were transferred to her in her $38bn divorce settlement.

As she has drawn on these shares to make the world a better place, Amazon’s price hasn’t taken that fat of a steaming dump. There is a slew of other billionaires who have sold their shares to live their lives, so I’d argue that this argument is empirically false.

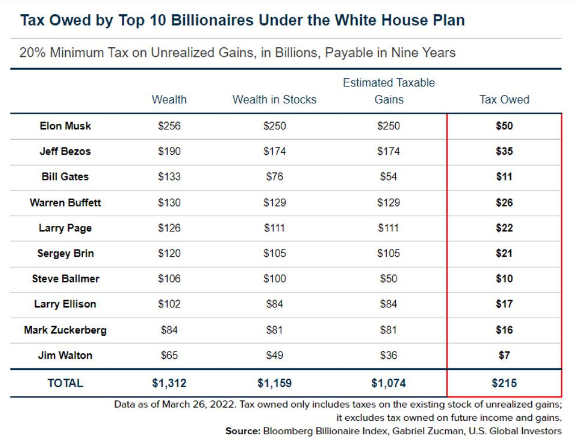

While you haven’t heard much about it lately, about a month ago, the current presidential administration proposed a wealth tax on unrealized gains for households that hold more than $100mn in wealth. This tax would apply to approximately 35,000 families across the country.

If you look at the taxes collected from the top 1% of families in America, objectively, the percentage of the IRS’s total “revenue” is around 40%. If you look at the potential taxes from the top ten billionaires in the US by taking 20% of their unrealized gains away, you’re looking at only about $215bn in additional revenues, which wouldn’t even make a dent in that 40%.

In America, there is over $7 trillion housed in 401k accounts, which is roughly a fifth of all the retirement savings in this country.

Food for thought: according to the US government, it ran a $2.7 trillion deficit in 2021, and this deficit is only going to get bigger in 2022. Even if the government forcibly seized our 401k’s, it wouldn’t even help support the federal deficit for three total years.

The top 1% in America have more than $40 trillion in wealth. The entry point to the one-percenter club is at around $11mn in wealth. If you’re considering the same proposed wealth tax on this entire group, you might be able to find enough money to run the country for a single tax year.

Deficit spending is as American as baseball, Marilyn Monroe, and apple pie. As interest rates go up, servicing the national debt will get more expensive. The tax revenue required, whether through a blanket wealth tax or boring ol’ income taxes, will also grow.

As we consider more creative taxation solutions to our spending addiction, I challenge you to think about one question. Has there ever been a specialized tax in this country that has not eventually been extended in some way to cover the entirety of the tax base?

|

Qui dolor et quam sed consequatur vitae. Distinctio ducimus qui earum sed. Occaecati amet quasi quos.

Porro quis quia sit nostrum dolores. Repudiandae cupiditate deserunt delectus aliquid nihil nam. Omnis et voluptatem incidunt et laborum occaecati.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...