Brace yourself

MARKETS

- U.S. markets: The S&P snapped its eight-day winning streak. Investors are dealing with nightmare fuel from the impending earnings season, trade worries, and a downer report on economic growth from the IMF. But we'll get to that.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

BANKING

The United Banks of America

Now that’s what we call a PR audible. One day before facing a Capitol Hill hearing, Bank of America (-1.03%) CEO Brian Moynihan said BofA plans to raise its minimum wage to $20 an hour from $15 over the next two years. That’ll make BofA’s minimum wage workers the highest-paid among any of the country’s big banks.

Two possible explanations for the hike

- It’s a tight labor market. Workers are getting their biggest raises since the Great Recession because there are too many openings and not enough people to fill them.

- And it offers some cushioning heading into today’s hearing, which will probe Midtown Manhattan’s white glove crowd in an era of record profits. Nothing says “corporate responsibility” like bigger paychecks for bank tellers, BofA hopes.

About that hearing

It’s the first time in a decade the CEOs of the largest U.S. banks will testify as a group in front of Congress, and it's the first time ever they'll testify without Patagonia vests.

Described as “riveting political theater,” this House Financial Services Committee hearing should hold you over until the new Avengers arrives. Even the name is epic...ly long: "Holding Megabanks Accountable: A Review of Global Systemically Important Banks 10 Years After the Financial Crisis."

The guest list: CEOs of Citigroup, JPMorgan, Goldman Sachs, Morgan Stanley, BofA, State Street, BNY Mellon, and as many as 60 lawmakers. (MIA? Wells Fargo.)

Both questioners and questionees are eager to display new attitudes.

- For lawmakers...Now that Democrats control the House, they’ll be flexing their muscles to make sure banks are being held accountable 10 years after the crisis.

- For the c-suiters...Minimum wage hikes are just the start—they want to show Congress all the ways they’ve reformed themselves in the past decade. Wells Fargo’s Mike Mayo, who’s essentially the Michael Jordan of big bank analysts, wraps it up: “If the top levels of the financial industry were tone-deaf around the financial crisis, this is the opposite.”

ECONOMY

FRAGILE ECONOMY: PLEASE HANDLE WITH CARE

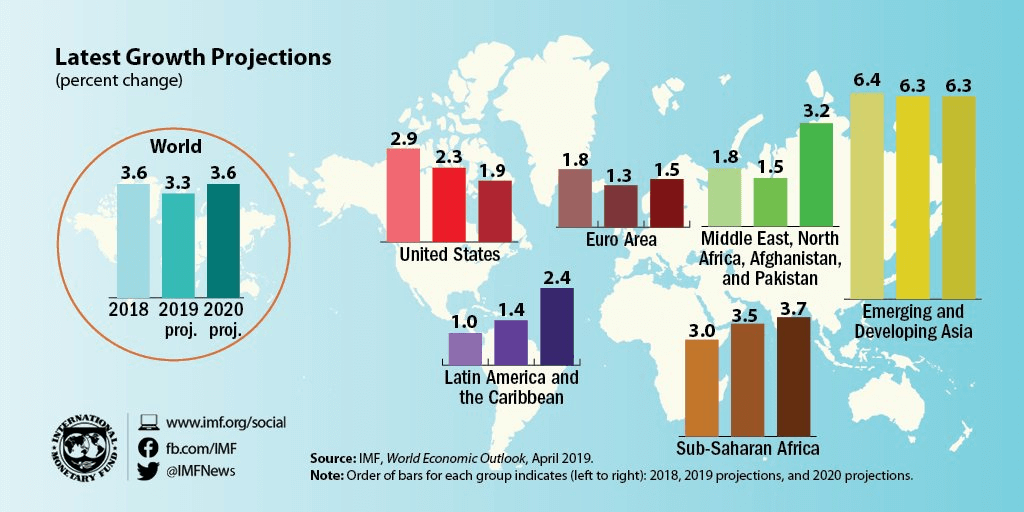

In its big picture overview of the world economy, the International Monetary Fund (IMF) concluded that we are in a “delicate moment.” It lowered its projections to 3.3% growth for 2019, which would be the lowest growth rate since 2009. But the IMF does expect a boost heading into 2020 if we keep things This Side Up.

We’re calling it a “bend, don’t break” economy.

- Bend: U.S.-China trade tensions, macroeconomic issues in Argentina and Turkey, auto sector disruption in Germany, and credit tightening in China.

- Don’t break: Central banks around the world have paused rate hikes, a U.S.-China trade agreement is taking shape, and struggling emerging markets are poised for a rebound.

Zoom out: If you’re in D.C. this week, watch out for all the finance ministers and central bankers getting rowdy on U Street. They’re in town for the spring meetings of the IMF and the World Bank.

HEALTH CARE

"Operation Brace Yourself" Leads to a Bust

The Justice Department has charged 24 people in a $1.2 billion telemarketing scam.

Officials said it was one of the largest health care fraud schemes in U.S. history...and the investigation was truly a marathon. They executed more than 80 search warrants across 17 federal districts, charging doctors and CEOs from New Jersey to California.

How the scam allegedly worked (do not try this at home):

- A network of telemarketers in the Philippines and Latin America pitched “free” orthopedic braces to seniors eligible for Medicare.

- Doctors would write prescriptions for these braces, whether patients needed them or not.

- The prescriptions were sold to medical brace manufacturers, who shipped the equipment off and billed Medicare anywhere from $500 to $900 per brace. Cue kickbacks of almost $300/brace, per the AP.

And where to launder the illicit profits? The usual suspects...exotic cars, yachts, and luxury real estate.

Bottom line: IRS criminal investigations chief Don Fort said the scheme exploited the “systemic flaws in our health care system.”

CRYPTO

In China, Crypto Mining Is no Minor Problem

The Brew’s emerging tech writer Ryan Duffy takes us to China...

...where top state planners proposed eliminating all cryptocurrency mining operations in the country as part of a larger shakeup to industrial policy.

The backstory: In China’s interior, where you can get coal and hydropower on the cheap, mammoth crypto miners have set up shop and become significant polluters.

- Why? Crypto mining is a very energy-intensive process. The World Economic Forum says that in 2020, bitcoin mining could consume as much power as the entire world uses today.

If China follows through, it’d be a win for the planet, but an L for China’s massive bitcoin mining market, which reportedly represents 74% of the world’s total crypto mining computing power.

On the other side of the world (but in a similarly rural setting), Montana’s Missoula County unanimously approved a resolution that requires new crypto mining to be offset by funding or building new renewable energy projects.

Crazy stat: Crypto mining in Missoula County directly employs 19 people, but it uses as much energy as 1/3 of county households, or about 40,000 people.

SOCIAL MEDIA

YouTube Brings You the Most Meta Moment of the Week

Yesterday, YouTube had to disable the comments sections on livestreams of a House Judiciary Committee hearing on hate crimes...because the comments became inundated with hate speech, including racist and anti-Semitic remarks.

The Inception didn’t stop there. Alexandria Walden, Google counsel for free expression and human rights, testified right after her colleagues disabled the comments—she said, “Hate speech and violent extremism have no place on YouTube.”

The hearing (which also included reps from Facebook) was aimed at picking apart the spread of white nationalism in the U.S. and the role of social media in its rise.

- YouTube—with its more than 1 billion users—has become a hotbed of hateful speech from alt-right groups

Looking ahead...Big Tech reps at the hearing emphasized their efforts to root out hate speech and troubling content using both human and AI tools. One of those efforts? Facebook said last month it will ban white nationalist and white separatist content from its platform.

WHAT ELSE IS BREWING

- Levi Strauss can feel pretty good about its first earnings report since returning to the public markets. Its quarterly revenue increased 7%, and its stock is up about 29% from its IPO price.

- Standard Chartered will pay U.S. and British authorities more than $1 billion to settle a probe over allegedly violating Iran sanctions.

- Wynn Resorts (-3.86%) withdrew its $7.1 billion offer to buy Australia’s Crown Resorts after that offer was leaked. This isn’t necessarily the end of the road for the deal, though.

- Aramco issued $12 billion of bonds in what Bloomberg calls "one of the most oversubscribed debt offerings in history."

- YouTube is developing choose-your-own-adventure style shows. If Black Mirror taught us anything, it’s to watch your back.

BREAKROOM

Math Is a Really Cool Thing

Start in the bottom left corner. Moving either up or right adding up the numbers along the way, what is the largest sum you can make?

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Breakroom Answers

Math Is a Really Cool Thing

28

Id minima iusto nulla rerum quod vel illum sunt. Magni mollitia id impedit et voluptas. Id velit sed inventore sint inventore omnis aut. Fugit enim corrupti sint veritatis saepe.

Aut id ipsum dolor corporis aliquid sed. Ut ipsum necessitatibus alias ut. Sit nemo molestiae ratione accusamus. Nihil reiciendis officiis et saepe et aspernatur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...